Earnings improvement is broadening

Earnings growth is on investors’ minds, especially as it broadens beyond the big tech stocks that have shown the most improvement in the past. We believe this is a positive sign for continued equity gains.

Equity market performance this year has been driven by better-than-expected earnings. With big tech dominating much of this growth, some investors have become concerned about concentration risk among technology stocks. However, current forecasts suggest earnings are improving beyond big tech into other sectors.

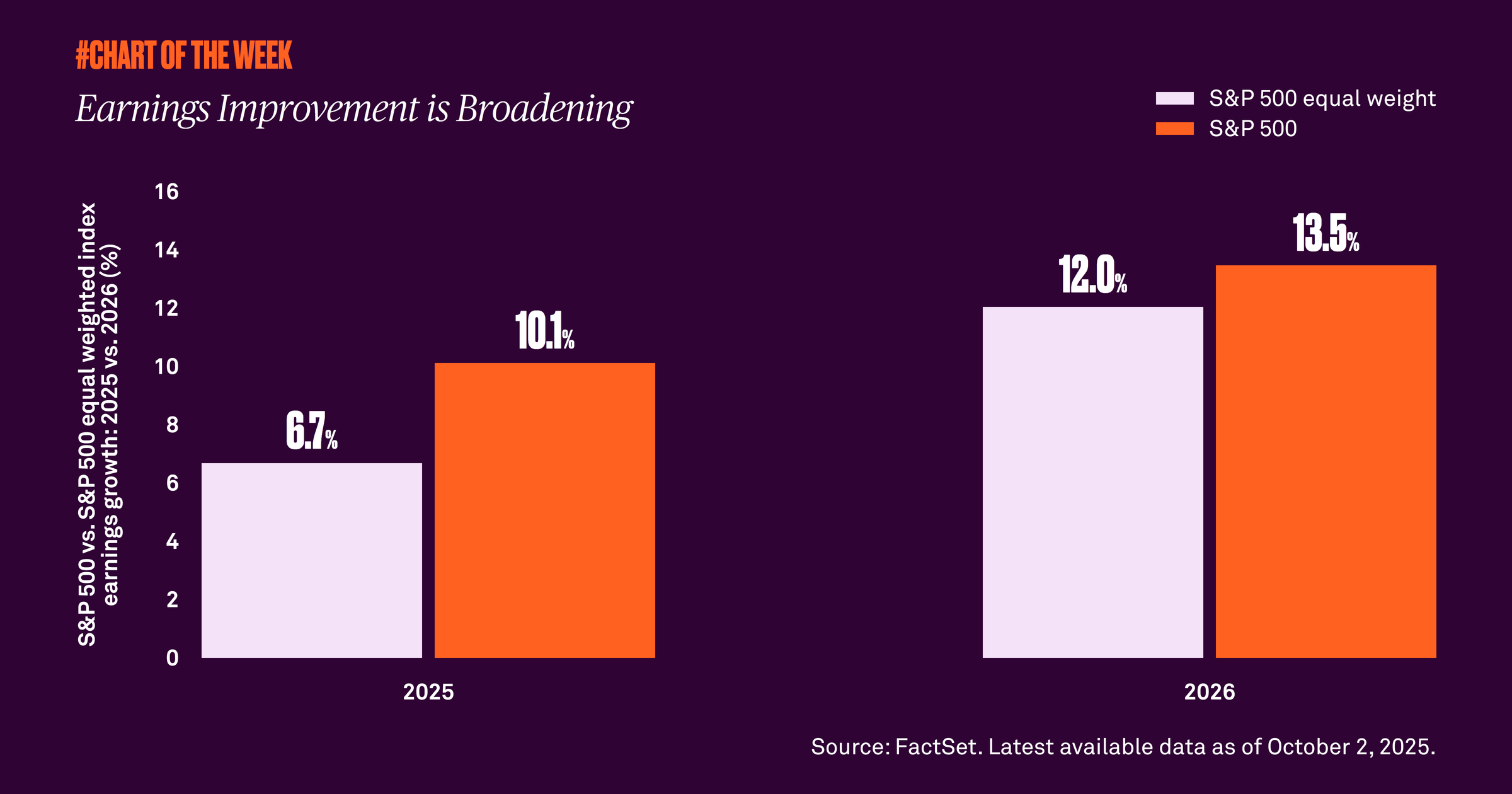

As of today, the market capitalization-weighted S&P 500’s earnings are forecasted to grow 10.1% in 2025 compared to 6.7% for the index’s equal-weighted counterpart, representing a gap of 3.4%. However, despite concerns about slowing jobs growth and the impact on the economy, that gap is expected to narrow in 2026 with S&P 500 earnings forecasted to grow 13.5% compared to 12% for the equal-weighted index — only a 1.5% difference.

Broadening earnings revisions should continue to support U.S. equities. Additionally, we are entering a seasonally favorable period, as the fourth quarter has historically been the best performing quarter of the year. These factors, combined with the Federal Reserve’s easing of monetary policy and improving margins, should be positive for stocks through year end.

815085 Exp : 07 October 2026

YOU MIGHT ALSO LIKE

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

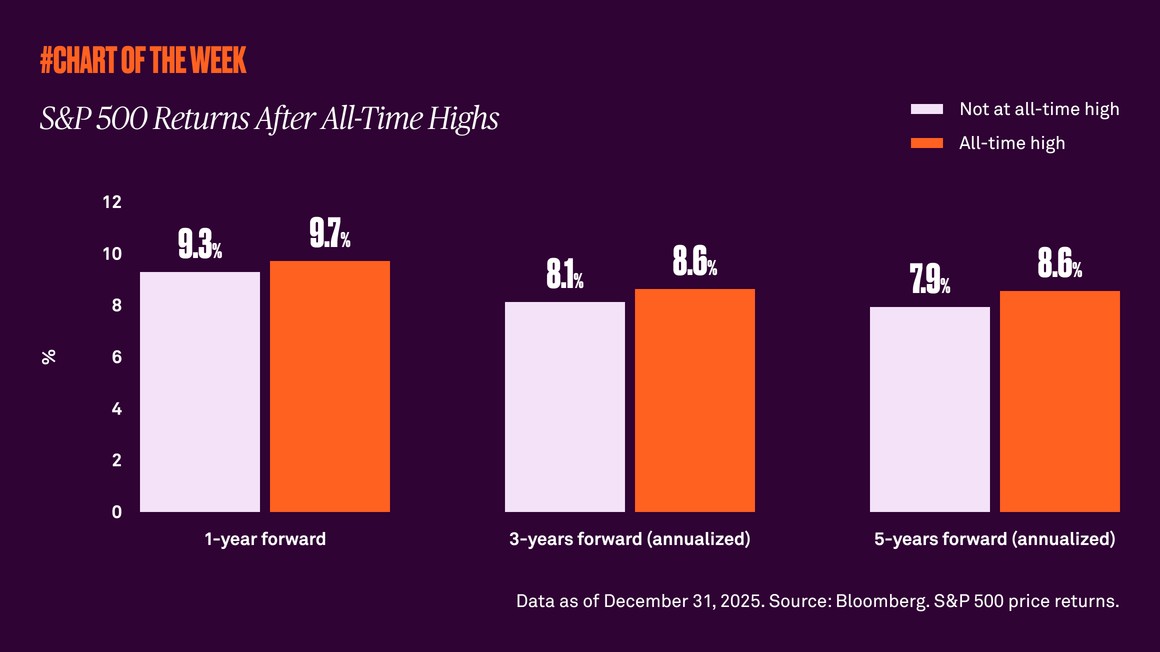

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

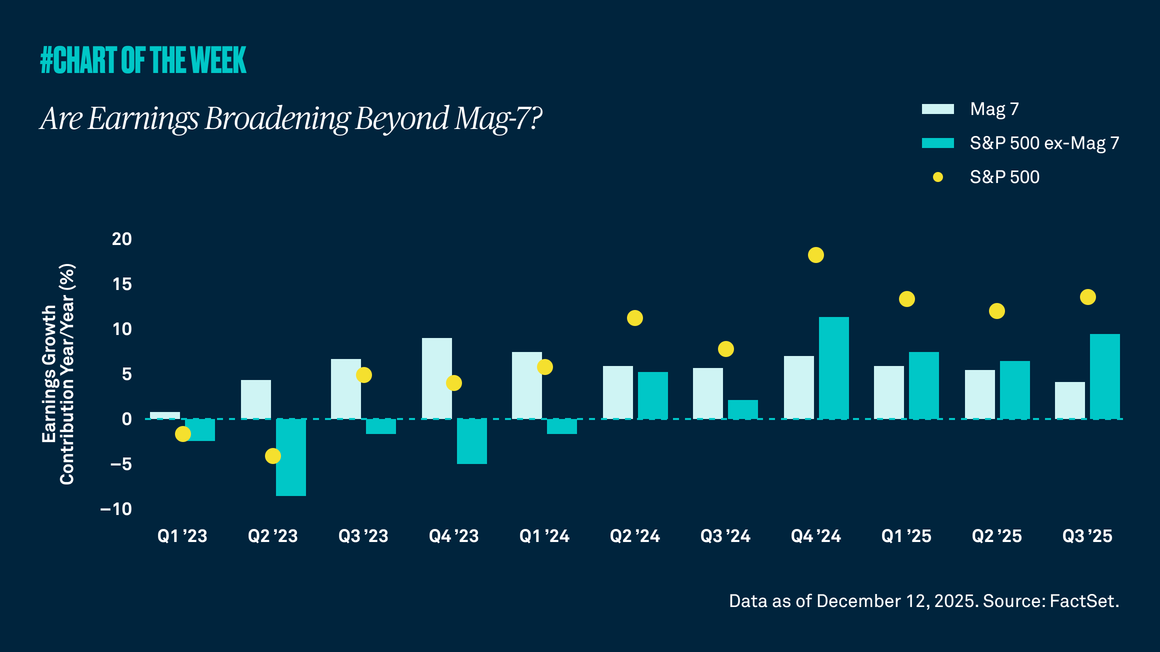

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

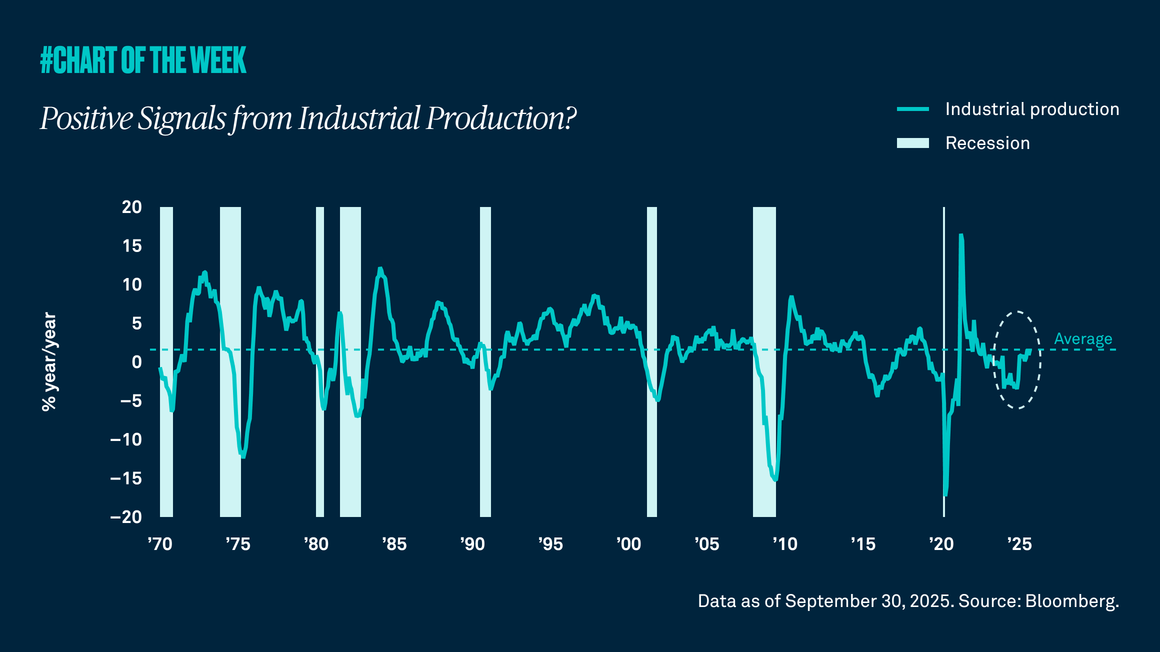

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.