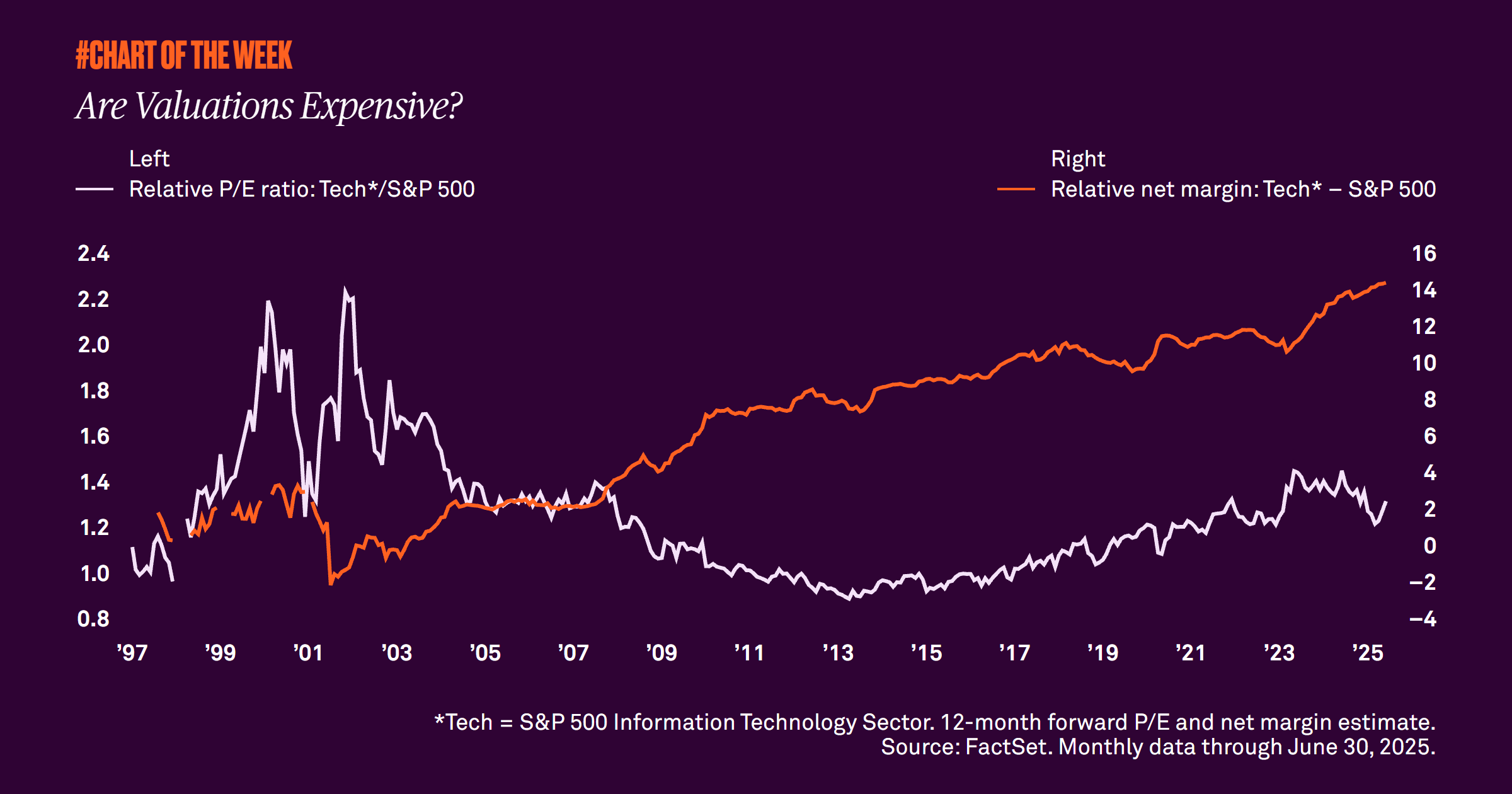

Are valuations expensive?

Last week the S&P 500 reached yet another all-time high. After nearing a 20% decline in April, the index is up over 8% year to date. With a 22x forward price-to-earnings ratio for the S&P 500, many investors are wondering if the market is expensive. Our analysis suggests that valuations are high because the market is more profitable, which is driven by tech.

Last week the S&P 500 reached yet another all-time high. After nearing a 20% decline in April, the index is up over 8% year to date. Its price-to-earnings (PE) ratio, a measure that indicates how much investors are willing to pay for earnings expected over the next 12 months, is now 22x compared to the roughly 17x average set since 1996. The wide discrepancy has led some investors to worry that the equity market has become too expensive.

Our analysis suggests that the technology sector has been a key driver of the above average PE ratios. While this could suggest tech is expensive, net margins, which indicate how efficiently companies convert revenues into actual profits, are 14.4% higher for the technology sector than the S&P 500. This marks the highest difference in history. In addition to better margins, relative valuations of technology stocks versus the S&P 500 are much lower than they were during the dotcom bubble.

Given better margins and lower relative valuations, we believe technology is not overvalued, and therefore neither is the broader market. While current valuations are historically high, we’re in a higher margin regime that is driven by tech. This means the market is better at turning revenue into profits, which helps explain current valuation levels and suggests we could be in a higher PE world. While we anticipate some volatility over the historically challenging August and September period, we remain constructive on equities and maintain our overweight to U.S. large caps.

780769 Exp : 28 July 2026

YOU MIGHT ALSO LIKE

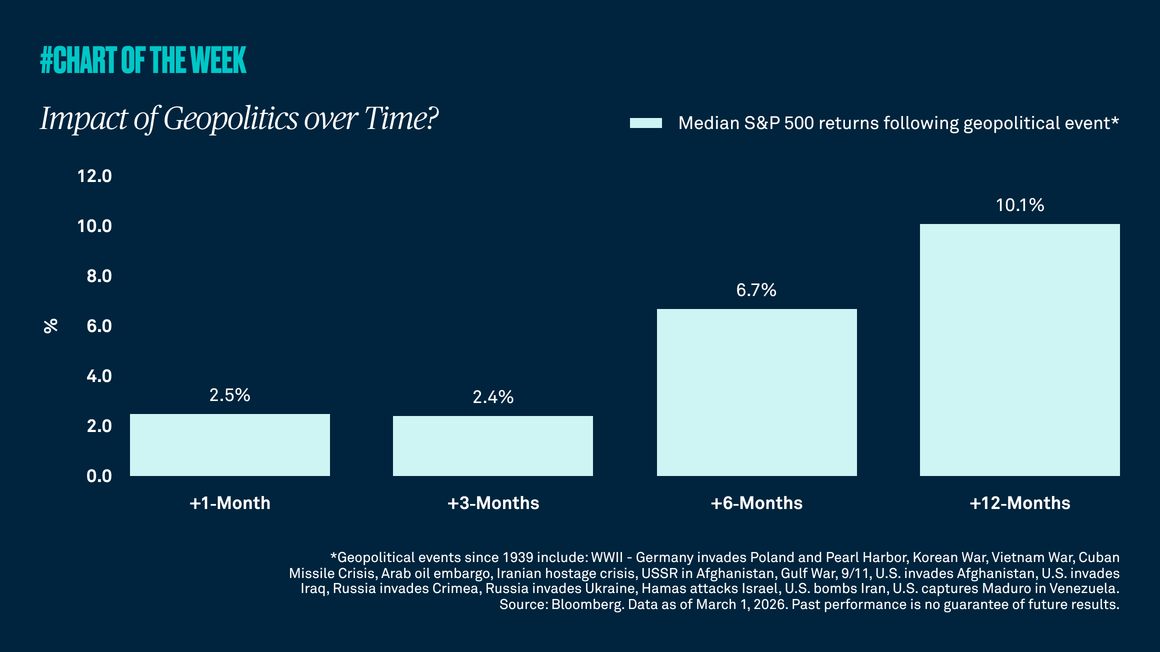

Tensions between the U.S./Israel and Iran have recently boiled over into a military conflict, which has given many investors the jitters. However, our research shows that equity market pullbacks resulting from geopolitical events are often short lived with the S&P 500 typically higher in the months following these events.

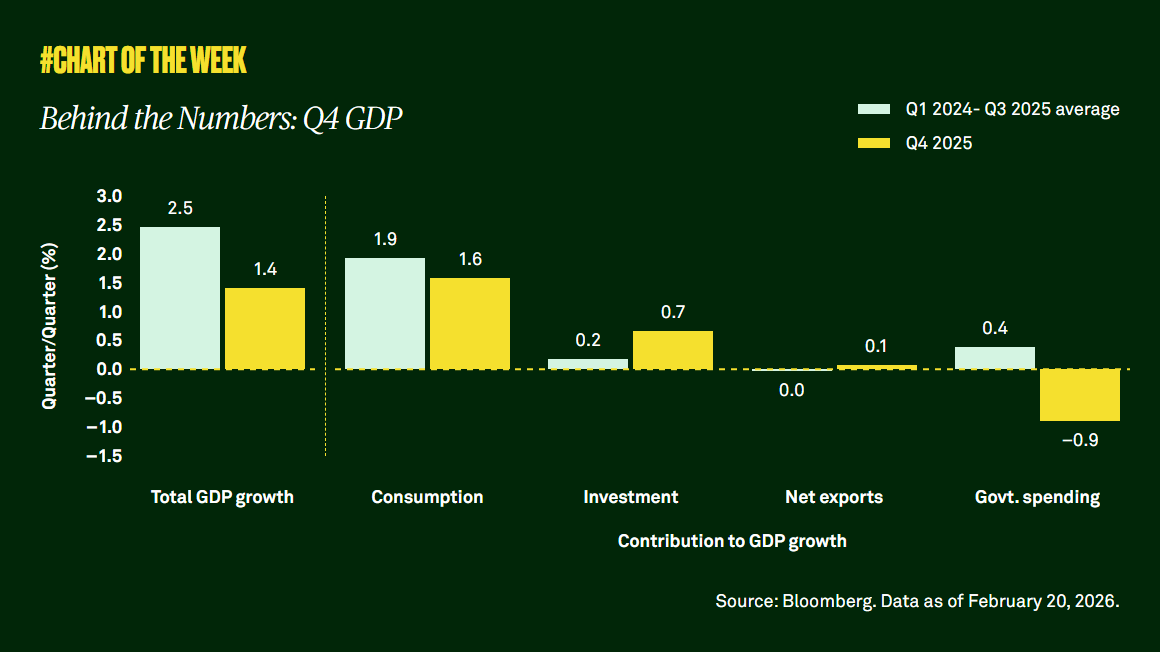

Gross domestic product undershot expectations last quarter, but the shortfall appears driven more by the temporary government shutdown than broad-based weakness. Consumer demand remains resilient, and with supportive fiscal policy, easing financial conditions and a steady labor market, the outlook points to a modest acceleration in economic activity this year.

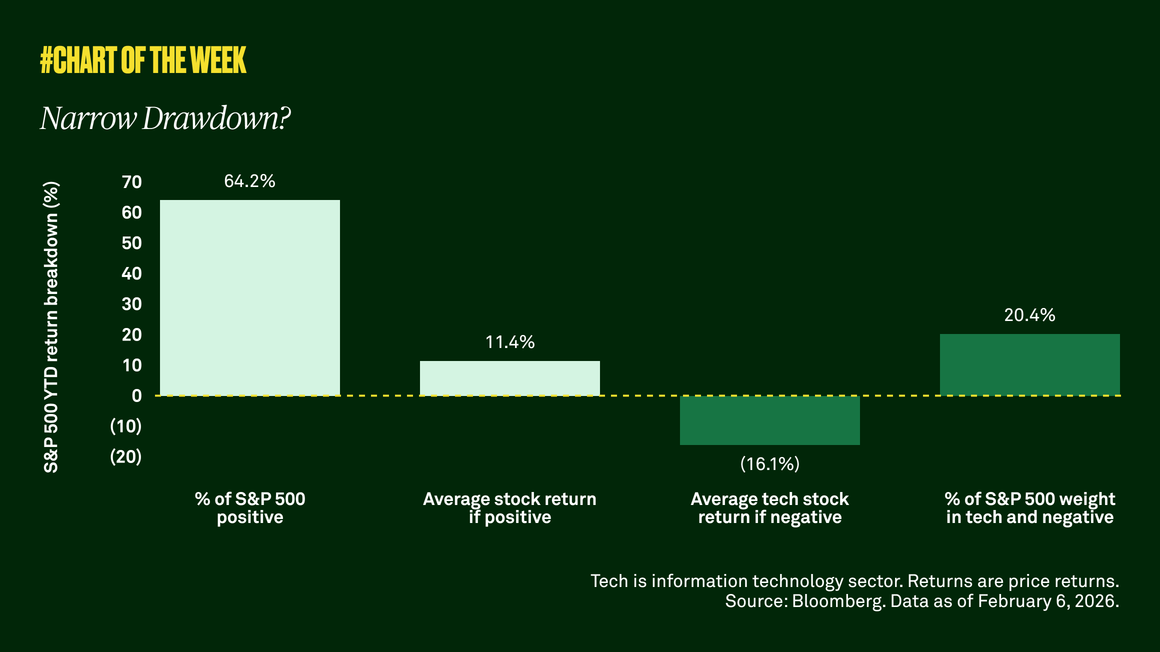

Equity volatility is rising, but all is not what it seems. The technology sector is weighing on the S&P 500 while value and cyclical stocks lead. A market rotation is underway as many investors begin to favor companies beyond tech.

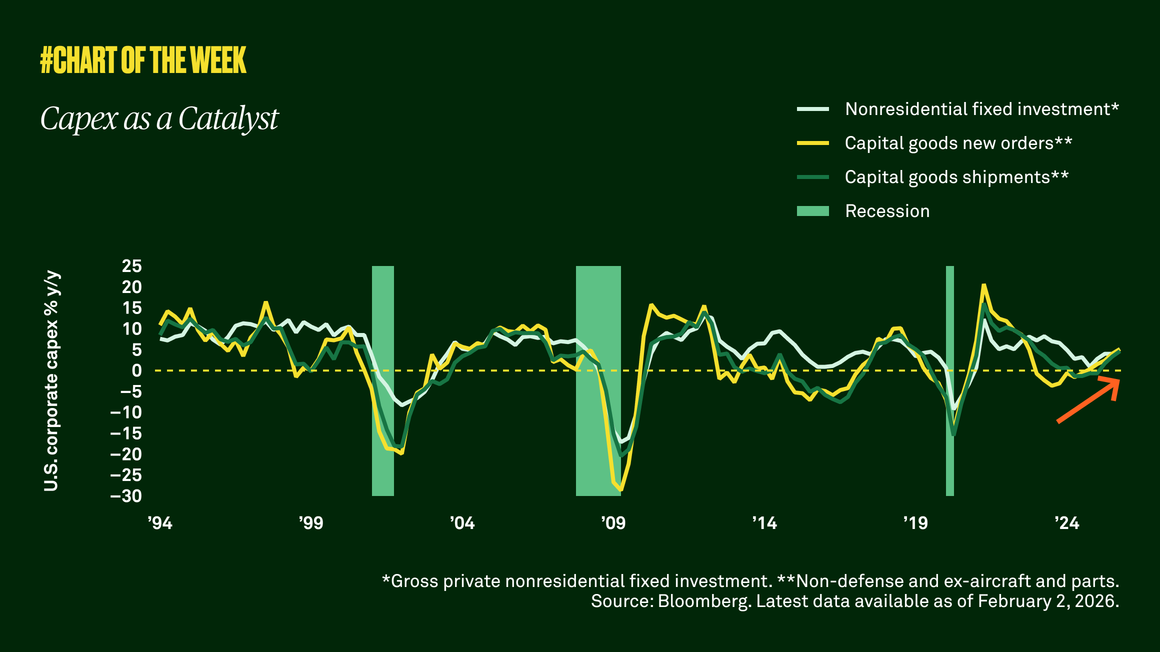

Capex as a catalyst

Capex as a Catalyst

Improved business confidence and recent tax legislation are compelling corporations to reinvest their cash flows in their businesses. We believe this is a positive signal for economic growth.