Our take

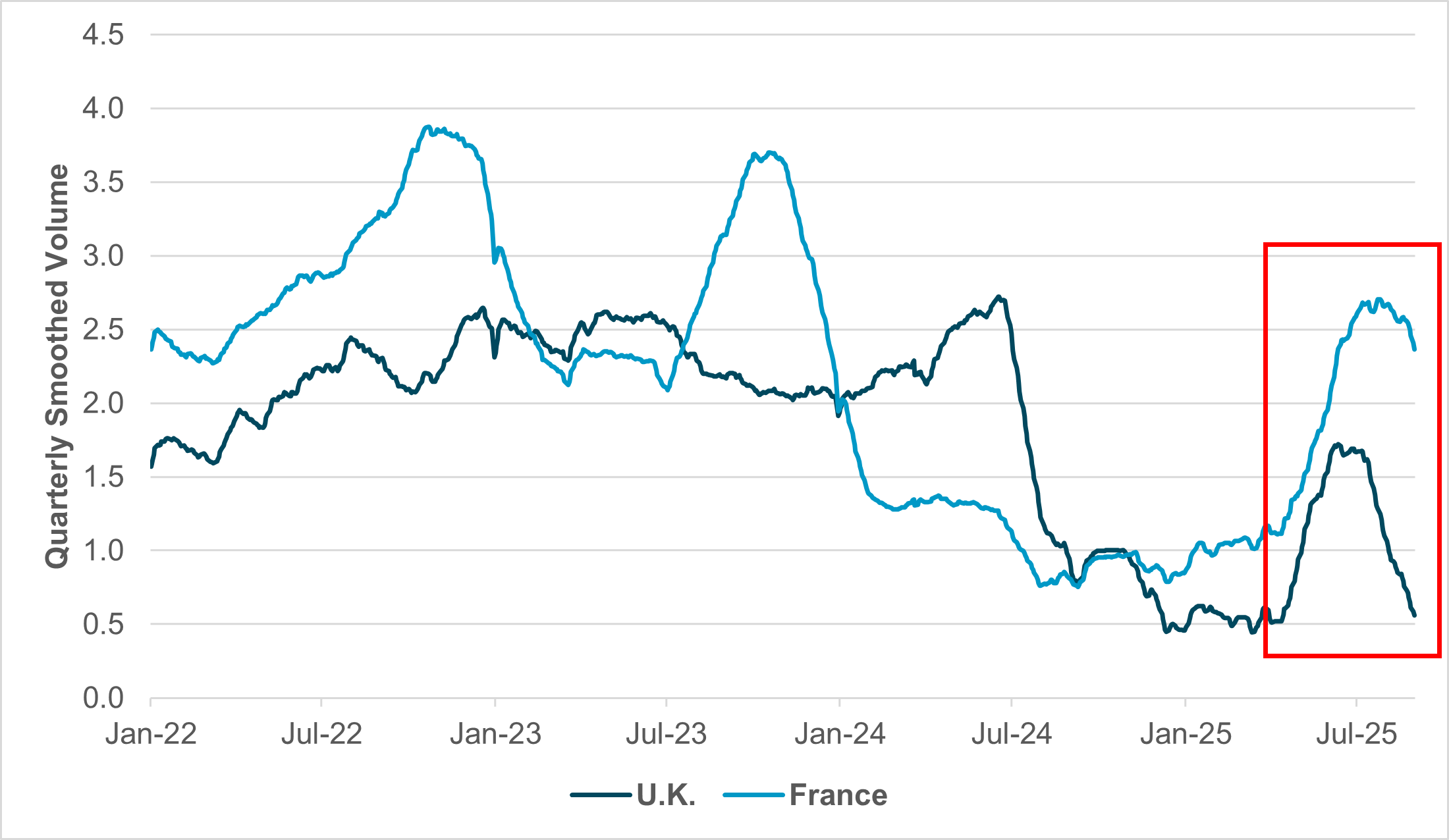

Currency and funding markets are the first ports of call to detect market stress. For long-only investors, whether as a result of sudden or anticipated risk aversion, iFlow will tend to identify a surge in flows into cash markets (defined as cash and short-term instruments not issued by governments), while transaction volumes rise. Since 2022, we can see that there have been some periods of sharp gains in cash transactions in France and the U.K., but it is only this year where the surge has been simultaneous (Exhibit #2). This was during the post-“Liberation Day” correction in markets, where the heavily liquidation of equity risk likely resulted in a significant inflow into cash. At that time, we did identify strong interest in European short-term debt as this was the only region which offered sufficient liquidity for rotational purposes.

Forward look

On an idiosyncratic basis, we find that periods of governmental stress – even when directly linked to fiscal risk – do not tend to generate spikes in cash transactions. For example, while turnover in U.K. debt was very high in September 2022 during the “mini-budget” episode, cash flows were even higher during the period of risk aversion associated with the banking sector in the U.S., the peak of U.K. cash transactions (relative to its long-term average) remains from summer last year as the Labour government identified fiscal gaps and the U.K.’s borrowing and spending outlook faced material revision. As upcoming adjustments are similar in nature, the marginal impact appears to have worn off. It is only broader exogenous factors, such as U.S. tariffs, which introduce new forms of risk into markets which can generate a cash surge. For the U.K. and France, without “unknown unknowns,” cash preference looks set to remain manageable.