What is an Assessment of Value (AOV)?

A report in which the board of BNY Mellon Fund Managers Ltd. aim to do exactly that – assess value. More explicitly, assess the value our funds have delivered to investors over the review period.

Why?

The Financial Conduct Authority (FCA) – a governing body over UK financial services – requires all UK authorised fund managers to assess the value offered by each of their funds. A public report must be produced and published annually.

How?

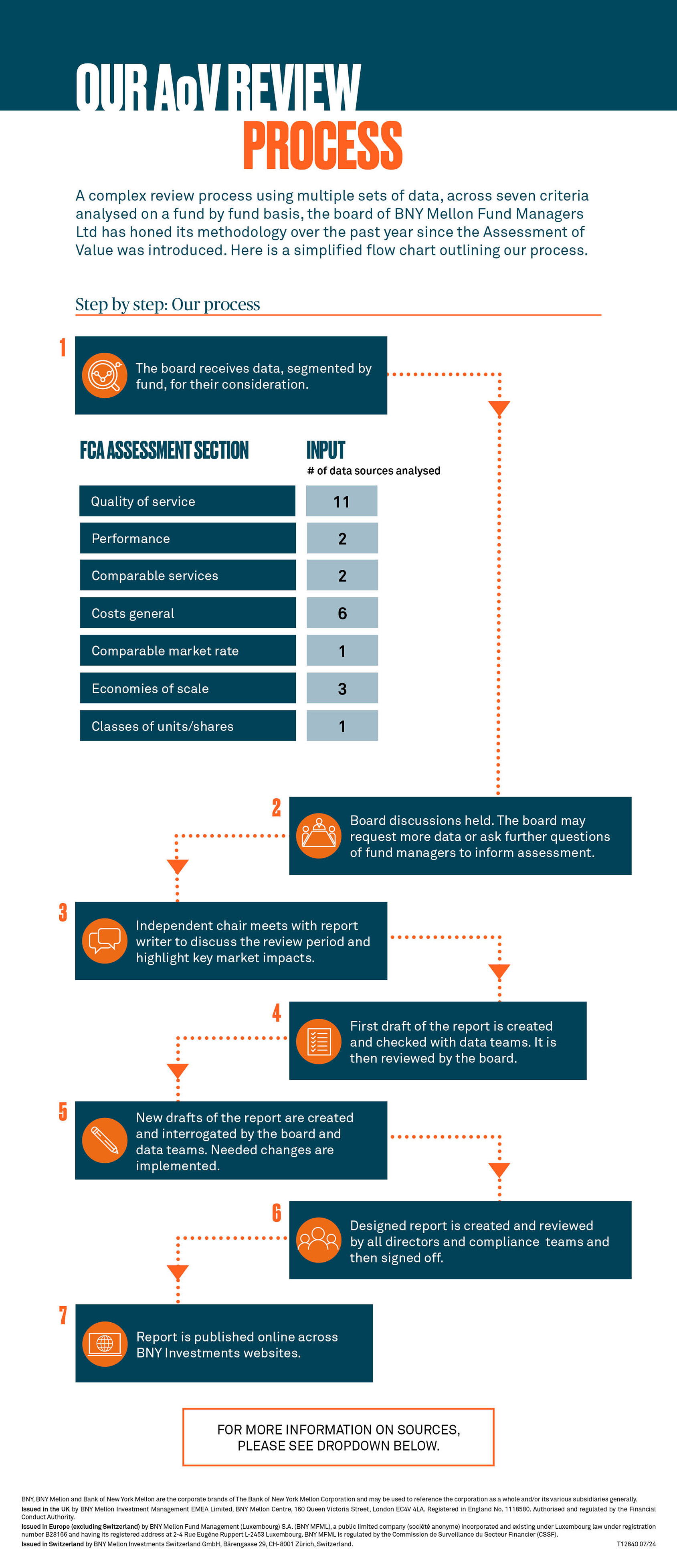

This report sees our board scrutinise each fund by assessing them across the seven criteria set out by the FCA. These include performance, quality of service, cost and the fair treatment of our investors. If it’s found that a fund does not offer good value, corrective action should be taken.

We provide more detail on the seven criteria and our process on this landing page.

How to read this report

If you have..

| 5 |

| Mins |

Focus on the results of your specific fund. Jump to your fund page (listed below) where you will find performance stats and an overall rating summary.

| 30 |

| Mins |

For a better understanding on how we assess our funds across seven criteria, read our in-depth explanation here.

| 60 |

| Mins |

Alongside reading about our methodology, a deeper analysis of our overall findings can be found here.

- BNY Mellon Asian Income Fund

- BNY Mellon Asian Opportunities Fund

- BNY Mellon Emerging Income Fund

- BNY Mellon European Opportunities Fund (Responsible)

- BNY Mellon FutureLegacy Fund 3

- BNY Mellon FutureLegacy Fund 4

- BNY Mellon FutureLegacy Fund 5

- BNY Mellon FutureLegacy Fund 6

- BNY Mellon FutureLegacy Fund 7

- BNY Gilt Fund

- BNY Mellon Global Absolute Return Fund

- BNY Mellon Global Dynamic Bond Fund

- BNY Mellon Global Dynamic Bond Fund (Responsible)

- BNY Mellon Global Emerging Markets Opportunities Fund

- BNY Mellon Global Equity Fund

- BNY Mellon Global Equity Income Fund (Responsible)

- BNY Mellon Global High Yield Bond Fund

- BNY Mellon Global Income Fund

- BNY Mellon Global Infrastructure Income Fund

- BNY Mellon Global Multi-Strategy Fund

- BNY Mellon Index-Linked Gilt Fund

- BNY Mellon Inflation-Linked Corporate Bond Fund

- BNY Mellon International Bond Fund

- BNY Mellon Long-Term Global Equity Fund

- BNY Mellon Multi-Asset Balanced Fund

- BNY Mellon Multi-Asset Diversified Return Fund

- BNY Mellon Multi-Asset Global Balanced Fund

- BNY Mellon Multi-Asset Growth Fund

- BNY Mellon Multi-Asset Income Fund

- BNY Mellon Multi-Asset Moderate Fund

- BNY Mellon Real Return Fund

- BNY Mellon Real Return Fund (Responsible)

- BNY Mellon UK Equity Fund

- BNY Mellon UK Income Fund

- BNY Mellon UK Opportunities Fund (Responsible)

- BNY Mellon US Equity Income Fund

- Responsible Horizons Strategic Bond Fund

- Responsible Horizons UK Corporate Bond Fund

- Newton Catholic Values Fund for Charities

- Newton Ethically Screened Fund for Charities

- Newton Growth and Income Fund for Charities

- Newton Growth and Income Fund for Charities (Responsible)

- BNY Mellon (Schroder Solutions) Global Equity Fund

Caylie Stallard

Executive Director Caylie has over 15 years of experience in the financial services industry and is Head of International Funds at BNY Investments. She is a board director across several BNY Mellon Group entities and chairs the BNY Mellon Investment Management, International ex-Japan Governance Committee.

- Client complaints log

- Investment Management Oversight Committee summary

- Prospectus for trustee fees

- Transaction charges

- Audit benchmarking

- Financial reports for the funds

- European MIFID Template (EMT) report

- Client holding and fee database

- Performance: Lipper IM

- FITZ Partners Board Reporting & Investment Advisory Fee Benchmarking Report

- MJ Hudson Amaces CMS Fund Accounting Report & CMS Custody and Treasury Report

- NatWest Trustee and Depository Services Fund Accounting Benchmarking Report, Custody Benchmarking Report, Custodian Oversight Pack & Quarterly Report

2025 Methodology

Our assessment follows the seven-factor criteria outlined by the UK regulator, the FCA. We used a variety of internal data to examine the individual funds within each of these areas. This data included that provided by external, independent consultants.

Further details on the seven criteria:

FCA definition |

Our assessment |

|

Performance |

The performance of the scheme*, after deduction of all payments out of scheme property** as set out in the prospectus. Performance should be considered over an appropriate timescale having regard to the scheme’s investment objectives, policy and strategy. | We assessed the performance of each share class against its stated objective. Funds – and their individual share classes – may frame objectives over a specified time frames. For instance, one may have a stated goal over three years, another over 12 months. We assessed the performance of each share class against its stated objective. |

| Quality of Service | The range and quality of services provided to unitholders. | We assessed the quality of the service provided to holders of the fund. Our analysis considered services provided to the fund by third parties, as well as the services investors received from BNY. |

| Comparable Market Rates | In relation to each service, the market rate for any comparable service provided: a) by the Authorised Fund Manager (AFM); or b) to the AFM or on its behalf, including by a person to which any aspect of the scheme’s management has been delegated. |

We assessed the fees paid by the investors in the funds against similar competitor products. |

| AFM Costs – General | In relation to each charge, the cost of providing the service to which the charge relates, and when money is paid directly to associates or external parties, the cost is the amount paid to that person. | We assessed the individual costs for services provided in the fund. These included the payment to the trustee and investment manager among others. We also considered the profitability of the funds. |

| Comparable Services | In relation to each separate charge, the AFM’s charges and those of its associates for comparable services provided to clients, including for institutional mandates of a comparable size and having similar investment objectives and policies. | We assessed the costs of the share classes of the fund, when compared to a negotiated fee share class, or a broadly similar mandate only available to institutional investors. |

| Economies of Scale | Whether the AFM is able to achieve savings and benefits from economies of scale, relating to the direct and indirect costs of managing the scheme property and taking into account the value of the scheme property and whether it has grown or contracted in size as a result of the sale and redemption of units. | We assessed whether any savings achieved by the fund increasing in size were passed on to the underlying investors. If a fund decreased in size, we assessed whether the costs disproportionately increased. |

| Classes of Units/Shares | Whether it is appropriate for unitholders to hold units in classes subject to higher charges than those applying to other classes of the same scheme with substantially similar rights. | We examined whether the investors of the fund were in the appropriate share class. If there were many share classes for one fund, it was assessed whether all of the share classes were still fit for purpose and required. |

*Scheme is what we would call the fund

**Scheme property is what we would call the underlying investments held by the fund

DOWNLOAD THE FULL REPORT

- Assessment of Value Report: October 2025

- Assessment of Value Report: October 2024

- Consolidated Assessment of Value Report: July 2024

- Assessment of Value Report: October 2023

- Consolidated Assessment of Value Report: July 2023

- Assessment of Value Report: October 2022

- Consolidated Assessment of Value Report: July 2022

2802100 Expiry: 6 November 2026