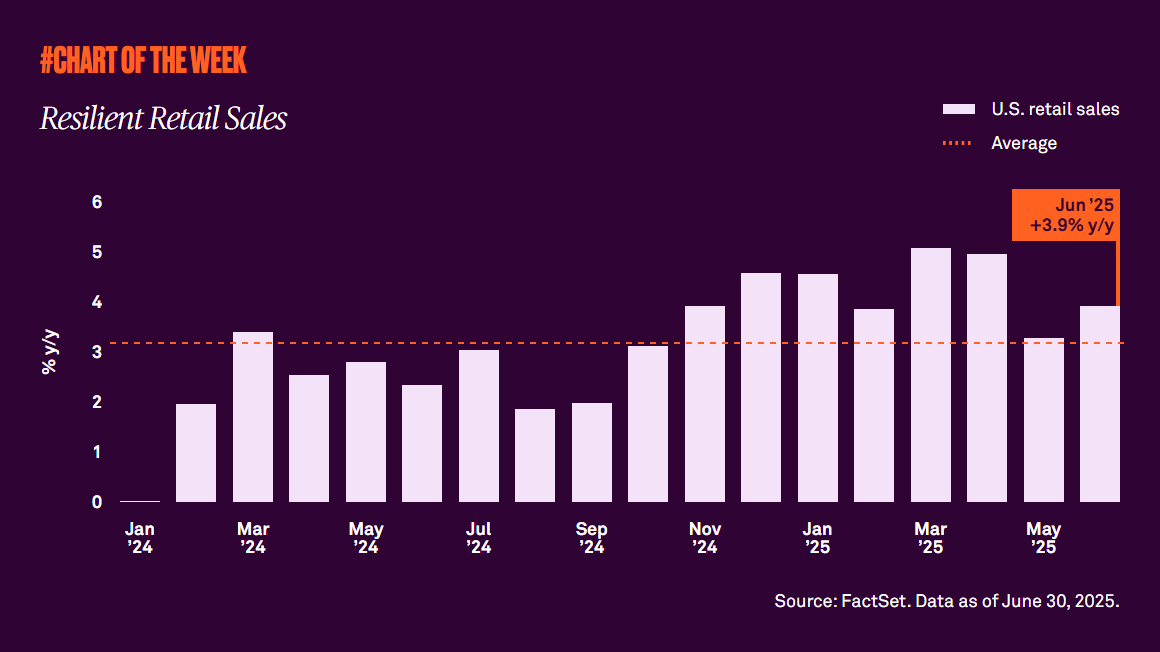

Resilient retail sales

This year has been characterized by policy uncertainty and fears about the potential impact of tariffs on inflation. While many expected the consumer would crack amid weaker sentiment, it hasn’t happened yet. Retail sales remain resilient, supported by a job market that remains good enough to support spending.

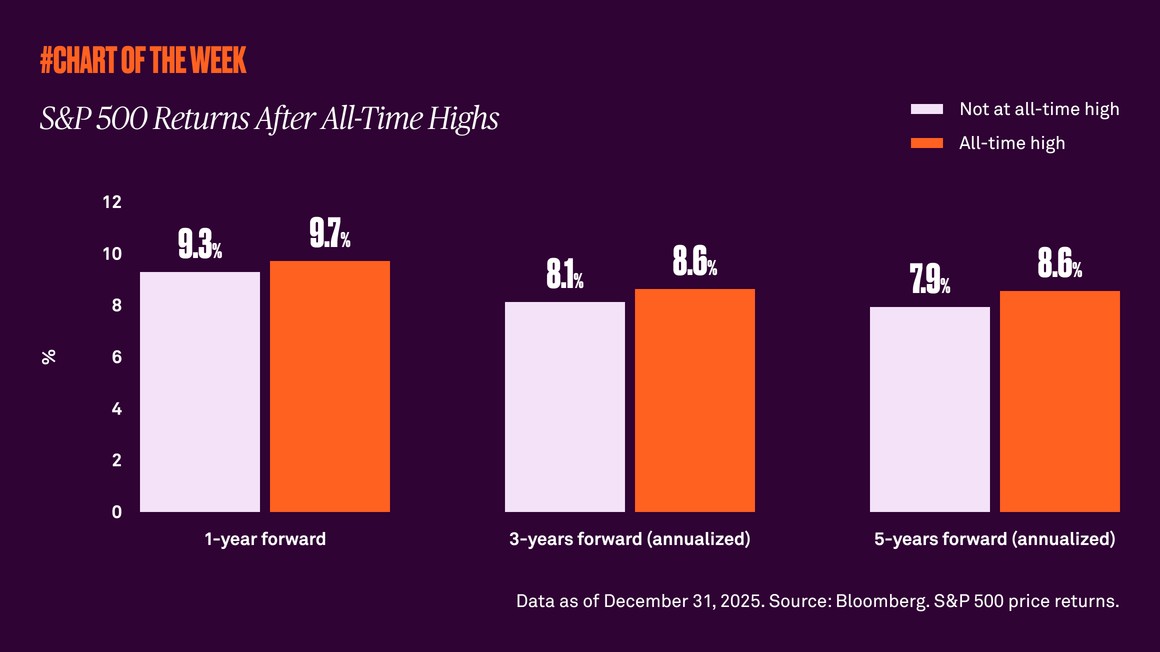

It has certainly been a volatile first half of the year for equity markets with uncertainty around tariffs and the administration’s other policies weighing on investor sentiment. From February 19 to April 8, the S&P 500 fell a notable 19%, skimming the surface of bear market territory. However, since then the index has risen 26% to a new all-time high on July 3.

While some investors may not feel comfortable buying when markets are at new highs, history shows there is little difference between future returns following a new all-time high and future returns following any other day when the market has not registered a new high. Since 1950, the S&P 500 has delivered strong returns in the forward 1-, 3- and 5-year periods from a new all-time high. The reason is the day of an all-time high is just like any other trading day, and investors are best served by viewing them all through the same lens.

Don’t let fear of all-time highs keep you on the sidelines or you’re bound to miss out. Rather, stay invested and diversified and maintain a long-term perspective. That’s the most effective way to build wealth.

775473 Exp : 21 July 2026

YOU MIGHT ALSO LIKE

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

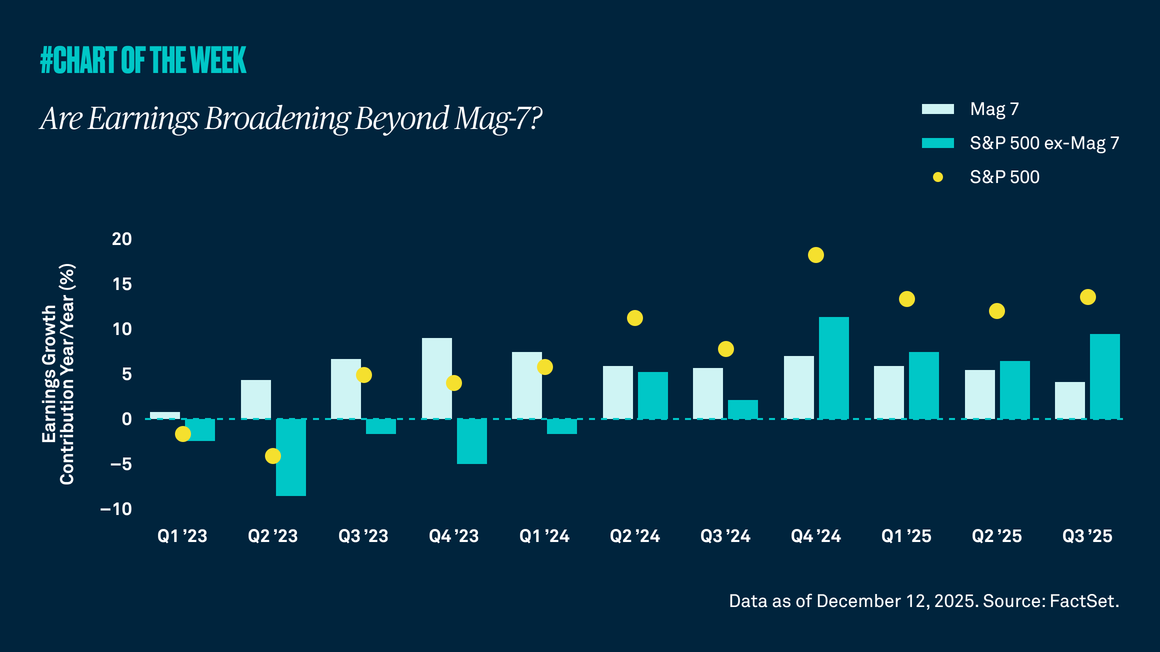

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

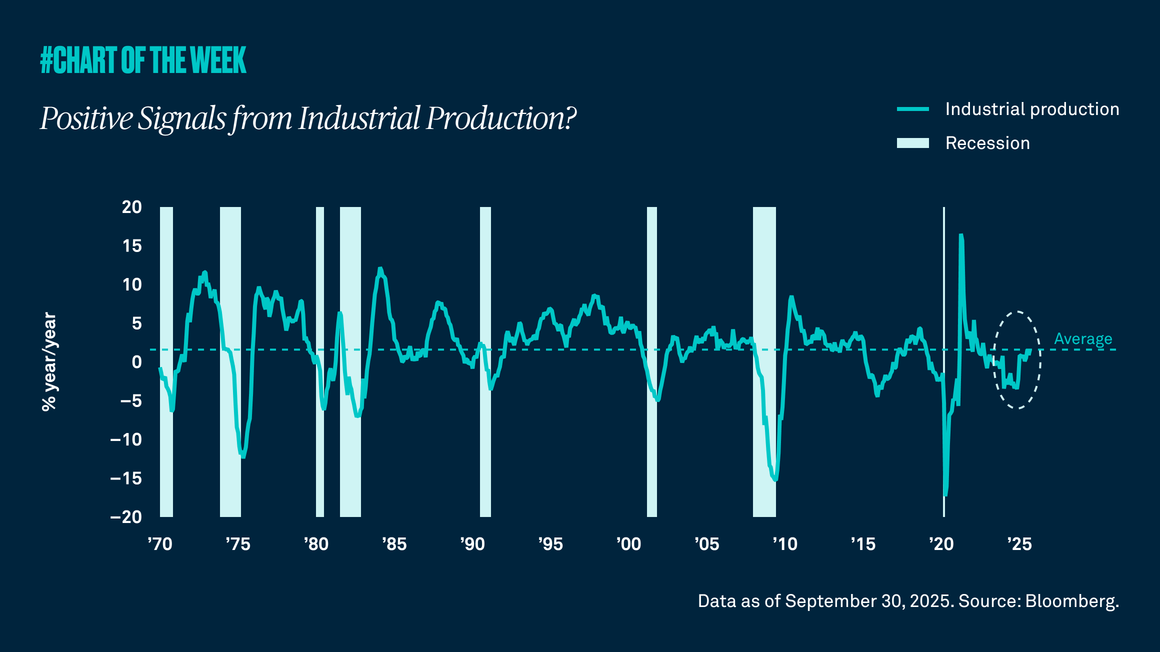

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.