Our clients drive and guide us. We are fortunate to have a client base that is the envy of the industry, including many of the world’s financial leaders who help make the markets function and global economies prosper.

Our clients rightly expect us to be the very best. It is an enormous responsibility that energizes us every day and that we take extremely seriously.

We were early among our industry peers to commit to a profound cultural, structural and operational transformation designed to navigate regulatory change and transform our company into a more digital, data-driven, global financial services powerhouse that delivers top performance for our clients and shareholders through all environments.

Our journey began by analyzing the forces reshaping the world of investments. We looked at our financial services industry peers but we also looked beyond them to learn what digital native companies were doing and how we could benefit. We cultivated business leaders with technology knowledge and technology leaders with business knowledge to create a blueprint for the future of our systems architecture. We welcomed fresh perspectives and aggressively challenged conventional thinking and ways of doing business across our company. BNY Mellon is today a very different company than we were just a few years ago. And we are still evolving and growing.

Our goal is to deliver better insights and solutions to our clients while consistently attaining the highest levels of investment performance, service, expertise, resiliency and reliability. Our current performance in some of these areas is best in class while, in others, such as the reliability of certain applications and the consistency of the client experience, there is more work to be done. We are redoubling our efforts to reach the high standards expected of us. Clients have told us they have seen changes in how we think, operate and approach our work – with improved agility, innovation, collaboration and a laser focus on clients’ needs.

Our success in incorporating new solutions for our clients’ benefit and in evolving our culture for the new marketplace has placed us at the leading edge of technological innovation. The investments we have made to digitize our company are reducing our operating costs, funding regulatory initiatives and, most importantly, strengthening the client experience and our overall value proposition. With many of the consequential benefits of our investments still to come, the Investments Company for the World is just beginning to redefine what is possible.

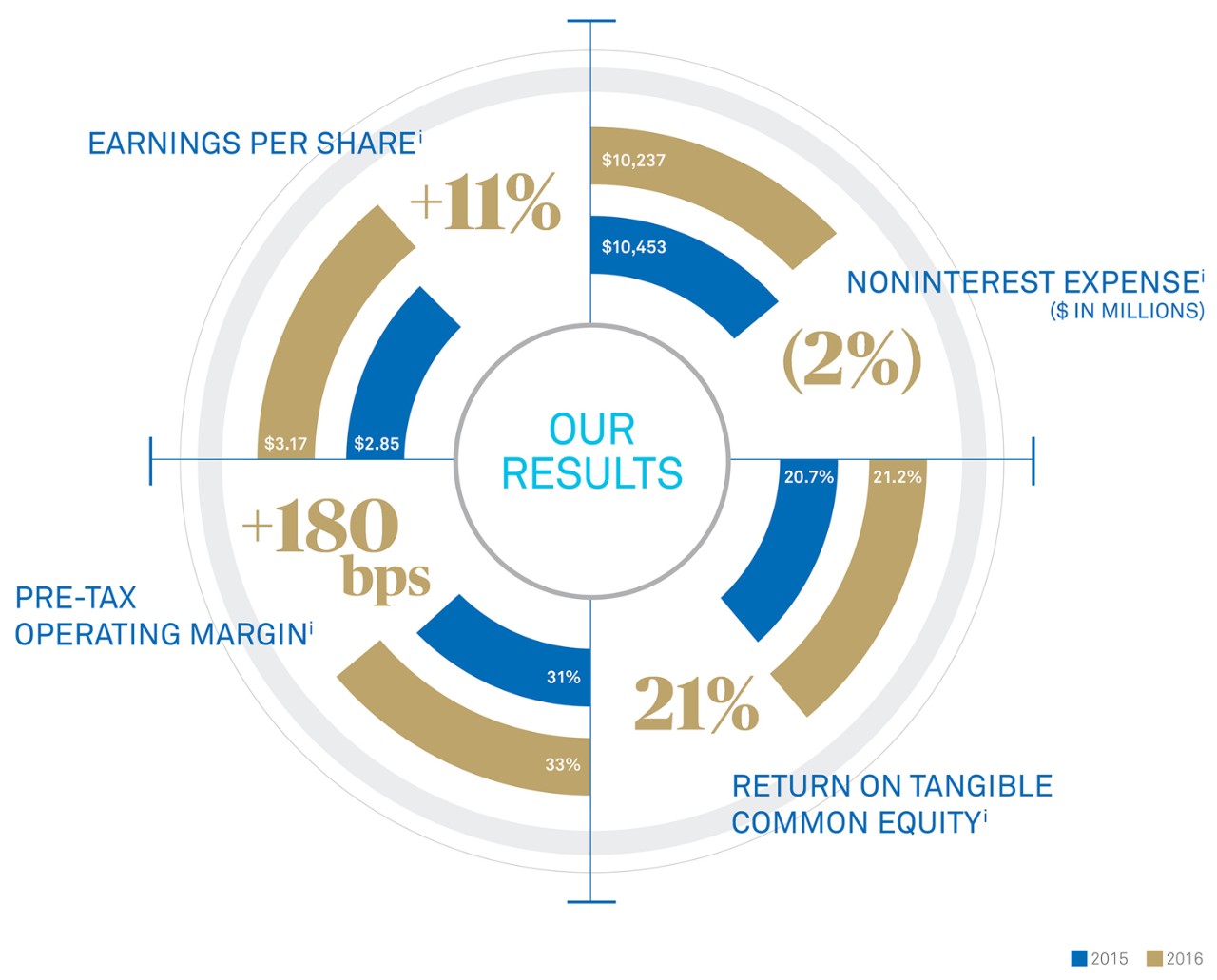

Summary of 2016 Financial Results, Year-Over-Year

INCREASED EARNINGS PER SHARE:

On a GAAP basis, we earned $3.15 per share in 2016, up 16 percent compared to 2015. On an adjusted basis, we earned $3.17 per share, up 11 percent from last year’s adjusted EPS.i

REDUCED EXPENSES:

On a GAAP basis, we reduced expenses by 3 percent compared to 2015. On an adjusted basis, expenses were 2 percent lower.i Our business improvement process and cost discipline more than offset continued strategic investments to improve the client experience, digitize our company, enhance our resolvability and strengthen our risk management, compliance and control functions.

INCREASED PRE-TAX OPERATING MARGIN:

On a GAAP basis, our pre-tax operating margin was 31 percent. Our adjusted pre-tax operating margin was 33 percent, up 180 basis points versus 2015, and we generated 274 basis points of positive operating leverage.i

INCREASED RETURN ON TANGIBLE COMMON EQUITY (TCE):

We achieved an adjusted ROTCE of 21.4 percent, up from 20.7 percent in 2015.i ROTCE is a good measure of the value we are creating from the investments we are making.

Delivering Against Our Performance Goals

Our efforts have already helped improve our financial performance. Since we shared our three-year strategic plan in October 2014, we have delivered eight quarters of solid performance against these goals despite the relative lack of industry and market catalysts. The revenue environment in 2016 remained challenging across our industry, though post the U.S. election, markets have strengthened. Our financial performance reflects the benefits of our well-diversified, lower-risk business model and our ability to manage through all environments. Our strategy is working and our aspiration to become best in class across the investment lifecycle spectrum remains intact.

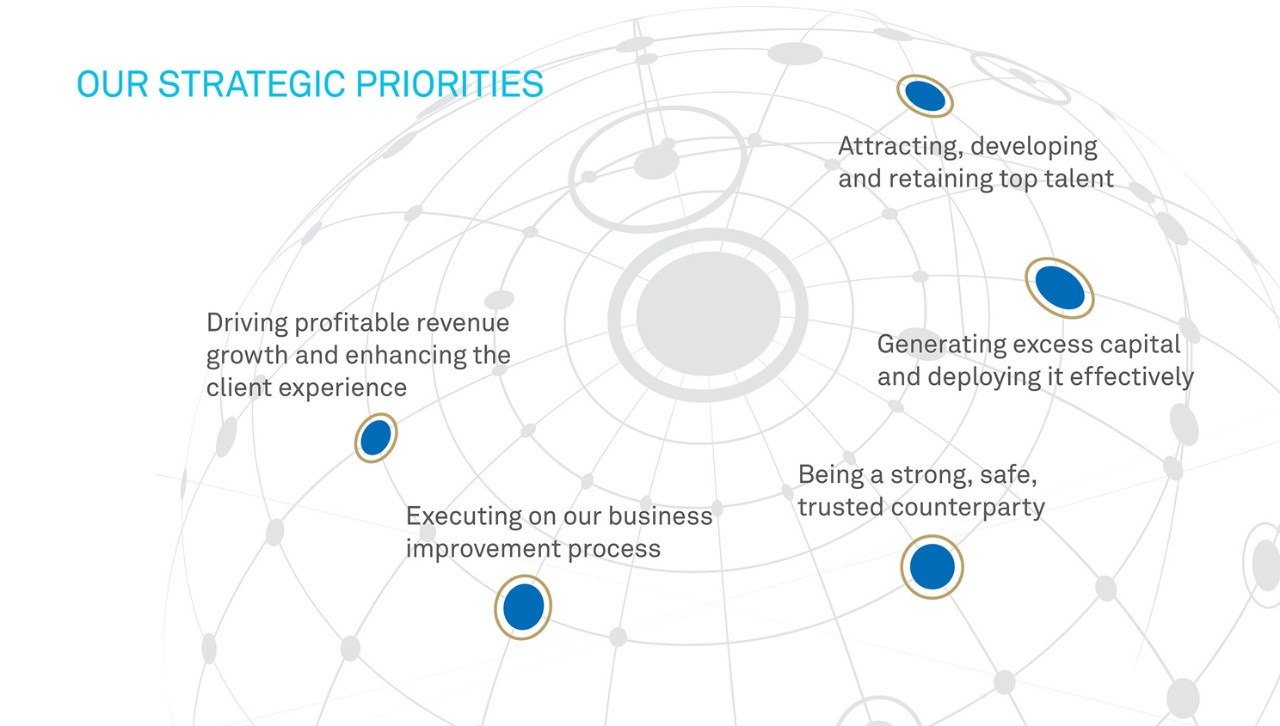

Executing on Our Proven Strategy

We are executing on a clear set of strategic priorities essential to sustain long-term growth and value creation for our clients and shareholders.

DRIVING PROFITABLE REVENUE GROWTH AND ENHANCING THE CLIENT EXPERIENCE

We are creating new sources of value for our clients, and revenue opportunities for us, by anticipating and capitalizing on the emerging trends within the financial sector.

Capitalizing on Forces Reshaping Client Demand

To position us to be our clients’ partner of the future, we have many growth initiatives at different stages of maturity that leverage our scale and expertise. Executed well, they should benefit clients and shareholders. Here are some examples of where we are making strategic investments:

- With market and regulatory trends driving investable assets toward lower-fee products and pressuring margins, asset managers of all types and sizes are looking to lower and variabilize their structural costs and focus more of their resources on investment returns. In our Investment Services business, we are building best-in-class technology and operations to deliver middle-office services that asset managers historically provided for themselves, enabling them to leverage our scale and expertise while we manage our technology platforms efficiently to achieve our profit objectives. We are also further investing in exchange-traded funds servicing to capitalize on the trend of retail investors increasing allocations to passive investment strategies.

- Shifting investor appetites have led us to revitalize our Investment Management capabilities to capitalize on established and emerging investment trends. With many active equity managers struggling to generate significant above-benchmark returns and interest rates stubbornly low, but beginning to rise, we are focusing on cash management, liability-driven investments, alternative strategies and other high-conviction and income-related strategies that are in highest demand and central to our active asset management businesses. The strength and diversity of our investment solutions from our multi-boutique model continue to position us as a partner of choice in providing tailored investment solutions to meet the goals of our clients across a wide spectrum of investment opportunities. And our recent investments in our Wealth Management franchise serving high-net-worth individuals and the focus on supporting the investment needs of leading third-party intermediary institutional advisors are helping us to capitalize on the growth in demand from individual investors.

- Collateral management optimization is an area where we are investing in capabilities with upside potential and where our business model gives us many competitive advantages. We have been providing collateral management services to large sell-side institutions for decades and have leveraged these capabilities to assist buy-side investment managers. New regulatory demands require the posting of collateral for a wide range of transactions across the globe. We are at the forefront of this market development, having developed cutting-edge collateral optimization engines that improve the efficient use of collateral, thus providing real value to all market participants.

- Alternative investments are among the fastest-growing investment classes. The servicing opportunity for us is significant. The capabilities we have built to address the administration needs of three major asset manager segments – real estate, private equity and single-manager hedge funds – have enabled us to attract significant new business. We have been consolidating all alternative servicing solutions onto a single global platform and leveraging our NEXEN® ecosystem to increase our scale, deliver seamless global capabilities and improve our clients’ experience.

Creating a Distinctive Client Experience

The quality of the client experience we deliver will continue to improve – everything from the ease and sophistication of the technology tools our clients use to the knowledge and responsiveness of our investments professionals. We proactively seek client feedback and, as a result, we are implementing numerous enhancements to our service delivery, which are becoming increasingly visible to our clients.

- NEXEN, our application programming interface-enabled digital ecosystem, is one of the most transformational of our investments. NEXEN is creating a platform where we can integrate the best data and predictive analytics services in the marketplace to offer solutions not previously possible. We are developing our own services but also co-developing software with our clients and fintech firms to meet specific marketplace needs. We see ourselves as being a great platform company that integrates the best of what we and others have to offer for the benefit of our clients. Our clients are just beginning to experience the ease with which they can connect to us at their desktops or on their mobile devices. While it is still early, we are confident in our future as we continue to invest, innovate and transform into a more digital, data-driven global financial services powerhouse.

- We are evolving our relationship management and client service delivery teams companywide to provide a common discipline and an approach that further improves how we interact with and service our clients. Through service excellence training, the adoption of common standards, processes and metrics, and stronger alignment between the technology, service and relationship management components, we are strengthening and improving the quality, timeliness and accuracy of our service delivery.

- Our use of cognitive technologies is leading edge. During 2016, we successfully expanded our adoption of robotics and machine learning to reduce risk and enable our people to switch their focus from repetitive work to providing value-added services for our clients. Transformation efforts are underway to address common client pain points through digitization and workflow changes.

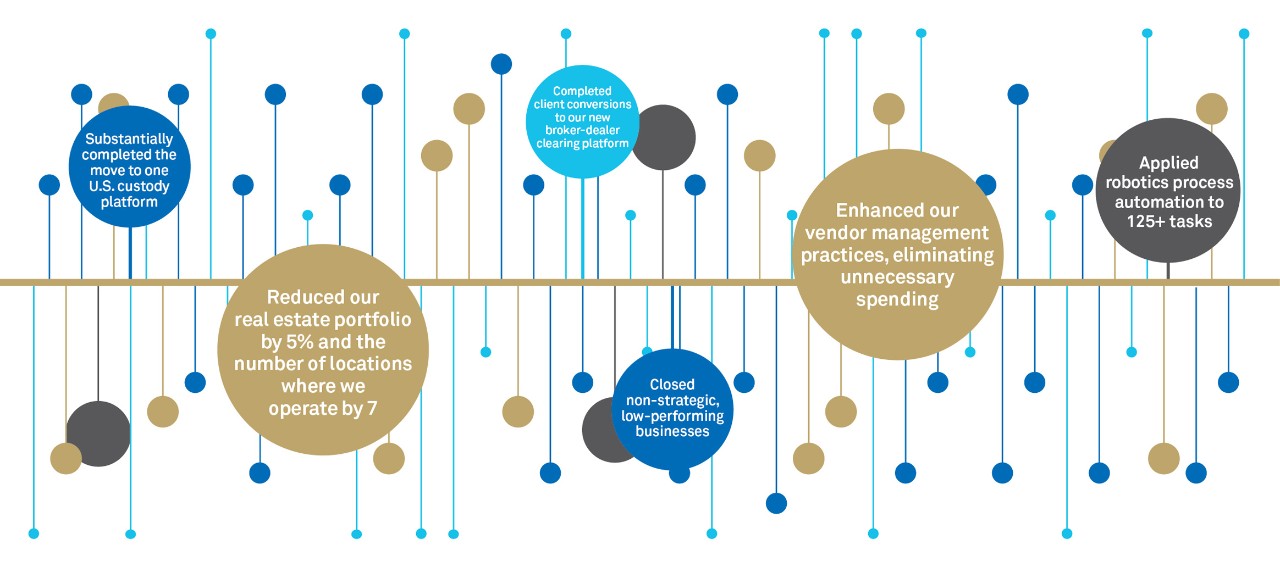

EXECUTING ON OUR BUSINESS IMPROVEMENT PROCESS

Our success in meeting or exceeding our business improvement process goals has been paying off. It is creating efficiency and quality benefits for our clients and reducing technology, operations and structural costs for us. These savings have helped us meet or, in some quarters, exceed our operating margini goals while reducing risk and enabling us to fund our growth, new client solutions, and important risk and regulatory compliance initiatives.

Here are some examples of our business improvement process at work:

Executing on Our Business Improvement Process

Our business improvement process is creating efficiency and quality benefits for our clients and reducing technology, operations and structural costs for us, while enabling us to fund our growth, new client solutions and risk and regulatory compliance initiatives.

STRONG, SAFE, TRUSTED COUNTERPARTY

Our reputation as a strong, safe, trusted counterparty reflects our success in building a solid balance sheet and robust risk culture. Our strategy is one of not incurring outsized risk to reach for returns. We have maintained among the highest credit ratings in the industry and our capital and liquidity positions remain strong.

Actions to increase our safety and soundness:

- Strengthened our capital adequacy process

- Expanded our operational risk management capabilities and control functions

- Shifted our resolution strategy to become more resolvable and made other investments in our resolution and recovery plans

- Streamlined and rationalized governance structures for better decision making

- Enhanced cybersecurity and conducted exercises, simulations and scenarios to ensure operational and technological readiness and resiliency

- Strengthened our risk identification and operational risk control processes

GENERATING EXCESS CAPITAL AND DEPLOYING IT EFFECTIVELY

We remain focused on maintaining a great balance sheet, including strong capital and liquidity positions, while at the same time returning significant value to our shareholders. In 2016, we returned nearly $3.2 billion to shareholders in the form of share repurchases and dividends while increasing our capital to meet new higher regulatory requirements. Our payout ratio in 2016 was 92 percent on an adjusted basisi. Over the last five years, on a gross basis, we have repurchased approximately $8.6 billion or 20 percent of our shares outstanding.

At year-end, we either met or exceeded all minimum regulatory capital requirements, including the Liquidity Coverage Ratio and the fully phased-in Supplementary Leverage Ratio required as a U.S. G-SIB.

ATTRACTING, DEVELOPING AND RETAINING TOP TALENT

People are our ultimate competitive advantage, and we are invested in attracting, developing and retaining truly outstanding talent. During 2016, we continued to strengthen our team by adding new talent with valuable experience and outside perspectives while providing more opportunities to stretch and grow our existing professionals. Our holistic people strategy aims to provide outstanding opportunities for the diverse talent across our company to grow personally and professionally.

The fact that the Anita Borg Institute once again named BNY Mellon to its Top Companies for Women Technologists Leadership Index is one of many indicators that we are on the right path. Our employees are more engaged than ever in supporting our mission and delivering for our clients.

Invested in Improving Lives

Corporate Social Responsibility (CSR) supports our vision of improving lives through investing. As an engine for the financial markets, we help drive global growth and prosperity. And we’re committed to creating an inclusive, sustainable world that encourages people to succeed and economies to thrive.

We focus on three CSR strategic pillars:

- Our Markets: As the Investments Company for the World, we take our responsibility as a key market infrastructure provider and investment manager of client assets very seriously. Trust and integrity are central to why clients choose us. We must never violate that trust.

- Our People:We launched our first-ever digital People Report, which, through the voices and perspectives of our employees, tells the story of how we are invested in our people and building a winning culture.

- Our World:We contribute solutions to some of our world’s greatest challenges. We are leaders in addressing climate change in our own firm – we are carbon neutral and have been named to CDP’s global Climate “A” List since 2013.

We collectively touch so many lives in positive ways. This year, our total employee, foundation and company contribution to charities in communities around the world reached approximately $37 million. Employees volunteered more than 100,000 hours of their personal time again this year. Approximately 30 percent of the hours are considered skills-based, where our employees use their business skills and expertise to deliver an even greater impact.

Further demonstrating our track record of excellence in CSR, our company is the only U.S. diversified financial firm named to the Dow Jones Sustainability World Index (DJSI World), one of the most highly regarded global sustainability indices, for the past three years running.

Looking Forward

We are committed to delivering increasing and compelling value to our clients and shareholders.

While we continue to execute on the financial goals we outlined in 2014, we are refreshing our strategic plan with updated financial priorities and goals that will extend until 2020. We plan to share our updated plan at our Investor Day in the fall.

As we look ahead, we are encouraged by the optimism we see for a growing economy. Many investors are anticipating a more favorable interest rate, regulatory and tax environment, which has been fueling the equity markets. Should any or all of these materialize, we stand to benefit. We are investing for the future in our core areas of strength – technology platforms and applications, innovative solutions to help our clients be successful, improving our business processes and ensuring we have the talent it takes to execute our agenda. We are confident in our strategy and optimistic about our future.

I am grateful to our extended BNY Mellon team for sharing my passion for excellence and to my Executive Committee partners for accepting the challenge to remake our company for the new era.

Allow me to also thank our Board of Directors for keeping the bar high and offering the strategic counsel we need to reach it. My special thanks to Catherine A. Rein, who will not stand for re-election after serving on our board for more than 35 years, and Karen B. Peetz, who has retired as President after nearly two decades with our company. Both have served with distinction and passion and kept our focus squarely on our clients. We welcome to our board Linda Z. Cook, Jennifer B. Morgan and Elizabeth E. Robinson, whose combined leadership experience and business and technology expertise will benefit our company immensely going forward.

Finally, thank you to my fellow shareholders for recognizing our unique value proposition and entrusting our global team to execute. We have never been stronger and we stand ready to deliver even more value to our clients and shareholders.

Gerald L. Hassell

Chairman and Chief Executive Officer

1. For a reconciliation and explanation of these non-GAAP measures, see pages 121-126 in our 2016 Annual Report.