Chart of the Week

We focus on macro and technical data driving markets, so you can focus on the trends that matter the most.

MOST RECENT

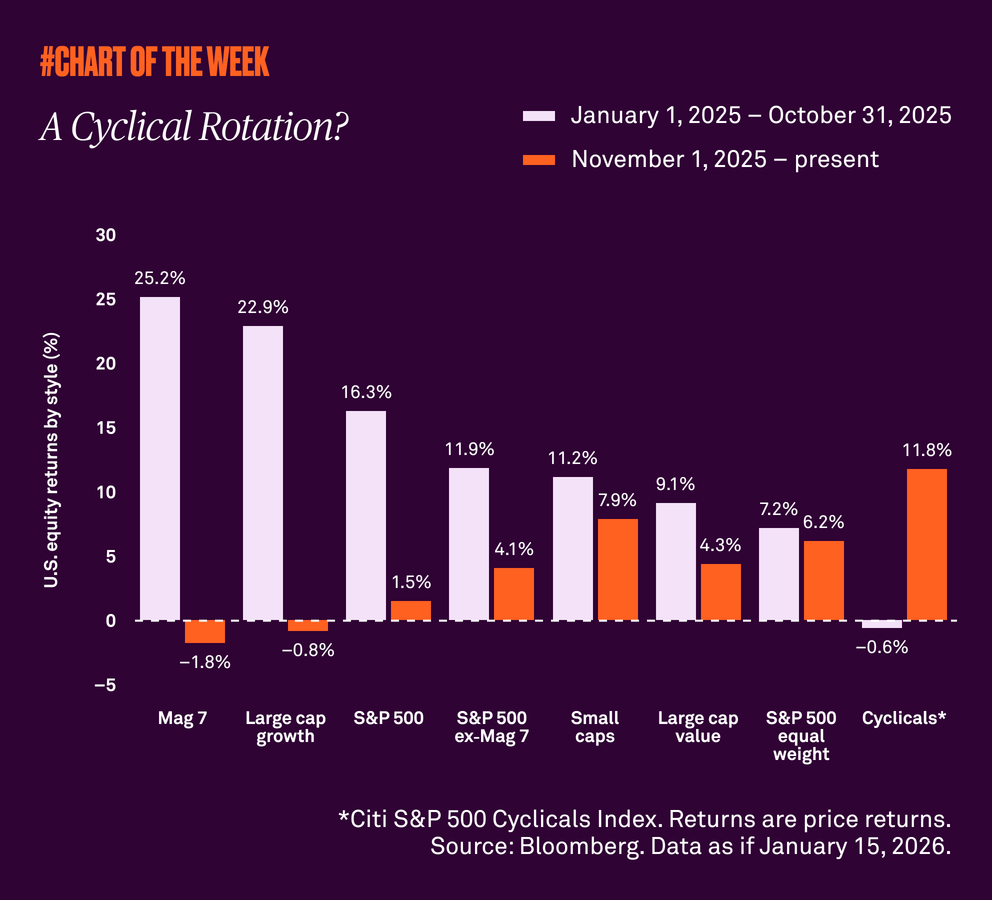

A cyclical rotation?

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

Previous Charts

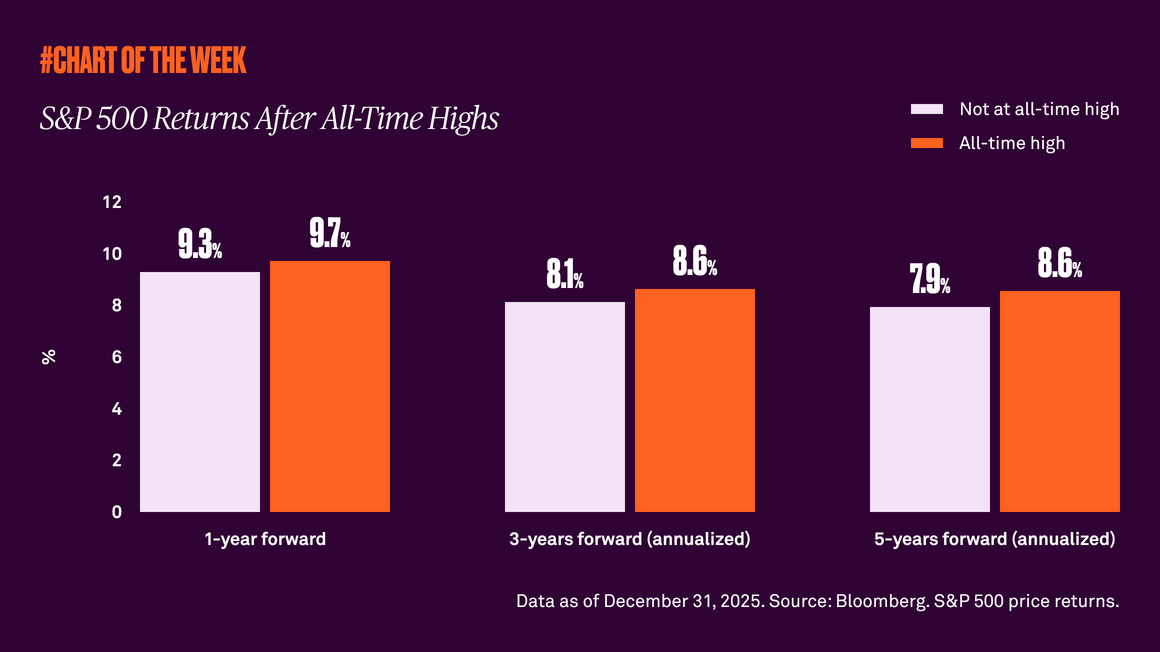

S&P 500 Returns After All-Time Highs

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

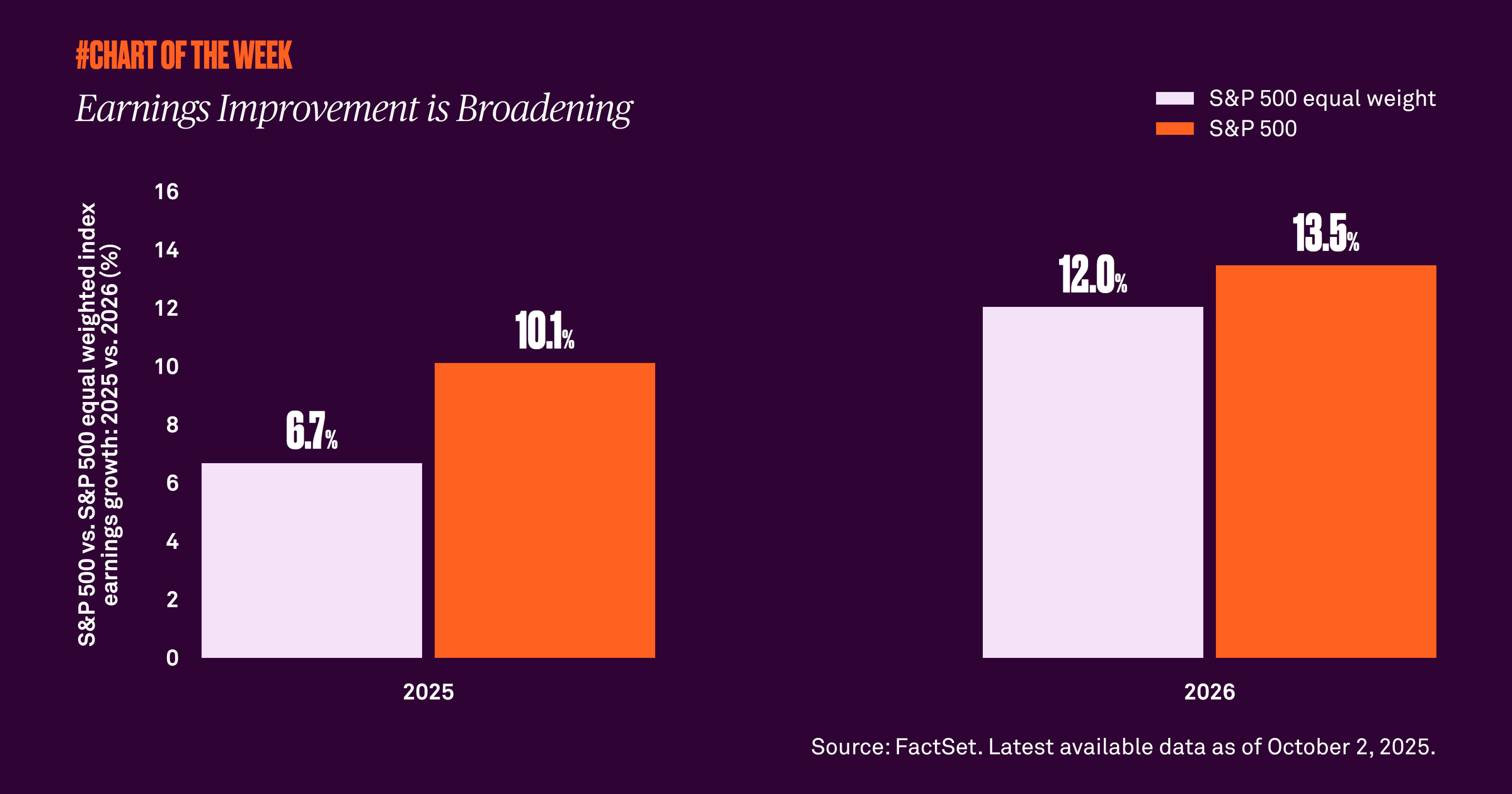

Are earnings broadening beyond the magnificent 7?

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

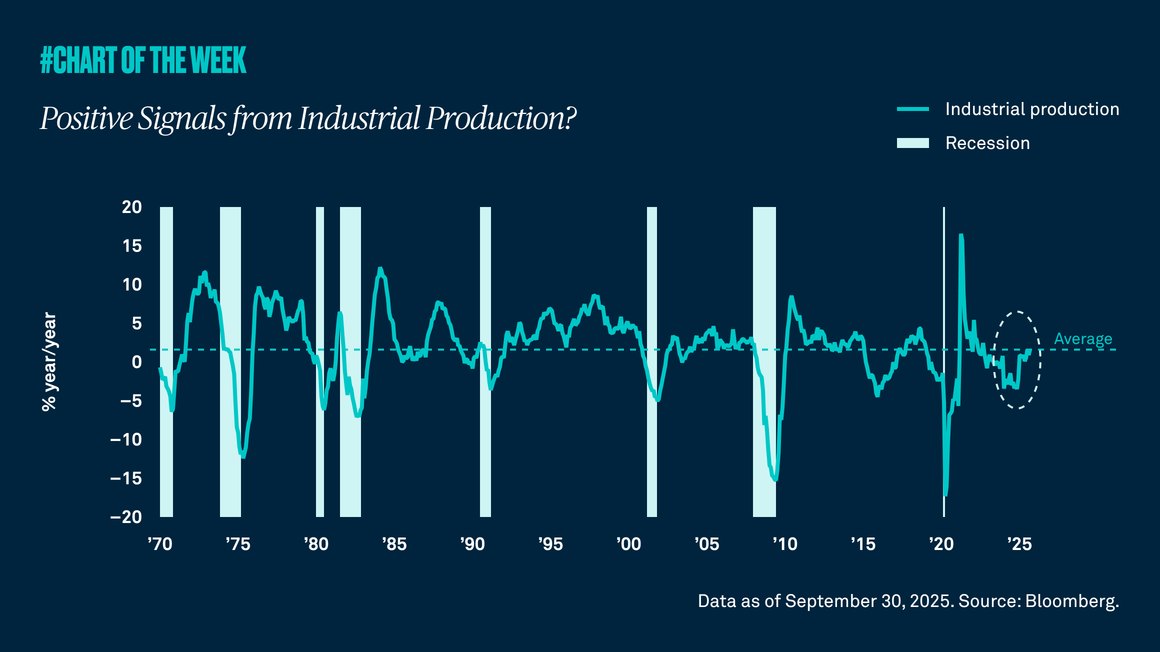

Positive signals from industrial production?

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.

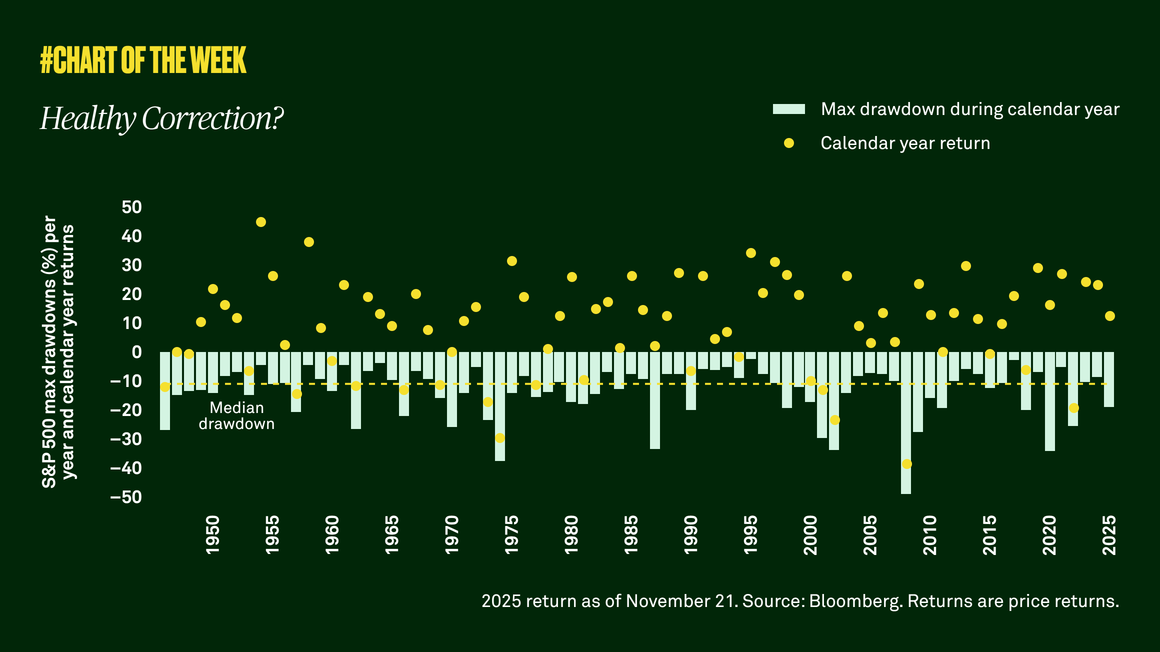

Healthy correction?

After climbing 17% year to date through late October, the S&P 500 declined 5% through November 20. We believe the market was due for a healthy correction. While further downside is possible, it would not concern us.

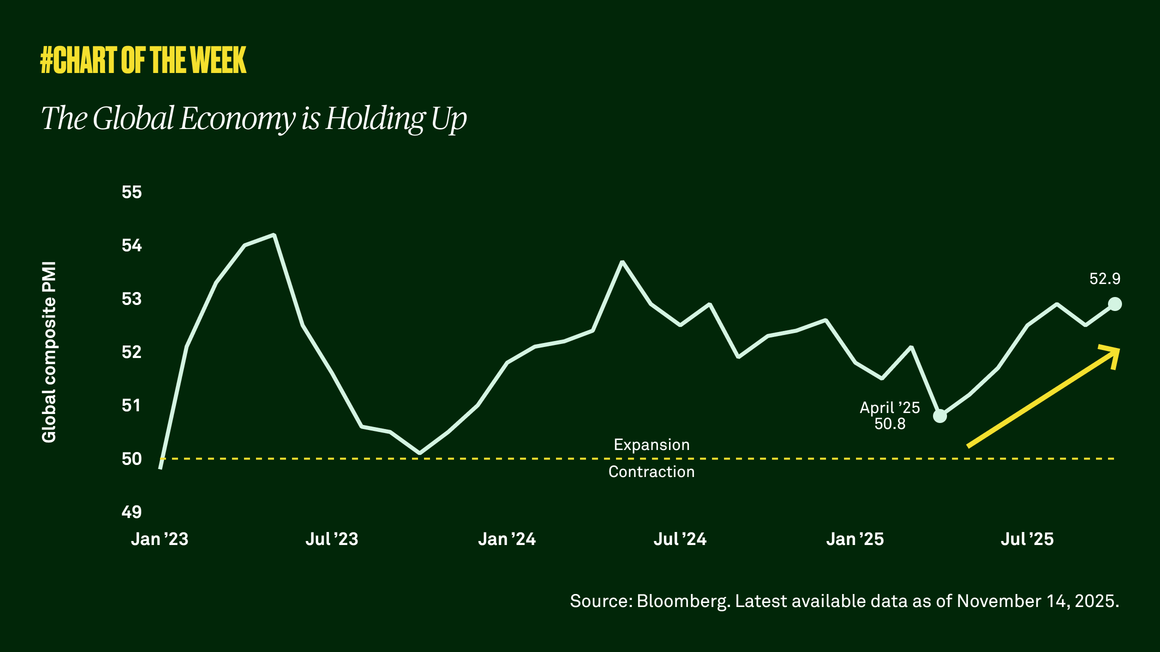

The global economy is holding up

This past year was rife with risks to the global economy: policy changes, tariff uncertainty and more. Yet, the global economy held up as manufacturing and services activity strengthened across the world. We see an opportunity for U.S. investors to diversify geographically.

Retail sales remain resilient

Considering the slowing job market, we dove into retail sales data to search for signs of the direction of household spending. We analyzed existing-store sales and found that, despite the softening labor market and concerns about growth, aggregate consumer spending remains resilient.

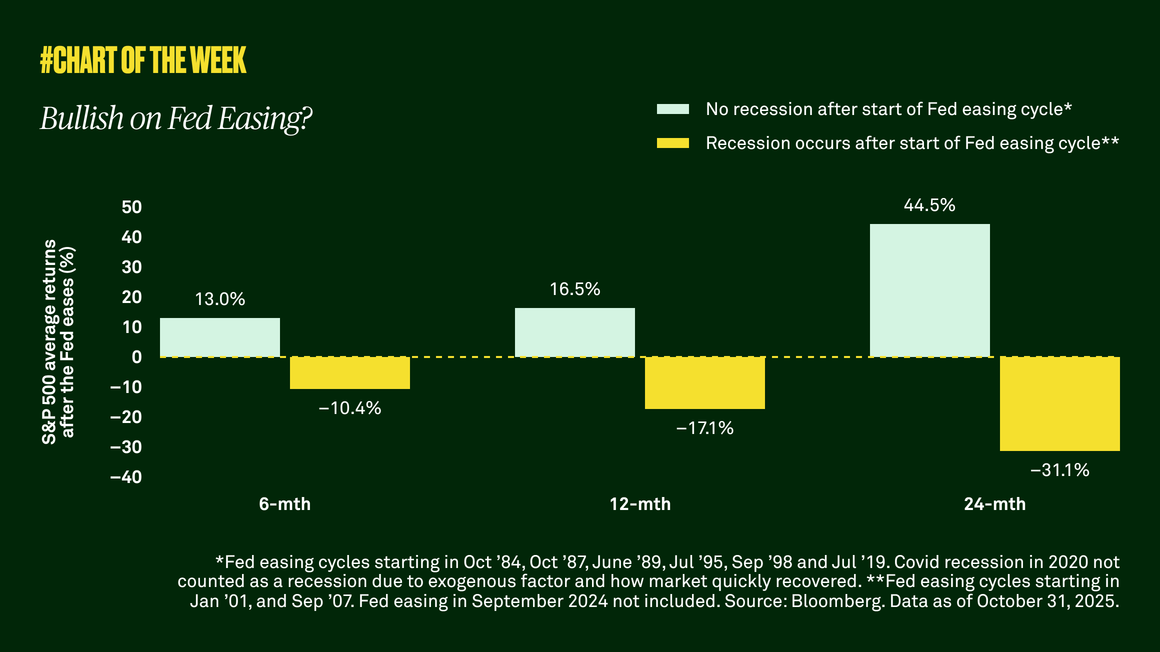

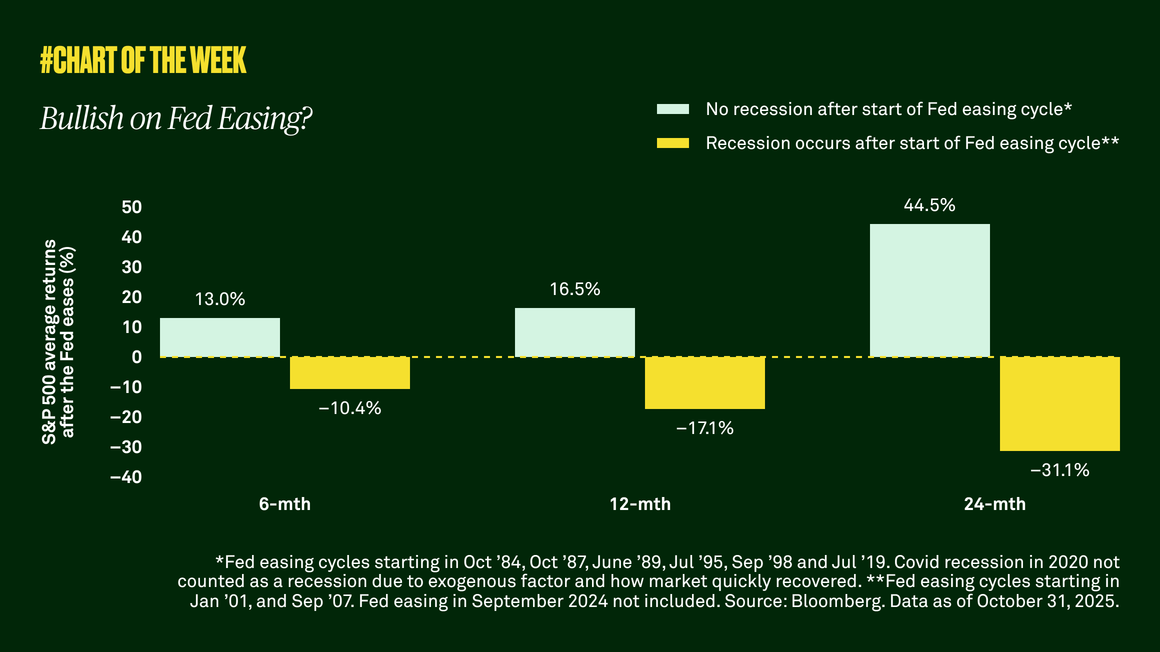

Bullish on Fed easing?

As expected, the Federal Open Market Committee delivered another 25-basis point rate cut. Investors are now focused on the pace of cuts from here. However, the more important driver of future equity returns is whether the Fed is easing into an economy that is growing or not.

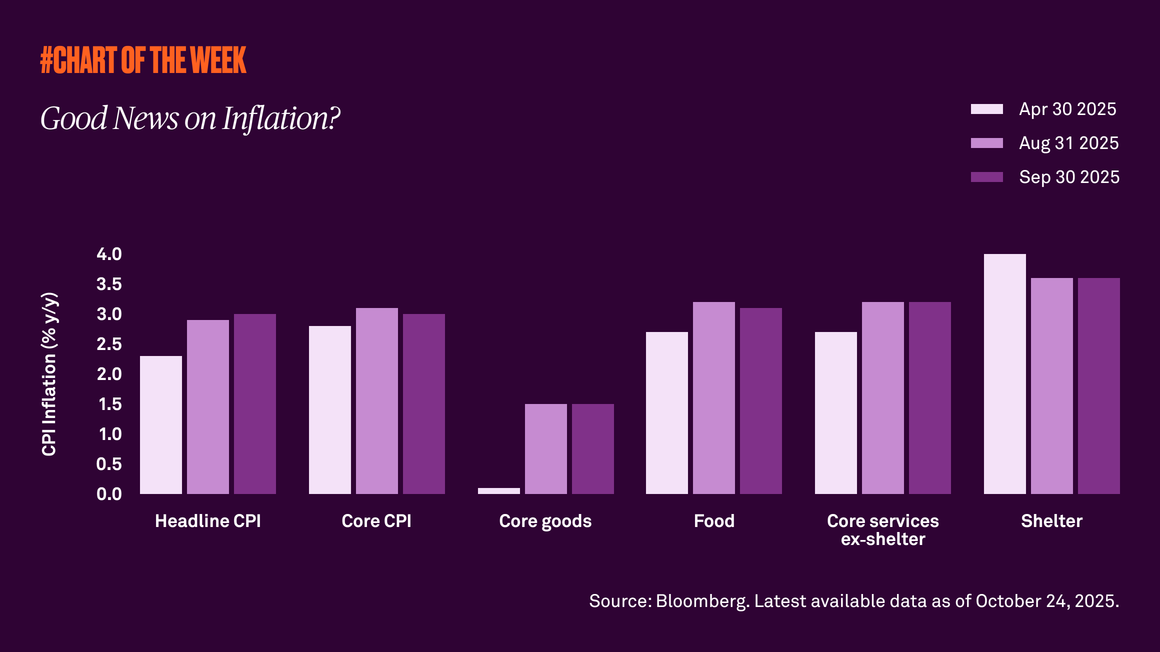

Good news on inflation?

Last week’s Consumer Price Index report, a widely used indicator of inflation in the U.S. economy, showed growth of 3% in September, which was above 2.9% in August but less than expected. Despite the modest increase, various categories have shown signs of stabilization. What does this mean for inflation going forward?

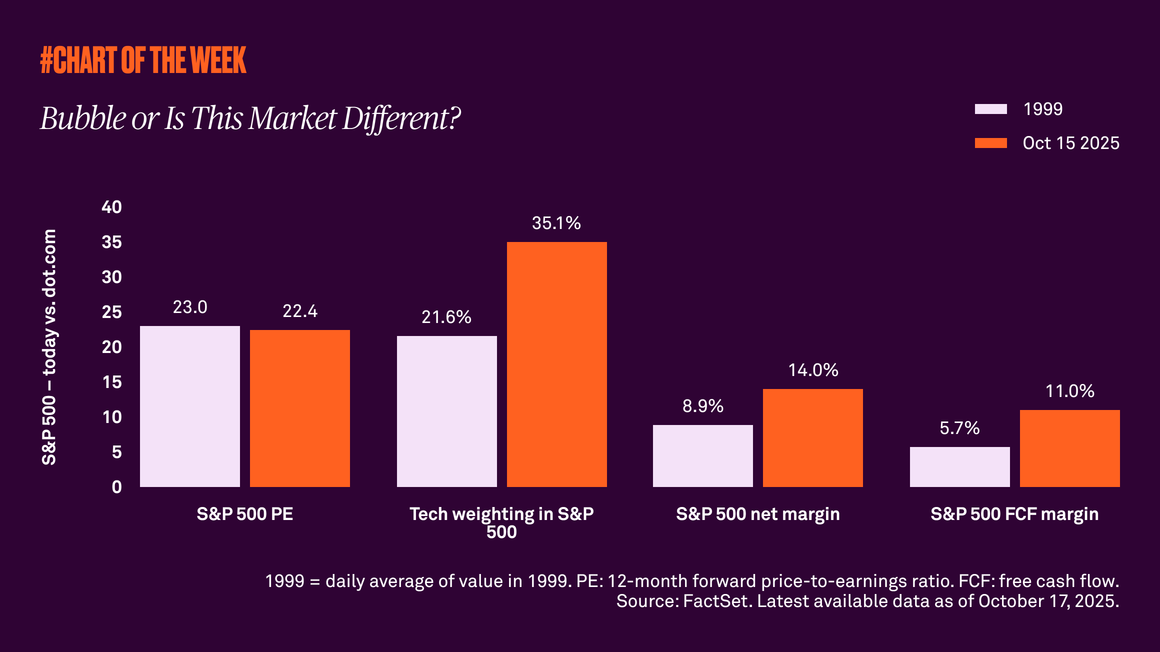

Bubble or is this market different?

The S&P 500 is up 14% year to date after gaining more than 20% annually over the past couple of years. Valuations are certainly elevated, but we believe the market is in a new world where higher multiples are normal rather than stretched.

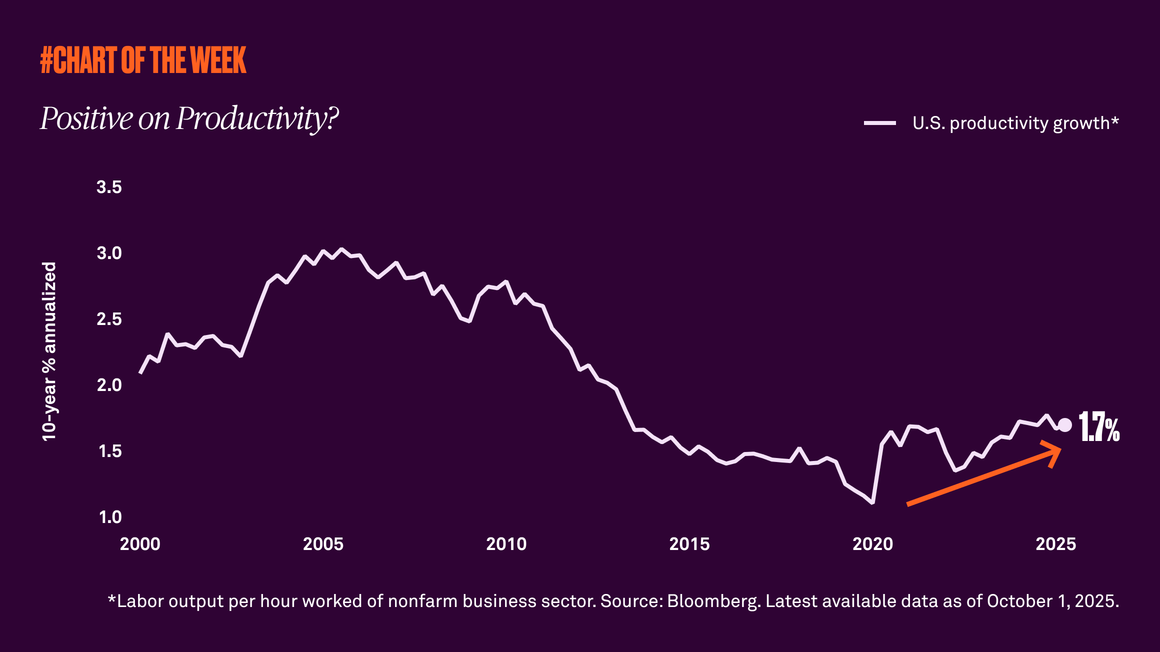

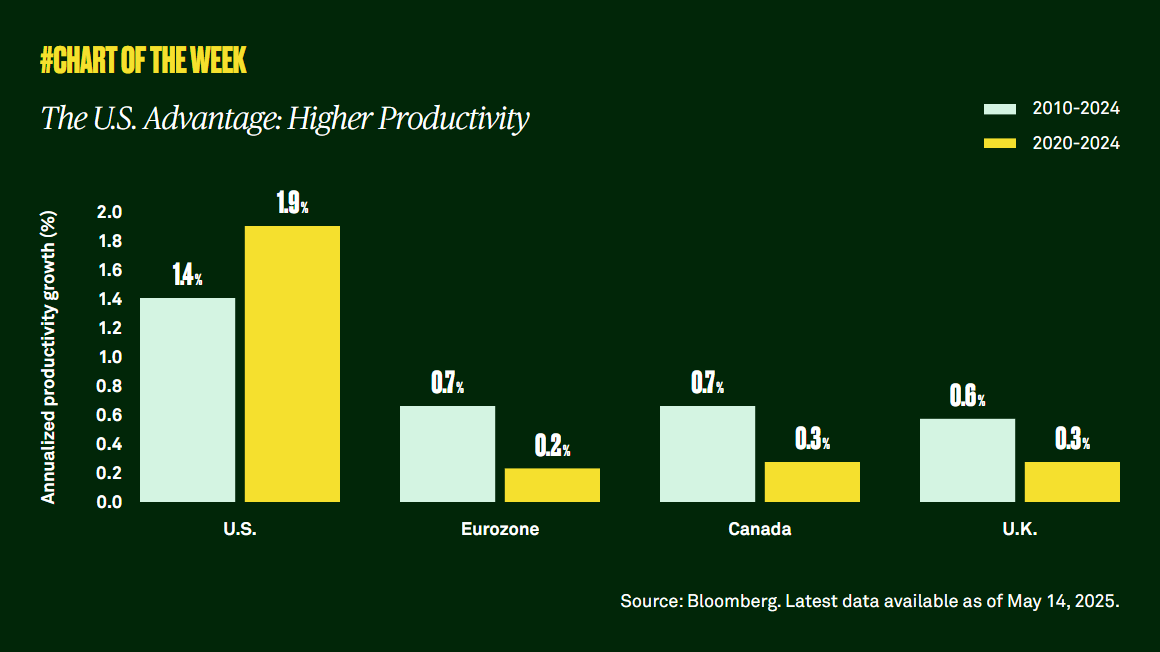

Positive on productivity?

Productivity, or output per hour worked, is a key driver of long-term economic growth. Now, after years of stagnation, productivity is on the rise again, a positive sign for future growth.

Earnings improvement is broadening

Earnings growth is on investors’ minds, especially as it broadens beyond the big tech stocks that have shown the most improvement in the past. We believe this is a positive sign for continued equity gains.

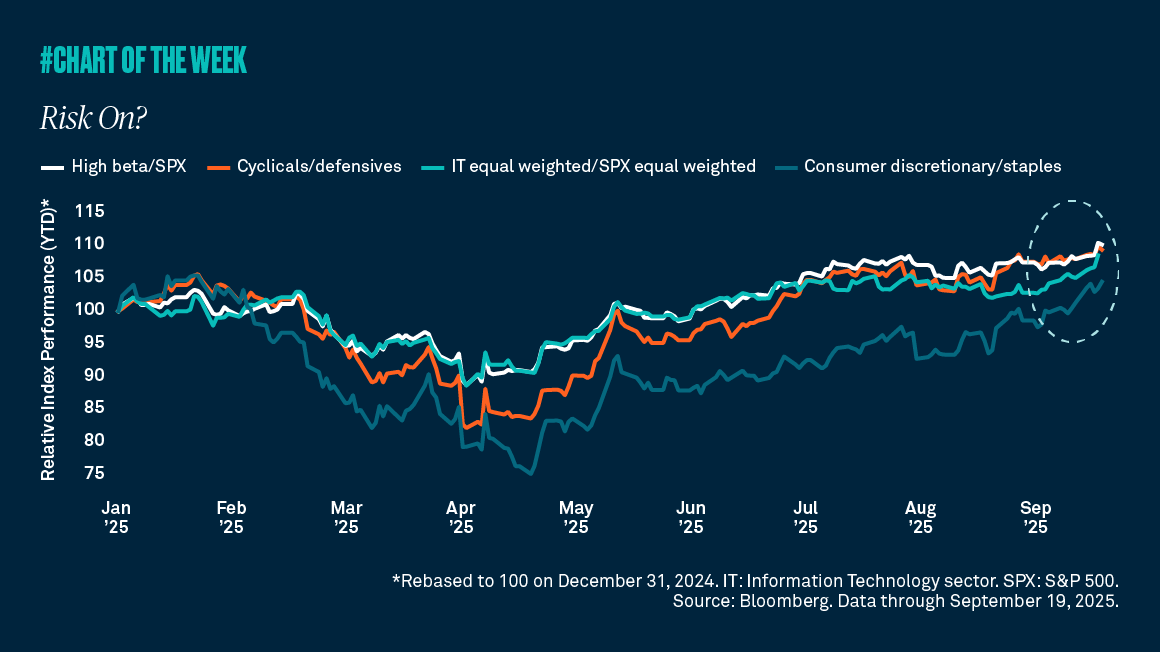

Risk on?

The S&P 500 is trading at record highs, which some investors didn’t see coming after the tariff-fueled drop in April. What may come as a bigger surprise, however, is the rally is broadening beyond big technology companies. Let’s examine different measures that prove this point.

Optimism grows among small businesses

Small businesses are becoming more optimistic, a positive indication at a time when economists are debating whether growth will slow. We view this confidence as a positive signal for future growth.

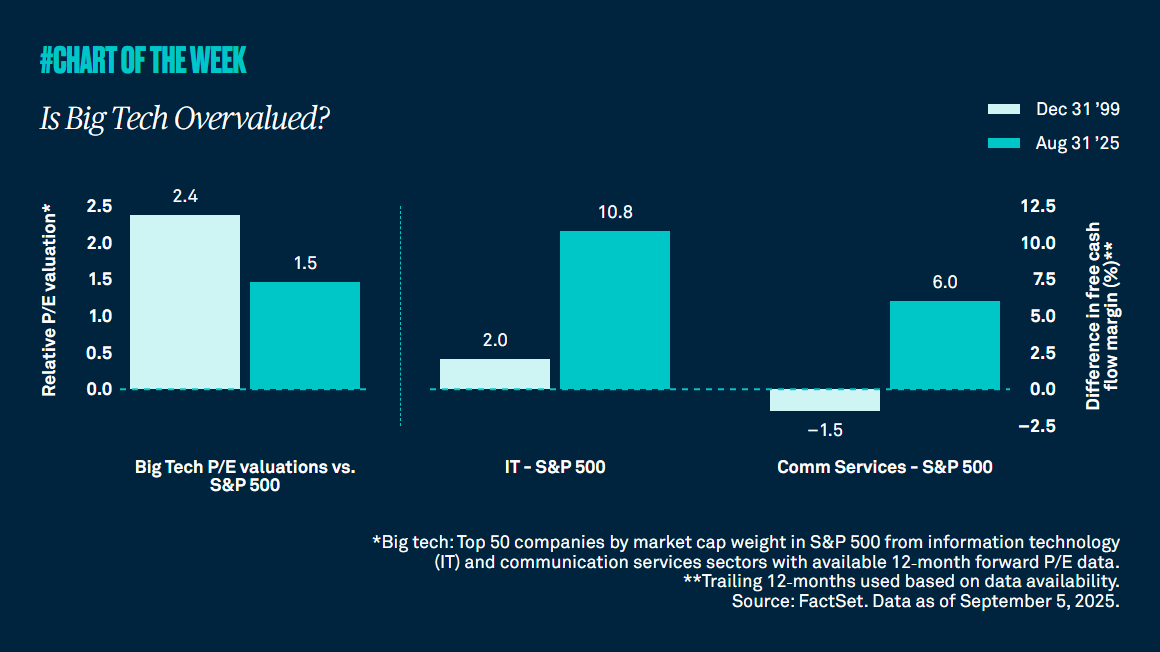

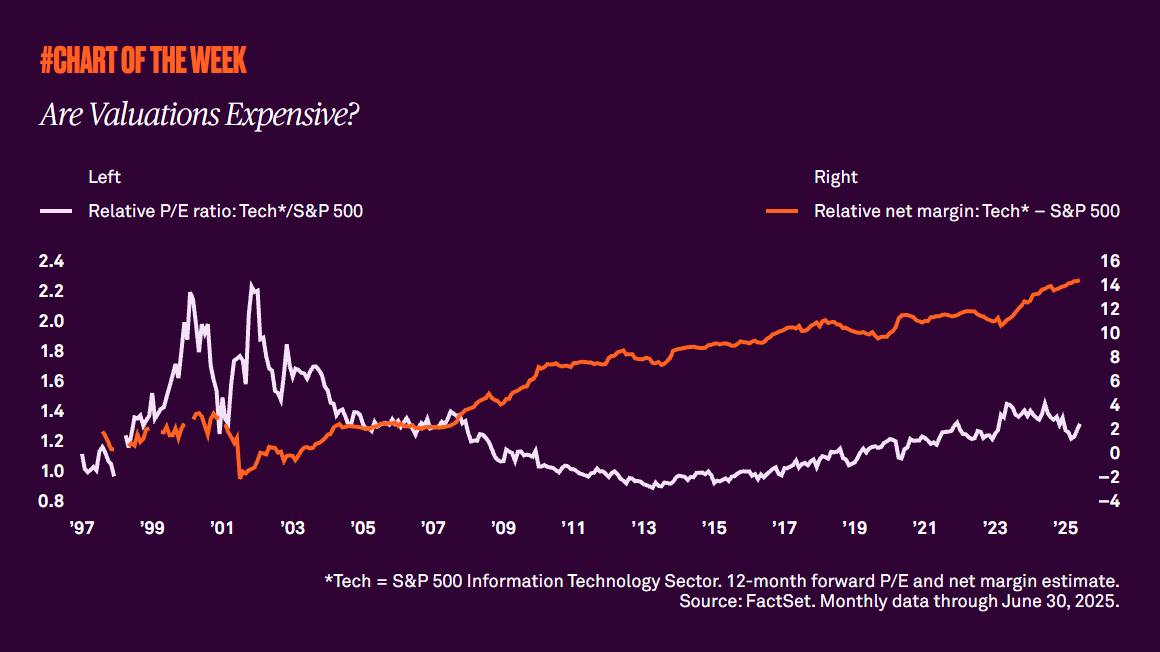

Is Big Tech Overvalued?

It’s true that the S&P 500 currently exhibits high valuations, with the technology sector alone comprising over 40% of its market capitalization and driving concerns about valuations. Are those high multiples justified?

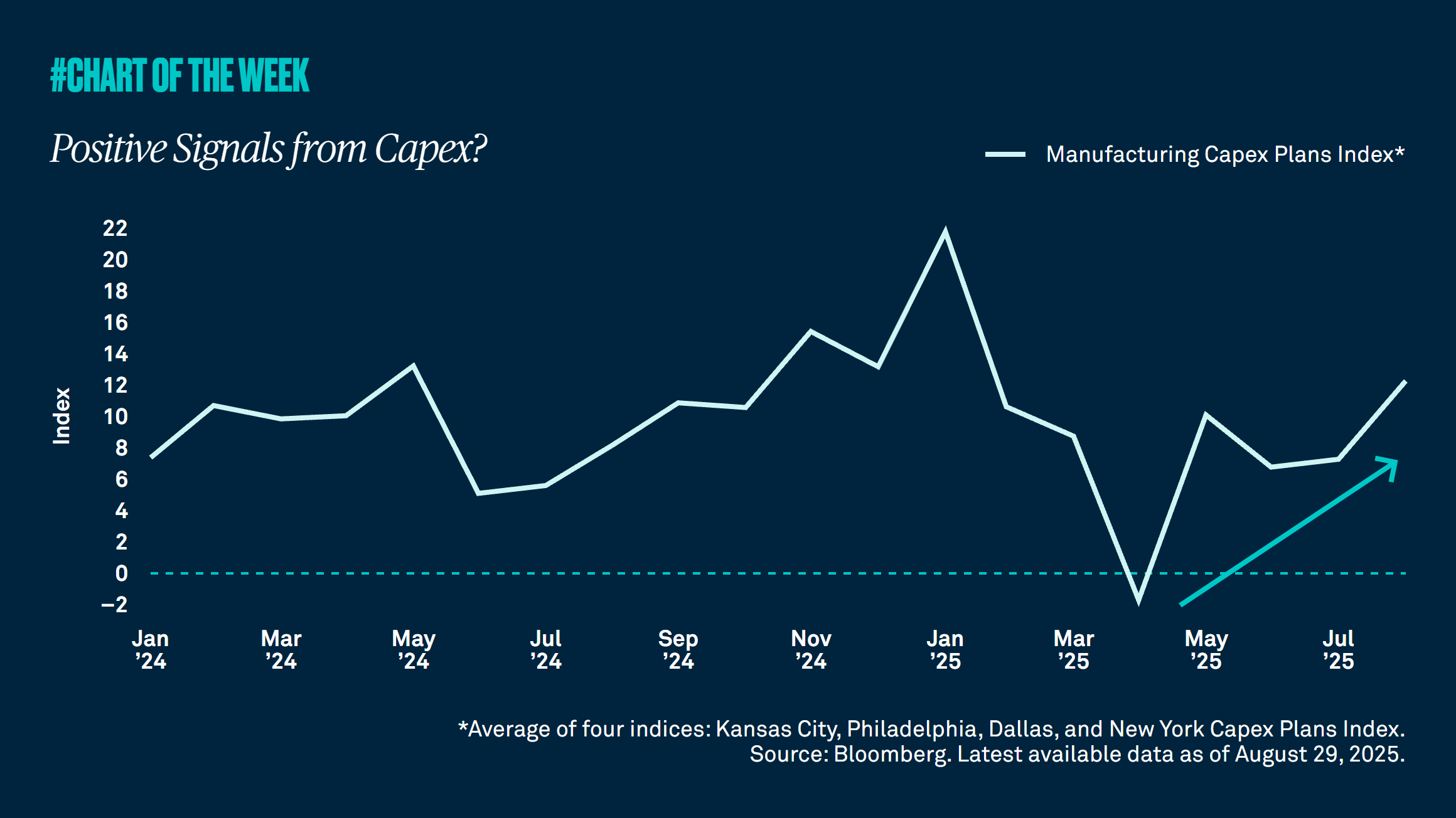

Positive signals from capex?

The One Big Beautiful Bill Act’s provision regarding the full expensing of capital expenditures is already having an impact on companies’ investment plans. We believe this a positive signal for economic growth.

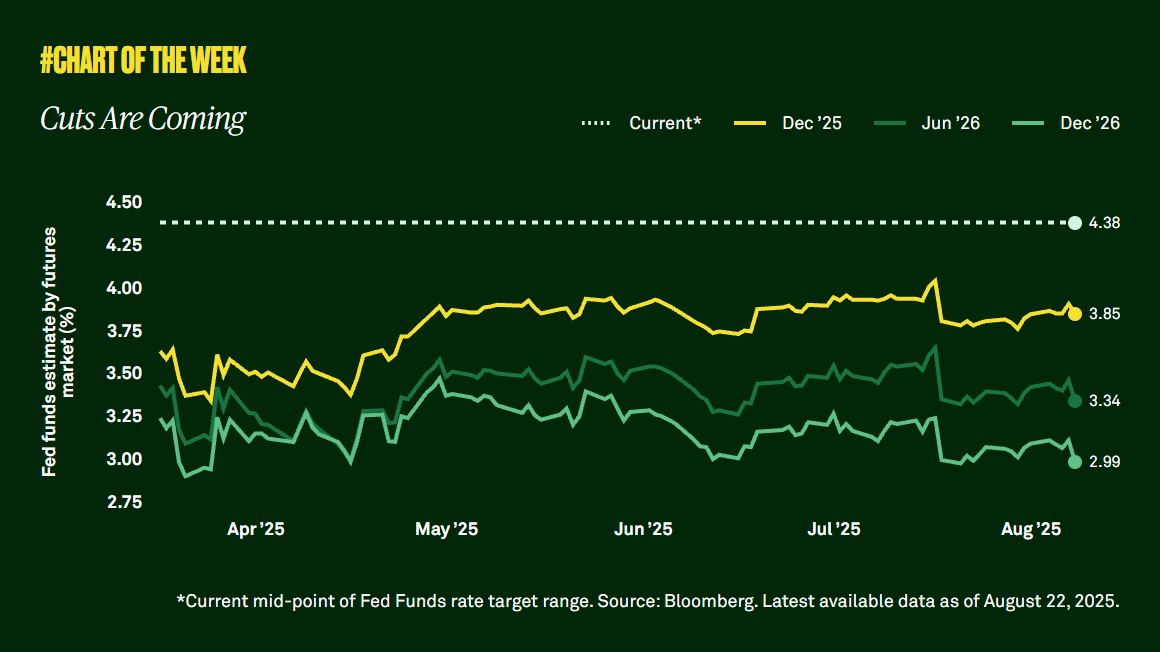

Cuts Are Coming

Last Friday, Federal Reserve Chair Jerome Powell described a shift in the balance of employment and inflation risks, and the market rallied on the news. For us, nothing has changed. We have been closely monitoring the labor market and indicators of inflation, and we continue to expect two rate cuts this year.

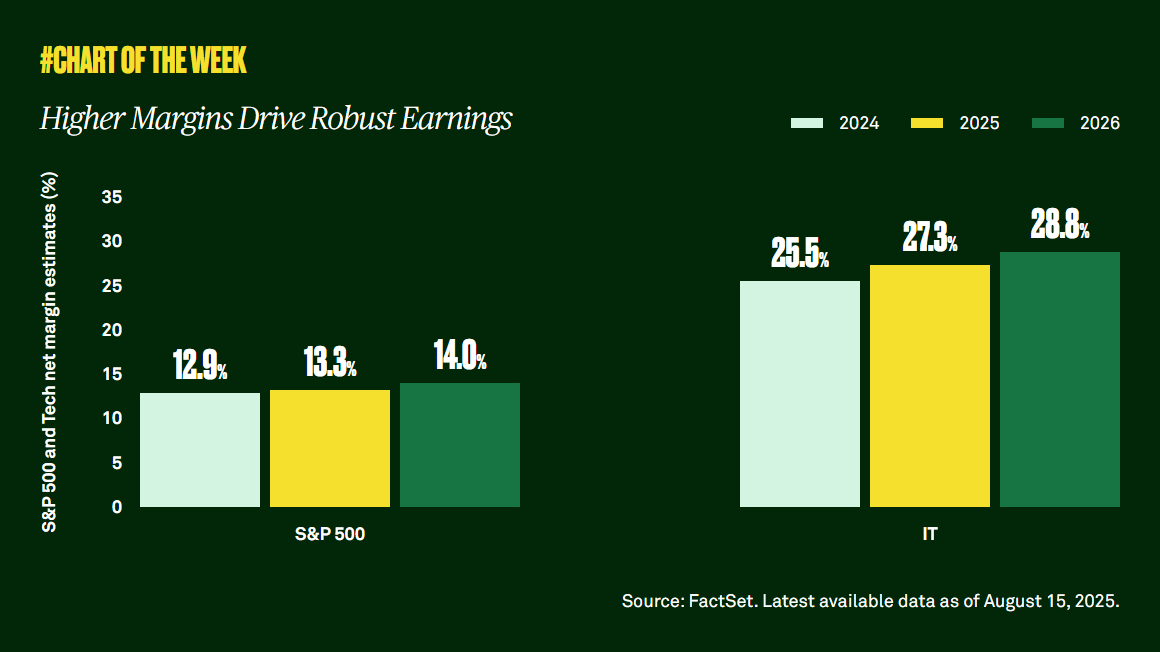

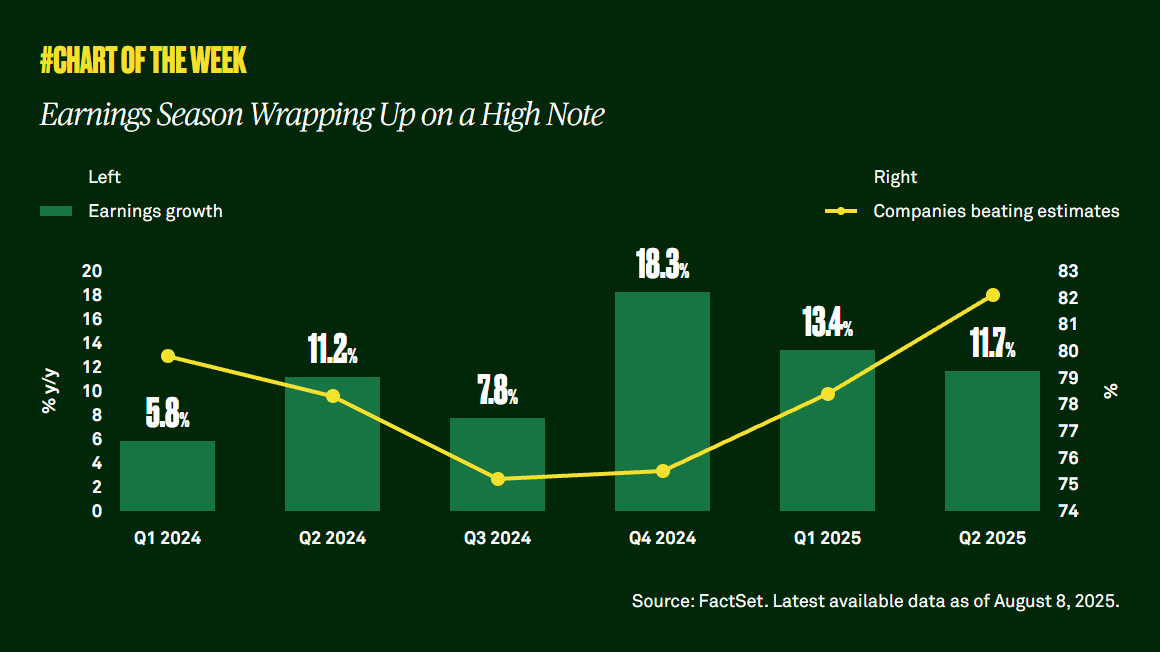

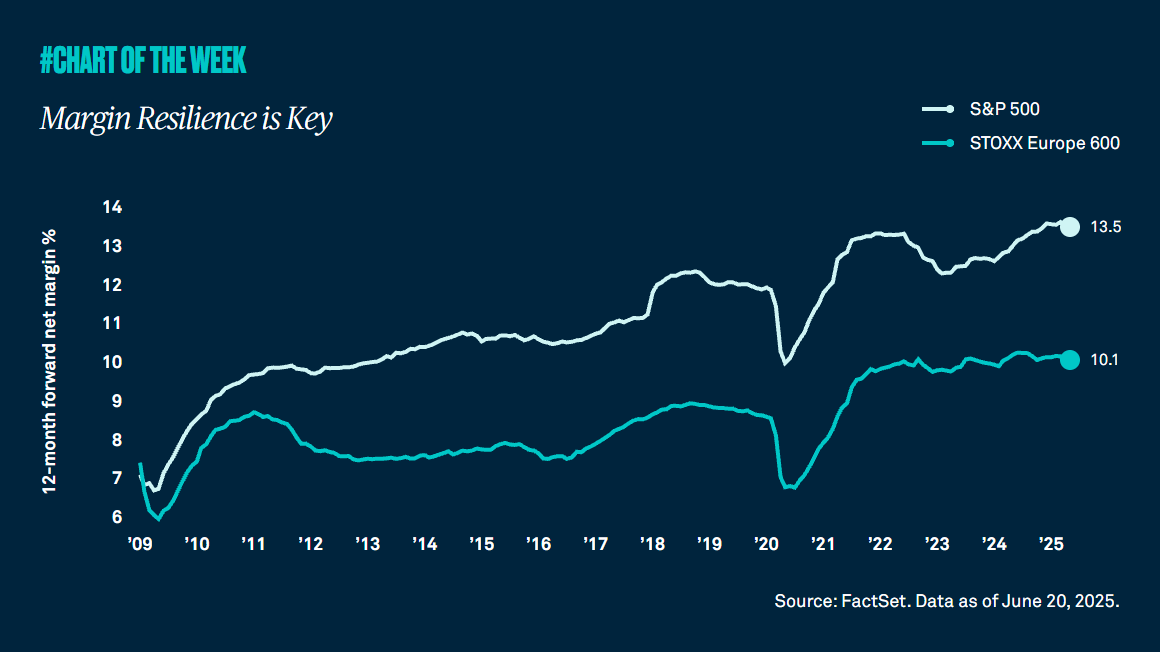

Higher Margins Drive Robust Earnings

Second quarter earnings season is winding down. Nearly all companies have reported, and the majority beat expectations as margin estimates continue to rise.

Earnings season wrapping up on a high note

Second quarter earnings season is winding down, but earnings are up, and better than expected. Despite some potentially concerning signals from the real economy, including muted job gains, and possible seasonal volatility, we remain constructive on equities. A positive second quarter earnings season strengthens our conviction.

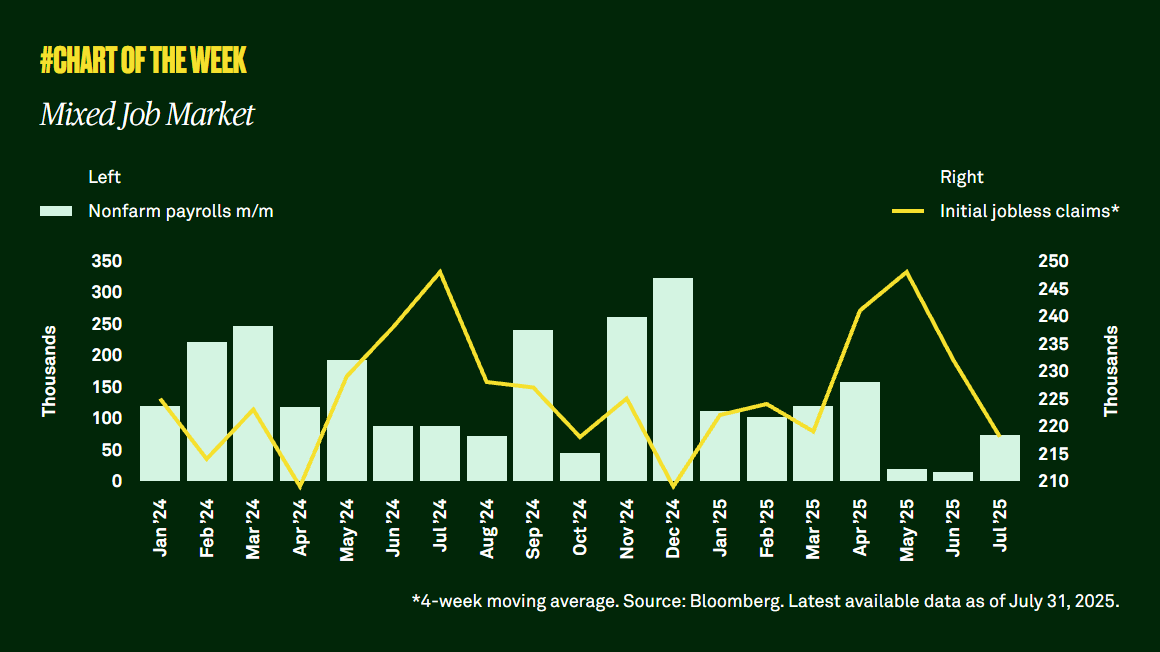

Mixed Job Market

Last week the market received mixed messages about the condition of the labor market. Nonfarm payrolls came in lower than expected, and the previous two months of data were revised sharply lower. Yet initial jobless claims were also lower, and the unemployment rate remains in range. We believe the U.S. economy can still deliver modest growth this year.

Are valuations expensive?

This year has been characterized by policy uncertainty and fears about the potential impact of tariffs on inflation. While many expected the consumer would crack amid weaker sentiment, it hasn’t happened yet. Retail sales remain resilient, supported by a job market that remains good enough to support spending.

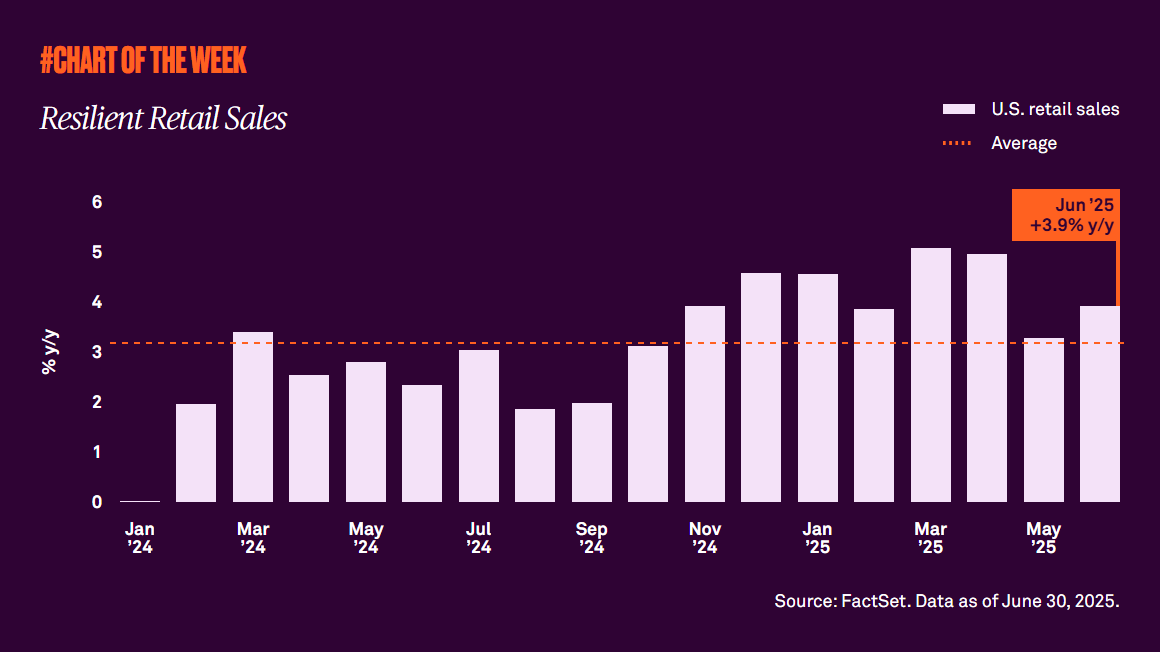

Resilient retail sales

This year has been characterized by policy uncertainty and fears about the potential impact of tariffs on inflation. While many expected the consumer would crack amid weaker sentiment, it hasn’t happened yet. Retail sales remain resilient, supported by a job market that remains good enough to support spending.

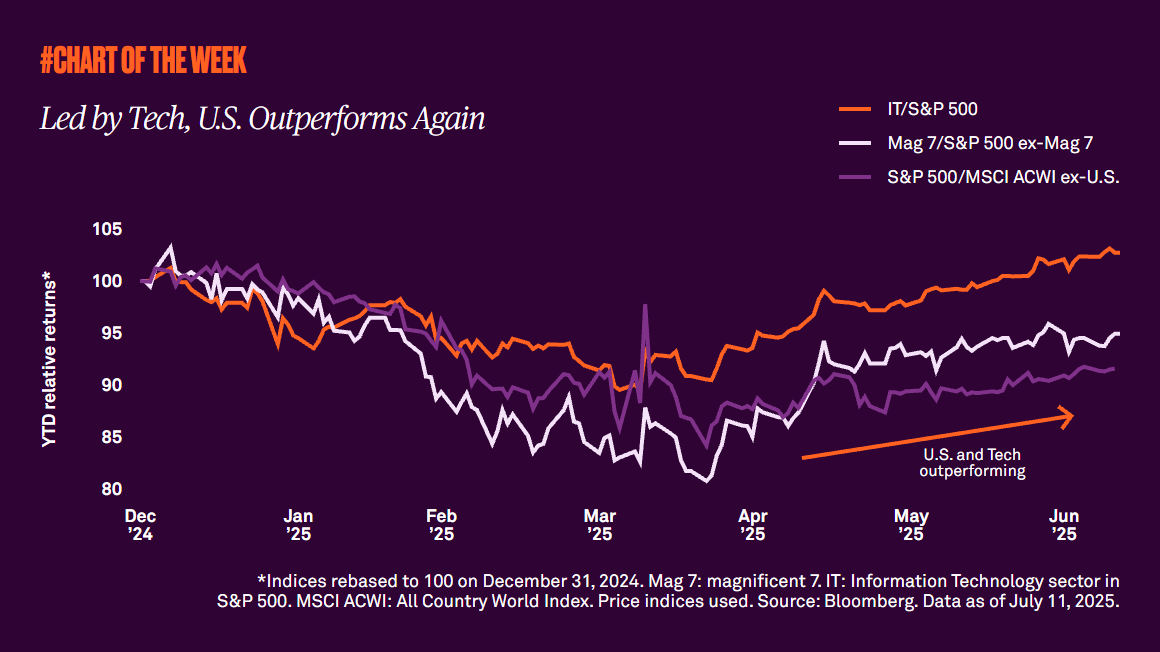

Led by Tech, U.S. Outperforming Since mid-April

After years of outperformance, the U.S. underperformed other regions during the first quarter. While the debate over whether U.S. exceptionalism can persist continues, the U.S. has resumed its leadership since mid-April - led by the technology sector.

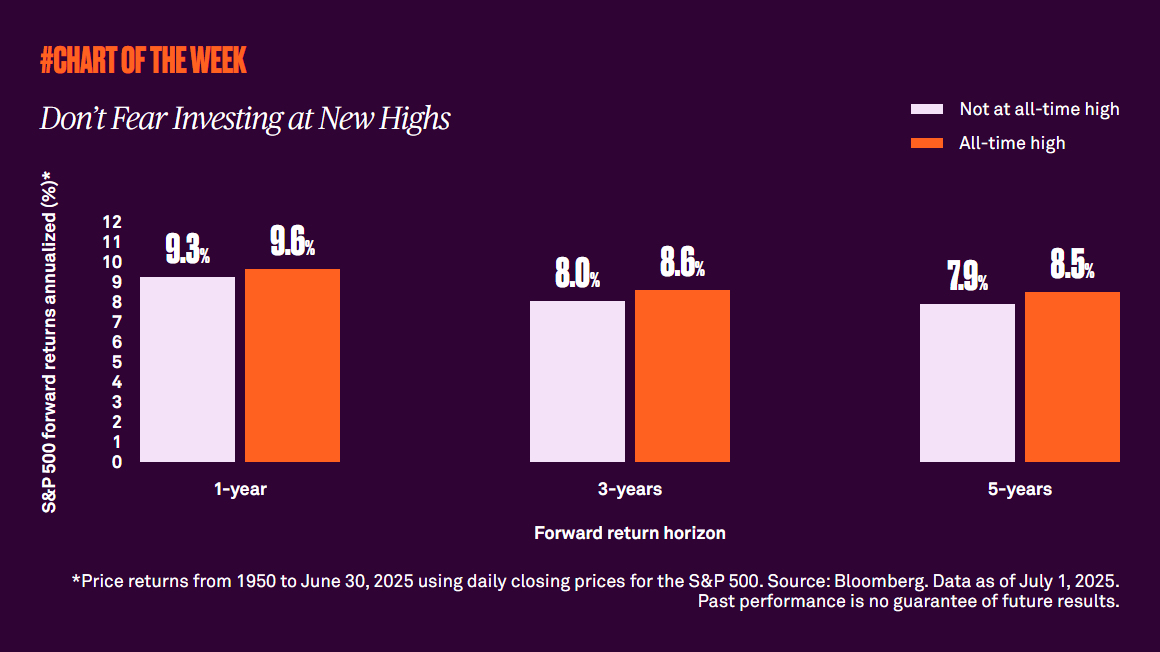

Don’t Fear Investing at New Highs

The S&P 500 recently hit another all-time high. Is it therefore time to exercise more caution? Not in our view. We see the potential for further upside, and history is on our side.

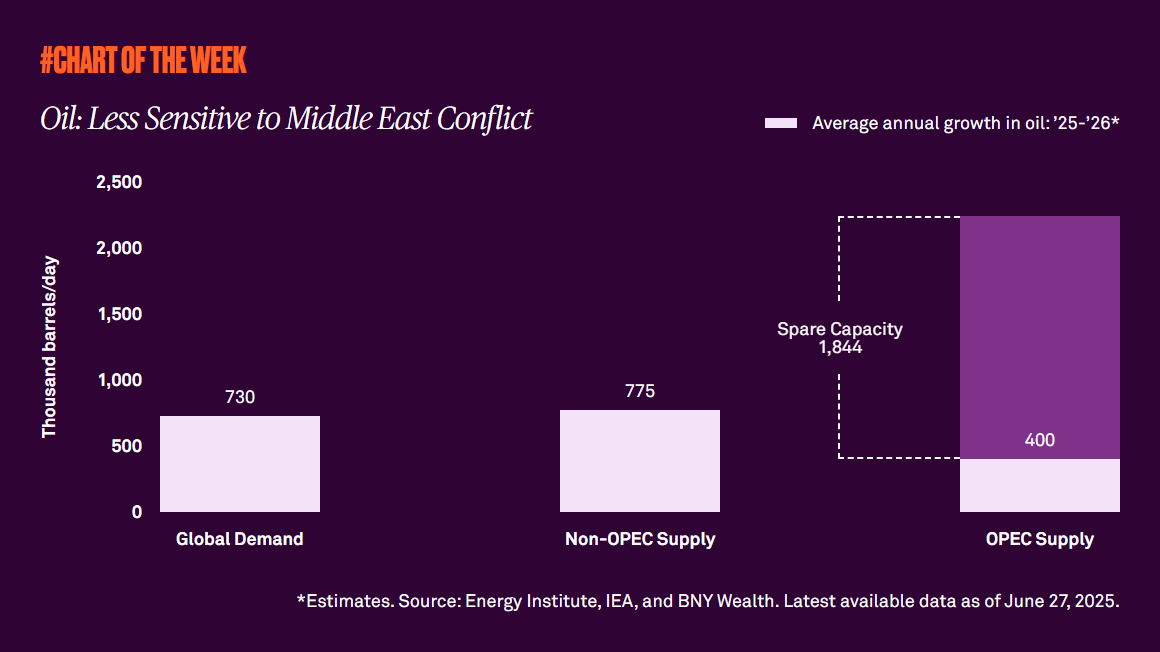

Oil: less sensitive to middle east conflict

The recent Middle East conflict sparked concerns surrounding Iran’s oil supply and the impact it could have on oil prices and the current disinflation trend. However, the price of oil is now at the level it was before the first strike on Iran. Due to the shale revolution, the oil market is ruled by new dynamics.

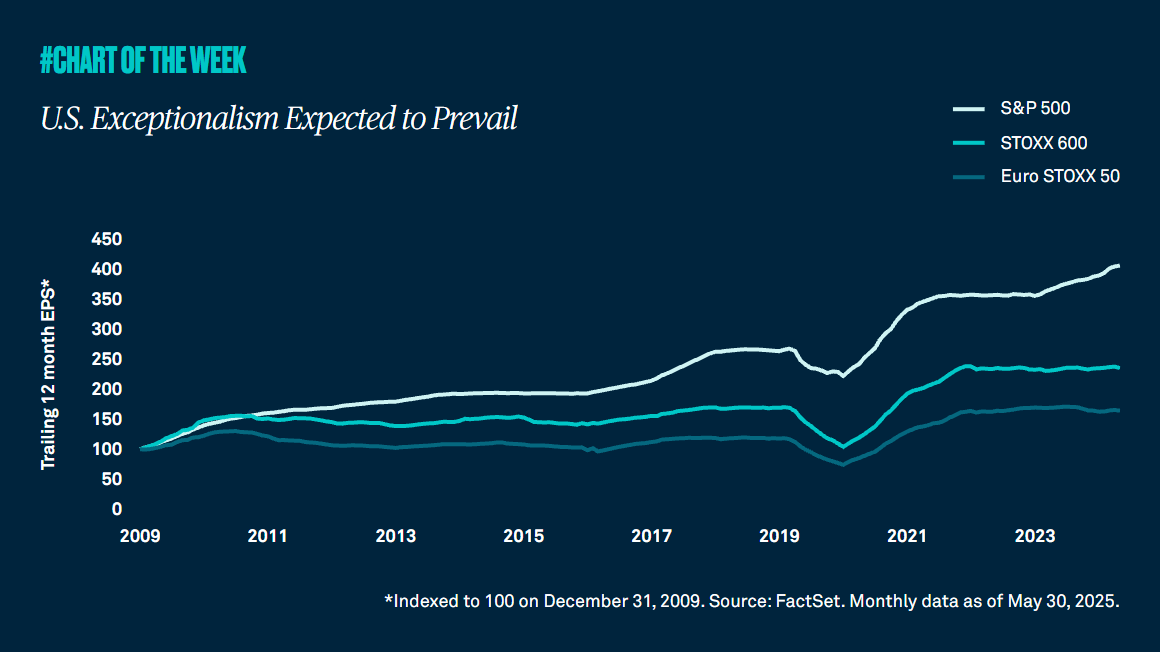

Margin Resilience Is Key

This year U.S. equities have underperformed the rest of the world due largely to policy uncertainty. However, an important driver of U.S. equity outperformance over the longer term has been stronger earnings and profit margins relative to peers, and our view is these factors will continue to drive long-term U.S. exceptionalism.

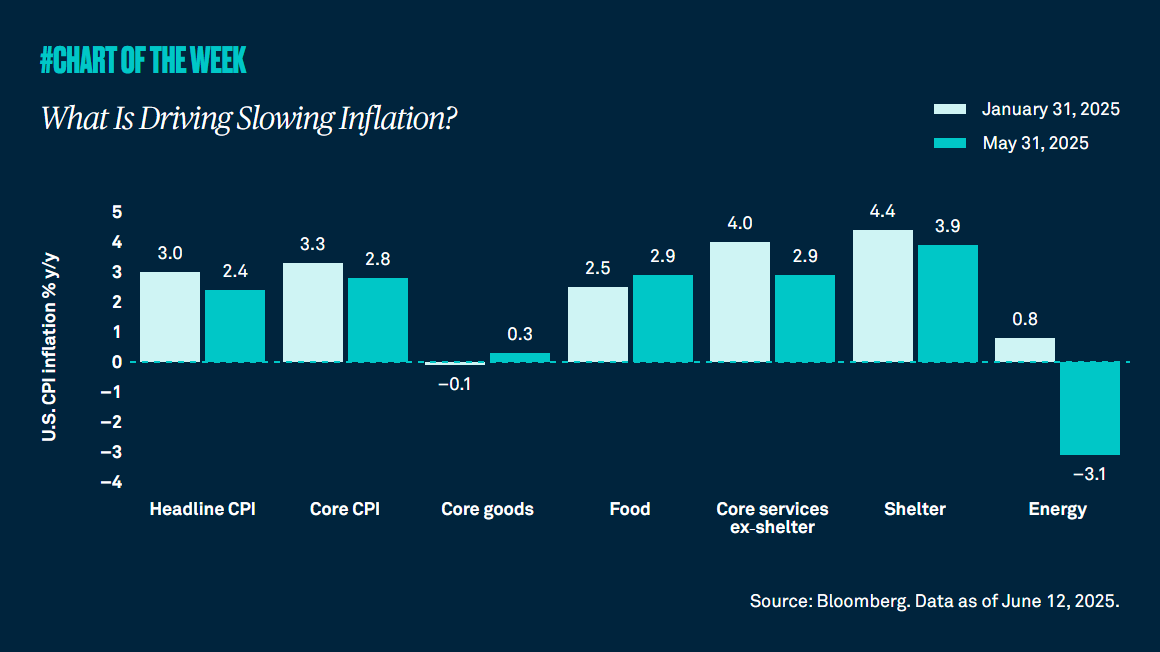

What Is Driving Slowing Inflation?

Inflation came in cooler than expected in May. In fact, it’s down from January’s growth rate of 3.0% year over year to 2.4%. While stickier services components such as shelter have driven this decline, could the recent uptick in oil prices and higher tariffs pose headwinds?

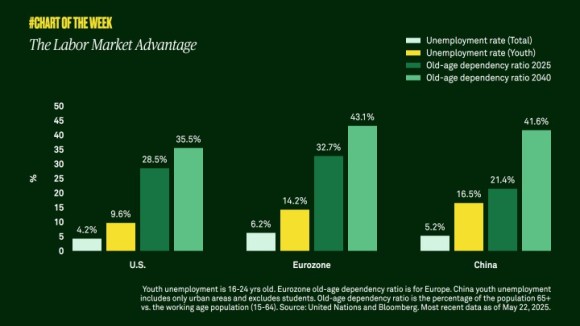

The labor market advantage

The labor market is an important consideration when evaluating the economic growth prospects of a country. In the U.S., unemployment and demographics metrics look favorable compared to other major economies.

A “Good Enough” Job Market

By no measure are we seeing a booming job market, but we are also not seeing a deteriorating one. In fact, current labor metrics lead us to conclude that the job market remains “good enough” to support our economic growth expectations for the year.

The U.S. Advantage: Higher Productivity

Lately, non-U.S. equities are outperforming the U.S. Is U.S. exceptionalism dead? Productivity growth tells a more positive story.

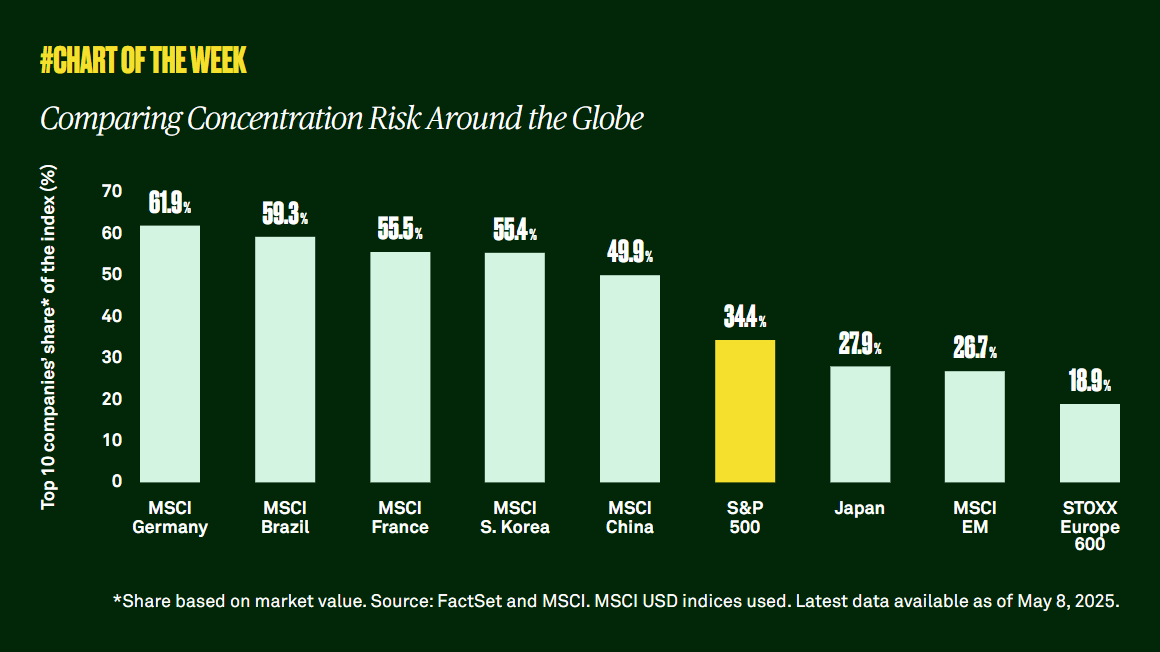

Comparing concentration risk around the globe

While some fear the S&P 500 is too concentrated in its top 10 stocks, our analysis tells us something different.

U.S. exceptionalism expected to prevail

International equity markets are outperforming the U.S. year to date. Is this a durable trend? According to relative earnings growth, the U.S. still has an advantage.