The crypto exchange-traded product (ETP) market saw robust growth in 2025, marked by key innovations such as staking, in-kind orders and alternative coin index exchange-traded products. With over 100 new products registered in the U.S., continued adoption by investors and active engagement between ETP issuers and regulators, the market is poised for continued expansion.

“BNY’s leadership in ETPs gives us the perspective and capabilities to champion our clients’ drive for product innovation, strengthening our position as a trusted partner in the rapidly evolving crypto ETP landscape,” says Ben Slavin, Managing Director, ETF Global Industry Lead.

Crypto ETP Market Hits New Highs

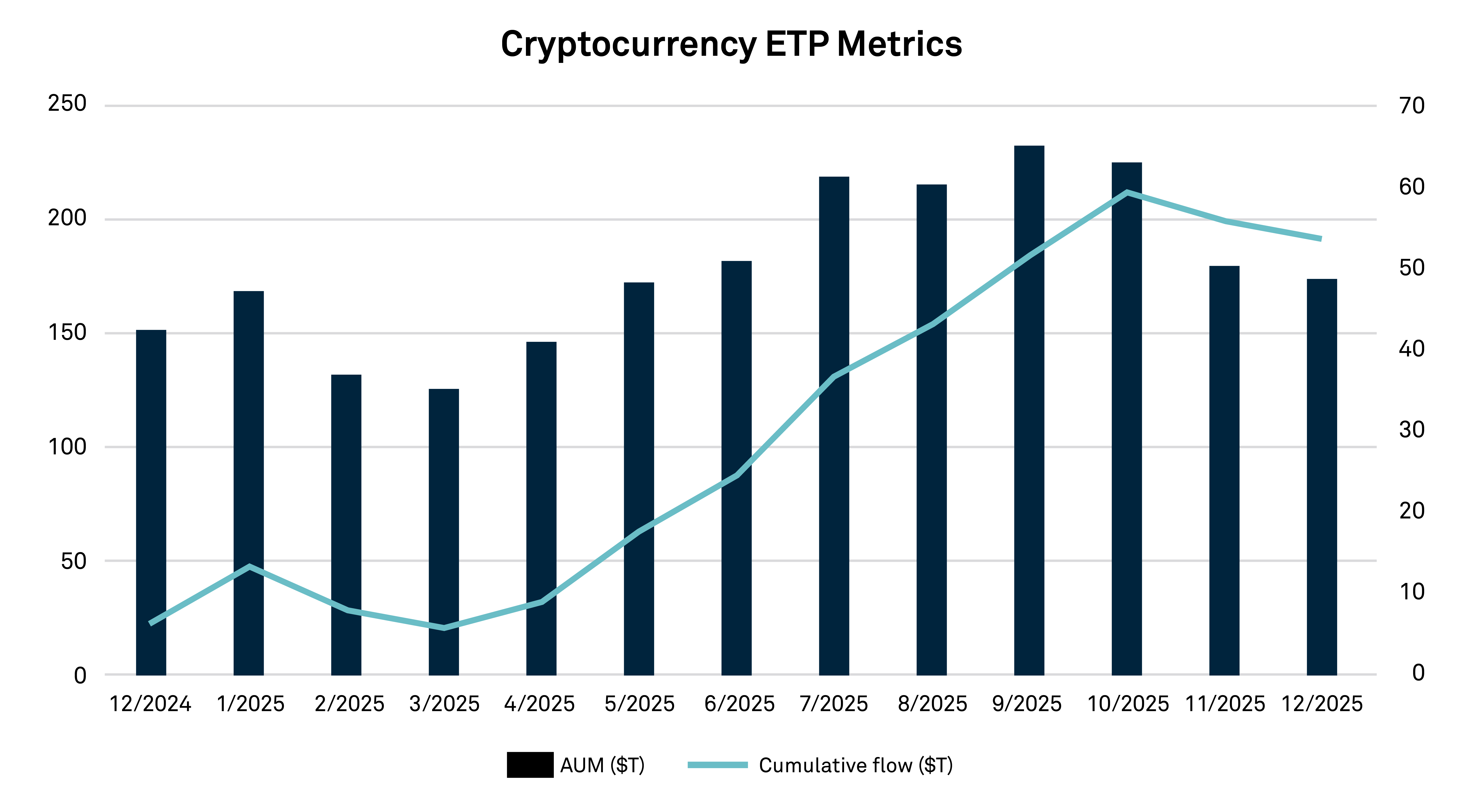

According to Bloomberg data, global digital assets under management (AUM) in ETPs reached a record $237 billion in October 2025. This includes various fund structures such as single-asset spot ETPs, index ETPs, derivative and futures-based ETPs and private trusts. Bitcoin ETPs are still the largest slice of the market, accounting for approximately 76% of the global market.

Source: Bloomberg (as of December 31, 2025)

“With ETPs representing about 7% of the world’s outstanding supply of Bitcoin, the market is experiencing a pivotal moment in mainstream adoption, reinforced by the integration of broader digital assets into established investment frameworks,” said Ralf Roth, Managing Director, Digital Asset Custody.

The iShares Bitcoin ETP (IB1T) is the fastest-growing ETP in history, peaking at close to $100 billion in assets under management in Q4 2025,1 ranking sixth among global ETPs in 2025, demonstrating strong marketplace demand. Other spot Bitcoin products sponsored by firms like Grayscale, Bitwise, Invesco, ARK 21Shares, Franklin Templeton and WisdomTree also continue to see robust growth.

“Listening to market signals and understanding our clients’ appetite for digital products, we have been building the internal infrastructure to support the unique requirements specific to crypto ETPs. Our comprehensive solutions bring a heightened focus on risk management, data transparency and operational resilience to meet the rapidly evolving needs of issuers in a secure environment,” said Bob Humbert, Managing Director, Global Product Head of ETFs, Registered Funds and Alternatives.

BNY's hub for ETF insights and execution expertise supports issuers, investors, sponsors and authorized participants. Our collection of insights focuses on industry trends to help grow and scale your business.

Regulatory developments are paving the way for crypto ETPs

The crypto ETP market, particularly in the U.S., has achieved several key milestones over the past few months, including:

- Crypto generic listing standards: Perhaps the most significant development in the U.S. crypto market is the SEC’s approval of generic listing standards. The new regulatory framework for spot commodity ETPs, including digital assets, marks a pivotal development, as it streamlines the launch process, reducing the time to launch a product from over 240 days to less than 75. This framework eliminates the need for individual case-by-case filings and applies to ETPs investing in a broad range of crypto assets. The move enhances issuer speed-to-market, expands investor access and strengthens the U.S. capital market as a leading hub for digital asset innovation.

- In-kind orders: The SEC’s approval of in-kind order processing marks an important shift, as it allows issuers to conduct transactions in-kind rather than on a cash-only basis. This provides another source of liquidity and removes friction in the primary market dealing with these products, bringing crypto ETPs into line with other types of ETPs.

- Staking: Staking, in which investors post some of their assets as collateral, is becoming more widespread among crypto ETPs. The trend started with Grayscale’s launch of staking-enabled Ethereum ETPs, mirroring practices already established in markets like Canada. Shareholders can potentially benefit from the additional returns generated by those products that allow this practice. ETPs must maintain sufficient underlying liquidity to meet any shareholder redemptions based on factors like the length of the staking exit queue.

- Index trackers: The SEC also greenlit alternative coin index ETPs, broadening investor access to diversified digital asset exposure through products including Solana, XRP and Cardano. Indexes are particularly attractive for asset allocation products or investors who are simply interested in exposure to the digital asset category but may not have a view on one asset versus another.

- Platforms: Major U.S. wealth platforms continue to add investor access to the cryptocurrency ETP. As regulators have warmed up to crypto and assets have poured into ETPs, distribution platforms (and their advisors) risk losing a portion of client assets. Early adopters are putting pressure on other platforms to allow client access to these products.

Crypto ETPs Scaling Worldwide

Crypto ETPs continue to see global growth, driven by rising investor interest and clearer regulatory pathways. Canada has a strong crypto ETP market with a large number of products, including Bitcoin, Ether and basket products. The country recently expanded its offering to include staking ETPs. Europe, Germany, Switzerland and Sweden have listed products on local markets, while other countries in the region are preparing for ETP launches as regulators continue to make progress toward a regulatory framework. A similar pattern is playing out in Asia, where Hong Kong has listed Bitcoin and Ethereum products, while other markets are considering regulations and product approvals. For example, Japan’s Financial Services Agency, the primary securities regulator in that country, is advancing reforms to reclassify crypto as securities and lower tax rates, paving the way for future spot Bitcoin and Ethereum ETPs. “These regional developments highlight a further global shift toward mainstream adoption, with each region advancing its own regulatory and product strategies,” said Slavin.

The U.S. crypto ETP industry has a robust pipeline of new alternative coin ETPs that are coming to market in the weeks and months ahead. There are more than 100 filings pending with the SEC for alternative coin ETPs, including SUI, Polkadot, HBAR and others offering different types of investment exposure. BNY's support for crypto ETPs is expected to grow substantially with the launch of new digital asset ETPs, pending SEC approval.

“Product innovation, particularly in digital assets, requires a partner with a comprehensive, scalable platform that can cater to any asset type or fund structure, both traditional and digital. Relying on a robust infrastructure that provides efficiency and transparency through data helps our clients confidence to quickly launch innovative crypto ETP products in a proven framework. With more than $120 billion in assets under management in U.S. spot crypto ETP and a commanding 83% market share, our ETP offering plays a pivotal role in defining the digital asset ETP landscape,” said Humbert.

BNY stands at the forefront of digital asset innovation, setting new standards through a series of industry-first achievements in the U.S. crypto ETP market.

“These accomplishments reflect our proactive approach to evolving investor needs and our active role in shaping the future of digital finance. Our leadership in ETP servicing — leveraging a robust front-to-back servicing and seamless access to capabilities across the ETP lifecycle — puts us in a strong position to facilitate clients bringing to market digital asset products and ultimately unlock new opportunities to raise capital,” added Slavin.

1,SEC Approves Generic Listing Standards for Commodity-Based Trust Shares," sec.gov, U.S. Securities and Exchange Commission, Sept. 17, 2025, https://www.sec.gov/newsroom/press-releases/2025-121-sec-approves-generic-listing-standards-commodity-based-trust-shares?utm_medium=email&utm_source=govdelivery