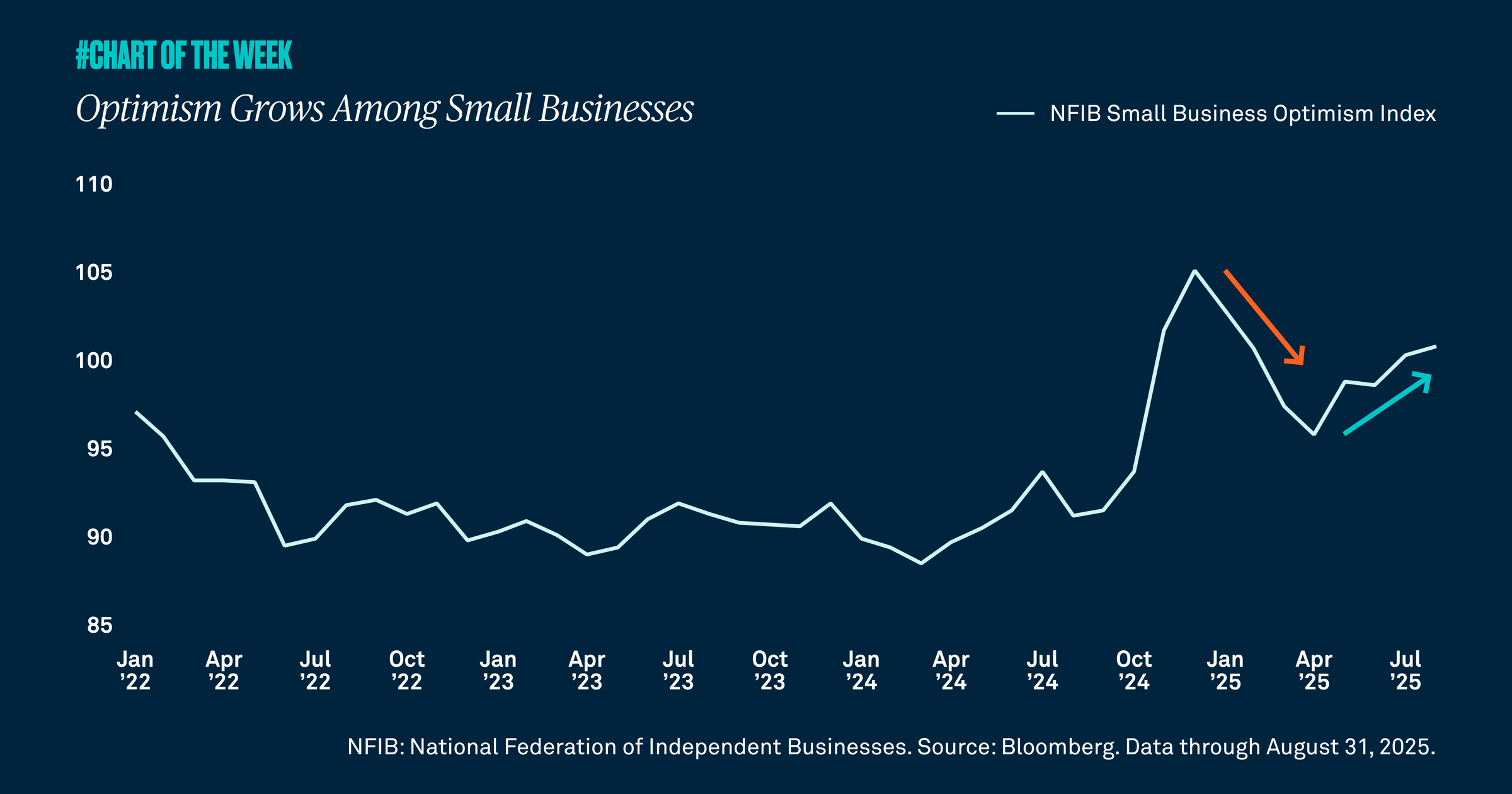

Optimism grows among small businesses

Small businesses are becoming more optimistic, a positive indication at a time when economists are debating whether growth will slow. We view this confidence as a positive signal for future growth.

There is a debate among economists about whether growth resilience will weaken heading into the fourth quarter and 2026. While we recognize that job growth has slowed, we find improving business confidence a positive sign for future growth

The NFIB Small Business Optimism Index, a measure of sentiment among small companies, fell sharply from December to April as policy uncertainty spiked. Since April, confidence among small businesses has improved and is now at its highest level since February.

In our view, despite slowing jobs growth, the economy is showing signs that the outlook heading into 2026 is improving. Earnings are strong and growing stronger, and companies only stand to benefit from easing monetary policy. Though gross domestic product may fall short of 2024 performance, we anticipate it will come in positive this year between 1.5%-2%. While we believe improving small business optimism is positive for growth, we will continue to monitor the attitudes of small business owners, watching to learn whether recent momentum can persist.

804812 Exp : 16 September 2026

YOU MIGHT ALSO LIKE

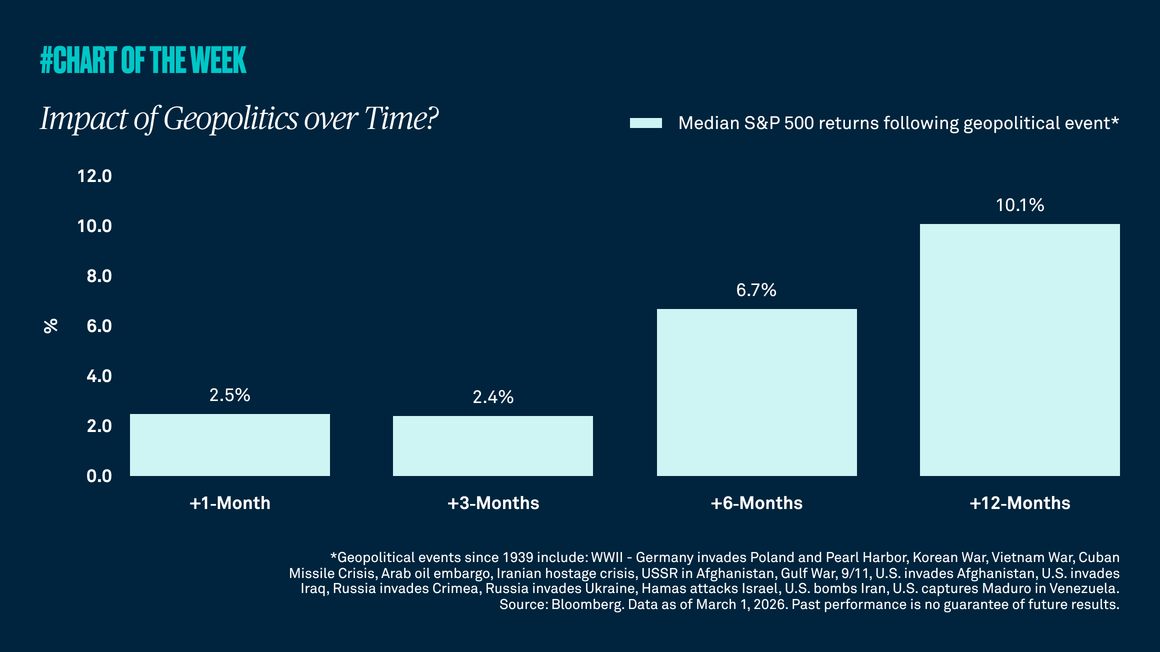

Tensions between the U.S./Israel and Iran have recently boiled over into a military conflict, which has given many investors the jitters. However, our research shows that equity market pullbacks resulting from geopolitical events are often short lived with the S&P 500 typically higher in the months following these events.

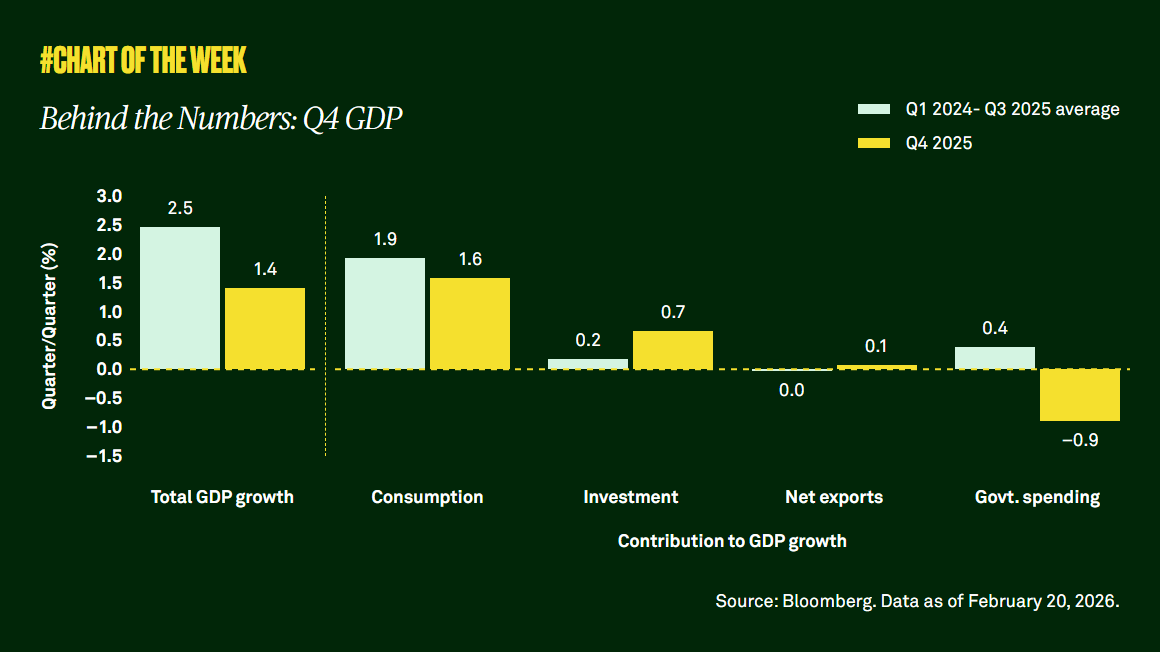

Gross domestic product undershot expectations last quarter, but the shortfall appears driven more by the temporary government shutdown than broad-based weakness. Consumer demand remains resilient, and with supportive fiscal policy, easing financial conditions and a steady labor market, the outlook points to a modest acceleration in economic activity this year.

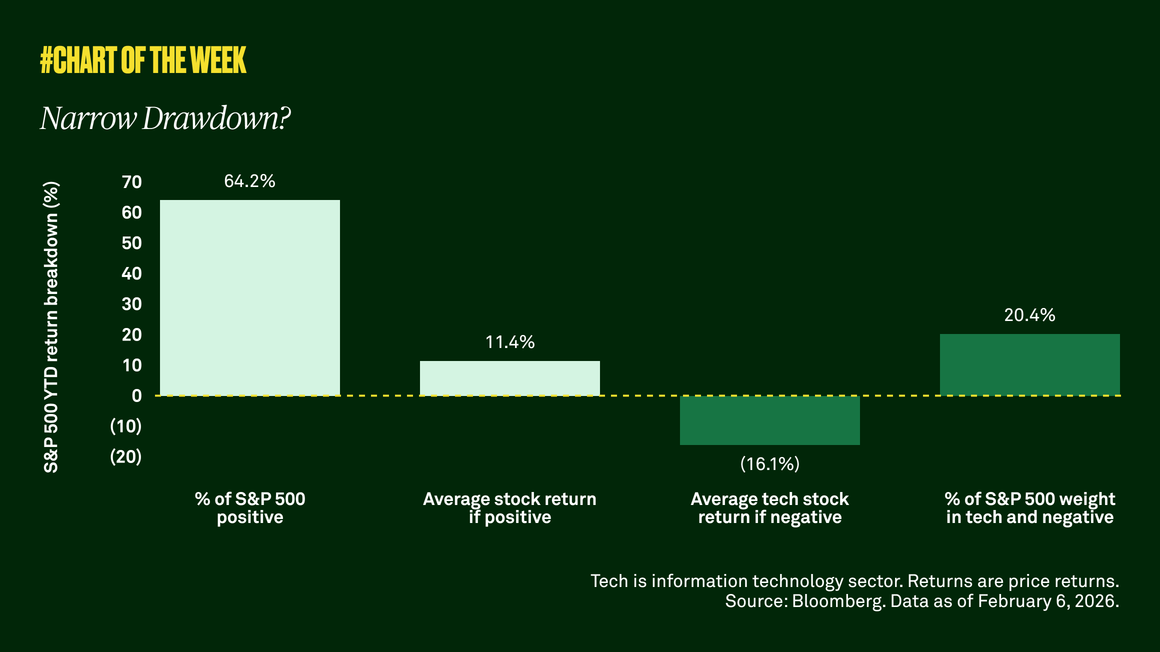

Equity volatility is rising, but all is not what it seems. The technology sector is weighing on the S&P 500 while value and cyclical stocks lead. A market rotation is underway as many investors begin to favor companies beyond tech.

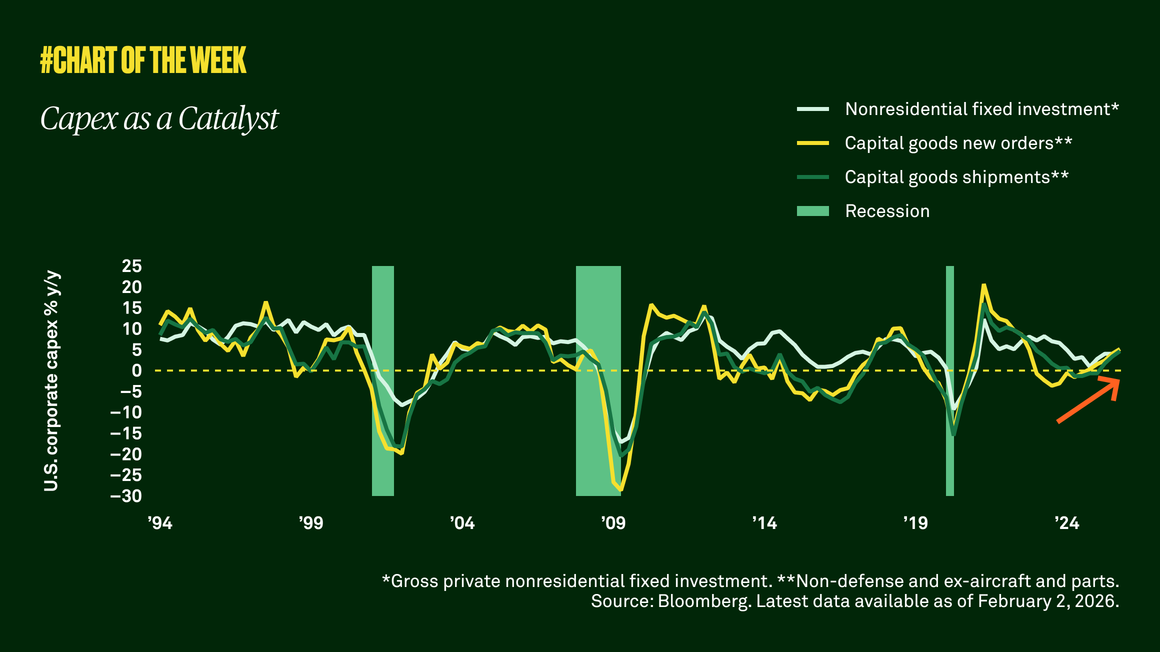

Capex as a catalyst

Capex as a Catalyst

Improved business confidence and recent tax legislation are compelling corporations to reinvest their cash flows in their businesses. We believe this is a positive signal for economic growth.