Overview

We are delighted to bring you our latest investment research, ‘Shaping tomorrow’s portfolios: The strategic role of fixed income’.

There was a time when bonds were viewed as a dependable but unexciting constituent of any investment portfolio. In recent years however, bonds have offered investors a different experience. The market gyrations of 2022 reset the asset class and with higher yields now offering a myriad of opportunities for investors, the stereotype of bonds being boring feels very misplaced.

As one of the UK’s largest fixed income investors, we wanted to understand how advisers’ attitudes and approaches to fixed income are adapting. We are delighted to be working again with NMG Consulting to help us gather, analyse and present how advisers think about fixed income.

We have organised our findings against three key themes.

- Delivering resilience in a changing world.

- How advisers choose solutions to deliver in today’s market.

- The demand for innovation in fixed income.

We hope you enjoy the report and look forward to working with you to safely unlock the opportunities of this very exciting asset class.

Michael Beveridge,

Head of UK Distribution, BNY Investments

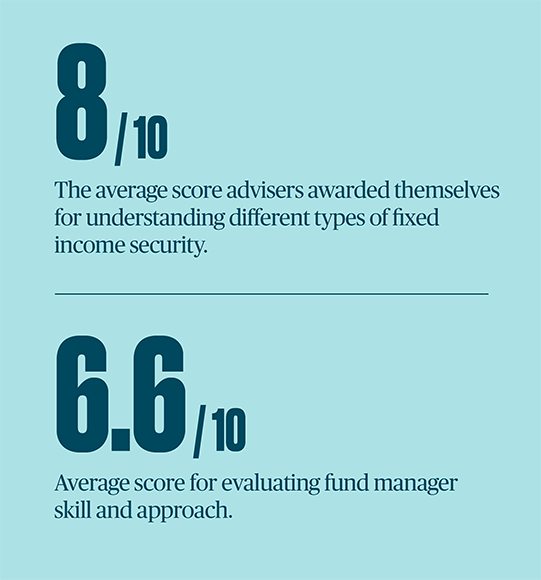

Research conducted by NMG Consulting for BNY Investments, based on responses to surveys with 125 fixed income-focused financial advisers between March and April 2025.

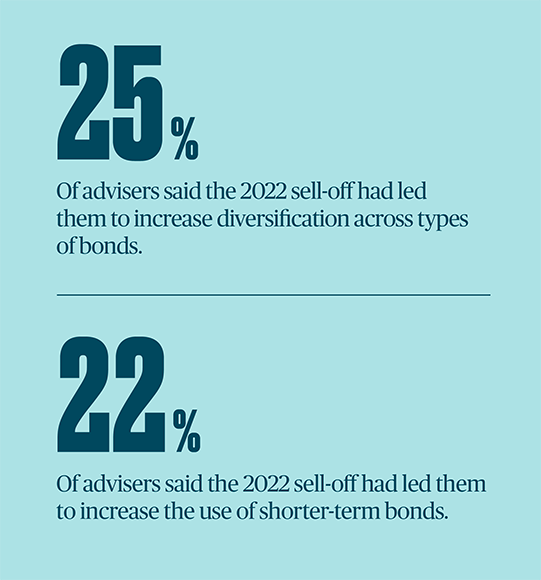

The 2022 market turbulence triggered a fundamental recalibration of our fixed income approach

DELVING DEEPER

Fixed income: the product development imperative

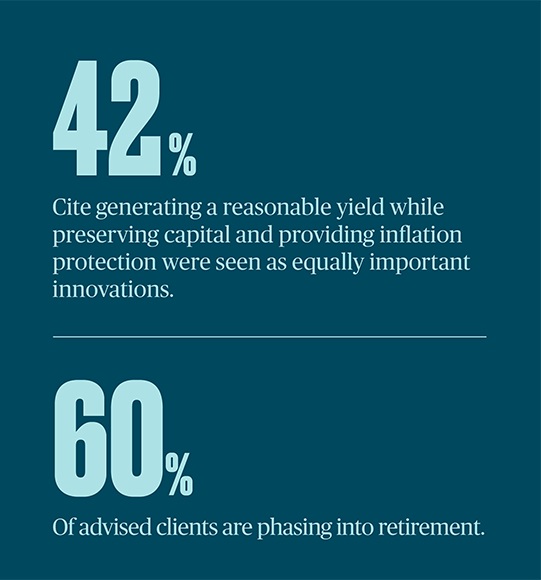

The demands on fixed income within client portfolios are evolving rapidly. With an ageing population, there is an increasing need for consistent, reliable income streams to support retirement, alongside protection from interest rate volatility and a diversification buffer against stock market fluctuations. Our latest BNY Insight Fixed Income report highlights a clear imperative for innovation.

Key takeaways

Growing demand for reliable retirement income

With an ageing population, advisers need fixed income solutions that provide consistent income and capital preservation amid market volatility.

Innovation needed in fixed income products

Advisers seek outcome-focused, actively managed funds and access to institutional strategies in retail formats to better meet client needs.

Education and communication gaps persist

Advisers want clearer, scenario-based guidance to confidently assess fixed income options and navigate evolving market challenges.

RELATED INSIGHTS

Fixed income: the product development imperative

The demands on fixed income within client portfolios are evolving rapidly. With an ageing population, there is an increasing need for consistent, reliable income streams to support retirement, alongside protection from interest rate volatility and a diversification buffer against stock market fluctuations. Our latest BNY Insight Fixed Income report highlights a clear imperative for innovation.

Why high-yield debt issuers call bonds early

It’s a common question among fixed income investors: why are some bonds called early? Insight Investment’s high yield team answers this and explores some of the opportunities it can create.

Real Return: 6 for 2026 outlook

Ella Hoxha, Co-head of BNY Investments Newton’s Real Return team, sees a constructive yet fragile outlook for financial markets, with opportunities arising from potential monetary policy easing balanced by persistent risks, including inflation and valuation constraints.

6 for 2026 Outlook: Global Credit

Fading cash yields could see a powerful rotation into credit markets, while AI growth financing and the emerging markets could offer new opportunities. Peter Bentley gives his 6 potential catalysts for credit investments in 2026.

Musical Chairs in Fixed Income

Leaders rotate in and out. No single fixed income sector consistently dominates performance over time, and strong performance in one sector rarely carries over from one year to the next. For example, U.S. Treasury bills led in 2018 and 2022 but are one of the weakest performers year-to-date.

Global Short-Dated High Yield: Why spreads don’t tell the whole story

Cathy Braganza, senior portfolio manager at Insight Investment, explains why tightening spreads with high yields create a potentially attractive risk-return balance for credit investors.

About the research

NMG Consulting, in collaboration with BNY Investments, undertook primary research to better understand the fixed income landscape from the adviser perspective. The research comprised of:

- In depth-qualitative interviews with senior financial advisers and gatekeepers. These semi-structured discussions explored evolving fixed income strategies, implementation challenges, and innovation opportunities.

- A comprehensive online survey completed by 125 financial advisers. Participants were screened to ensure significant involvement in fixed income allocation decisions for clients portfolios.

Advisers

surveyed for their

views on key topics

Hours of in-depth

qualitative interviews

Discover our fixed income funds

Our fixed income funds are actively-managed by seasoned investors with extensive track records, looking to unlock hidden opportunities around the world.

Whatever your query, one of our team will be able to help. Get in touch today.

2303933 Expiry: 10 June 2026