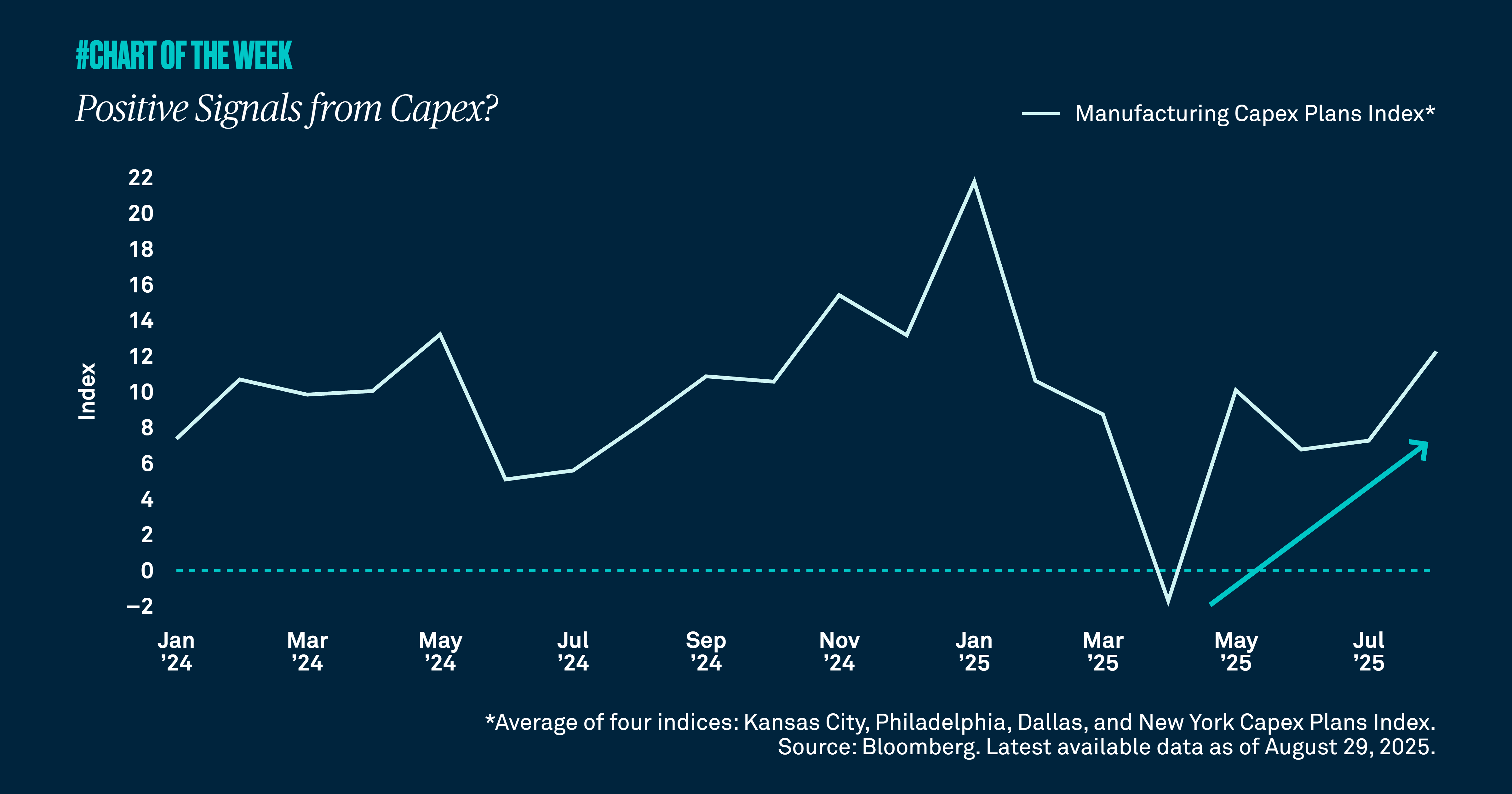

Positive signals from capex?

The One Big Beautiful Bill Act’s provision regarding the full expensing of capital expenditures is already having an impact on companies’ investment plans. We believe this a positive signal for economic growth.

Second quarter earnings season is winding down, with ~92% of S&P 500 companies having reported. Over 80% of those companies beat analysts’ expectations, pleasing many investors and correcting a downward shift in S&P 500 margin estimates that has stabilized since May.

Margins illustrate the quality and durability of corporate earnings by demonstrating how effectively a company controls costs and converts sales into profits. In 2025, net margins are expected to reach 13.3%, up from 12.9% in 2024, as well as increase another 0.7% to 14.0% in 2026. Notably, estimates for technology companies are significantly better than those of the entire S&P 500.

In fact, technology enhancements are the key driver of higher margins for the index. Specifically, the continued development and broadening adoption of artificial intelligence (AI) should bolster companies’ productivity and, in turn, lead to higher margins. Some of the ways that AI increases margins include improving operational efficiency, employing data-driven decision making, enhancing supply chain optimization, and enabling product and service innovations.

The immense progress in AI and its encouraging potential support our constructive view of equities. Improving estimates for both margins and earnings underscore our overweight position in large cap stocks and should push the market higher by year end.

798642 Exp : 01 September 2026

YOU MIGHT ALSO LIKE

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

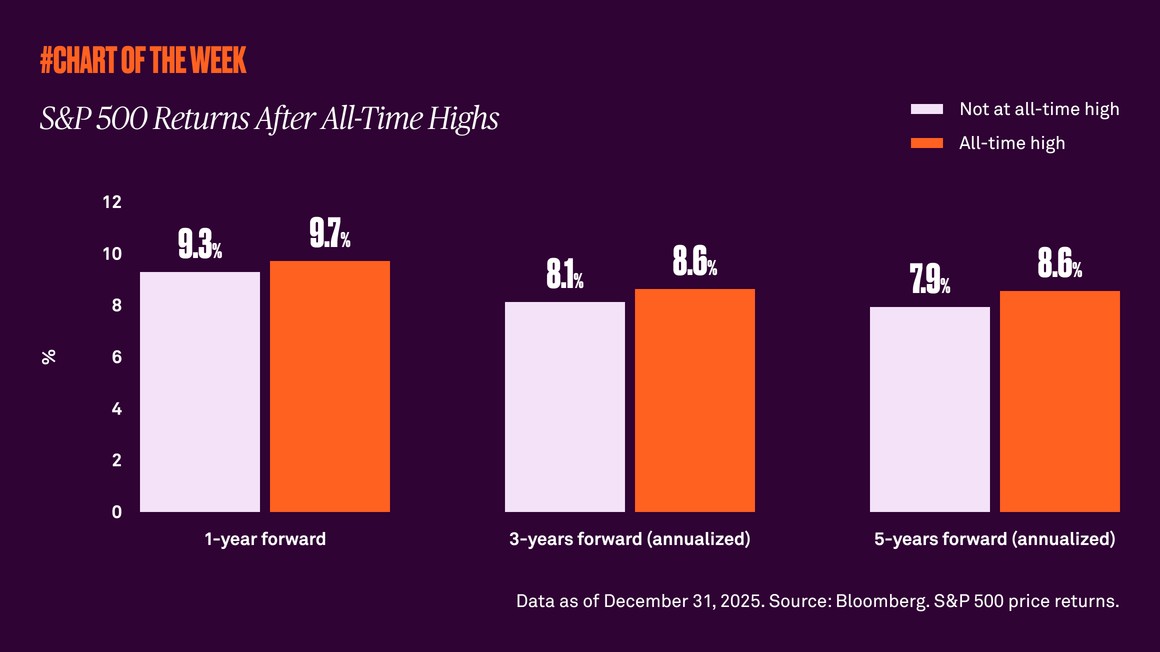

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

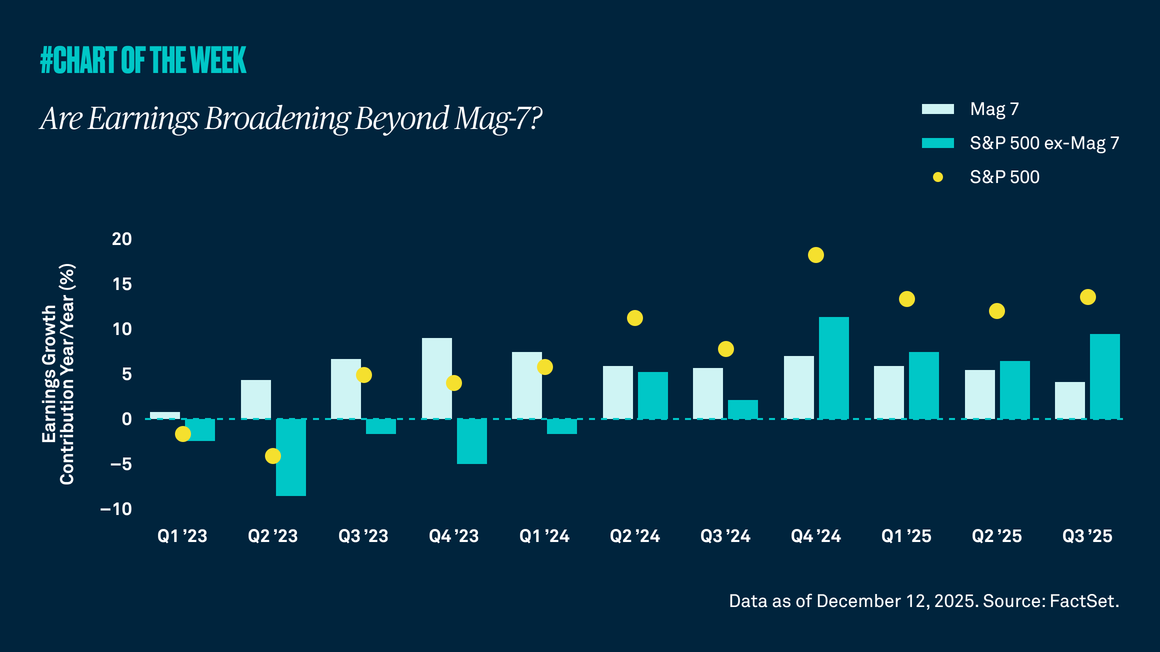

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

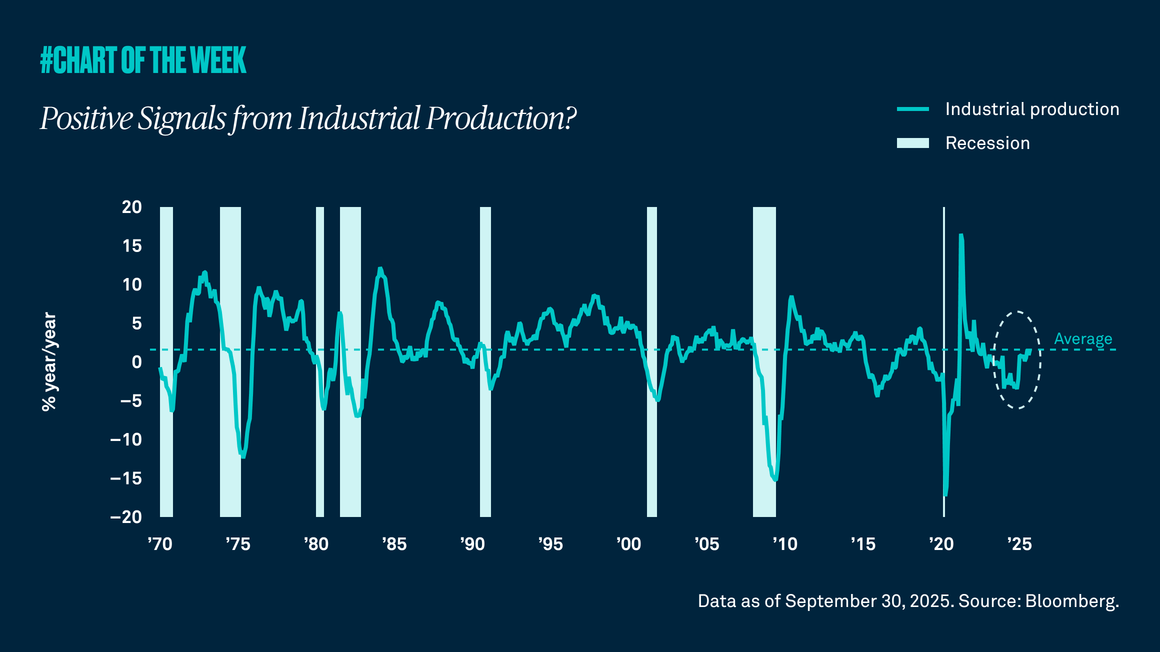

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.