Our take

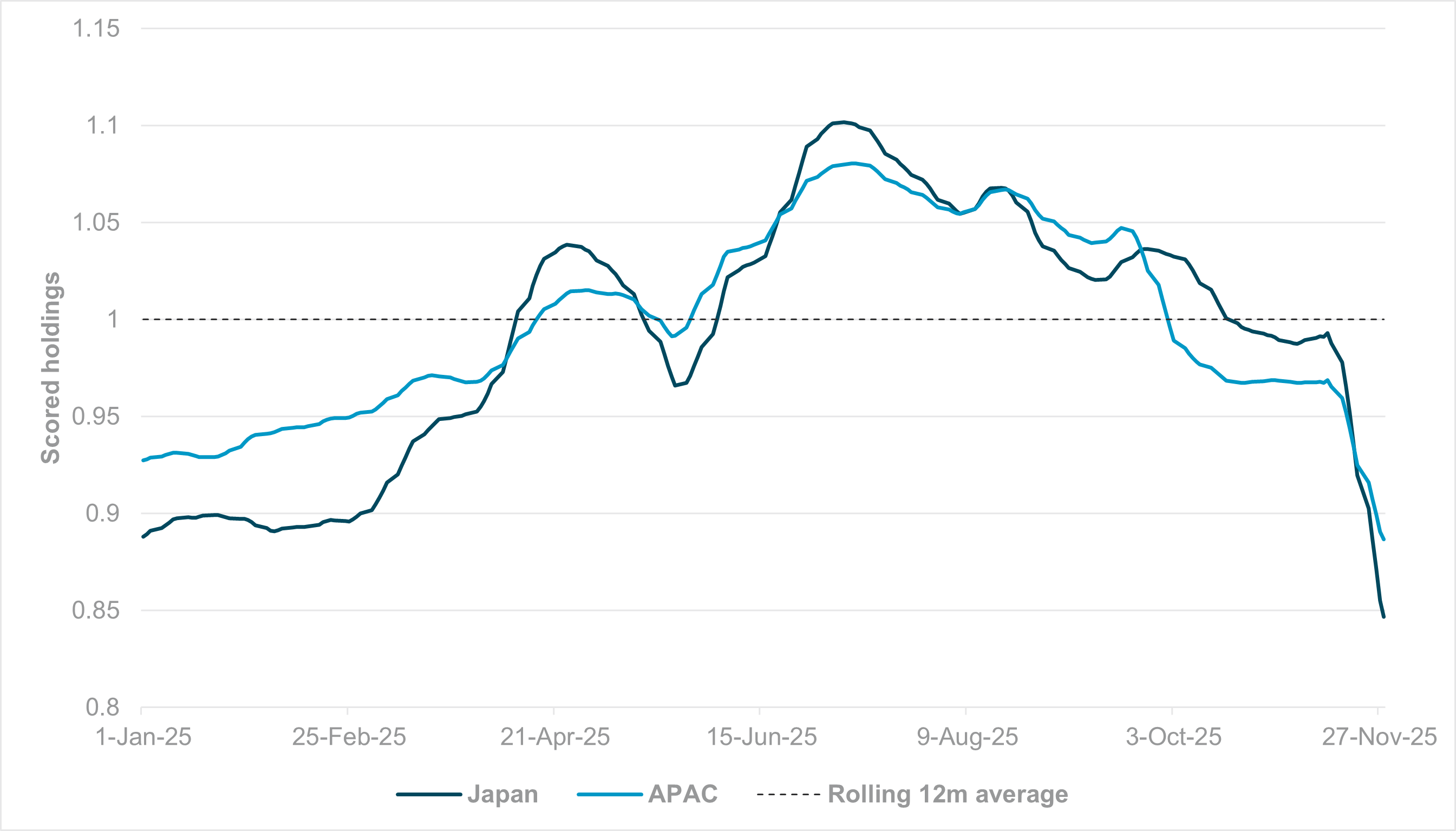

There is a growing consensus that 2026 allocations will be skewed more toward emerging markets (EM) amid a broader search for value. We are on board with this view, as our data indicate that current weightings in emerging market equities are disproportionately low relative to growth and economic differentials. For example, our clients’ U.S. equity holdings (65%) are more than 80 times larger than their Chinese holdings (0.8%), based on share of total global equity assets. Even accounting for access restrictions, this ratio is extreme.

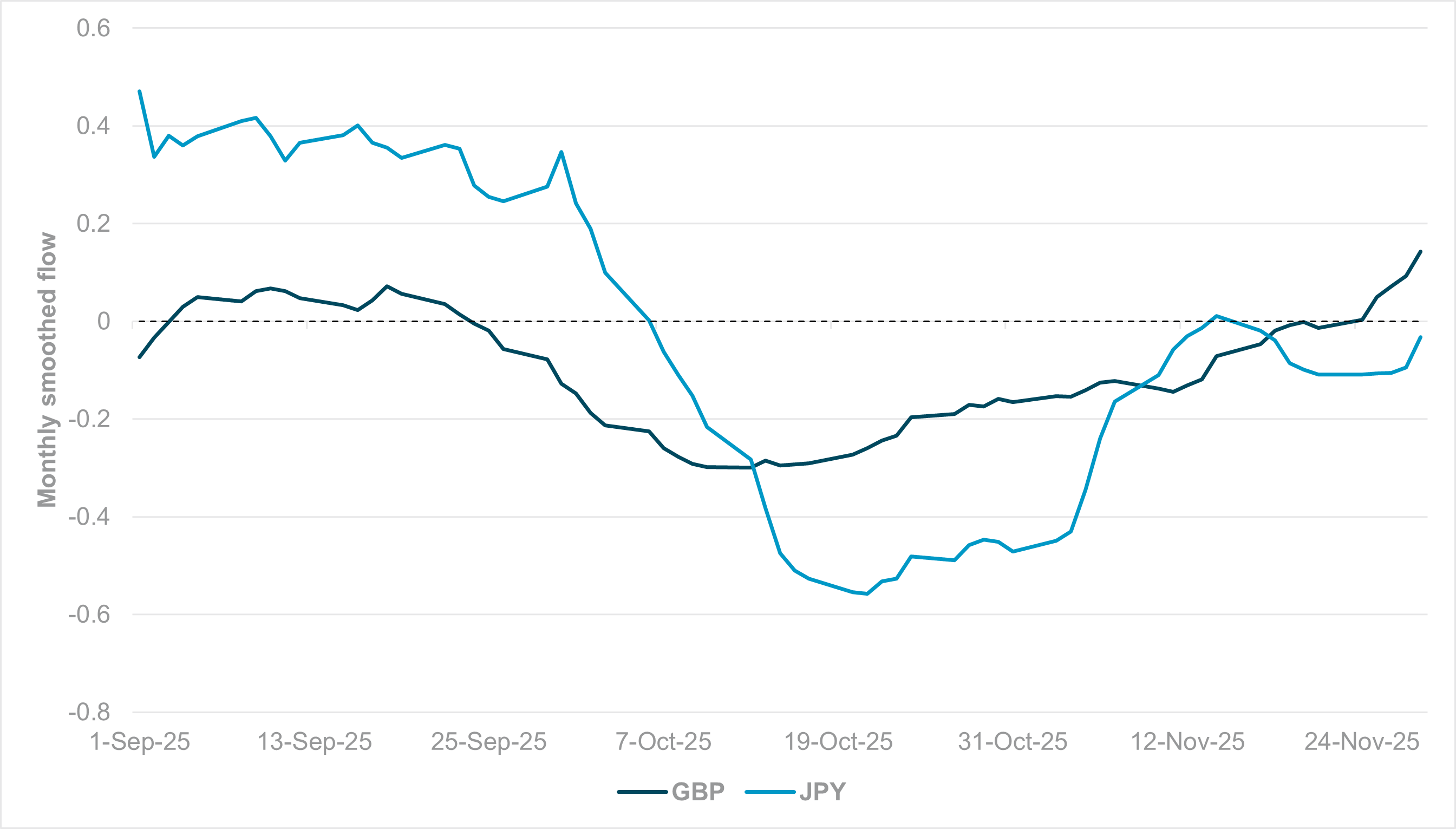

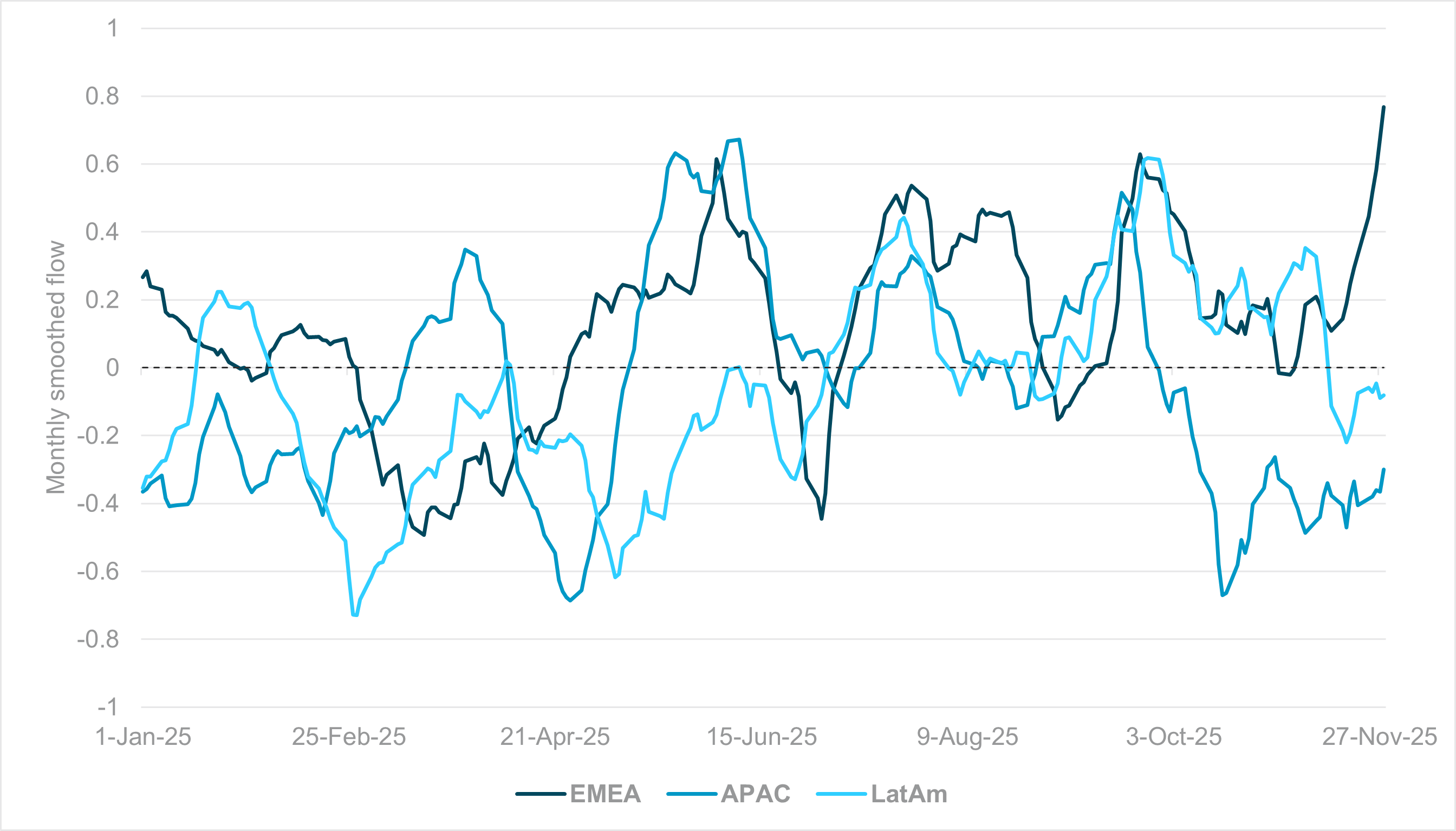

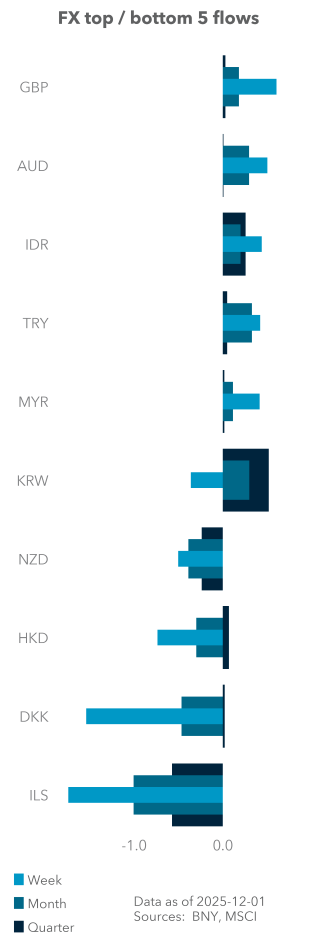

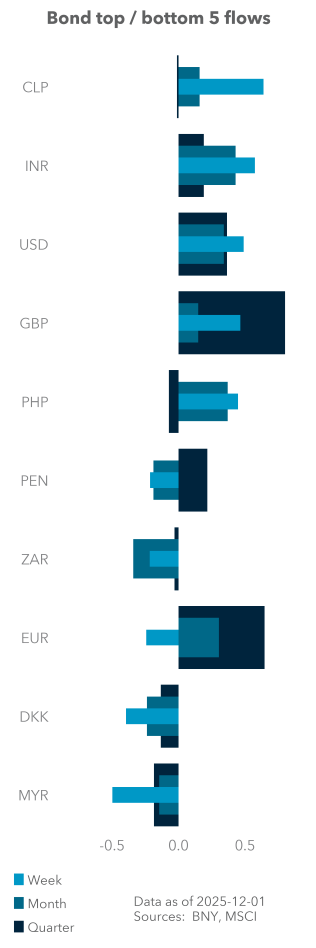

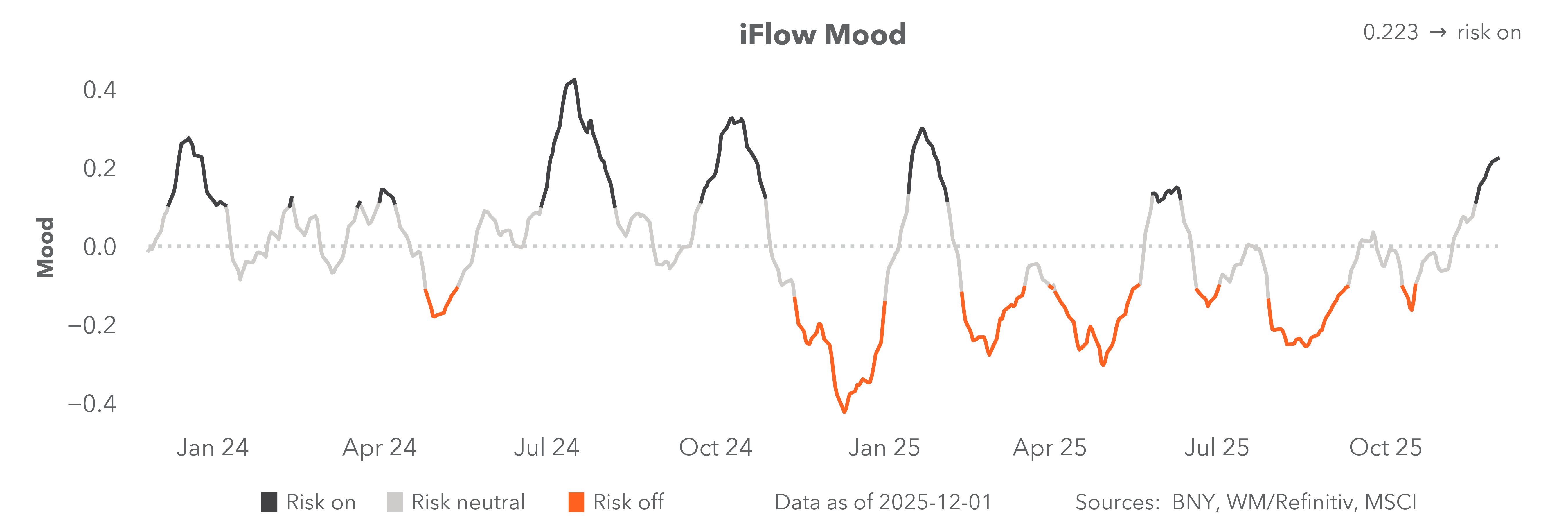

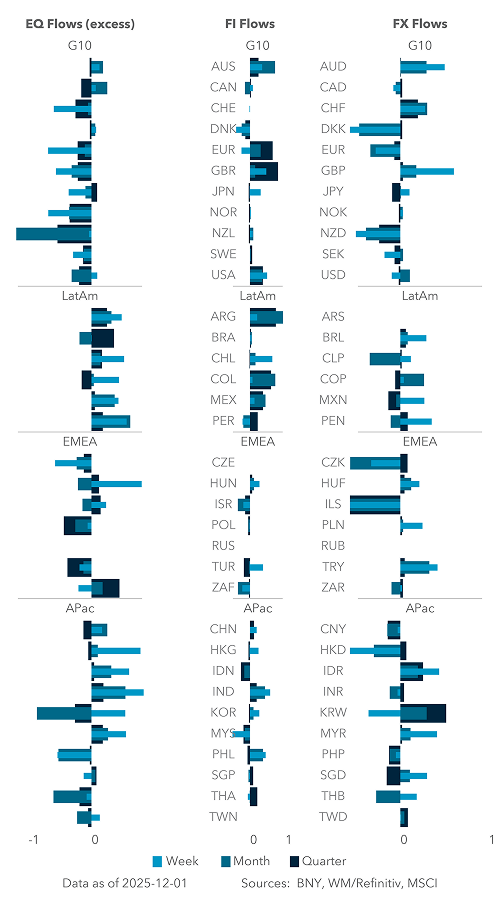

Yet, flows heading into year end show little sign of increased rotation, even with risk appetite recovering toward the end of November and early December. On a monthly smoothed basis, flows into EM APAC and EM Latin America have turned negative. Only EMEA is seeing a flow surge, reaching YTD highs (Exhibit #3). However, the underlying data indicate that flows are disproportionately heading into South Africa, which is benefiting from the mining narrative and institutional re-rating. Even hitherto well-held Central and Eastern European (CEE) markets are struggling, with fiscal dominance fears in Hungary, Poland and Romania threatening tighter financial conditions. Czech assets also face headwinds amid growing structural risks to Germany’s industrial outlook.

Forward look

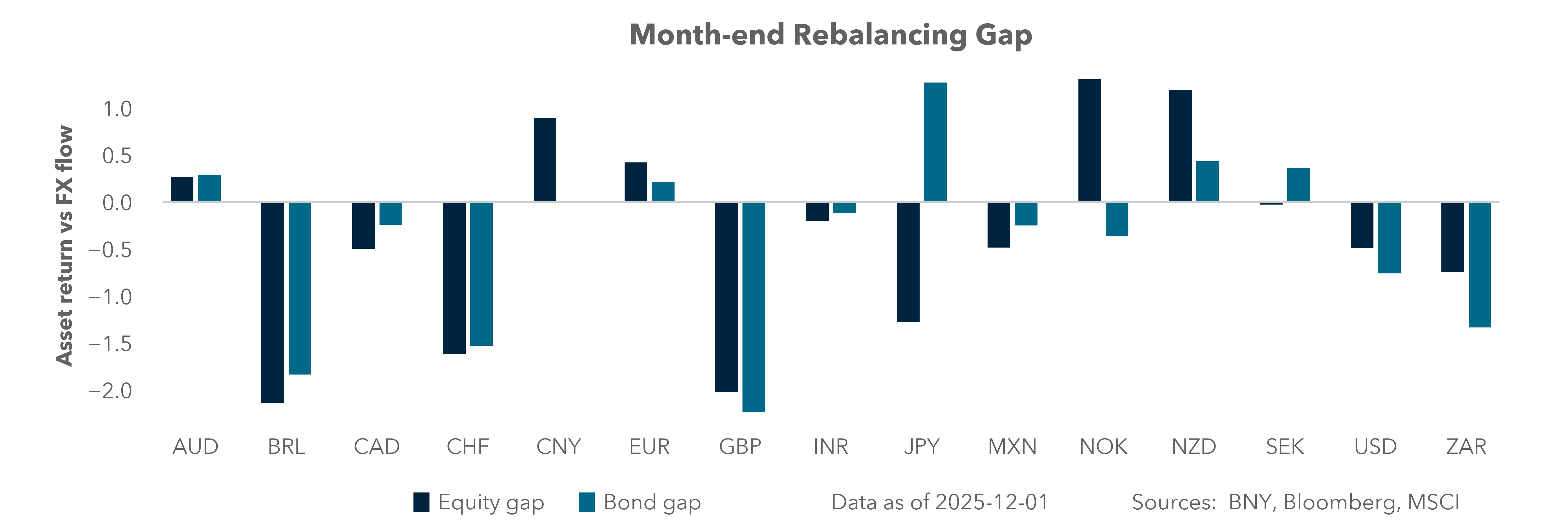

A December Fed cut reverting to the market’s base case has clearly improved global financial conditions, but equity market reactions suggest the boost to U.S. equities from lower U.S. rates is now stronger than in other markets. In other words, U.S. tech now has the “highest beta” to the Fed, and there is little appetite to shift equity allocations into other markets.

Furthermore, EM continues to lack a reflation or earnings expansion narrative that Europe enjoyed in 2025. On the other hand, the solutions are clear, especially for EM APAC, which is expected to attract the lion’s share of any reallocation, as a stronger fiscal impulse to drive reflation a necessary condition. EM APAC remains the only region with such capacity, but we doubt markets will take a strong view until China’s fiscal plans are announced in late Q1 2026.