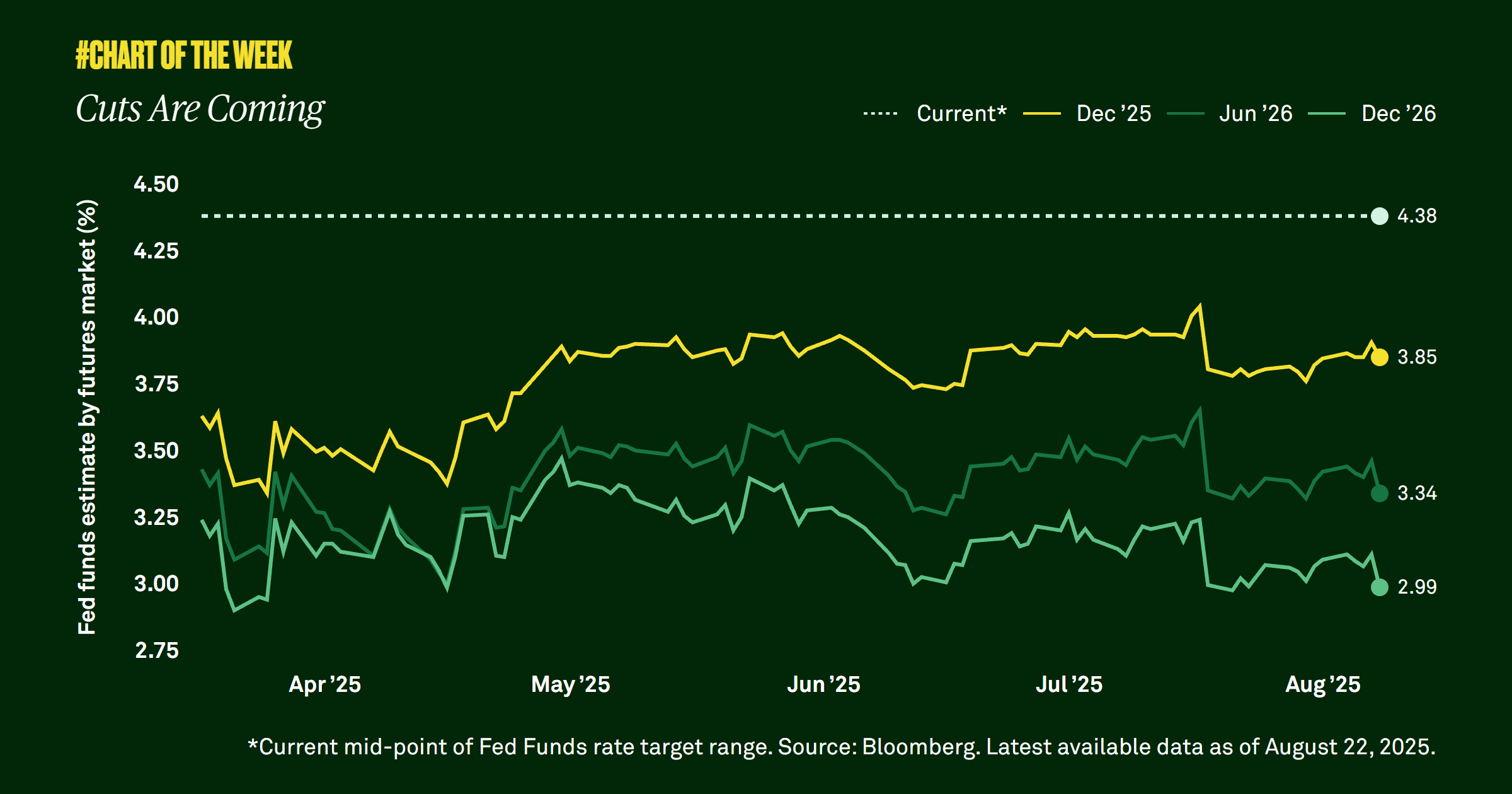

Cuts are coming

Last Friday, Federal Reserve Chair Jerome Powell described a shift in the balance of employment and inflation risks, and the market rallied on the news. For us, nothing has changed. We have been closely monitoring the labor market and indicators of inflation, and we continue to expect two rate cuts this year.

Second quarter earnings season is winding down, with ~92% of S&P 500 companies having reported. Over 80% of those companies beat analysts’ expectations, pleasing many investors and correcting a downward shift in S&P 500 margin estimates that has stabilized since May.

Margins illustrate the quality and durability of corporate earnings by demonstrating how effectively a company controls costs and converts sales into profits. In 2025, net margins are expected to reach 13.3%, up from 12.9% in 2024, as well as increase another 0.7% to 14.0% in 2026. Notably, estimates for technology companies are significantly better than those of the entire S&P 500.

In fact, technology enhancements are the key driver of higher margins for the index. Specifically, the continued development and broadening adoption of artificial intelligence (AI) should bolster companies’ productivity and, in turn, lead to higher margins. Some of the ways that AI increases margins include improving operational efficiency, employing data-driven decision making, enhancing supply chain optimization, and enabling product and service innovations.

The immense progress in AI and its encouraging potential support our constructive view of equities. Improving estimates for both margins and earnings underscore our overweight position in large cap stocks and should push the market higher by year end.

794299 Exp : 25 August 2026

YOU MIGHT ALSO LIKE

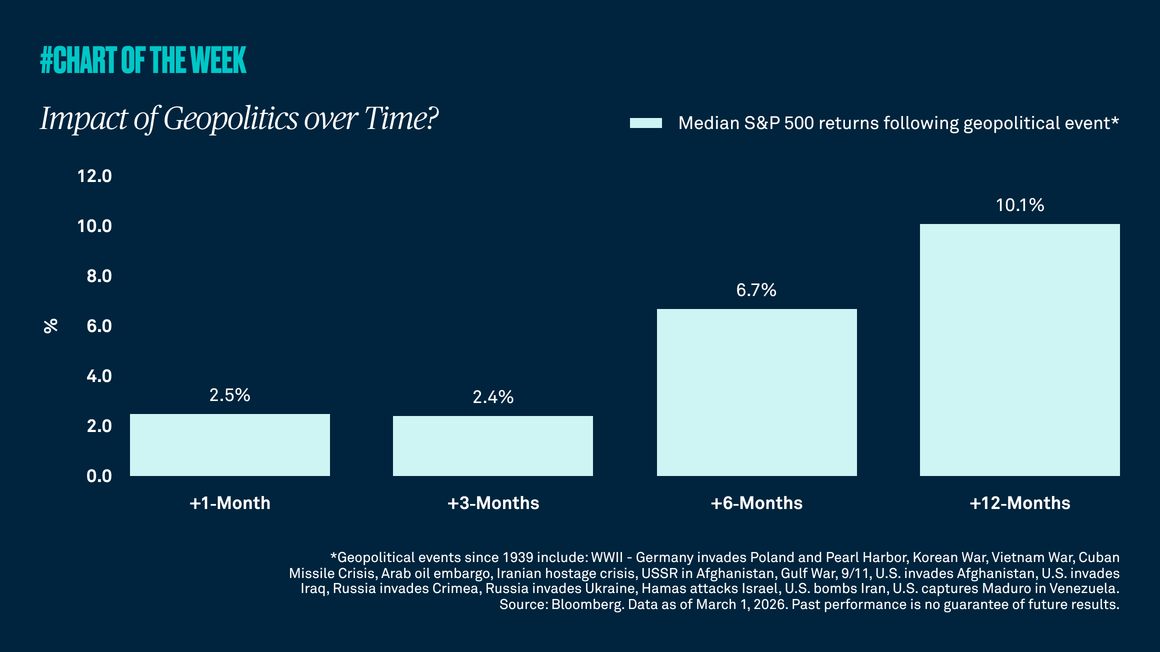

Tensions between the U.S./Israel and Iran have recently boiled over into a military conflict, which has given many investors the jitters. However, our research shows that equity market pullbacks resulting from geopolitical events are often short lived with the S&P 500 typically higher in the months following these events.

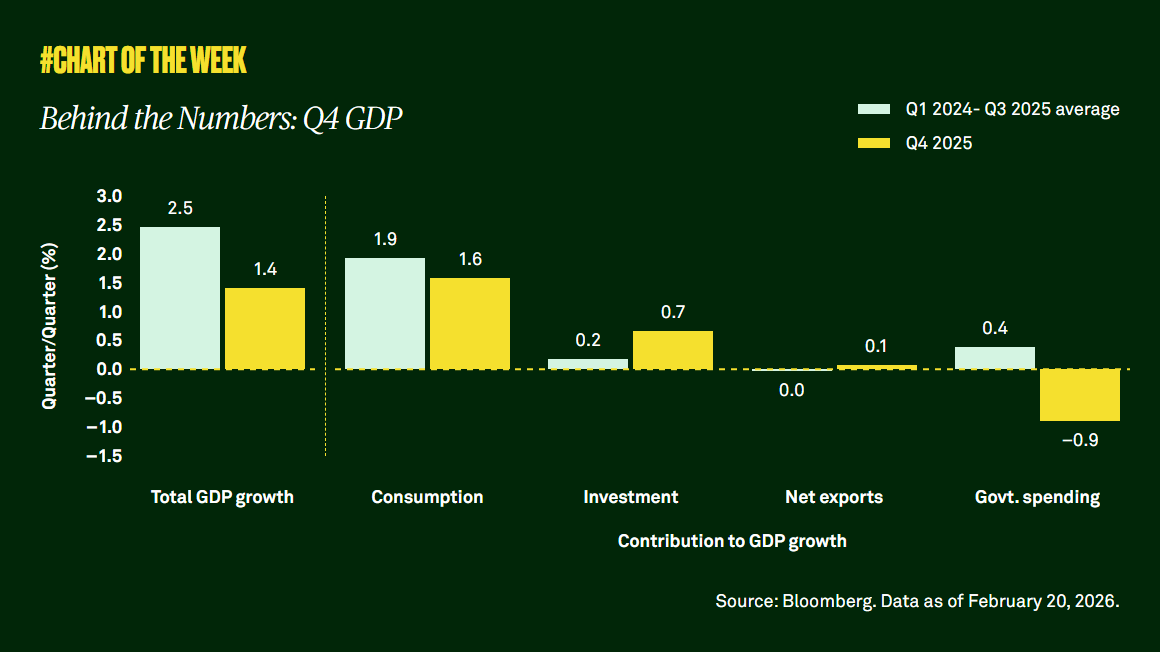

Gross domestic product undershot expectations last quarter, but the shortfall appears driven more by the temporary government shutdown than broad-based weakness. Consumer demand remains resilient, and with supportive fiscal policy, easing financial conditions and a steady labor market, the outlook points to a modest acceleration in economic activity this year.

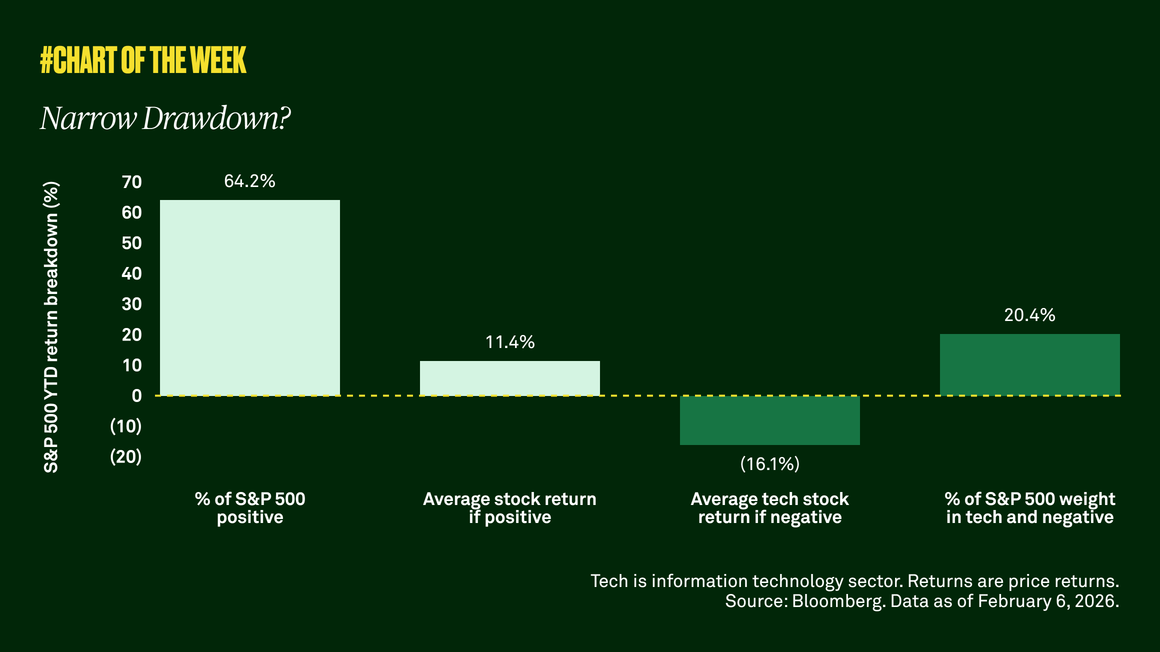

Equity volatility is rising, but all is not what it seems. The technology sector is weighing on the S&P 500 while value and cyclical stocks lead. A market rotation is underway as many investors begin to favor companies beyond tech.

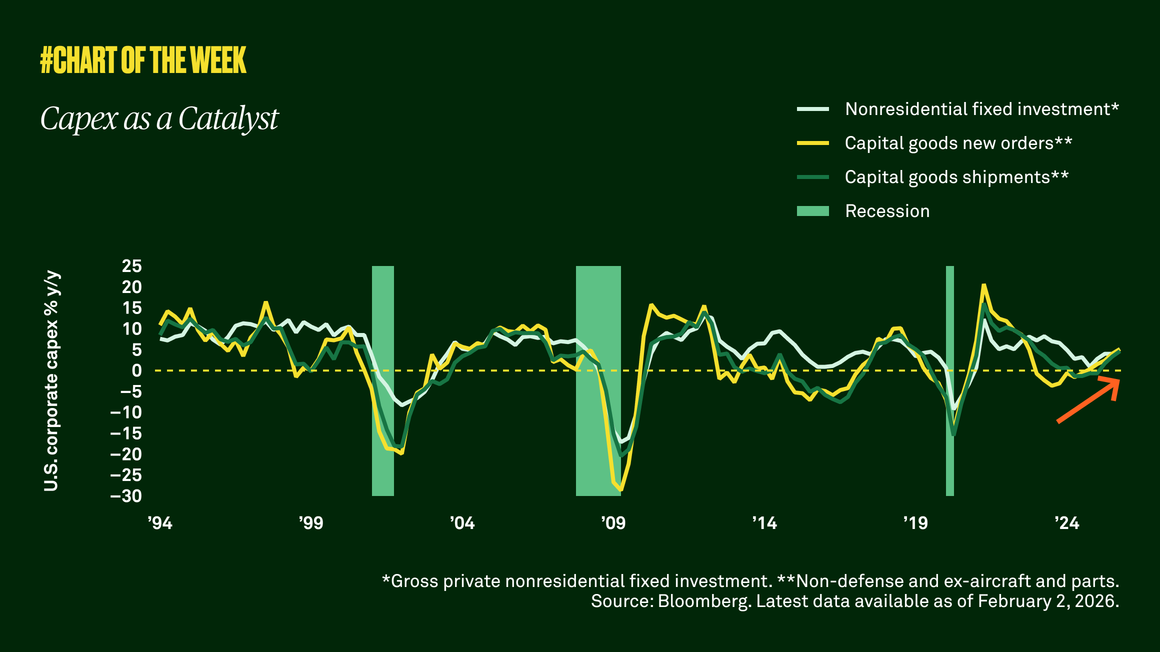

Capex as a catalyst

Capex as a Catalyst

Improved business confidence and recent tax legislation are compelling corporations to reinvest their cash flows in their businesses. We believe this is a positive signal for economic growth.