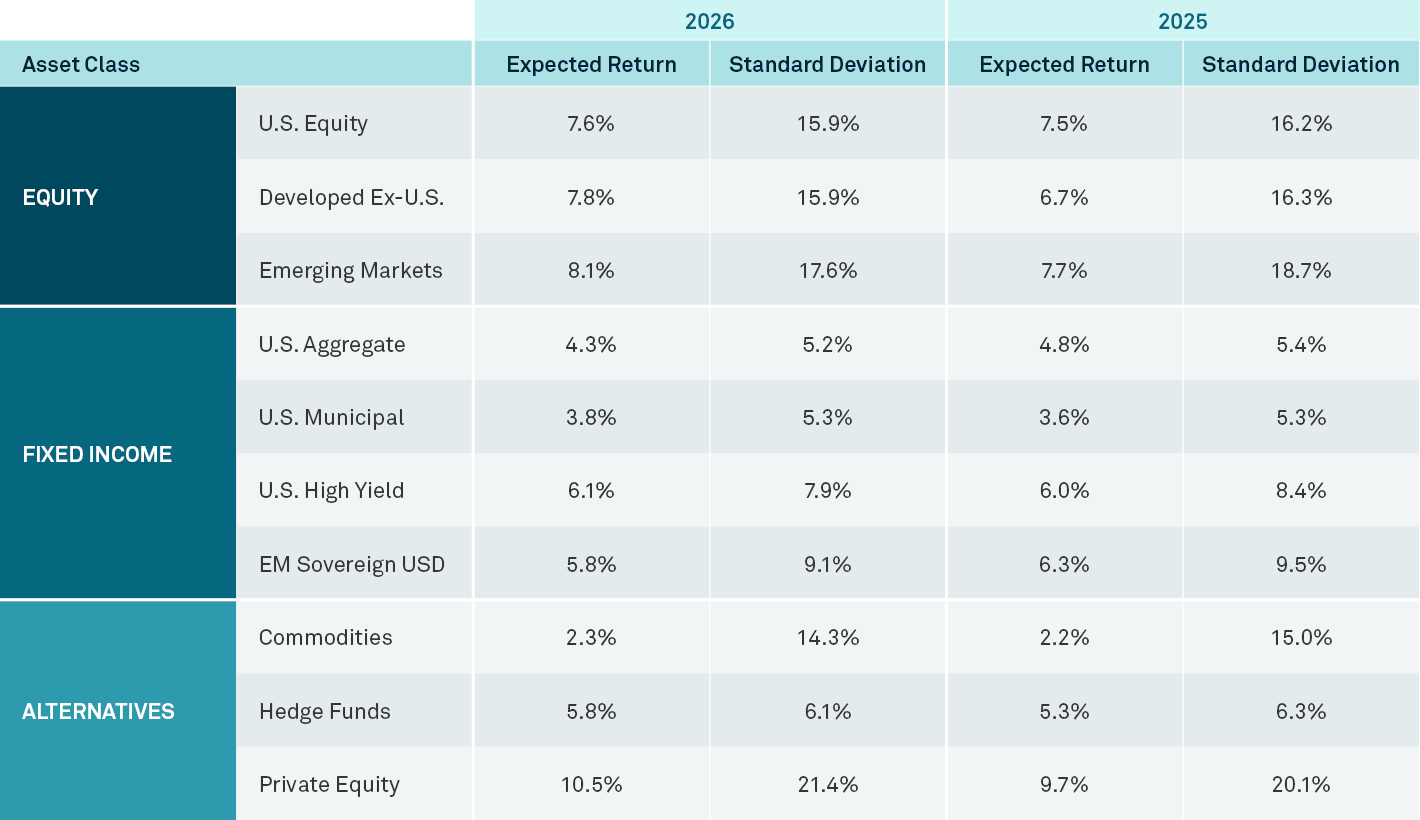

The 2026 edition of our 10-Year Capital Market Assumptions (CMAs) offers our projections for asset class returns, volatilities and correlations over the coming decade.

Overview

Each year, BNY Investments develops CMAs for asset classes spanning global markets and currencies. These 10-year forward expected return, volatility and correlation assumptions are designed to guide investors in the development of long-term strategic asset allocations and planning activities.

In today’s evolving market landscape, persistent structural pressures are evident, including sovereign debt burdens, evolving currency dynamics, rapid advances in artificial intelligence (AI), and the continued expansion of private capital. These forces underscore the importance of flexibility, durability and diversification in portfolio construction.

Key Highlights:

- Our 10-year return projection for a hypothetical balanced portfolio1 has increased slightly from 6.3% to 6.5%.

- Equity returns are expected to benefit from AI-driven productivity gains and a more favorable global outlook as the U.S. dollar weakens. Our 10-year return outlook has improved most notably for international equities, with developed ex-U.S. equities and emerging market equities now expected to deliver 7.8% and 8.1%, respectively. U.S. equities are forecast to deliver 7.6%.

- In fixed income, elevated yields and expectations for gradual monetary easing support our outlook. With starting yields a strong determinant of expected long-term total results, our 10-year expected return for U.S. aggregate bonds is 4.3% and 3.8% for municipal bonds.2

- AI stands out as the macro theme of the decade. Its impact on productivity and competitive dynamics will become more visible, with markets focusing on which companies can best capture AI-driven value.

- Among alternative assets, private equity return expectations have risen to 10.5% annually, fueled by a robust illiquidity premium and the expanding role of private capital in innovation and infrastructure. More companies are choosing to remain private for longer, allowing for greater growth before entering public markets.

Snapshot of 2026 vs. 2025 10-Year Capital Market Return Assumptions

Source: BNY Investments. Data as of December 31, 2025.

The Use of Capital Market Assumptions

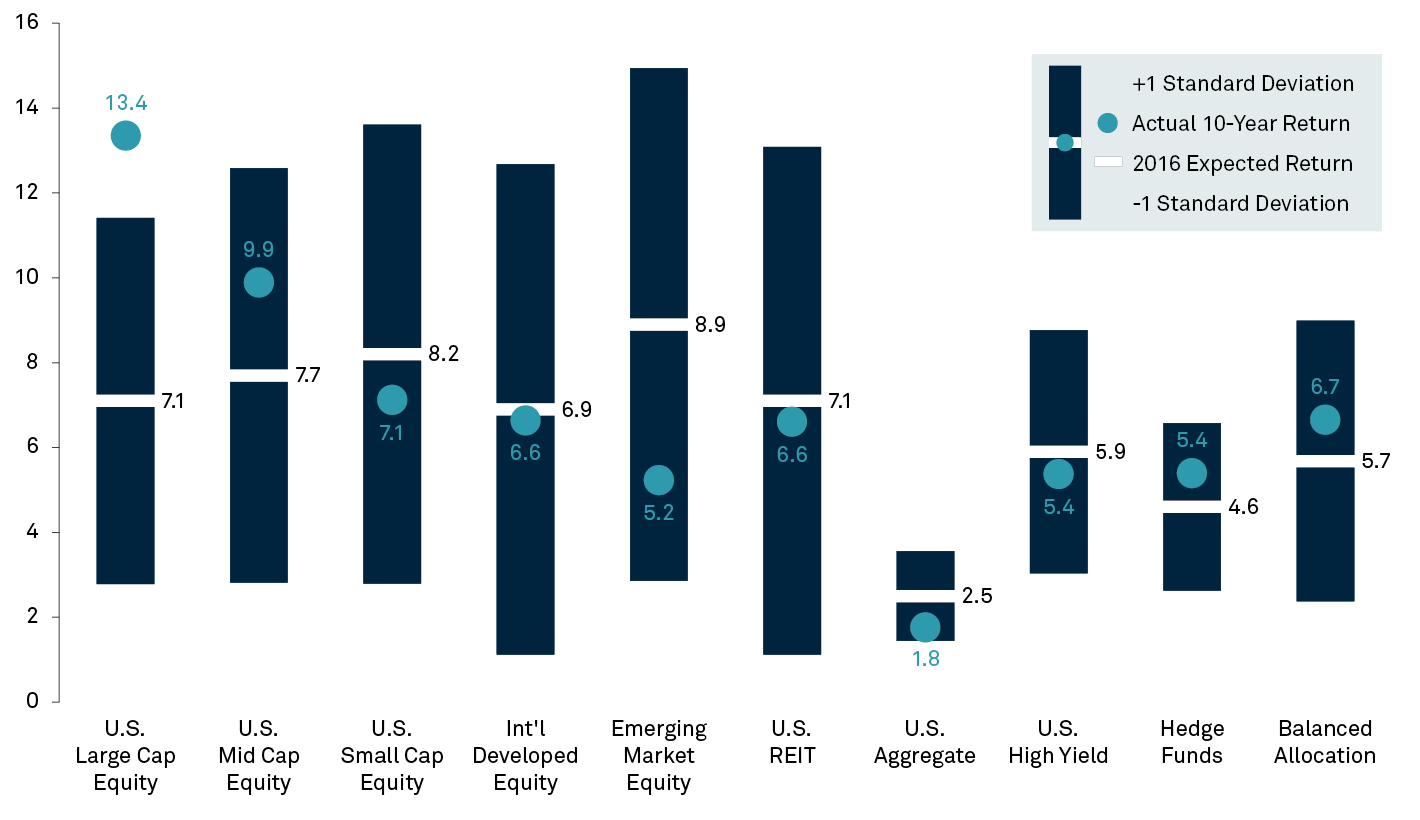

For many years, BNY has developed CMAs to assist our clients in designing long-term asset allocations aligned with their goals and risk tolerance. In this report, we validate our assumptions against realized market returns by comparing our 2016 return expectations with actual 10-year returns. Our 10-year forecast returns were relatively accurate, with a balanced portfolio of stocks, bonds, and alternatives returning 6.7% versus 5.7% expected.

2016 Capital Market Assumptions vs. Actual 10-Year Returns

Source: BNY Investments, Bloomberg. Data as of June 30, 2025.

CMAs help to inform our recommended asset allocation, which includes tactical asset allocation shifts based on short-term market dislocations and is tailored to each client’s objectives, risk profile and tax sensitivity. CMAs also influence medium- to long-term holistic wealth planning, including the development of strategic spending, borrowing and tax-management plans.

1Assumes a hypothetical balanced portfolio with weights of 20% U.S. Large Cap Equity, 7% U.S. Mid Cap Equity, 3% U.S. Small Cap Equity, 16% International Developed Equity, 7% Emerging Market Equity, 2% U.S. REIT, 25% U.S. Aggregate Fixed Income, 5% U.S. High Yield, and 15% Hedge Funds. Past performance is no guarantee of future results.

2Municipal bond returns are generally tax exempt. After-tax and tax-equivalent results depend on individual tax rates and state/alternative minimum tax considerations. For example, applying a 40.8% federal tax rate to the 4.3% U.S. aggregate bond return assumption implies approximately a 2.5% after-tax return, less than the 3.8% tax-exempt municipal bond assumption.