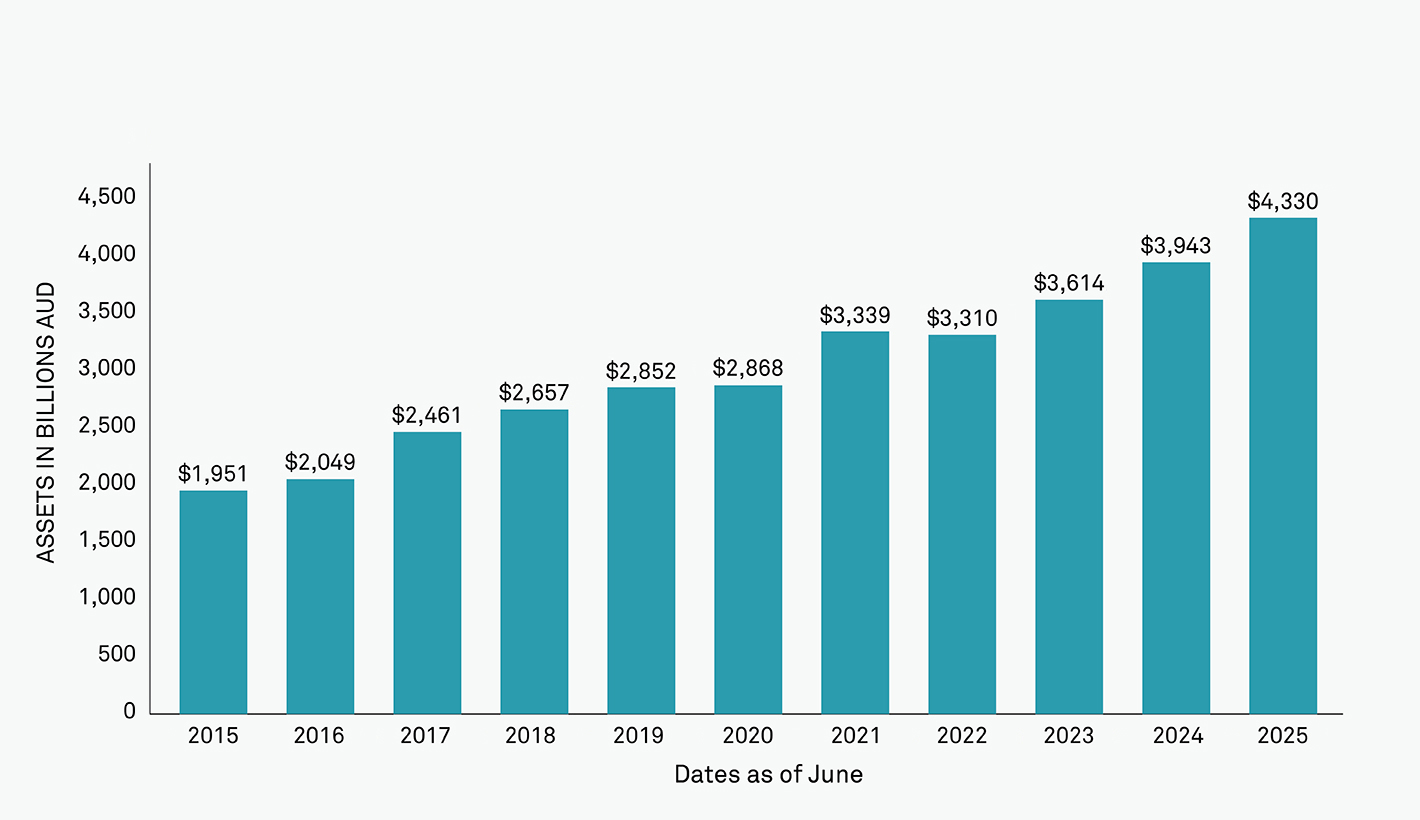

Australia’s superannuation system has been a standout success for 30 years – compulsory contributions, strong governance and long investment horizons have built a substantial pool of retirement capital. Total superannuation assets now amount to about A$4.3 trillion,1 around 150% of GDP, and are expected to continue to grow.2 But success has also created new challenges as the system has outgrown the domestic market, with an increasing number of investments held offshore, a larger portion is now being allocated to investment in private asset classes, at an average allocation of 20% and for some upwards of 30%, coupled with an increased number of members now drawing income in retirement or planning to retire, with estimates of 2.5 million members planning to retire between now and 2035.3

This means balancing a greater focus on the liquidity profile of these superannuation funds, as many members enter into their draw down phase and are focused on capital preservation, all of which requires an increasingly large and complex investment product and underlying operational setup, all while delivering expected outcomes to members. The superannuation system has been a great savings system, fuelled by the superannuation guarantee, but it is at an inflection point as it also starts to focus on the complexities of drawdown and changing nature of retirement.

AU SUPERS ANNUAL ASSET GROWTH 2015 - 2025

Source: APR

Lessons from COVID-19: Liquidity Stress in Australia’s Superannuation System

The system underwent a live stress rehearsal during the COVID-19 pandemic. In early 2020, the federal government sanctioned early access to funds for hardship relief, with members switching into defensive investment options in large numbers as markets fell.

Over the course of the COVID early-release scheme there were roughly 4.9 million applications worth A$37.3 billion.4 To meet this demand and ensure liquidity, managers of superannuation funds lifted aggregate cash by about A$51 billion in a single quarter, in large part through the sale of bonds and foreign equities.5 The system held up, but the episode revealed how quickly liquidity pressure can spike when market volatility and changes in mass member behaviour collide.

Australian Superannuation: Navigating Liquidity and Operational Resilience

Explore how Australia’s superannuation funds manage liquidity and collateral risks with BNY’s solutions to ensure operational resilience.

Download the PDF file_downloadMounting Liquidity and Collateral Pressures in Australia Superannuation Funds

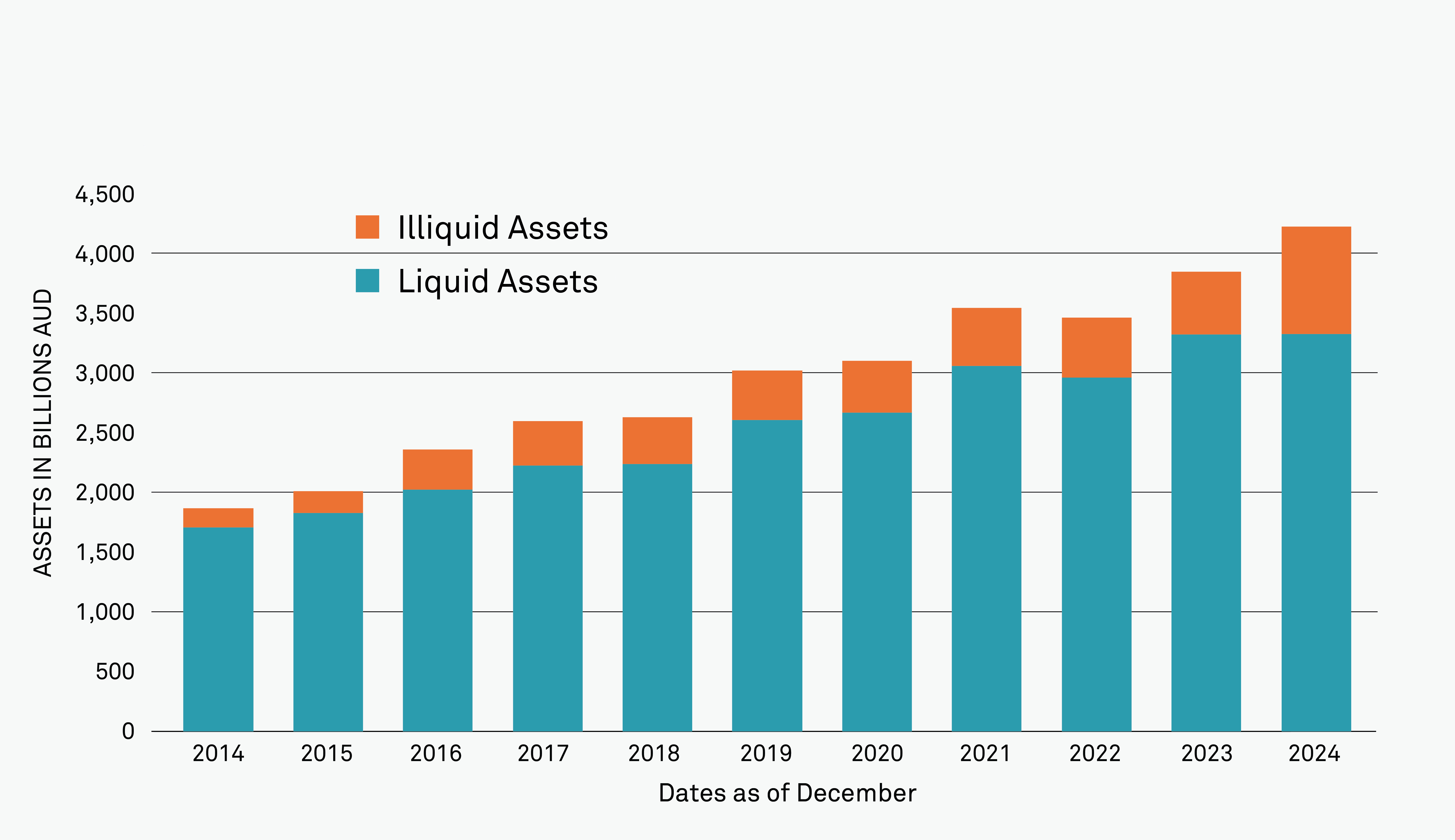

Two structural features will make the next test harder. Firstly, portfolios carry an increasing sleeve of unlisted assets, as infrastructure, property and private markets have added diversification and return sources.6 That depth strengthens retirement outcomes over time, but illiquid assets can complicate life in moments when access to cash is a priority.

AU SUPERS ASSET MIX LIQUID VS ILLIQUID 2014 - 2024

Source: ASFA Superannuation Statistics March 2025

Secondly, Australia’s member investment choice architecture allows switching between investment options in roughly three business days, as well as superannuation fund portability. The IMF has warned that this flexibility, when paired with the level of exposure to illiquid assets common in the Australian market (above 20% on average),7 shortens the effective duration of liabilities and can transmit stress into markets if many members move at once. Superannuation fund trustees cannot change the architecture, so they must design for it.

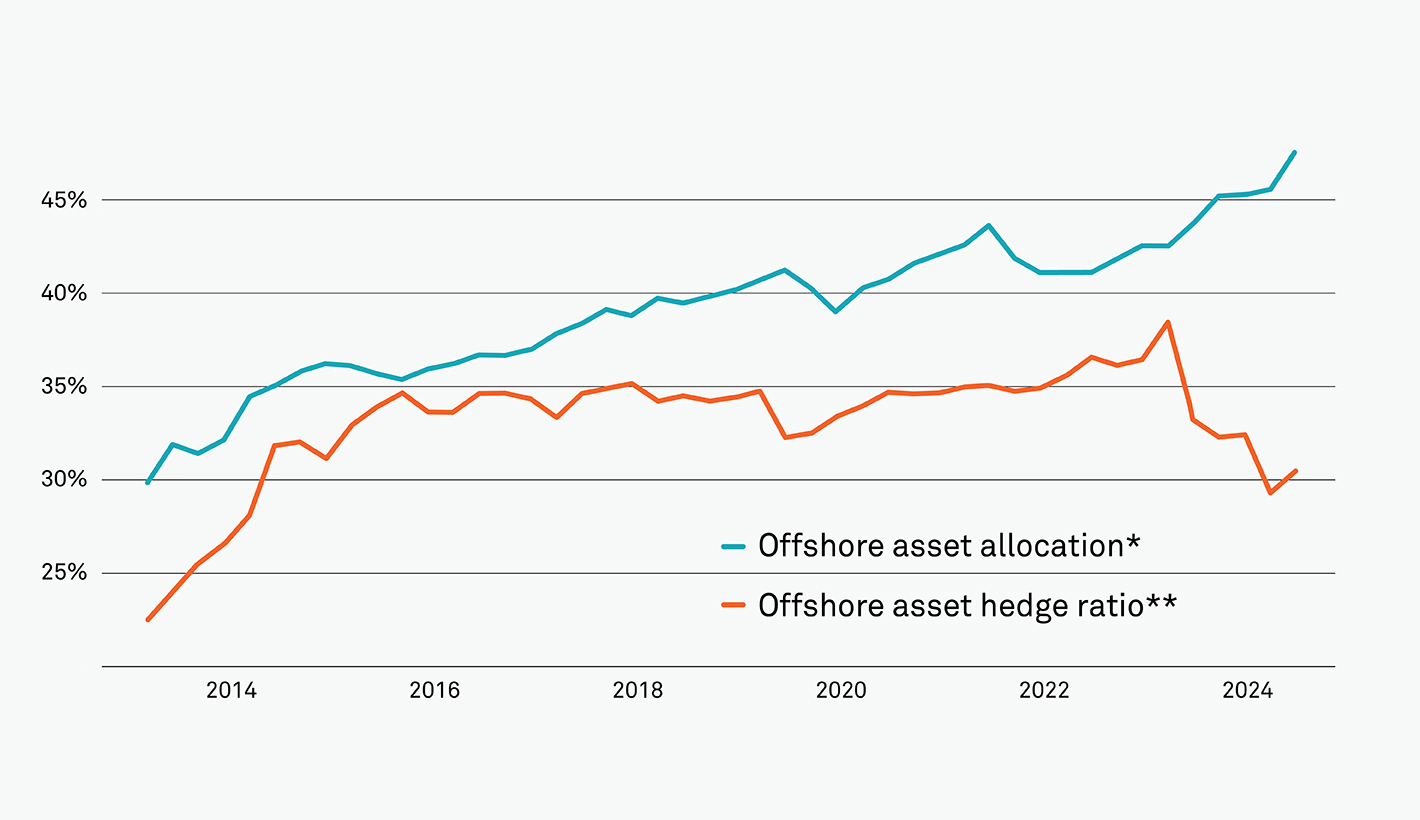

Globalisation adds further complexity. As offshore allocations grow, hedge books grow with them because most funds seek to reduce currency volatility using FX forwards and swaps. The Reserve Bank of Australia (RBA) has been explicit that the sector’s FX hedging and related collateral needs are likely to expand substantially over the coming decade.8 When the Australian dollar moves sharply, margin calls can arrive quickly and at a large scale. The question is no longer whether funds can access liquidity in principle, but how predictably they can source eligible collateral, across time zones and jurisdictions, when they need it.

Domestic market plumbing matters here. Australia’s repo market has become a more important onshore funding channel, but remains largely bilateral. Triparty usage via ASX Collateral is mainly associated with RBA open market operations and still only accounts for a small portion of activity, about 5% of outstanding market value. 9 That is very different to the U.S. and parts of Europe, where triparty and central clearing provide elastic capacity to turn a wide range of securities into cash. Local regulators are reassessing whether central clearing of bonds and repos would deliver system-wide benefits given the growth of participants like superannuation funds.

Trustees are not waiting for policy to catch up. Several large funds now manage multi-currency liquidity, rather than relying solely on Australian dollars, with explicit U.S. dollar access so they can meet overseas obligations or derivative margins without forced conversion at unfavourable exchange rates during periods of market stress.

By outsourcing the post-trade collateral workflow to a neutral agent, funds can mobilise diverse assets against eligibility schedules, automate substitutions, and reuse the collateral they receive to meet initial margins, reducing the drag on cash and operational friction. This allows funds to take control of their own collateral and liquidity, rather than depending on counterparties’ balance sheets.

SUPERANNUATION FUNDS' OFFSHORE ASSETS

Source: APRA; RBA calculations

Meeting governance requirements

Regulation has raised liquidity management expectations for these funds in recent years. Australian Prudential Regulation Authority’s (APRA) strengthened Investment Governance standard, SPS 530, which has been in force since January 2023, which requires board-approved liquidity management plans, regular stress testing and robust valuation frameworks for unlisted assets.10 This is not box-ticking. In December 2024 APRA reviewed 23 large fund and their trustees, which represented most of the industry’s fund assets and found 12 funds needing material improvements in valuation governance or liquidity risk management, including stress triggers and liquidity action plans. Remediation is underway and the message to trustees is clear: liquidity and valuations are matters of governance accountability.11

Superannuation funds are also being integrated into the broader stability regime, for example during April 2025 APRA included selected large super funds alongside banks in Australia’s first system-wide stress test. The purpose was to map feedback loops under severe but plausible market shocks. The results will inform policy and supervisory expectations over the coming years.12

Benchmarking Progress

What does good look like in this environment? To start, liquidity should be designed at portfolio level rather than at investment option level. That means central pools, explicit buffers sized for combined stresses, and forecasting that runs daily and within the day, pulling together benefit payments, switching behaviour, private-asset capital calls and derivative margins. The intraday layer turns planning into execution: real-time cash visibility across accounts, automated payment and settlement processing, direct links to payment systems and market infrastructures for same-day funding, and optimisation that limits idle balances and lowers funding costs.

Second, collateral can be treated as a strategic asset. Eligibility mapping, margin forecasting and triparty mobilisation can enable funds to meet calls with the right assets in the right place, which preserves return-seeking exposures.

Third, valuation governance for unlisted assets must be independent, frequent and event-sensitive because accurate prices are essential to protecting member equity when switches or stress rise. Finally, operational playbooks for stress scenarios need to be rehearsed. Fire drills that combine currency depreciation, outflows and private-market cash calls produce muscle memory and shorten reaction time when it matters.

There is a policy and infrastructure dimension too. Australia’s debate on central clearing of bonds and repos is timely. Clearing would not remove the need for prudent buffers, but it could expand liquidity channels, diversify counterparties and improve transparency in stress. In parallel, wider adoption of triparty services would make it easier for funds to raise and route cash across markets without bespoke bilateral negotiations. Those two developments, together with continued enhancements to data and reporting, would support a superannuation system that is ever more global, yet anchored in predictable local systems.

Strengthening for a promising future

By internalising more of their own collateral and liquidity decisions, cutting dependence on intermediaries and gaining the ability to finance assets across custodians, superannuation funds can keep long-term strategies intact while strengthening their ability to meet member needs in the moment. BNY’s scale underpins this support. Our global triparty platform connects more than 11,000 participants and we hold around 65% of collateral balances globally, with US$7.9 trillion in balances managed. This breadth means Australian superannuation funds can access a wider set of counterparties, leverage a broader range of collateral types and rely on infrastructure already trusted by many of the world’s largest pension funds and asset managers.

The resilience test ahead is not a reason to retreat from growth or from long-horizon investing. It is a reason to invest in the operating disciplines that let large, global portfolios meet near-term cash needs without sacrificing long-term outcomes. If trustees and boards keep building those disciplines, Australia’s superannuation funds can act as stabilisers when markets wobble, rather than amplifiers of stress, and they can do so while the system grows to a scale few countries will match.

Providing scalable solutions to meet complex challenges for Super Funds

The test facing Australia’s superannuation funds is not just about scale but rather complexity too. Portfolios are global, cash needs can arise overnight and operational teams are leaner than at banks. BNY makes resilience practical without forcing funds into costly structural change.

The centre of this approach is BNY CollateralONE, a platform where superannuation funds can view and mobilise cash and eligible collateral across providers. Rather than having to migrate assets or rebuild custody models, the superannuation funds can obtain a consolidated view of their positions and can allocate them quickly to meet margin, settlement or financing needs.

Liquidity discipline is built into the model. Forecasting tools link together benefit payments, switching behaviour, private-asset capital calls and derivative margins, producing a forward view of cash needs. That forecast is tied to buffers that can be tapped when required, avoiding the kind of forced sales that defined COVID-era stress.

BNY’s global triparty platform connects more counterparties and collateral types than any other, funds can translate diverse holdings into cash with less friction, while securities lending and re-use options provide latent sources of liquidity that can be unlocked quickly.

These strengths also support governance. Trustees can see where assets are held, how they can be mobilised, and what buffers are available under stress, giving trustees confidence that they can meet their member needs without disrupting long-term investment strategies.

Alexander Cadmus, Strategy Lead, Global Liquidity Services and Otto Vaeisaenen Head of Liquidity, Finance & Collateral Australia / New Zealand Sales & Coverage contributed to this article.