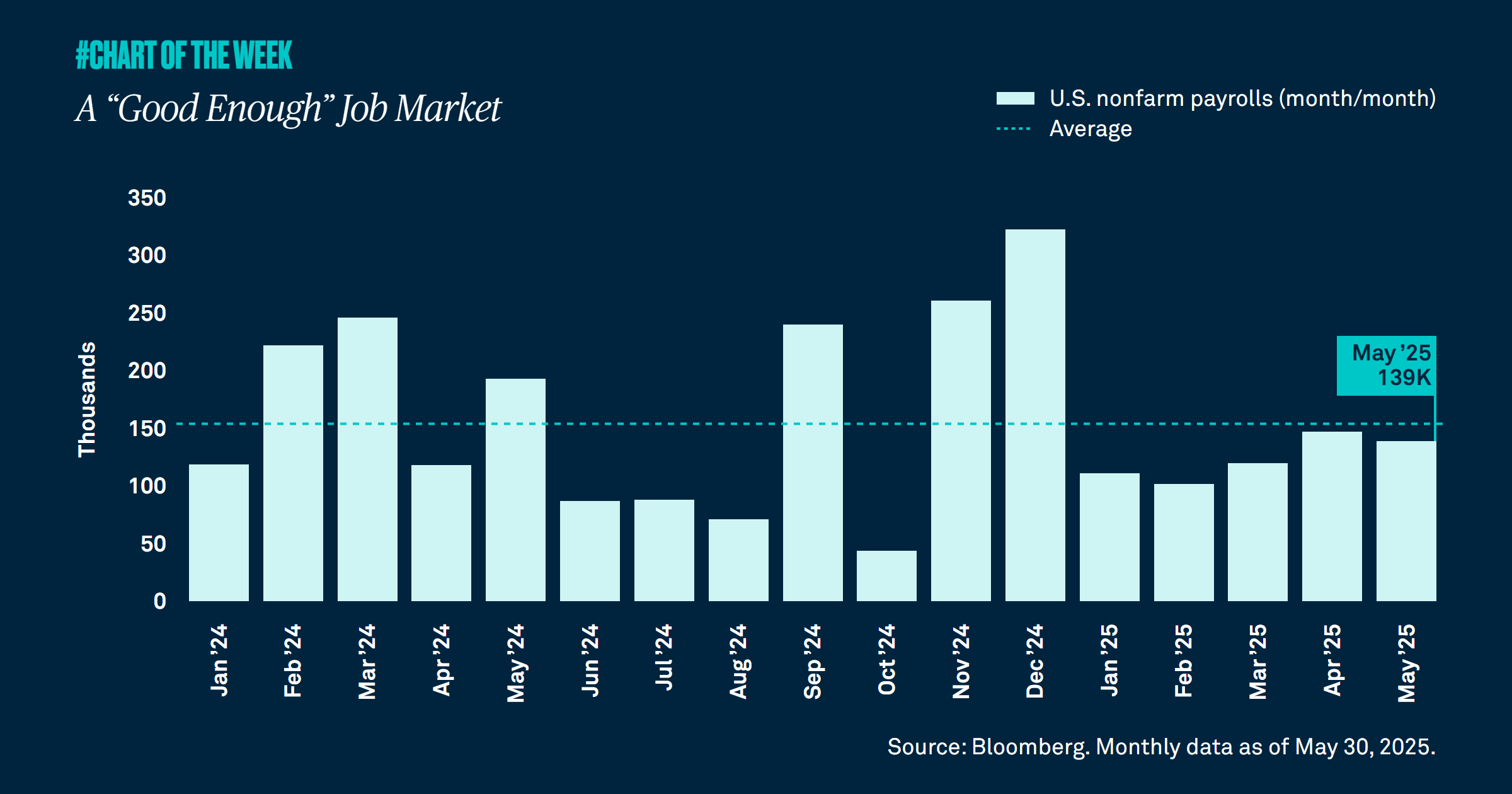

A “Good Enough” Job Market

By no measure are we seeing a booming job market, but we are also not seeing a deteriorating one. In fact, current labor metrics lead us to conclude that the job market remains “good enough” to support our economic growth expectations for the year.

A popular topic of conversation among investors has been the idea that after a healthy run, U.S. exceptionalism may be out of steam. Over the period of January 1 to May 31, international equity markets have outperformed the U.S. for the first time since 2017. Still, we believe the S&P 500 will continue its strategic outperformance. Why? One key reason is superior earnings growth.

Earnings can help predict relative returns across different regions when one examines their long-term performance trends. Since 2010, S&P 500 earnings grew at an annualized rate of 9.6%, outpacing the STOXX Europe 600 by 1.7 times and three times for the more concentrated EURO STOXX 50. Additionally, this year S&P 500 earnings are expected to grow 8.8% compared to 2% for the STOXX Europe 600 and 3.6% for the EURO STOXX 50.

As we discussed in previous weeks, greater productivity and labor market characteristics in the U.S. are priming the domestic economy for faster growth than its peers abroad. Economic growth feeds stock market returns and earnings growth, which is anticipated to rank highest in the U.S. For these reasons, we expect U.S. exceptionalism to resume and strategic outperformance to persist. As a result, we continue to favor U.S. equities over the rest of the world.

752488 Exp : 10 June 2026

YOU MIGHT ALSO LIKE

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

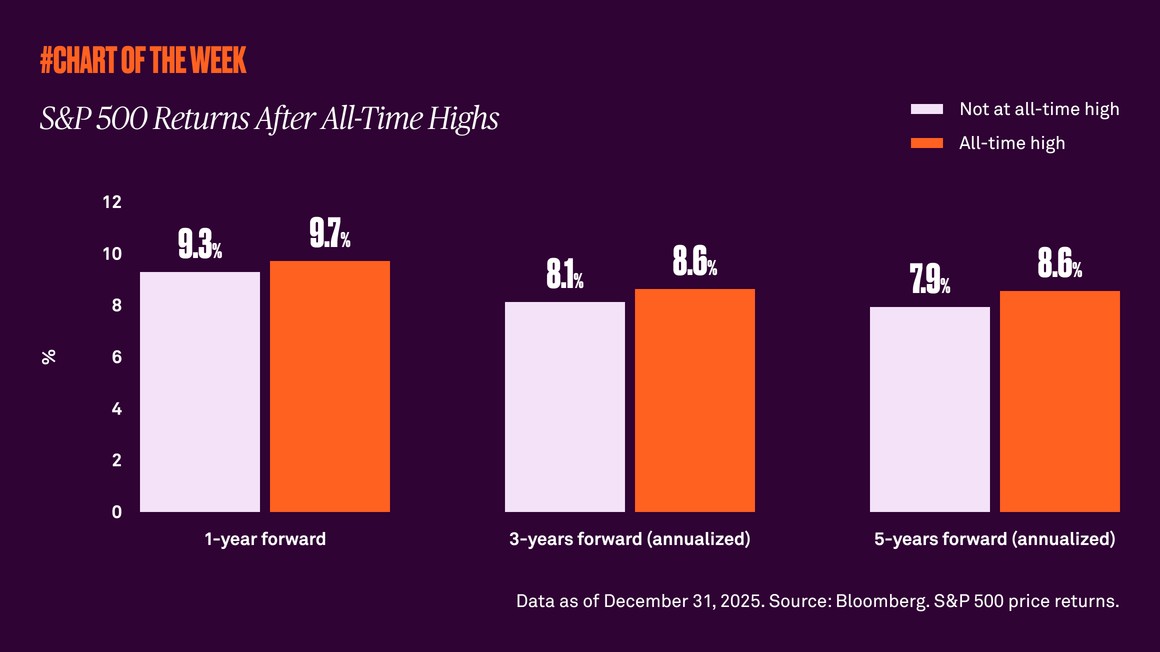

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

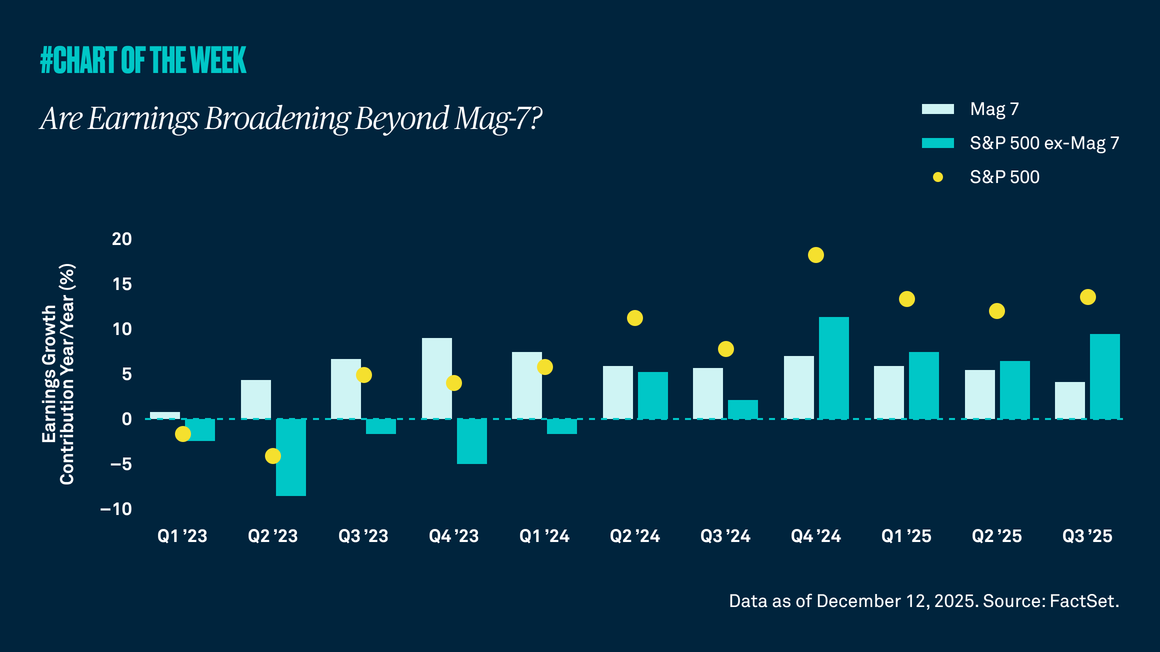

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

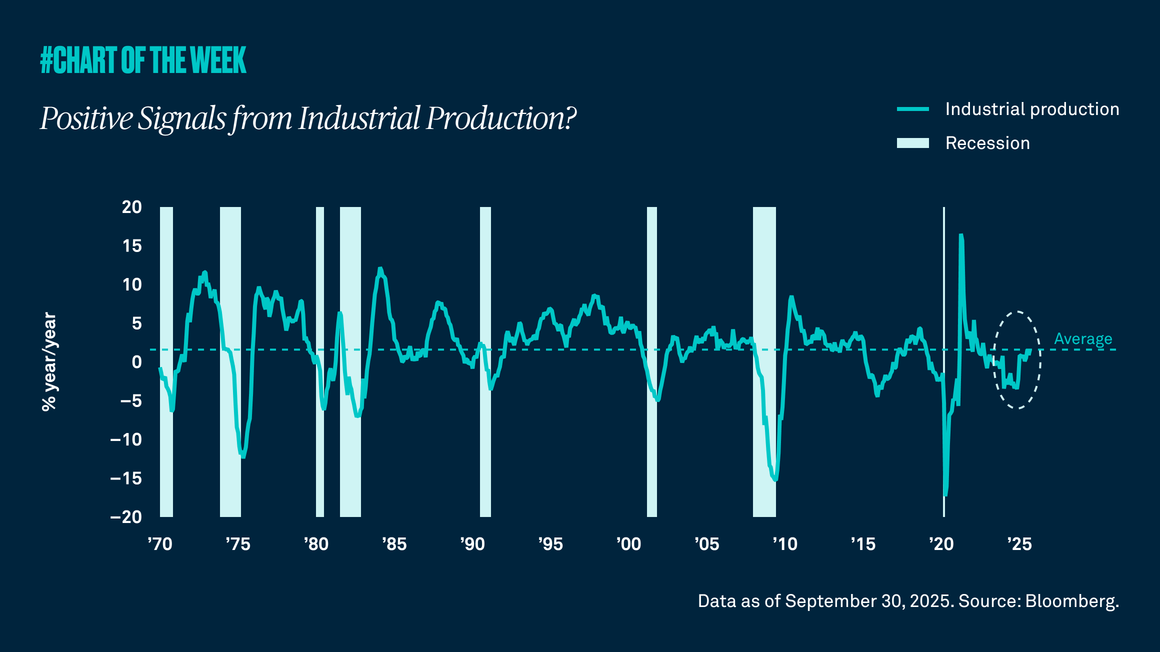

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.