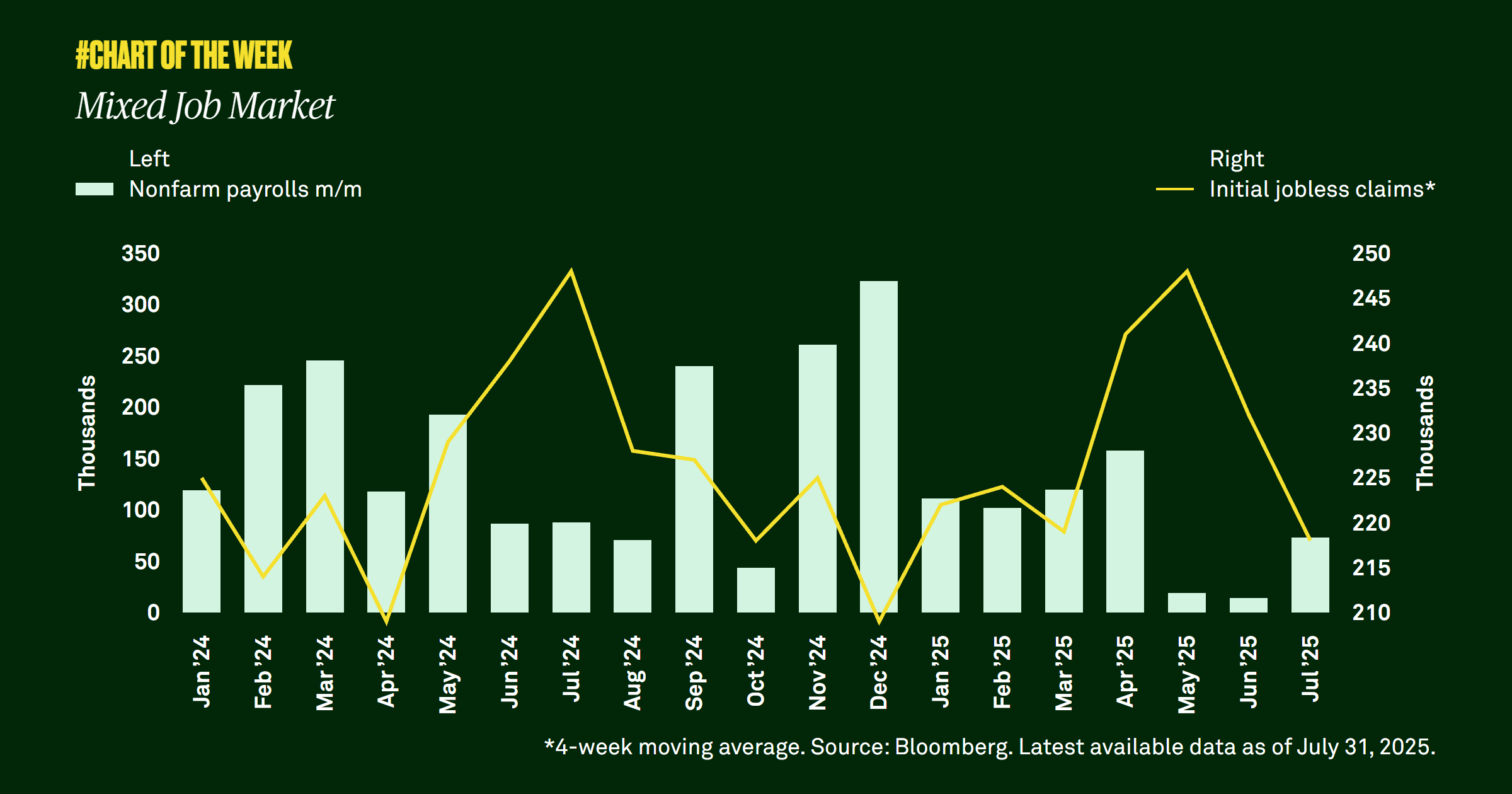

Mixed job market

Last week the market received mixed messages about the condition of the labor market. Nonfarm payrolls came in lower than expected, and the previous two months of data were revised sharply lower. Yet initial jobless claims were also lower, and the unemployment rate remains in range. We believe the U.S. economy can still deliver modest growth this year.

This past Friday, the nonfarm payrolls report missed expectations of 104,000 with a monthly addition of 73,000. Moreover, the prior two months’ additions were revised lower by a combined 258,000, the biggest downward revision since 2020. These results stoked anxiety in many investors, and helped push the major U.S. indices lower last week.

It’s important to note that though this information suggests the labor market may be cooling, initial jobless claims came in last week at their lowest level in four months, and the unemployment rate ticked up just 0.1% to 4.2%, remaining in the 4-4.2% range where it has held steady over the past 14 months.

Labor market signals are clearly mixed, but the latest numbers do not change our outlook on economic growth. Demand for labor has weakened, but initial jobless claims suggest companies are not laying off workers, which has helped support consumption. We are watching to see whether the latest prints are simply noise or the beginning of a trend, and we continue to believe the economy can avoid a recession and deliver modest growth of around 1% this year.

784118 Exp : 05 August 2026

YOU MIGHT ALSO LIKE

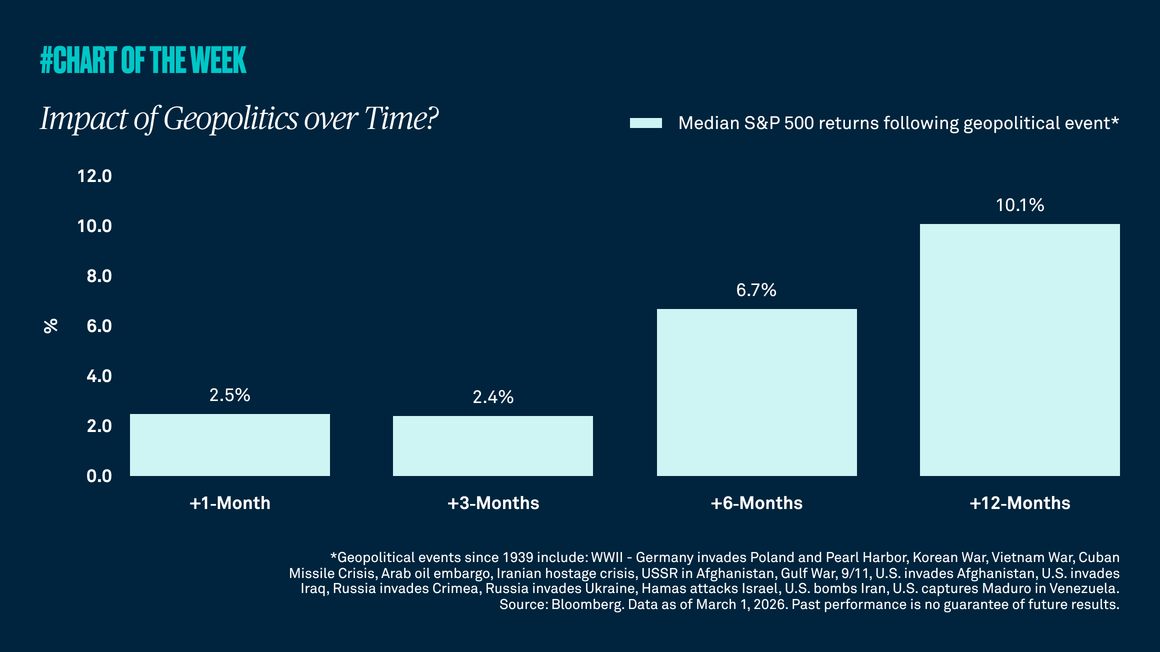

Tensions between the U.S./Israel and Iran have recently boiled over into a military conflict, which has given many investors the jitters. However, our research shows that equity market pullbacks resulting from geopolitical events are often short lived with the S&P 500 typically higher in the months following these events.

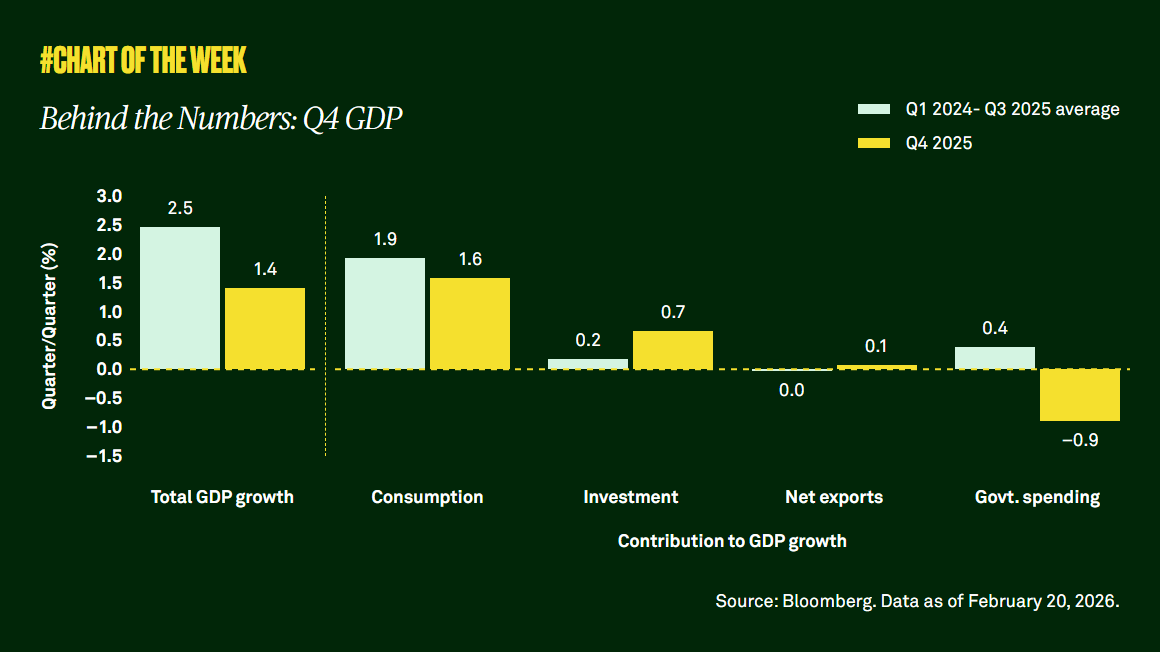

Gross domestic product undershot expectations last quarter, but the shortfall appears driven more by the temporary government shutdown than broad-based weakness. Consumer demand remains resilient, and with supportive fiscal policy, easing financial conditions and a steady labor market, the outlook points to a modest acceleration in economic activity this year.

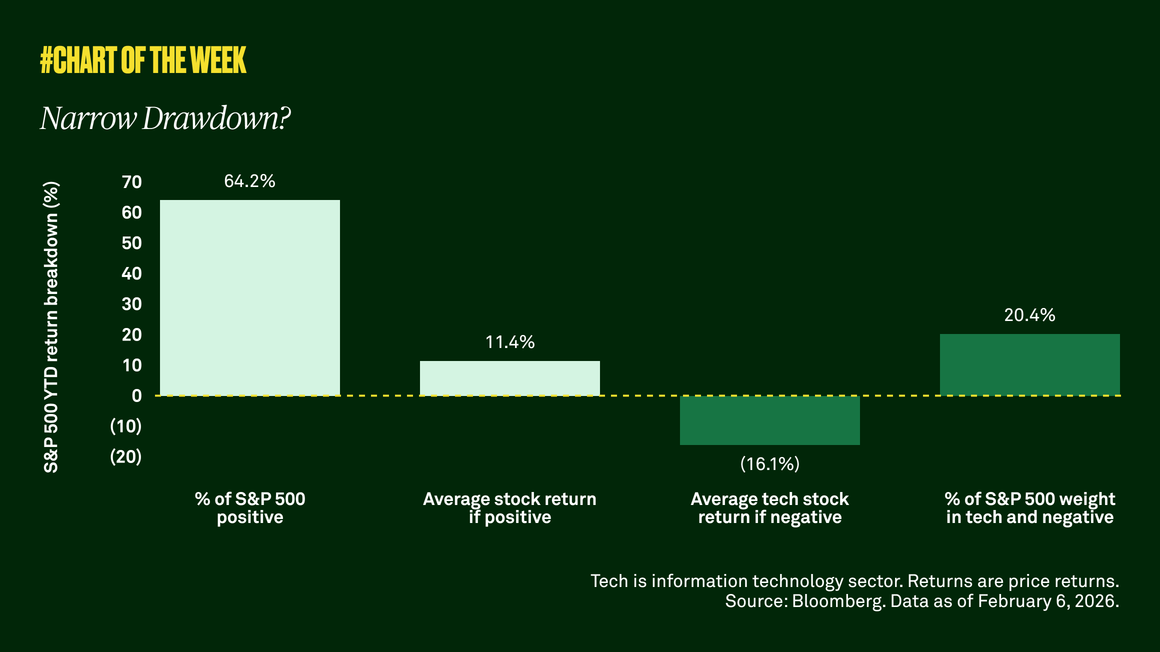

Equity volatility is rising, but all is not what it seems. The technology sector is weighing on the S&P 500 while value and cyclical stocks lead. A market rotation is underway as many investors begin to favor companies beyond tech.

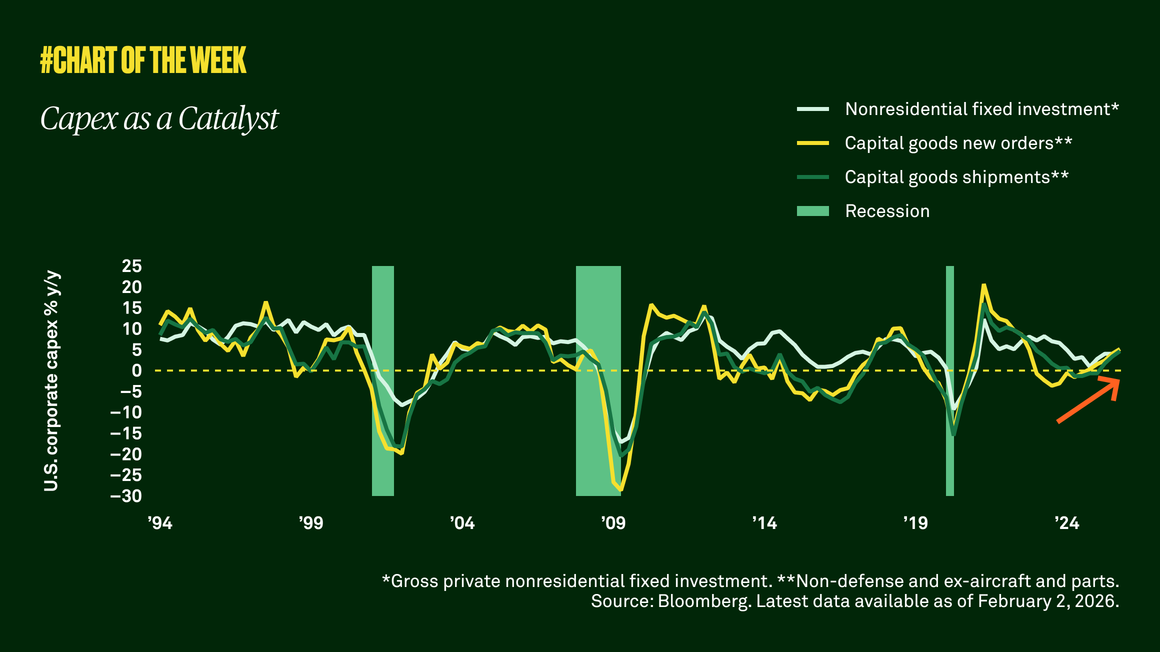

Capex as a catalyst

Capex as a Catalyst

Improved business confidence and recent tax legislation are compelling corporations to reinvest their cash flows in their businesses. We believe this is a positive signal for economic growth.