Policy changes, central bank decisions, tariffs and technological advances — what do these developments mean for economic growth and global markets?

In the United States, the Federal Reserve is restarting rate cuts amid labor market softening, and slowing job growth has prompted expectations of more cuts. At the same time, persistent inflation may slow the pace of easing. August’s 0.4% CPI increase pushed annual inflation to 2.9%, the highest level since January. The Fed faces a delicate balancing act: lower rates to support growth without reigniting inflation. Meanwhile, equities continue to rise, reflecting confidence in the expansion’s resilience. Growth is slowing, not stalling, and well-calibrated policy can sustain it. Our experts expect U.S. growth to be modestly above consensus but below trend, aided by reduced trade uncertainty and Fed attentiveness to labor dynamics. Globally, fiscal spending, central bank easing and a weaker U.S. dollar offer support for the time being. This suggests a moderated slowdown, not contraction, allowing investors to stay engaged. Overall, there are several dynamics at play amid a backdrop of broad uncertainty. One thing is clear: there is opportunity across asset classes but watching how these dynamics interact is key to unlocking value.

Gears in Motion: What’s Driving Global Markets Now

What impact will policy changes, central bank decisions and tariffs have on economic growth and global markets? Our latest report examines market dynamics to help unlock new opportunities.

Download the PDF file_downloadEquities

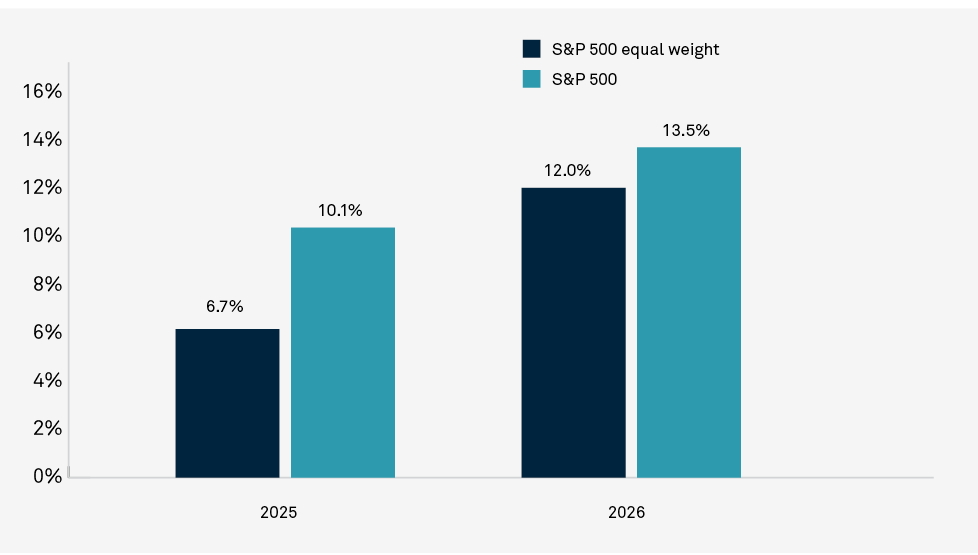

Despite growth concerns, the S&P 500 has gained 14% so far this year as earnings and margins proved stronger than expected. In the U.S., performance is broadening beyond big tech, with cyclicals, high beta, consumer discretionary and equal-weighted tech leading recent gains. Earnings are forecast to grow 10% in 2025 and 13.5% in 2026,1 with the gap between the S&P 500 and the equal-weighted index narrowing from around 3.5% to 1.5% — evidence that profitability is improving across a wider range of companies (Figure 1).

FIGURE 1: EARNINGS IMPROVEMENT IS BROADENING

S&P 500 vs. S&P 500 Equal-Weighted Index Earnings Growth: 2025 vs. 2026

Source: FactSet; latest available data as of 10/2/2025

Compared to other sectors, our experts are most optimistic about tech, where AI-driven demand for semiconductors and infrastructure should sustain above-market earnings growth. Utilities are attractive, too, as rising data center power needs and grid modernization efforts will create durable growth in addition to steady dividends. In financials, a steeper yield curve, deregulation and stronger deal activity may support improving profitability. Our experts also see opportunities in industrials, which should benefit from reshoring and defense spending, and consumer discretionary, where resilient household demand and next year’s tax stimulus will provide additional support. Overall, the tax bill might help corporates offset tariff impacts, as a total of $230 billion in tax savings is expected through 2026. Additional tailwinds could come from lower rates via Fed easing and positive seasonality as Q4 returns are, on average, the year’s highest.

Outside the U.S., Fed easing and a weaker dollar could prove supportive. There are select opportunities in developed international markets in the near term and potentially beyond. In Europe, higher spending on defense and infrastructure will support industrials, while Japan stands to benefit from corporate governance reforms and steady economic growth. Emerging markets are particularly well positioned to benefit from Fed easing, with lower valuations offering tactical upside along with continued economic growth.

Rates and U.S. Sovereign Bonds

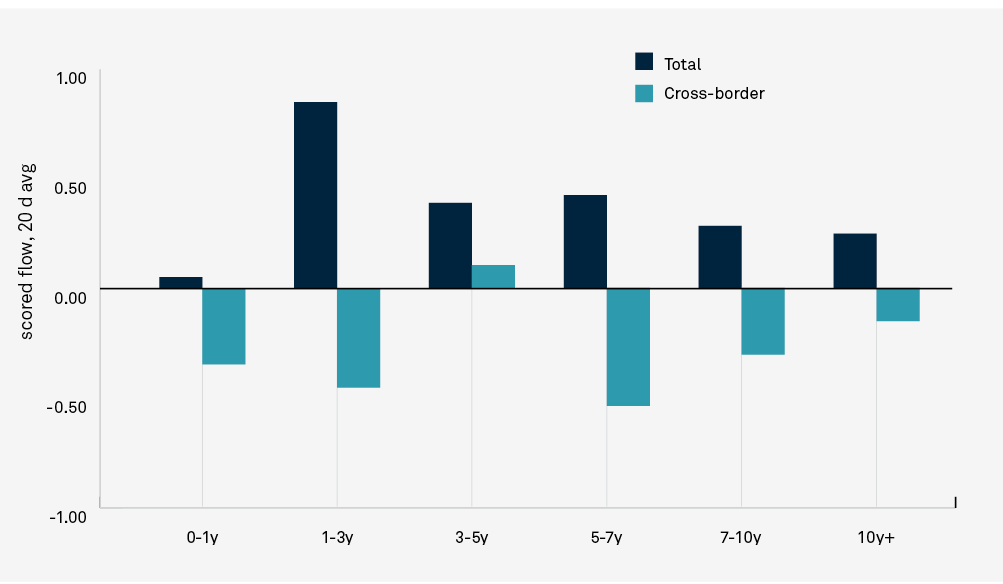

U.S. sovereign bonds have produced a return of over 5% so far this year, following an 8.5% decline in the Bloomberg US Treasury Index from the beginning of 2022 to the end of 2024. This is the result of further weakness in U.S. yields across the curve, and in response to the increasing likelihood that the Fed would cut rates, the yield curve steepened, mostly because of falling short-end yields (Figure 2). From a global perspective, U.S. rates look more interesting to investors as we head into Q4, as the rate cycle for the rest of the world appears to be closer to the end of the easing cycle.

FIGURE 2: U.S. TREASURY DEMAND BY MATURITY

Source: BNY iFlow

While the Fed has begun lowering policy rates as a precautionary measure or “insurance” against possible labor market weakness, inflation is still significantly higher than the target level. The direct tariff pass-through to final prices remains largely unobserved, which could temper enthusiasm for more rate cuts.

U.S. funding markets are beginning to show some volatility, with September featuring elevated repo rates, partially contained by the presence — and somewhat limited use — of the Fed’s standing repo facility. As systemwide liquidity in the form of bank reserves continues to decline, our experts expect tightness in the market to persist, especially at important periods like month- and quarter-end, which could mean quantitative tightening is nearing its end.

Credit

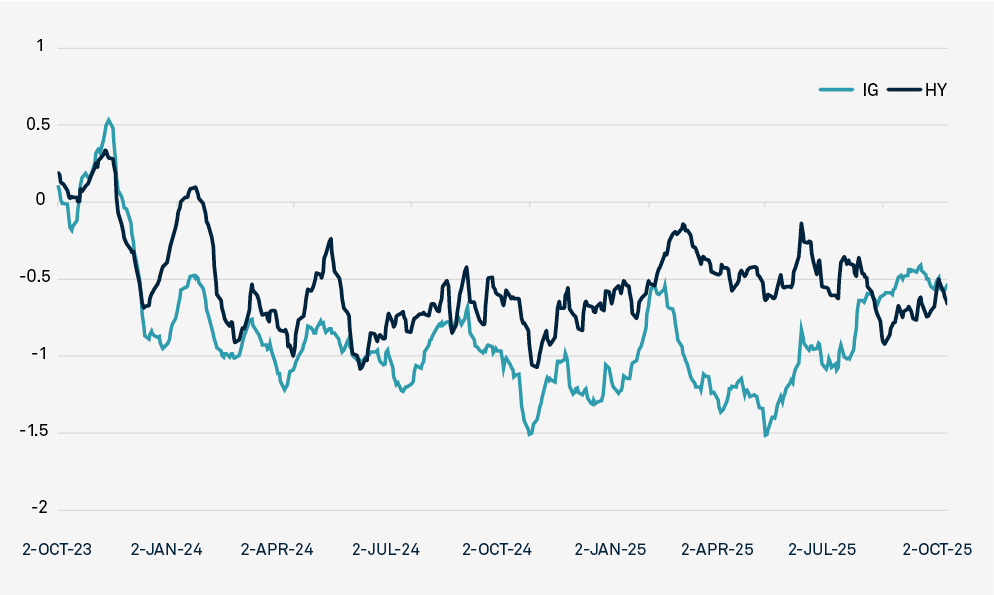

The historic tightening of credit spreads has surprised many, given mixed signals on growth in the U.S. and the failure of some sub-prime lending companies. Our iFlow data suggests that investors have continued to look for yield over the summer and into Fed rate cuts. The September issuance of $200 billion in investment-grade credit was easily absorbed, and our experts have seen a notable increase in high-yield interest (Figure 3). In fact, the expectation of further Fed rate cuts has added to the credit market relief buying in high yields. Mortgages are seeing some tension as a result of rate-cut expectations, leading to increased refinancing pressures down the curve. Overall, credit markets have shown resilience over the summer, and, thanks to monetary policy shifts, the outlook for Q4 points to further stability, despite signs of a slowing economy.

FIGURE 3: INVESTOR INTEREST IN HIGH-YIELD ISSUANCE REMAINS HIGH

U.S. Corporate Bonds

Source: BNY, WM/Refinitiv, Bloomberg; data as of 10/3/25

Foreign Exchange

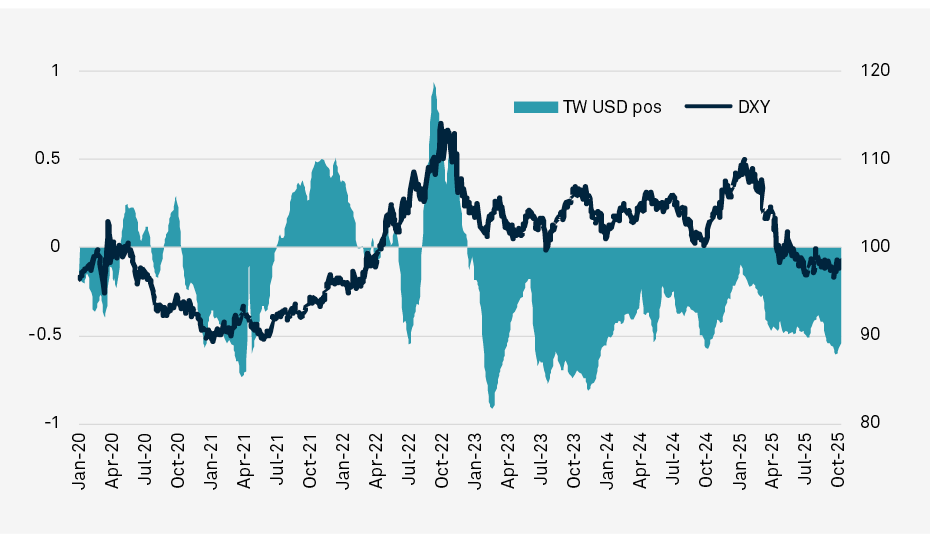

U.S. dollar weakness, which was a dominant theme in Q2, was less pronounced in Q3, but further weakness is expected in Q4. This is being driven by several trends: 1) increased hedging by cross-border investors; 2) the reduction in hedging costs as a result of Fed rate cuts; and 3) the impact of ongoing U.S. policy uncertainty on assets, with earnings reports being watched for signs of margin compression or tariff cost pass-through. As a result, and as our iFlow data shows, USD positioning remains short but still above recent historic lows (Figure 4).

FIGURE 4: TRADE-WEIGHTED USD POSITIONING

Source: BNY iFlow

Expectations of Fed easing contrast with expectations of rate hikes in Japan and are out of cycle with EMEA economies, driving opportunity for markets outside the U.S. in the near term. Broadly speaking, our experts’ observations from market activity suggest APAC assets may have the most to gain from USD weakness given the growth outlook and low inflation in the region, with a focus on South Korea, Singapore and Taiwan for currency appreciation. The EUR continues to face headwinds on growth and inflation, with European Central Bank policy viewed as near the bottom of the easing cycle, while in the U.K., the focus on fiscal policy and political concerns has left the Bank of England split over inflation risks likely to cap GBP gains. The rise of commodities as a hedge against stagflationary risks is likely to continue, as our flows suggest that AUD, CAD and other currencies linked to energy, rare earths and precious metals have upside potential.

Final Thoughts

As global gears continue to shift, markets are navigating a landscape shaped by evolving policy, persistent inflation and dynamic cross-border forces. The Fed’s cautious easing, resilient equity and credit markets, and a recalibrating FX environment reflect a delicate balance between supporting growth and containing risks. In this complex environment, opportunities will present themselves to those who are agile in their positioning.

Bryan Besecker, Eric Hundahl, Bob Savage, Jess Stern and John Velis contributed to this article.

1 FactSet; latest available data as of 10/2/2025

iFlow® / FX MARKET COMMENTARY

The products and services described herein may contain or include certain “forecast” statements that may reflect possible future events based on current expectations. Forecast statements are neither historical facts nor assurances of future performance. Forecast statements typically include, and are not limited to, words such as “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “likely,” “may,” “plan,” “project,” “should,” “will,” or other similar terminology and should NOT be relied upon as accurate indications of future performance or events. Because forecast statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict.

iFlow® is a registered trademark of The Bank of New York Mellon Corporation under the laws of the United States of America and other countries. iFlow captures select data flows from the firm’s base of assets under custody, as well as from its trading activity with non-custody clients, on an anonymized and aggregated basis.

BNY General Disclaimer

BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

© 2025 The Bank of New York Mellon. All rights reserved. Member FDIC.