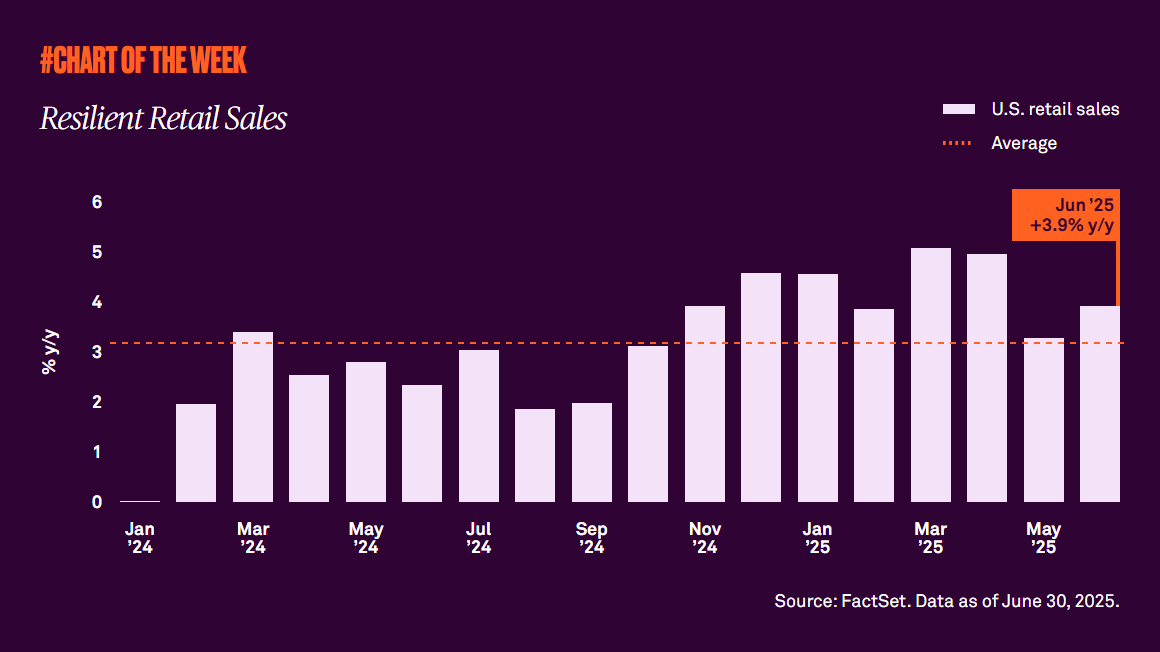

Resilient retail sales

This year has been characterized by policy uncertainty and fears about the potential impact of tariffs on inflation. While many expected the consumer would crack amid weaker sentiment, it hasn’t happened yet. Retail sales remain resilient, supported by a job market that remains good enough to support spending.

It has certainly been a volatile first half of the year for equity markets with uncertainty around tariffs and the administration’s other policies weighing on investor sentiment. From February 19 to April 8, the S&P 500 fell a notable 19%, skimming the surface of bear market territory. However, since then the index has risen 26% to a new all-time high on July 3.

While some investors may not feel comfortable buying when markets are at new highs, history shows there is little difference between future returns following a new all-time high and future returns following any other day when the market has not registered a new high. Since 1950, the S&P 500 has delivered strong returns in the forward 1-, 3- and 5-year periods from a new all-time high. The reason is the day of an all-time high is just like any other trading day, and investors are best served by viewing them all through the same lens.

Don’t let fear of all-time highs keep you on the sidelines or you’re bound to miss out. Rather, stay invested and diversified and maintain a long-term perspective. That’s the most effective way to build wealth.

775473 Exp : 21 July 2026

YOU MIGHT ALSO LIKE

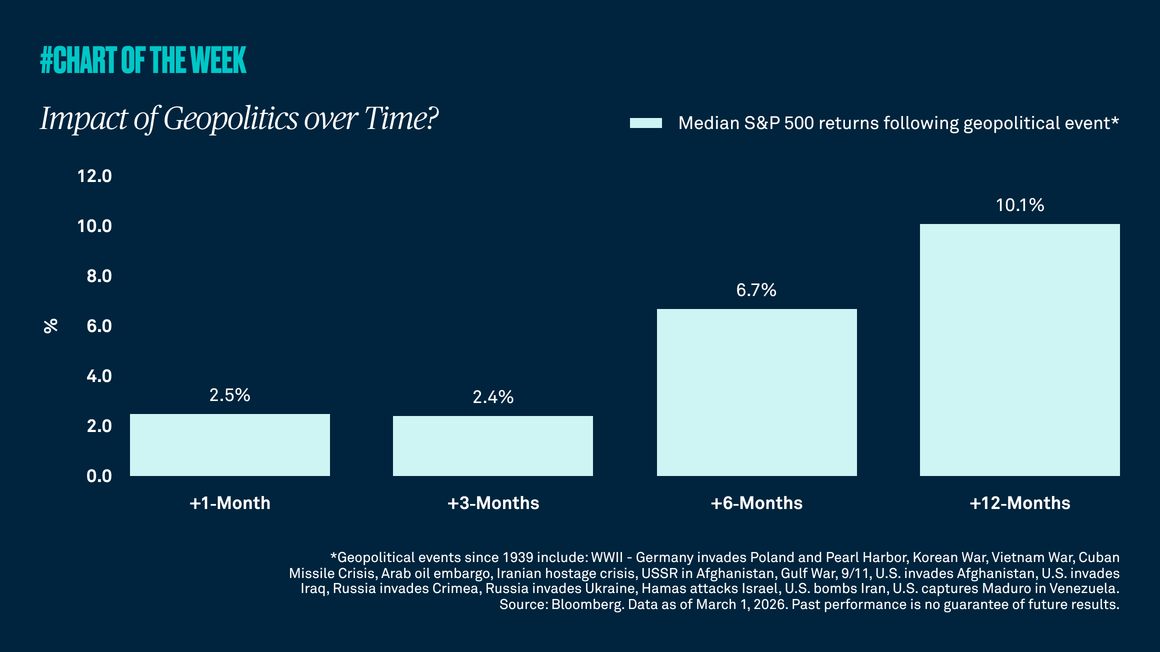

Tensions between the U.S./Israel and Iran have recently boiled over into a military conflict, which has given many investors the jitters. However, our research shows that equity market pullbacks resulting from geopolitical events are often short lived with the S&P 500 typically higher in the months following these events.

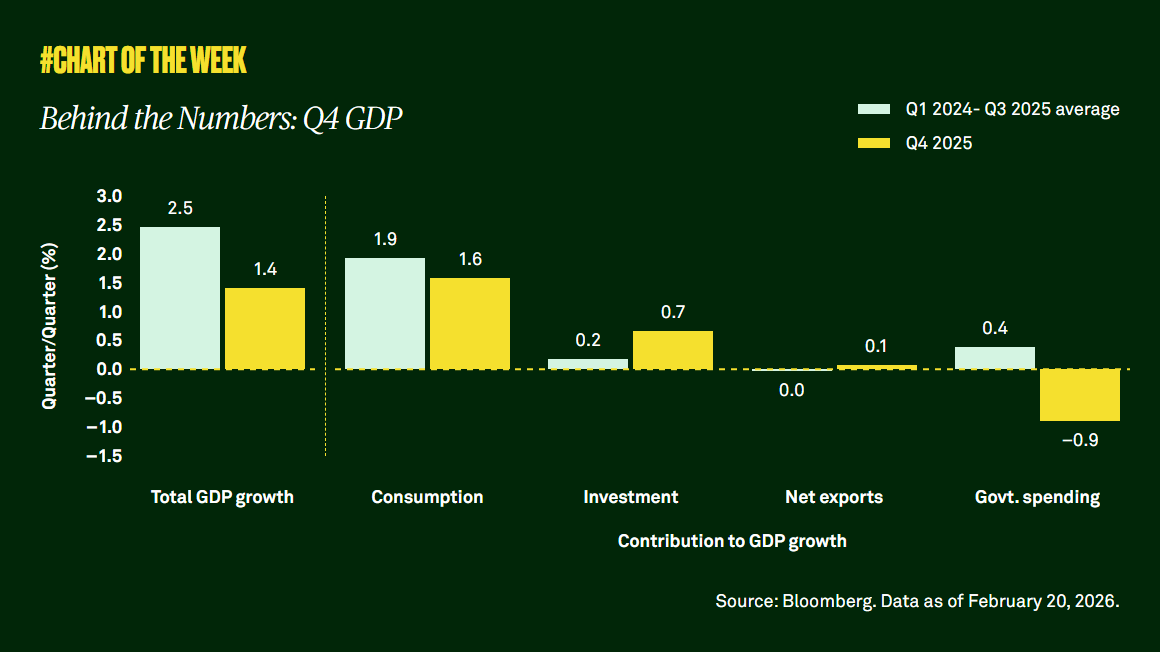

Gross domestic product undershot expectations last quarter, but the shortfall appears driven more by the temporary government shutdown than broad-based weakness. Consumer demand remains resilient, and with supportive fiscal policy, easing financial conditions and a steady labor market, the outlook points to a modest acceleration in economic activity this year.

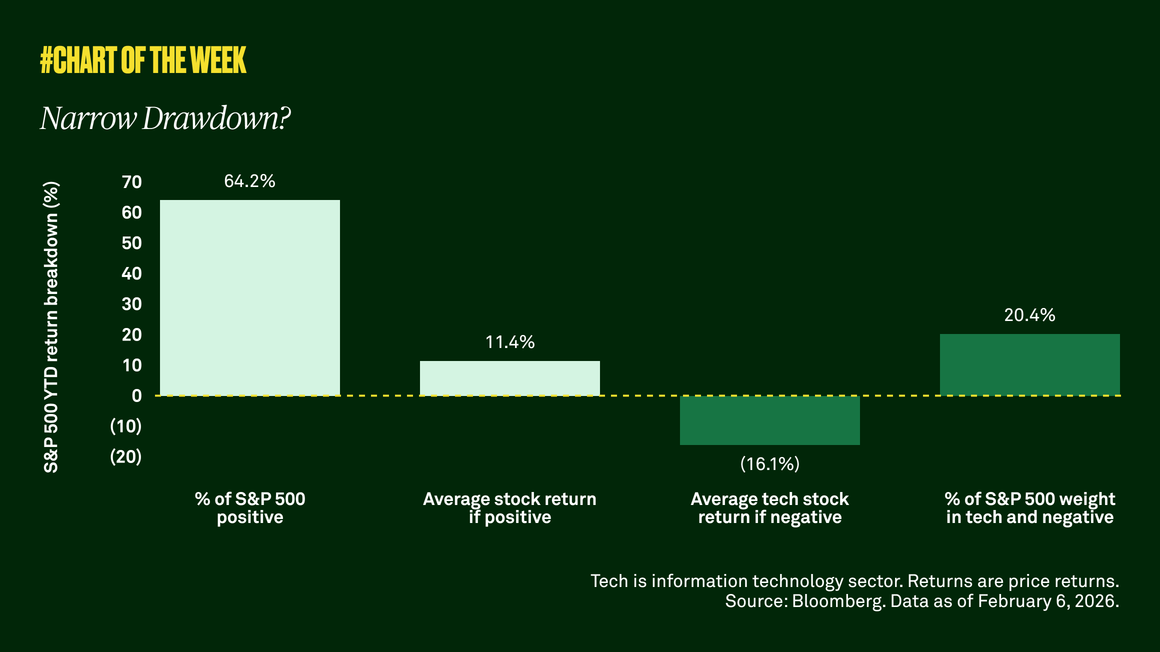

Equity volatility is rising, but all is not what it seems. The technology sector is weighing on the S&P 500 while value and cyclical stocks lead. A market rotation is underway as many investors begin to favor companies beyond tech.

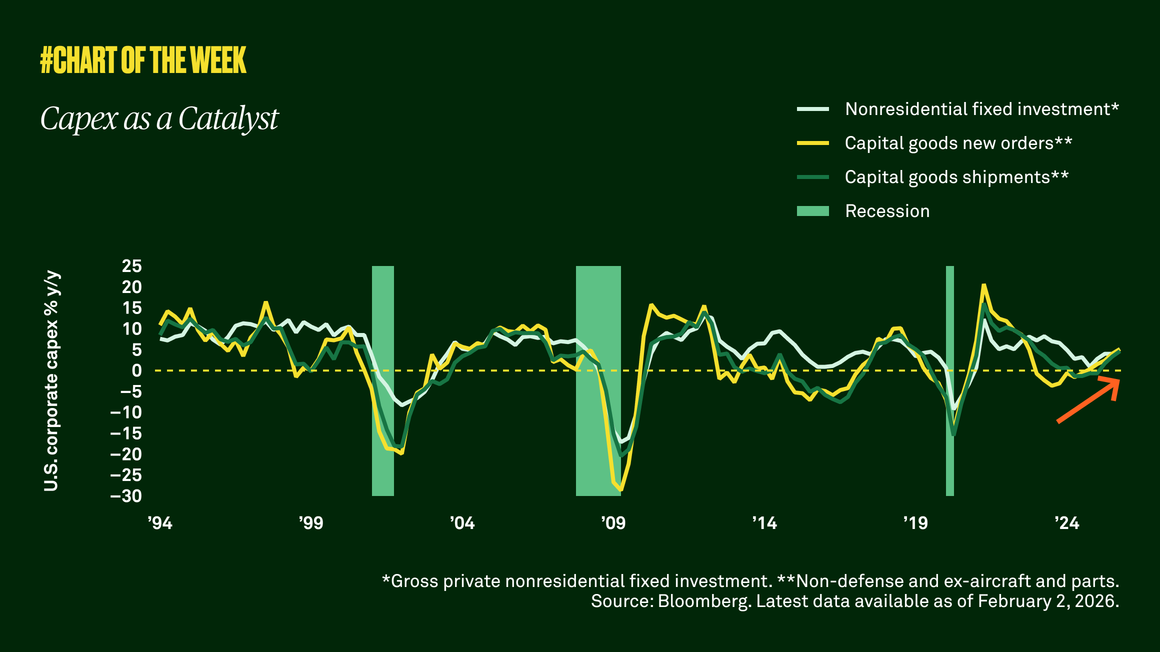

Capex as a catalyst

Capex as a Catalyst

Improved business confidence and recent tax legislation are compelling corporations to reinvest their cash flows in their businesses. We believe this is a positive signal for economic growth.