Good news on inflation?

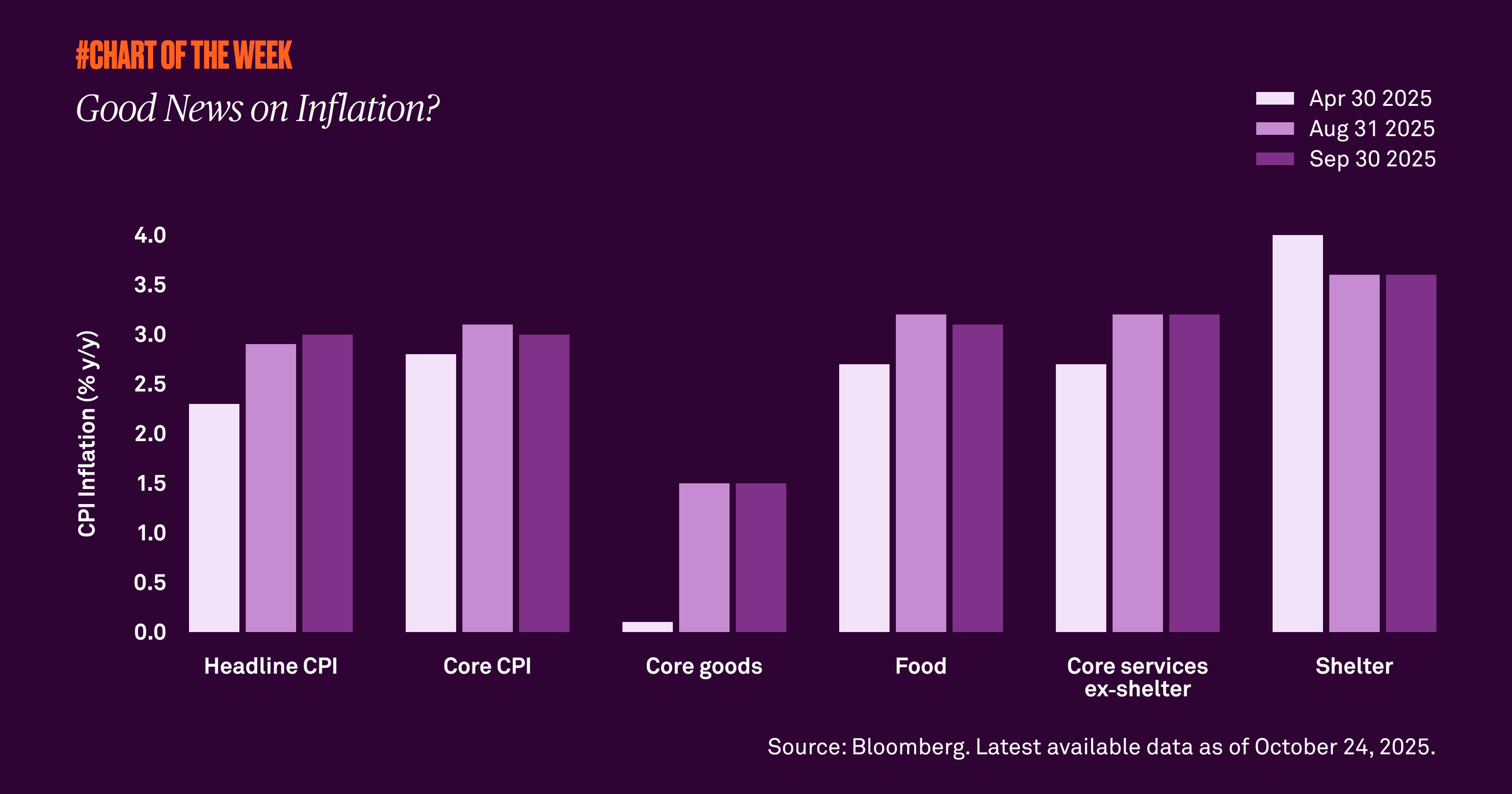

Last week’s Consumer Price Index report, a widely used indicator of inflation in the U.S. economy, showed growth of 3% in September, which was above 2.9% in August but less than expected. Despite the modest increase, various categories have shown signs of stabilization. What does this mean for inflation going forward?

Last week’s Consumer Price Index (CPI) report, a widely used indicator of inflation in the U.S. economy, showed modest growth from 2.9% on an annual basis in August to 3% in September. Yet, the number came in below analysts’ expectations, helping to allay fears of rising inflation. Consequently, the market ended the week higher.

Though the inflation reading was slightly higher than in August, a look at underlying components is encouraging. Core goods, food and core services ex-shelter have risen since April, but appear to have peaked with readings either unchanged or lower in September. Importantly, shelter, which accounts for 35% of CPI, continues to slow, helping to stabilize inflation.

There is the question of what the impact of tariffs will be on inflation once all potential deals are in effect, but we maintain that the result will be a one-time rise in prices rather than a sustained increase. Our view is that inflation will remain within a range of 2.6% to 3.3% through year end.

829871 Exp : 28 October 2026

YOU MIGHT ALSO LIKE

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

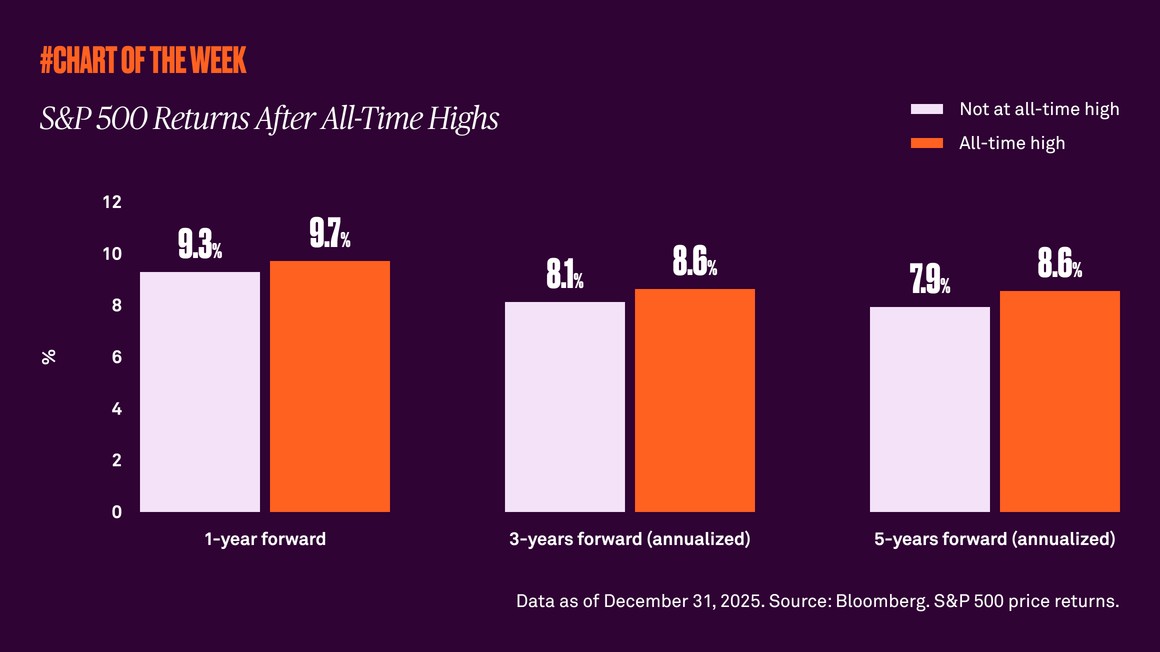

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

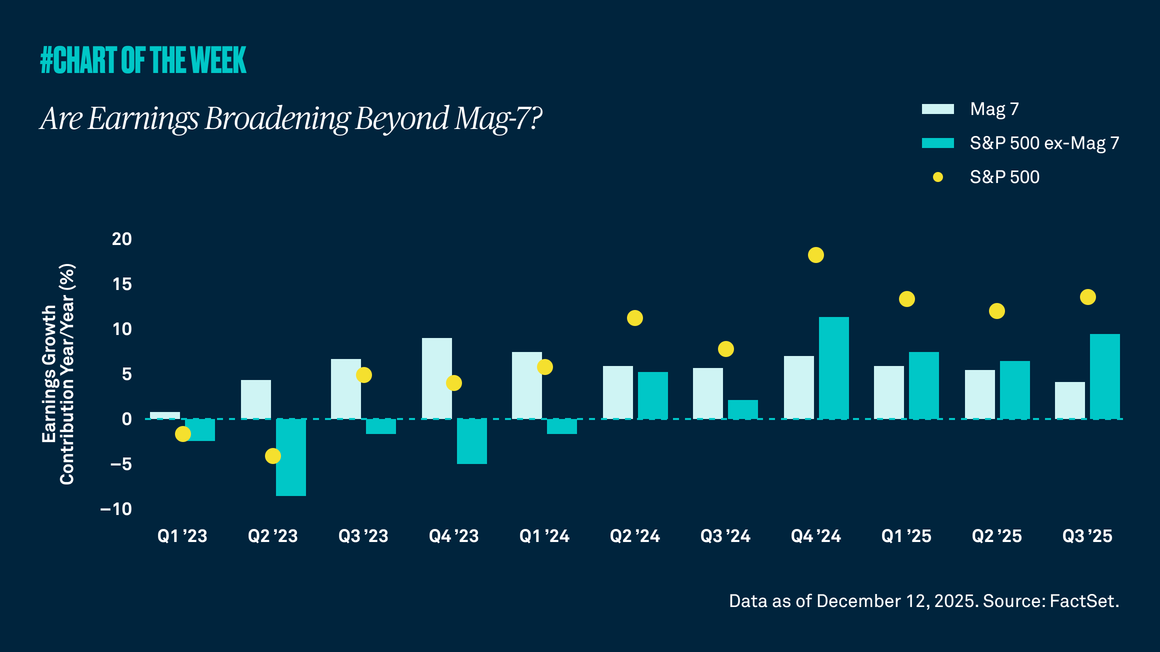

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

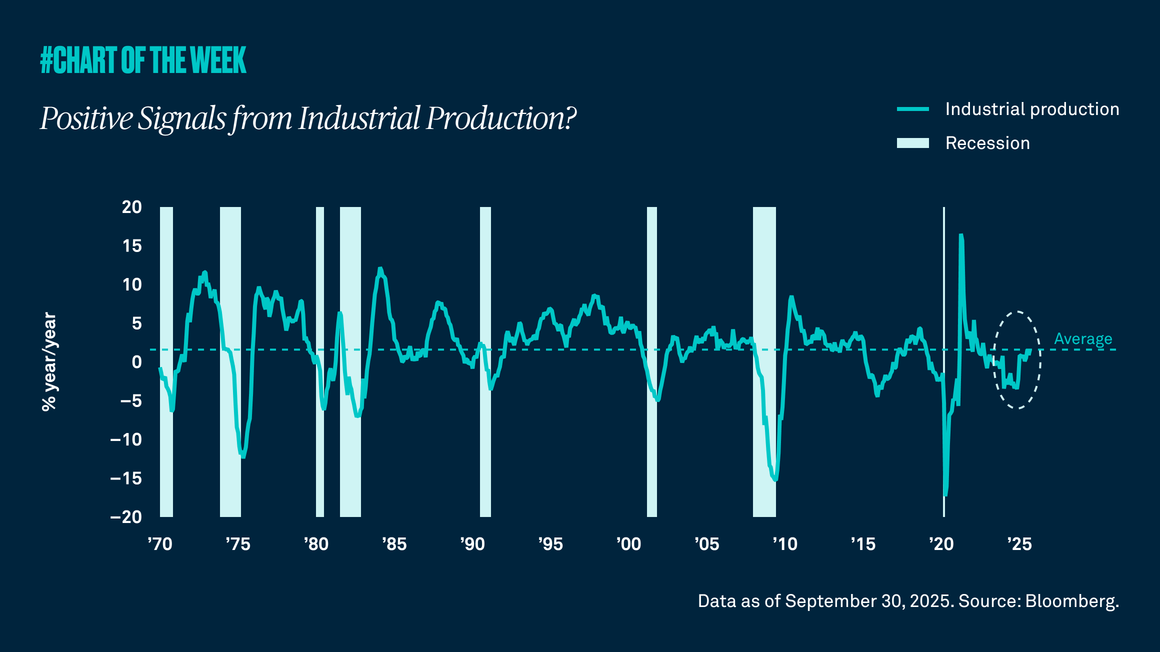

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.