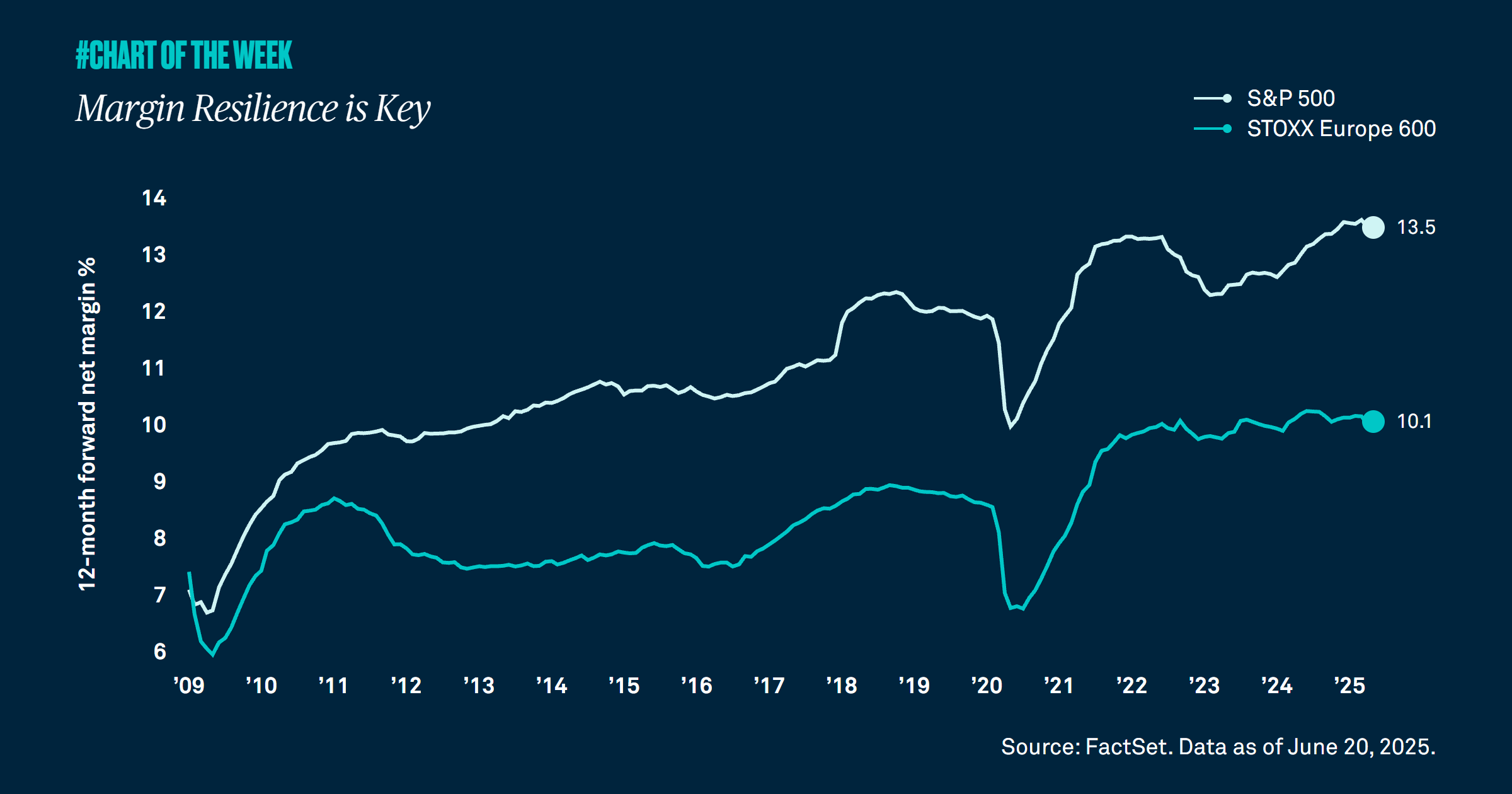

Margin Resilience Is Key

This year U.S. equities have underperformed the rest of the world due largely to policy uncertainty. However, an important driver of U.S. equity outperformance over the longer term has been stronger earnings and profit margins relative to peers, and our view is these factors will continue to drive long-term U.S. exceptionalism.

U.S. equities have had a challenging first half of the year, underperforming the rest of the world. A primary cause of this underperformance has been higher policy uncertainty and concerns about the impact of higher tariffs on growth.

While policy uncertainty can impact short-term volatility and lead to temporary underperformance, what does this mean for returns over the long term? An important driver of long-term returns is earnings and profit margins, where the U.S. has continued to outperform. In fact, since 2010 margins increased 6.4% to 13.5% as compared to a 2.7% increase in Europe to 10.1%. The difference between U.S. and European margins is now 3.4%, near the highest in history.

Additionally, technology leadership and increased adoption of artificial intelligence (AI) across diverse industries will likely support the continued expansion of U.S. margins, allowing them to surpass the rest of the world. Considering the many ways AI can improve profit margins for businesses, we anticipate that 2025 S&P 500 earnings per share will come in at $260-$270, demonstrating positive growth of roughly 8% as strong earnings and margin expansion continue to drive U.S. exceptionalism into the future.

759433 Exp : 25 June 2026

YOU MIGHT ALSO LIKE

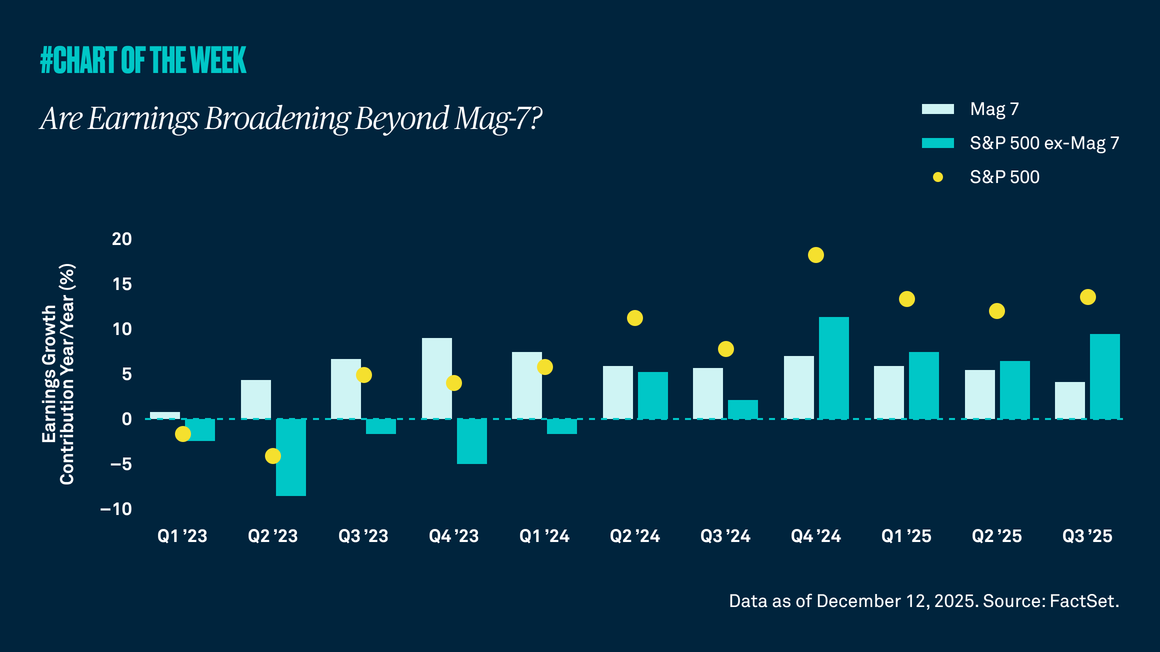

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

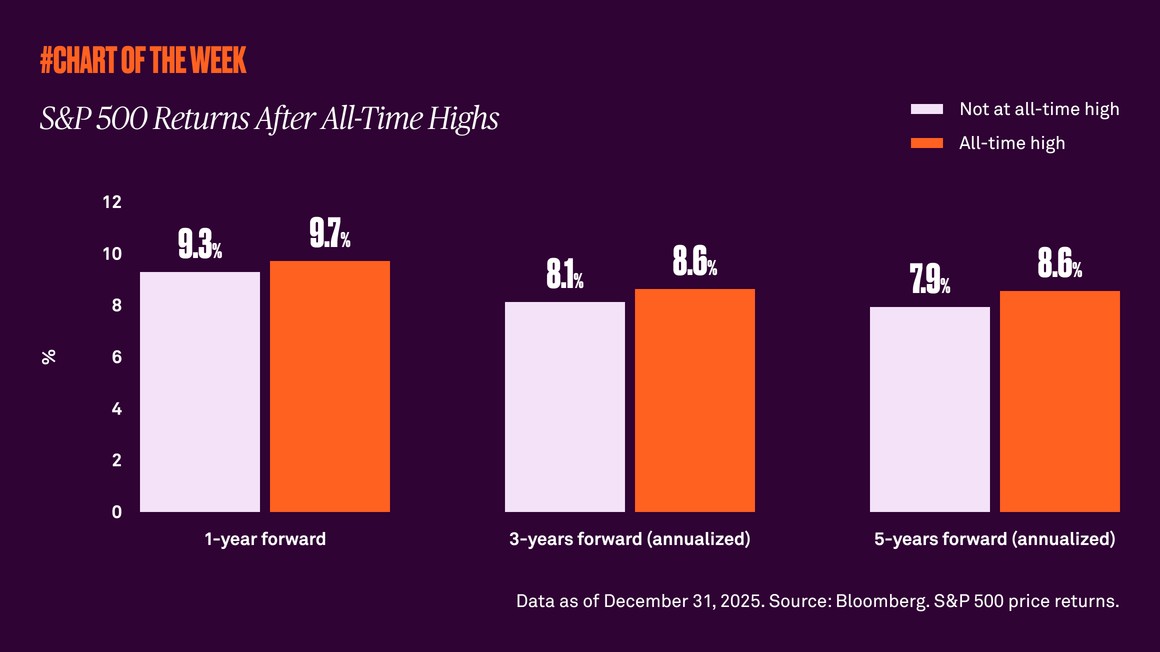

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

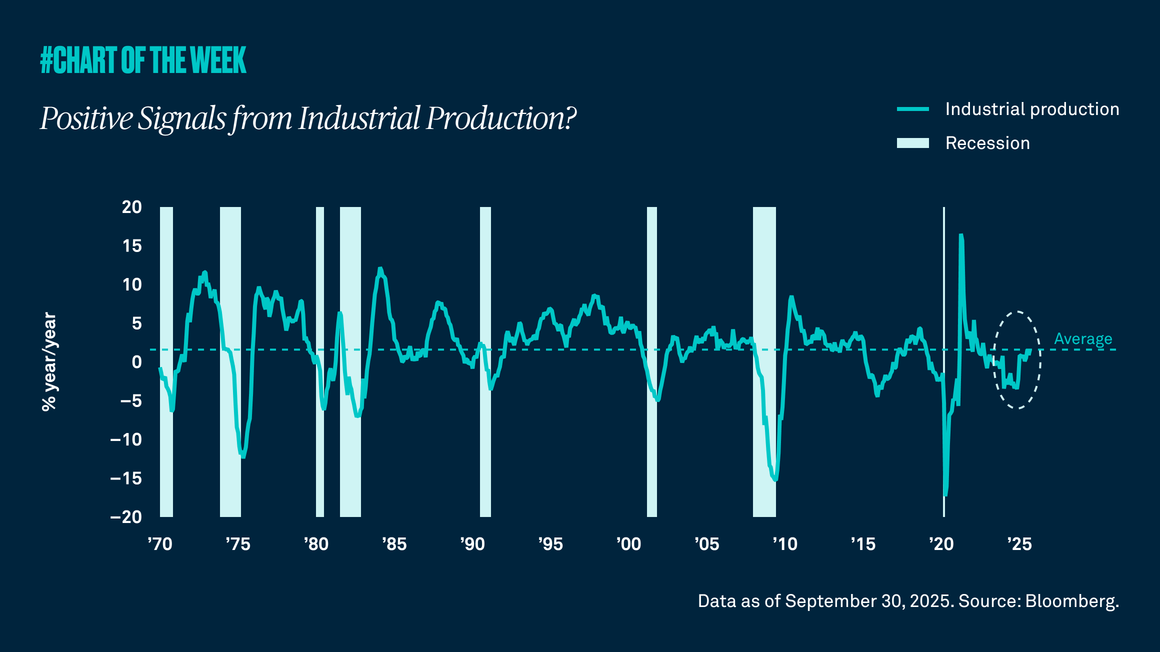

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.