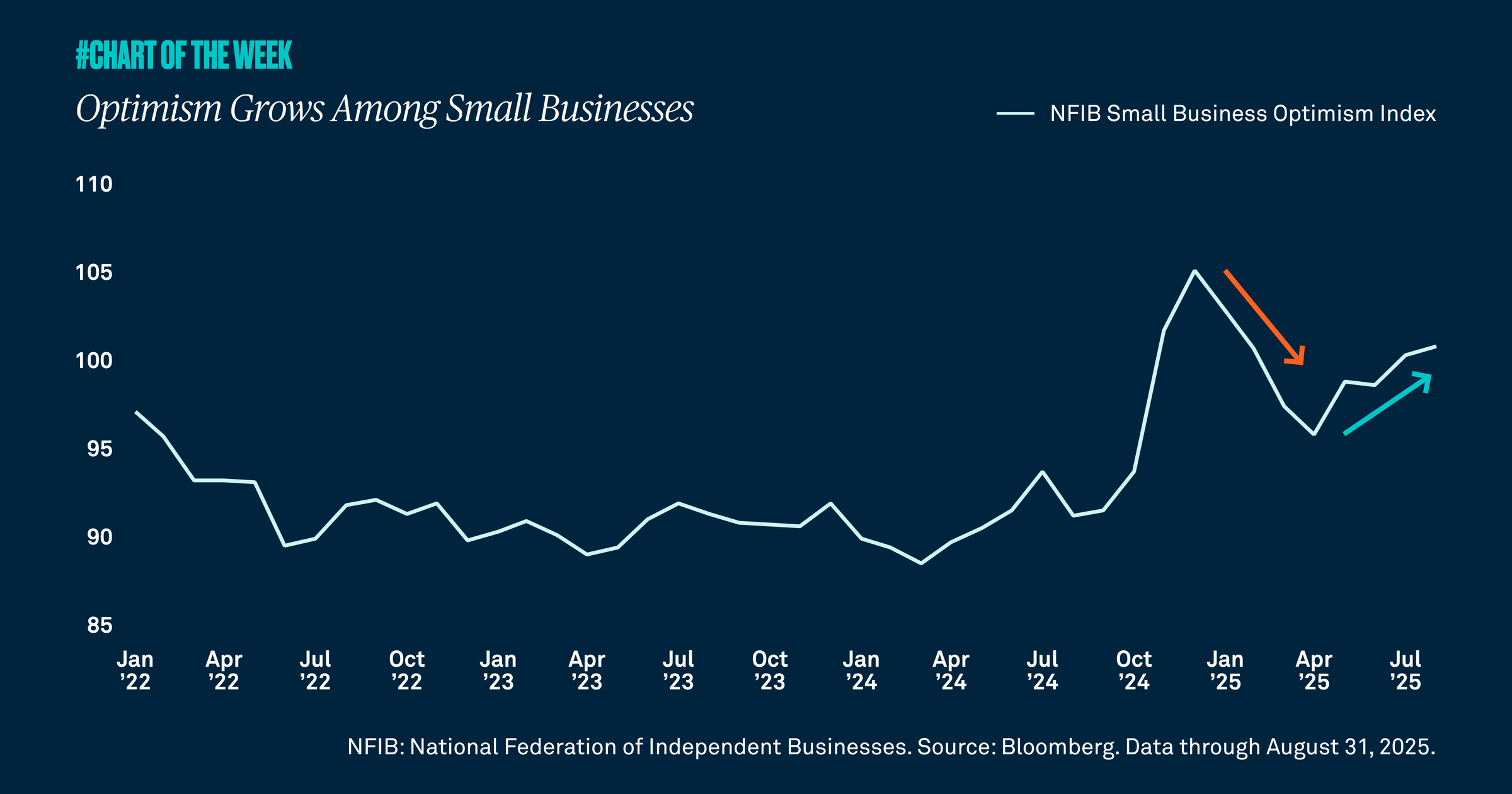

Optimism grows among small businesses

Small businesses are becoming more optimistic, a positive indication at a time when economists are debating whether growth will slow. We view this confidence as a positive signal for future growth.

There is a debate among economists about whether growth resilience will weaken heading into the fourth quarter and 2026. While we recognize that job growth has slowed, we find improving business confidence a positive sign for future growth

The NFIB Small Business Optimism Index, a measure of sentiment among small companies, fell sharply from December to April as policy uncertainty spiked. Since April, confidence among small businesses has improved and is now at its highest level since February.

In our view, despite slowing jobs growth, the economy is showing signs that the outlook heading into 2026 is improving. Earnings are strong and growing stronger, and companies only stand to benefit from easing monetary policy. Though gross domestic product may fall short of 2024 performance, we anticipate it will come in positive this year between 1.5%-2%. While we believe improving small business optimism is positive for growth, we will continue to monitor the attitudes of small business owners, watching to learn whether recent momentum can persist.

804812 Exp : 16 September 2026

YOU MIGHT ALSO LIKE

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

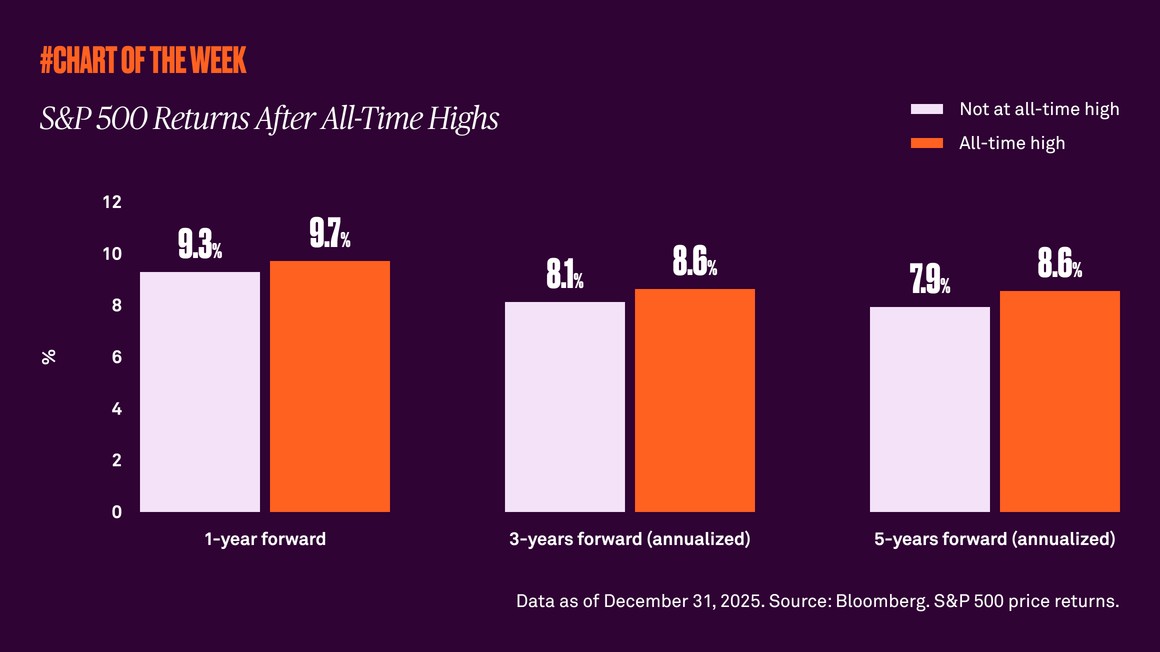

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

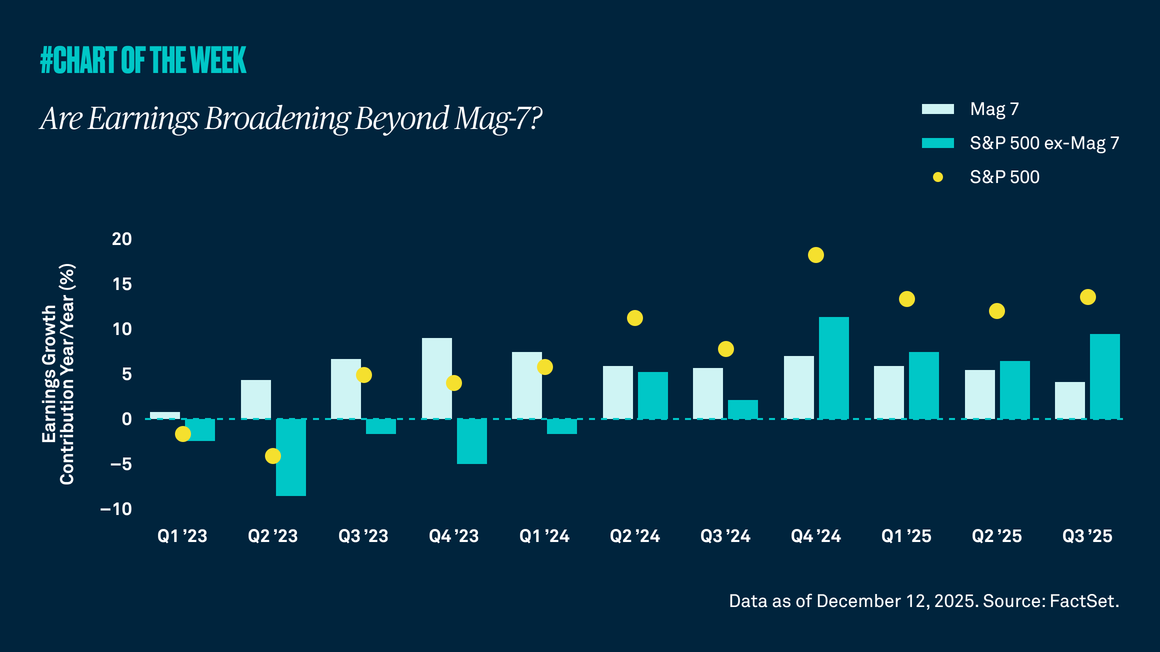

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

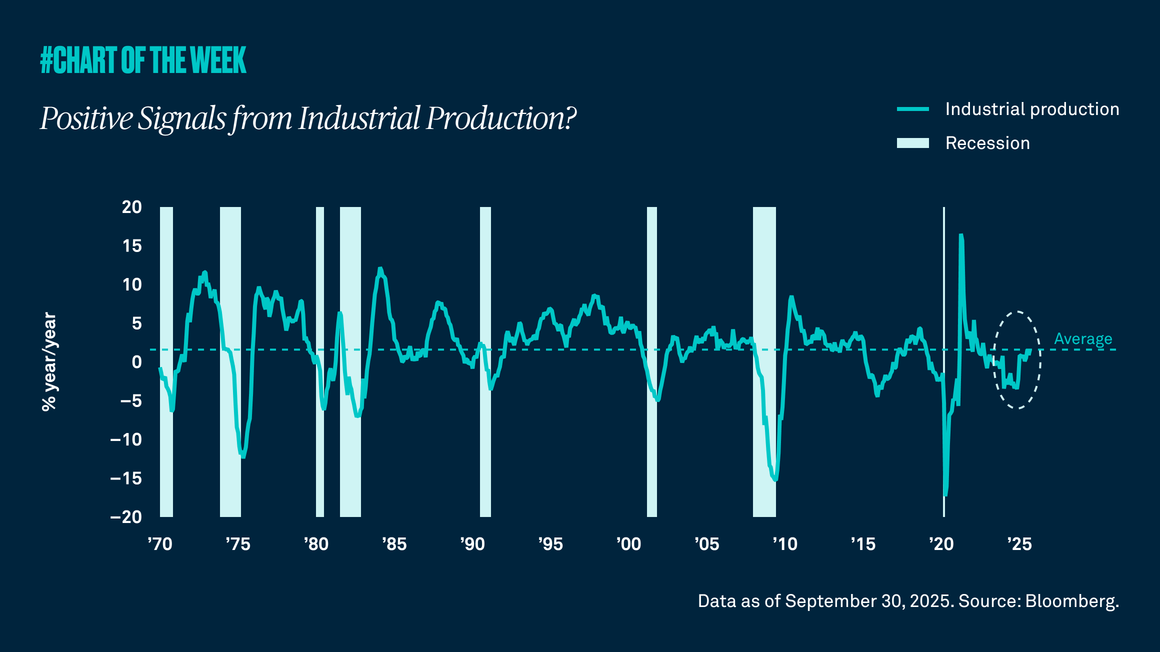

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.