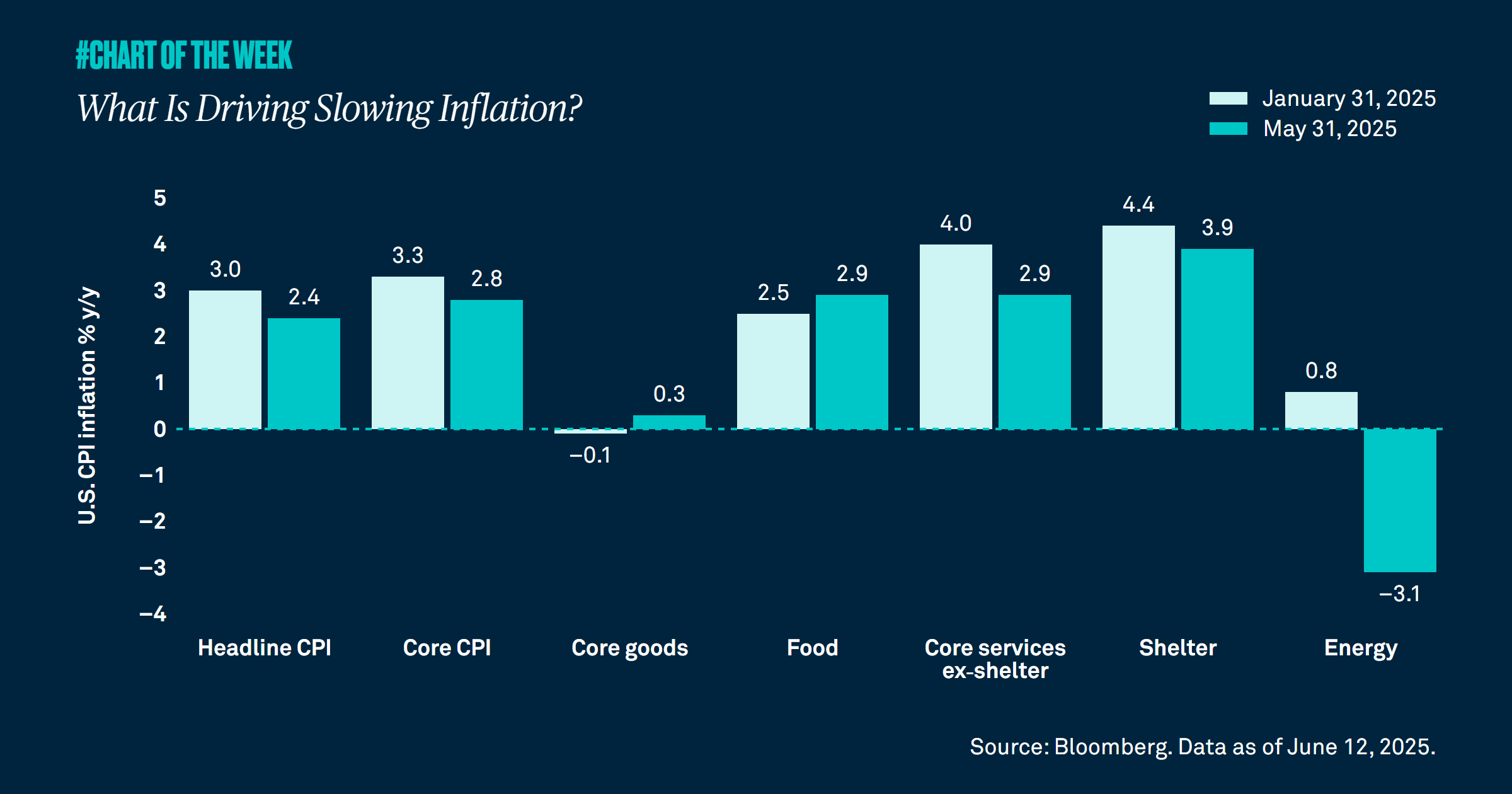

What Is Driving Slowing Inflation?

Inflation came in cooler than expected in May. In fact, it’s down from January’s growth rate of 3.0% year over year to 2.4%. While stickier services components such as shelter have driven this decline, could the recent uptick in oil prices and higher tariffs pose headwinds?

While we expected inflation to slow, it is encouraging to see the stickier components of services and shelter inflation driving the decline.

Led by services, the disinflation trend has been notable, with prices declining from a growth rate of 3.0% from a year ago in January to 2.4% in May. At 3.9% year over year, shelter inflation is the lowest it has been since November 2021, while core services at 2.9% is the lowest in more than four years.

However, could tariff-related price hikes and the recent increase in oil prices due to tensions in the Middle East hamper the downward path of inflation? We believe the impact of tariffs will amount to a one-time price adjustment as opposed to a long-term trend. Despite the roughly $17 increase in the price of oil since early May to $74 a barrel, it is only up 0.4% from a year ago. If there are no significant supply disruptions or if tensions de-escalate, the additional impact to energy prices or overall inflation should be limited. While the disinflation trend may slow from here, we maintain our year-end inflation forecast of 2.5-3.5%.

756588 Exp : 17 June 2026

YOU MIGHT ALSO LIKE

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

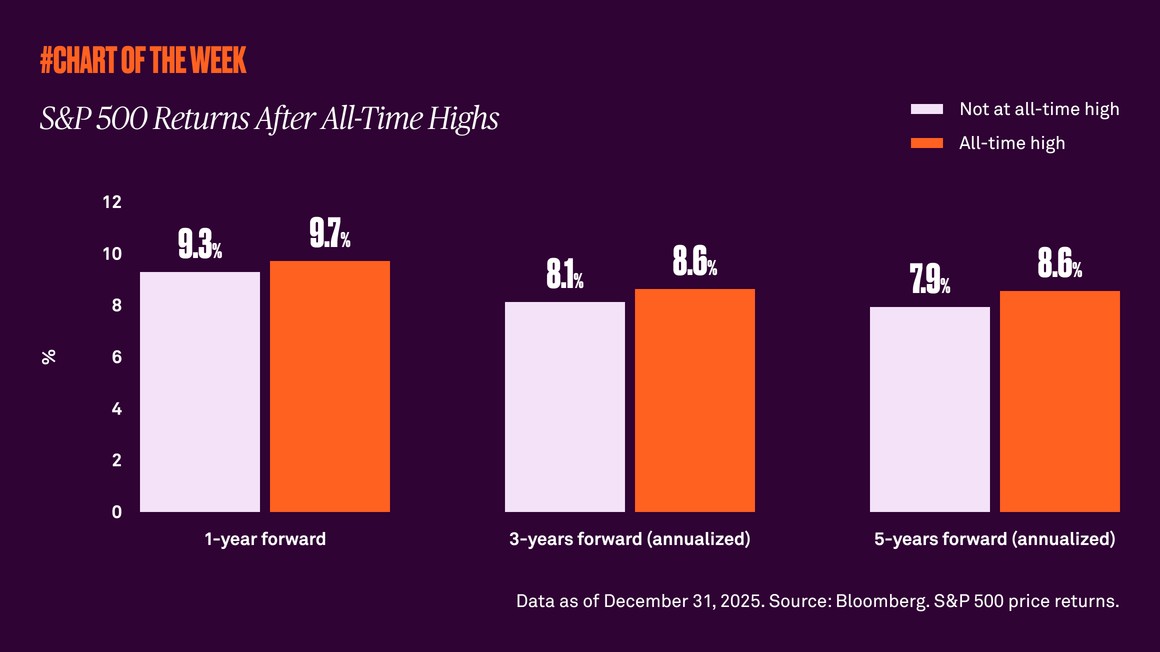

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

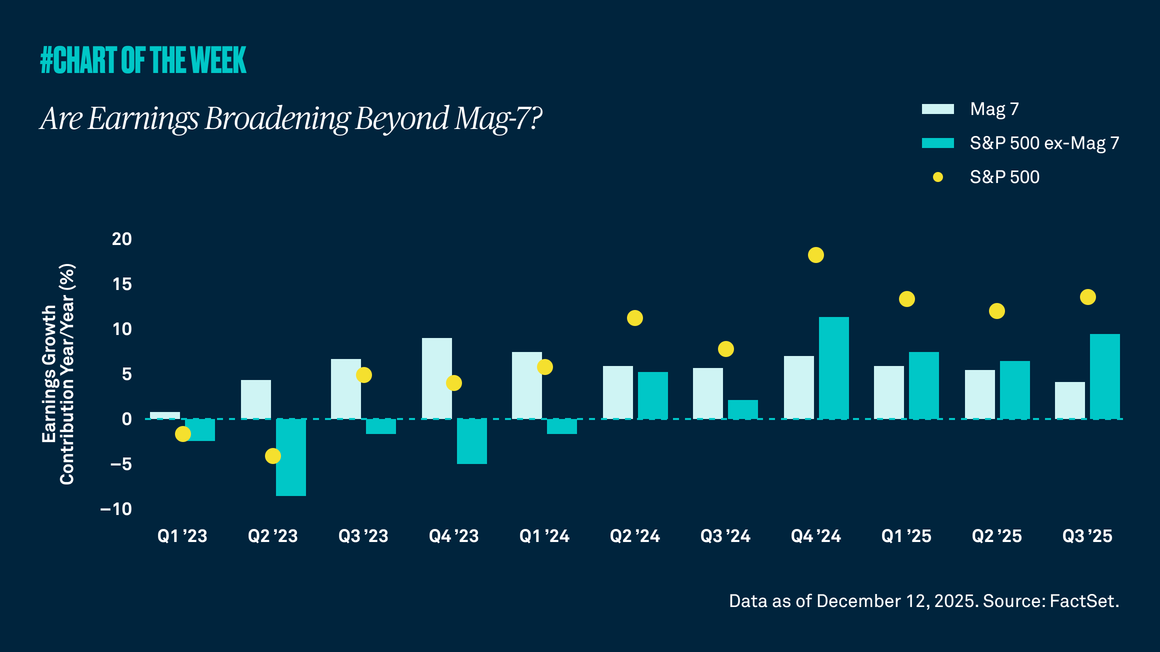

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

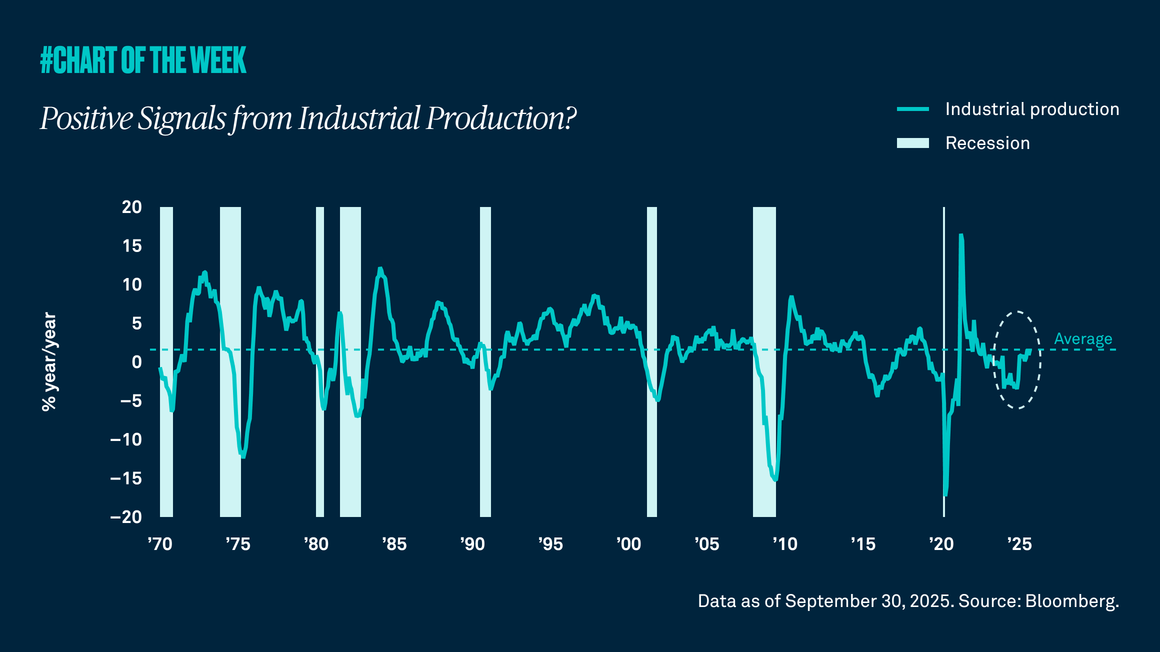

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.