Oil: less sensitive to middle east conflict

The recent Middle East conflict sparked concerns surrounding Iran’s oil supply and the impact it could have on oil prices and the current disinflation trend. However, the price of oil is now at the level it was before the first strike on Iran. Due to the shale revolution, the oil market is ruled by new dynamics.

Historically, one consequence of geopolitical tensions in the Middle East has been higher oil prices. The recent conflict sparked concerns surrounding Iran’s oil supply and the impact it could have on oil prices and the current disinflation trend. However, after spiking briefly following Israel’s first strike on Iran on June 13, the price of oil has remained steady and is back to where it was before tensions intensified.

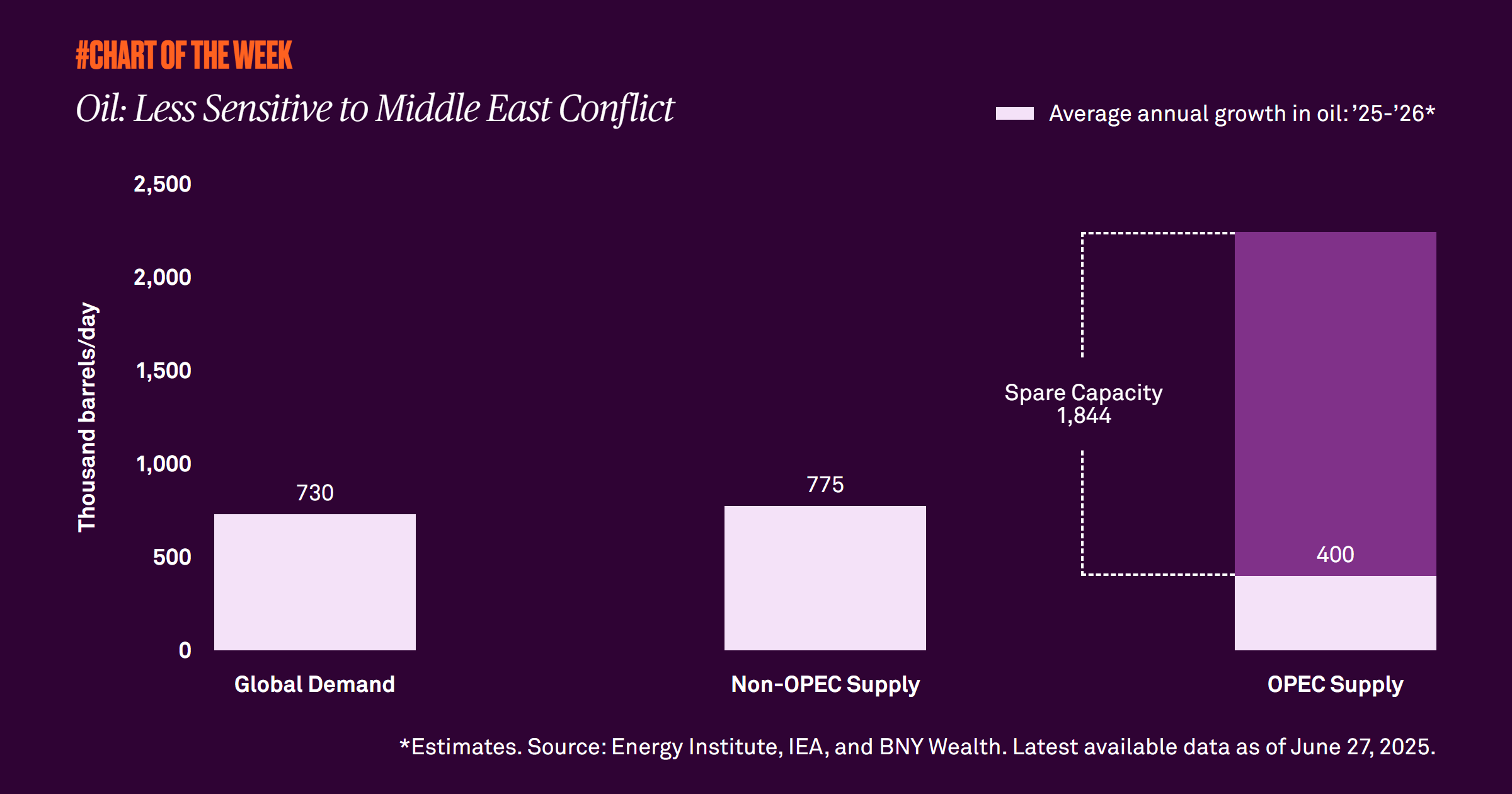

Why? In short, it’s due to the shale revolution that has transpired over the last decade or so, increasing U.S. oil production and reducing the world’s dependence on crude oil from the Middle East. From 2013 to 2024, growth in global oil demand was largely met by supply outside of the Organization of the Petroleum Exporting Countries (OPEC), an international organization of policy-setting oil-producing countries to which Iran belongs. The expectation for 2025 and 2026 is that supply from non-OPEC countries will continue meeting global demand for oil. Nevertheless, if Iran’s 1.6 million barrels per day of oil exports were no longer available, OPEC would still harbor excess capacity.

It appears that the global oil market is not extremely exposed to affairs in the Middle East as it once was. Since the latest conflict began, the S&P 500 has remained resilient, indicating that investors understand these oil market dynamics and have become somewhat desensitized to geopolitics. We remain constructive on U.S. equities and maintain our year-end forecast of 6,400 for the S&P 500.

762574 Exp : 30 June 2026

YOU MIGHT ALSO LIKE

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

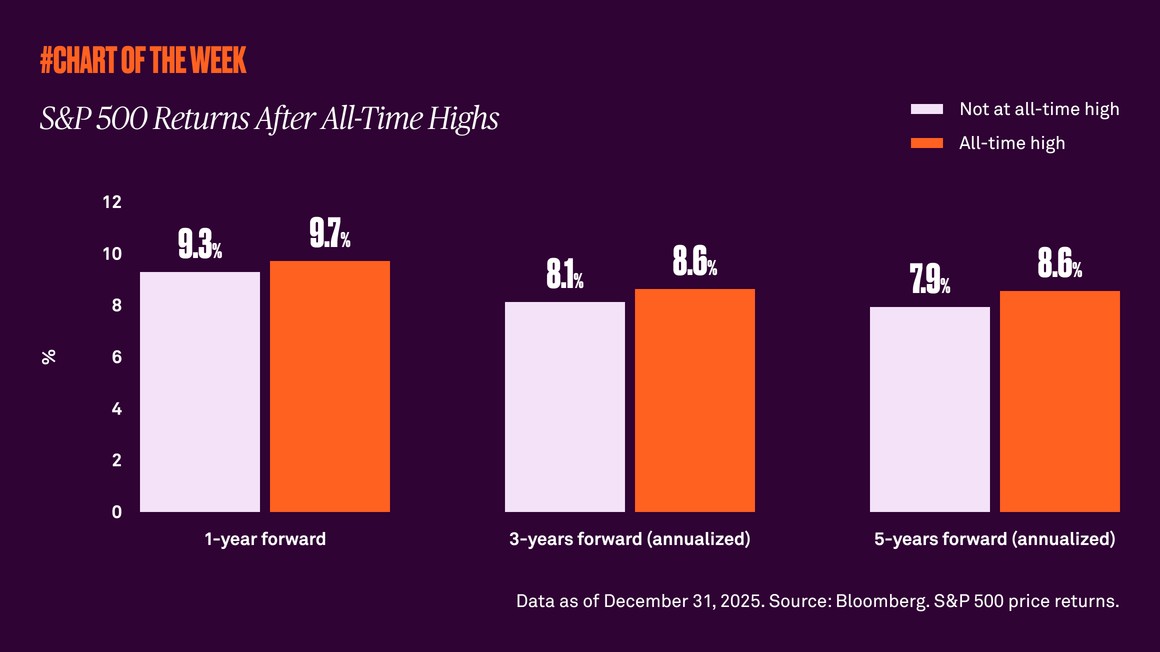

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

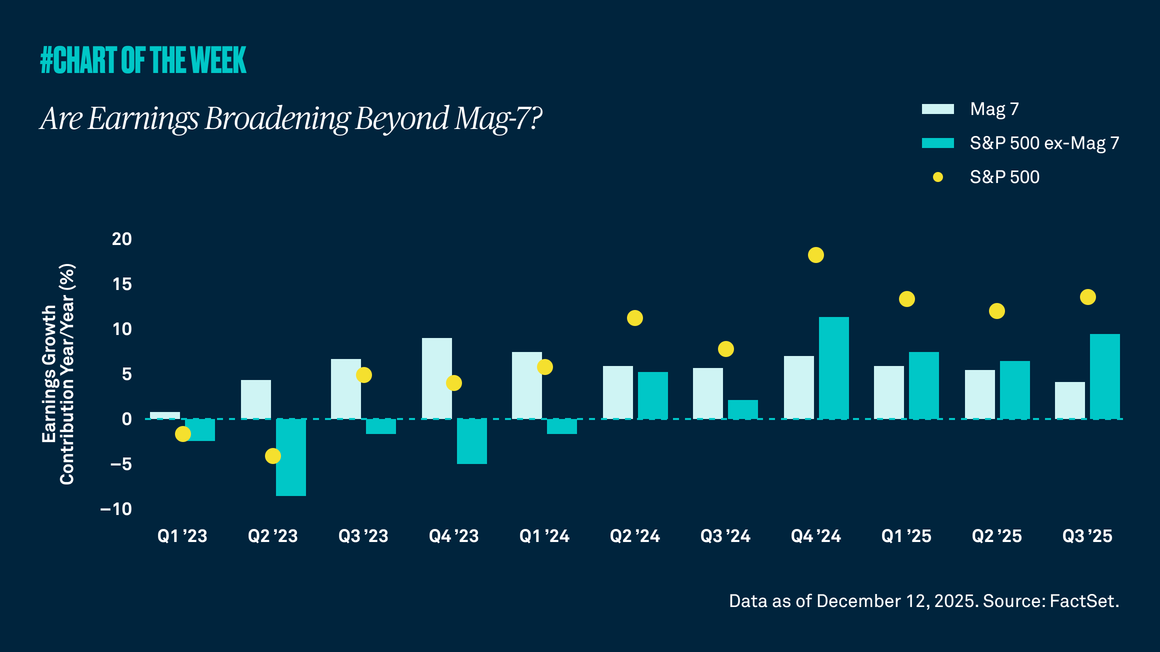

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

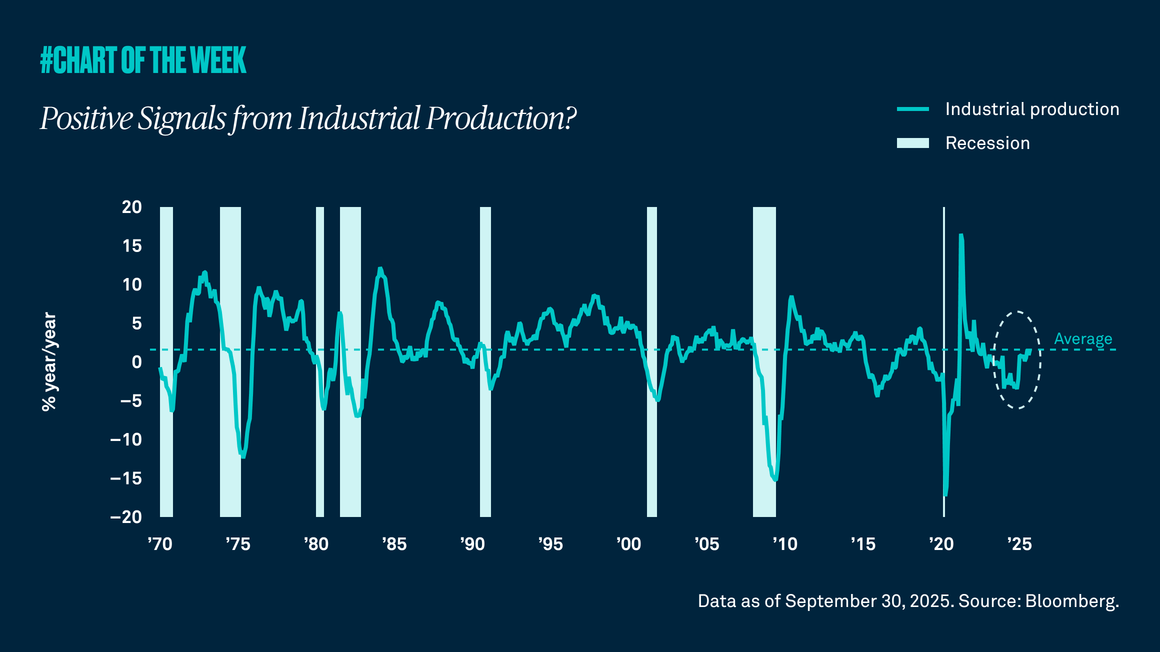

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.