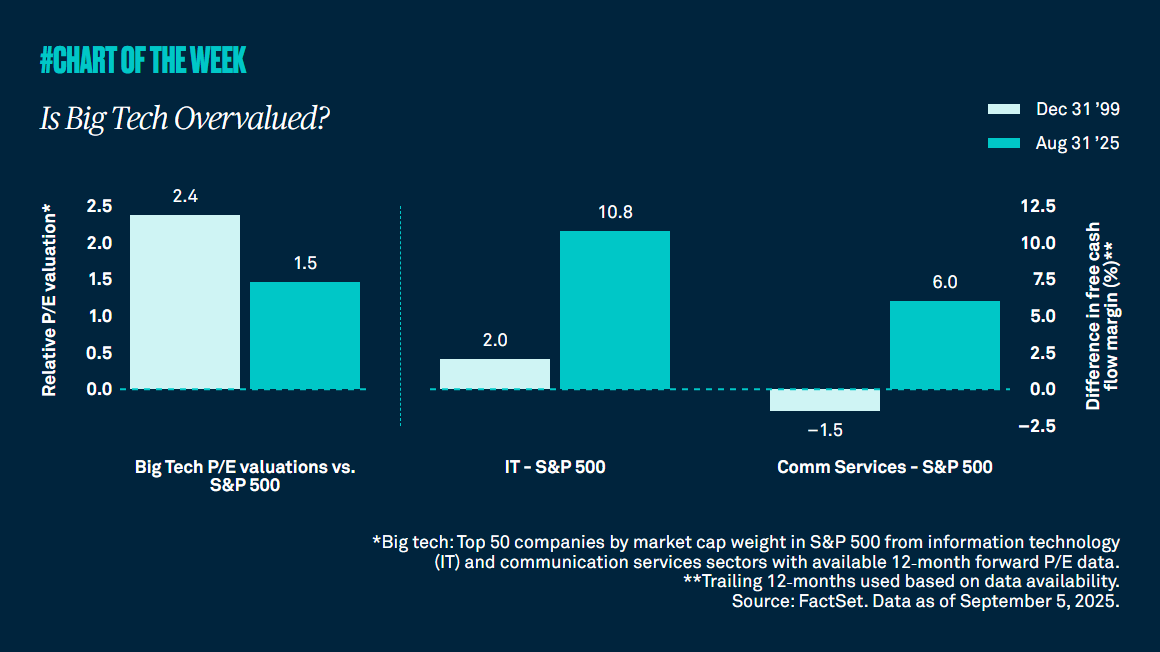

Is Big Tech Overvalued?

It’s true that the S&P 500 currently exhibits high valuations, with the technology sector alone comprising over 40% of its market capitalization and driving concerns about valuations. Are those high multiples justified?

There are concerns among some investors that technology stocks, which account for over 40% of the S&P 500’s market capitalization, are trading at valuations that call to mind the boom and bust of the dot.com era. However, during the dot.com bubble, big tech was 2.4X more expensive than the S&P 500 compared to only 1.5X today.

Another factor to consider is the profitability of the market as measured by free cash flow margins. In 1999, the Information Technology sector’s free cash flow margins were 2% higher than that of the S&P 500. Today that number is as high as 11%. Additionally, margins in Communication Services are 6% greater than that of the broader index compared to -1.5% in 1999.

Lower relative valuations and greater profitability suggest to us that big tech is not overvalued, and these companies justify their price tags. In our view, the late 90s and early 2000s do not, bear a convincing resemblance to today. We remain constructive on equities and U.S. large cap stocks in particular as we continue to anticipate the many ways artificial intelligence, a huge driver of growth in the tech space, can improve profitability for all the S&P 500 sectors.

WI-802601 Exp : 11 September 2026

YOU MIGHT ALSO LIKE

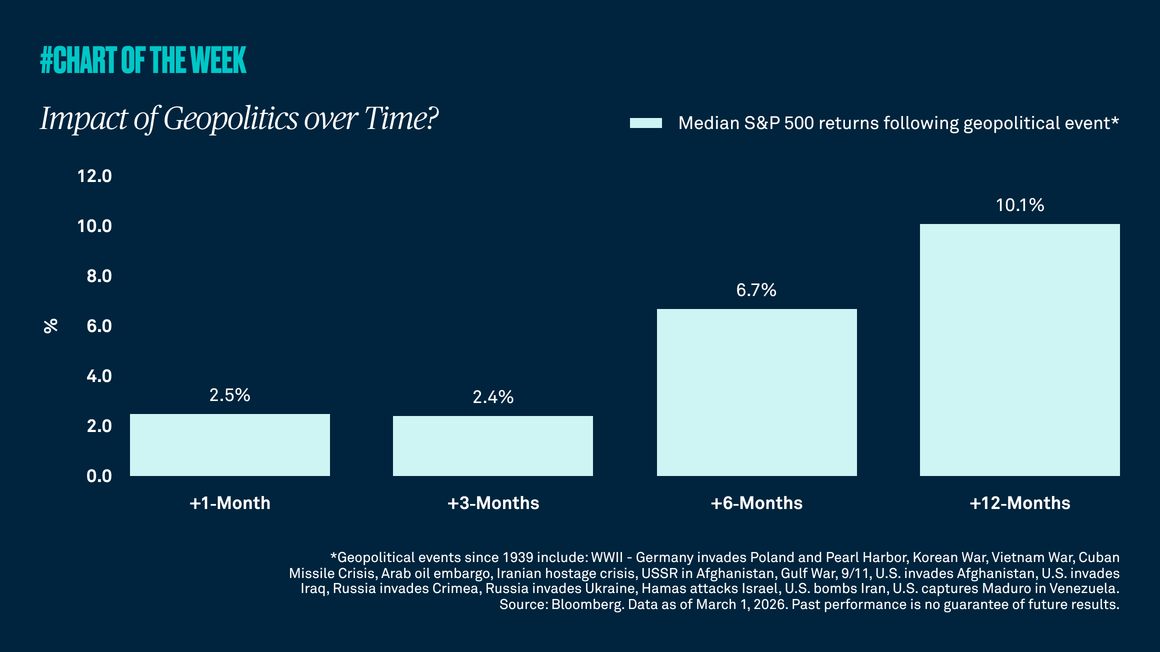

Tensions between the U.S./Israel and Iran have recently boiled over into a military conflict, which has given many investors the jitters. However, our research shows that equity market pullbacks resulting from geopolitical events are often short lived with the S&P 500 typically higher in the months following these events.

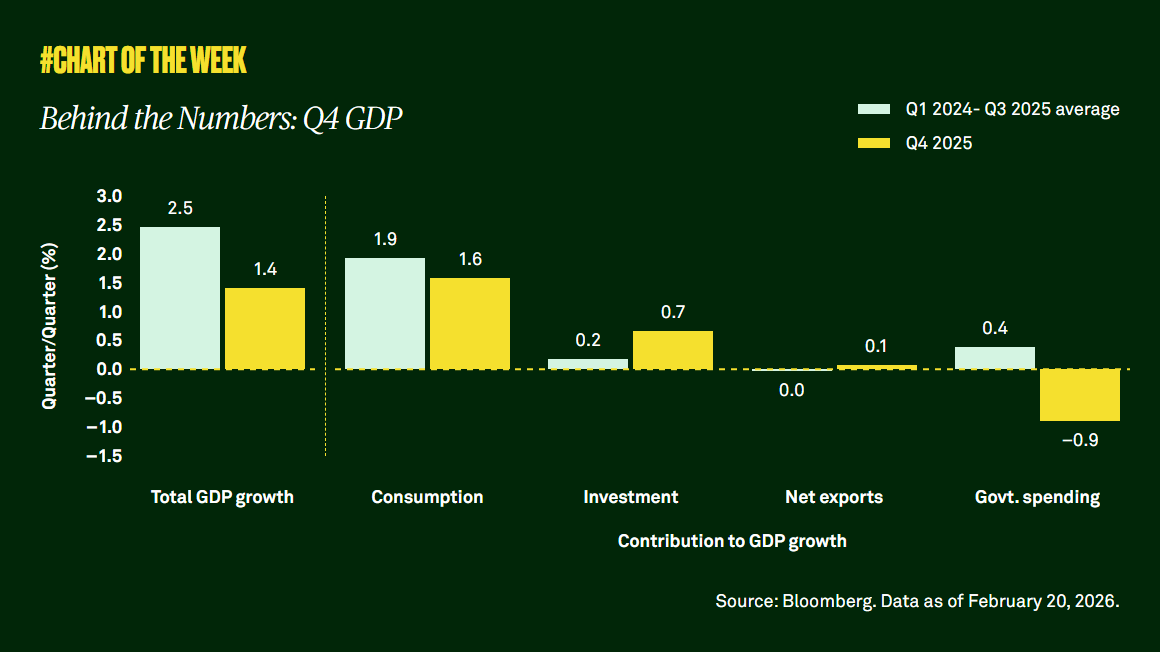

Gross domestic product undershot expectations last quarter, but the shortfall appears driven more by the temporary government shutdown than broad-based weakness. Consumer demand remains resilient, and with supportive fiscal policy, easing financial conditions and a steady labor market, the outlook points to a modest acceleration in economic activity this year.

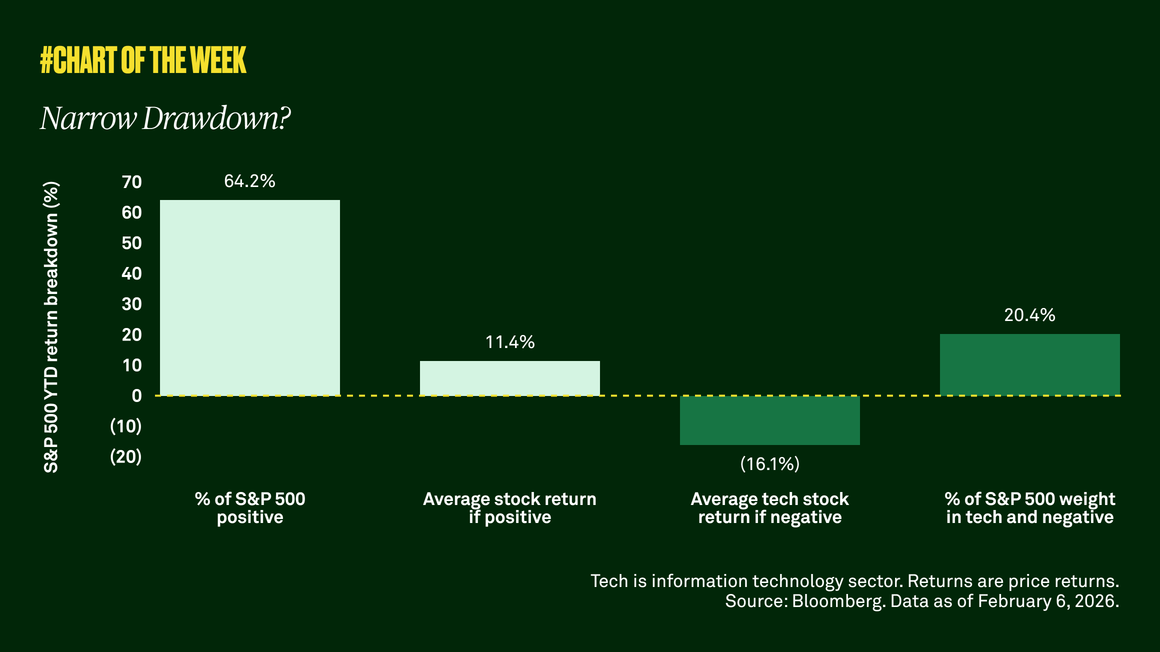

Equity volatility is rising, but all is not what it seems. The technology sector is weighing on the S&P 500 while value and cyclical stocks lead. A market rotation is underway as many investors begin to favor companies beyond tech.

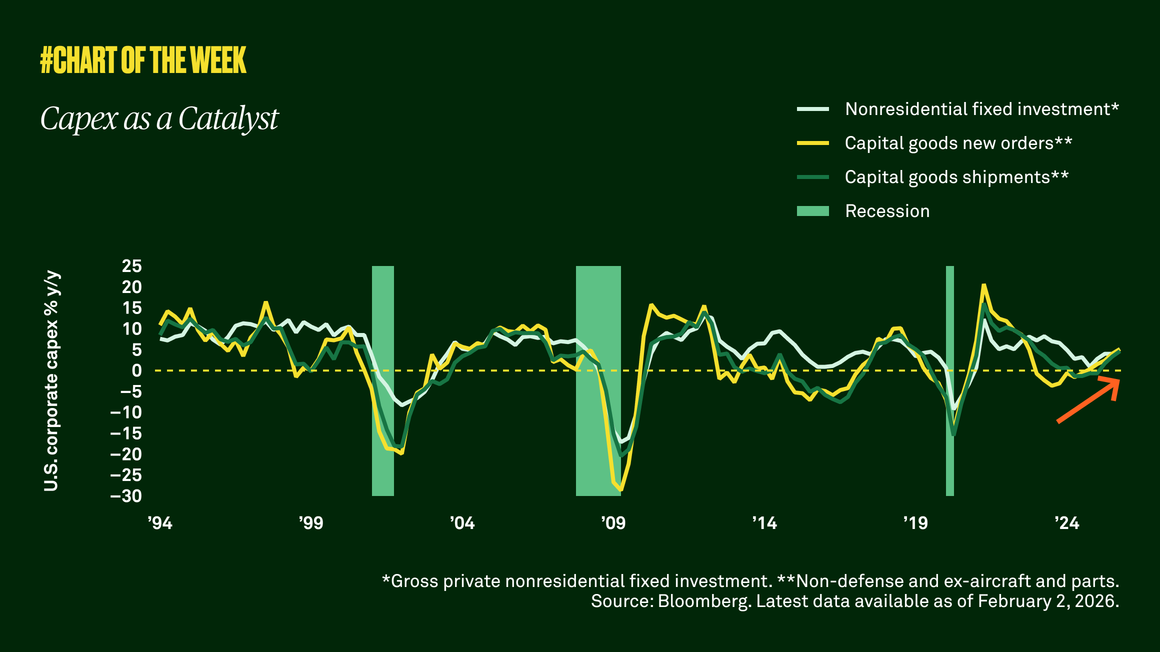

Capex as a catalyst

Capex as a Catalyst

Improved business confidence and recent tax legislation are compelling corporations to reinvest their cash flows in their businesses. We believe this is a positive signal for economic growth.