Fluctuations in the Japanese economy have a global impact, with the Bank of Japan (BOJ) playing a pivotal role in the balance of monetary policy, growth and innovation, and consumer spending. At BNY, our extensive global reach provides our experts with the data to impart key insights on the broader market implications of BOJ policies.

Background

For a number of years, in parallel to zero or negative rates in the U.S., U.K. and continental Europe, Japan had pursued negative policy rates and an expanding balance sheet. As the Federal Reserve and the European Central Bank began raising rates following the pandemic, widened interest rate differentials contributed to the weakening of the yen as the large gap between Japanese and global rates made the yen a popular funding currency for carry trades.

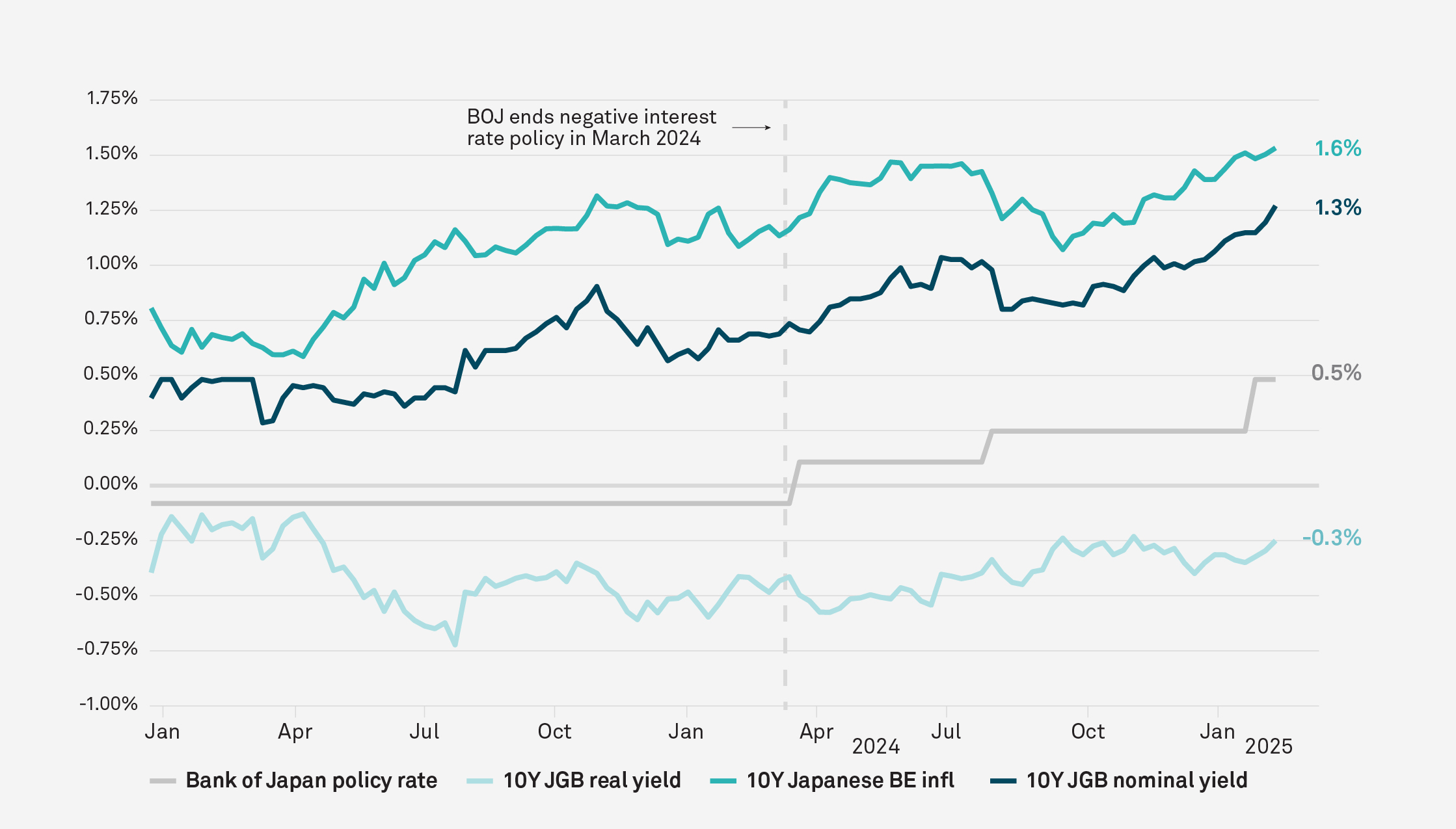

In March 2024, the BOJ adjusted its approach by ending negative rates and yield curve controls against the backdrop of higher import prices, wage growth and rising inflation expectations. Since then, 10-year and 30-year yields have both risen by ~50bps to 1.3% and 2.3%, respectively.

Outlook

Japan’s economy is seeing strength with 1.1% growth expected for 2025 following 0.5% growth in 2024. Foreign demand for Japanese equities has improved after some outflow pressure towards the end of 2024. In fact, the latest Tankan Survey,1 a quarterly measure of economic conditions in Japan, showed general optimism, especially across non-manufacturing sectors which is at its highest since the early 1990s. Following wage growth of 5.1% last year, Rengo, Japan’s largest labor union, is seeking an additional 5.0% increase in 2025, which if realized, would promote further growth via consumer spending.2

In terms of rates, we expect two additional quarter-point rate hikes this year, lifting the policy rate to 1% by the end of 2025 and 1.5% in 2026. Most Japanese government securities are held domestically with the BOJ and domestic banks and households but given the average maturity on outstanding Japanese government bonds (JGBs) at over eight years (vs. the U.S. under six years), it will require a longer period of rising rates to swell the government’s effective interest expense. Thus, Japan has a longer runway for any renewed pressure on its government debt and more policy options to manage it than other countries reliant on foreign funding. Interestingly, JGB yield increases since March 2024 seem to mainly reflect rising inflation expectations, and medium-term expectations of higher rates. Long-term real rates and term-premia have barely budged. (Figure 1)

FIGURE 1: JGB YIELD ADJUSTMENTS SINCE THE END OF NEGATIVE RATES MAINLY REFLECT INFLATION REPRICING

REAL YIELDS & BREAK-EVEN INFLATION, %

Source: Macrobond, BNY Advisors; Data as of 2/14/25

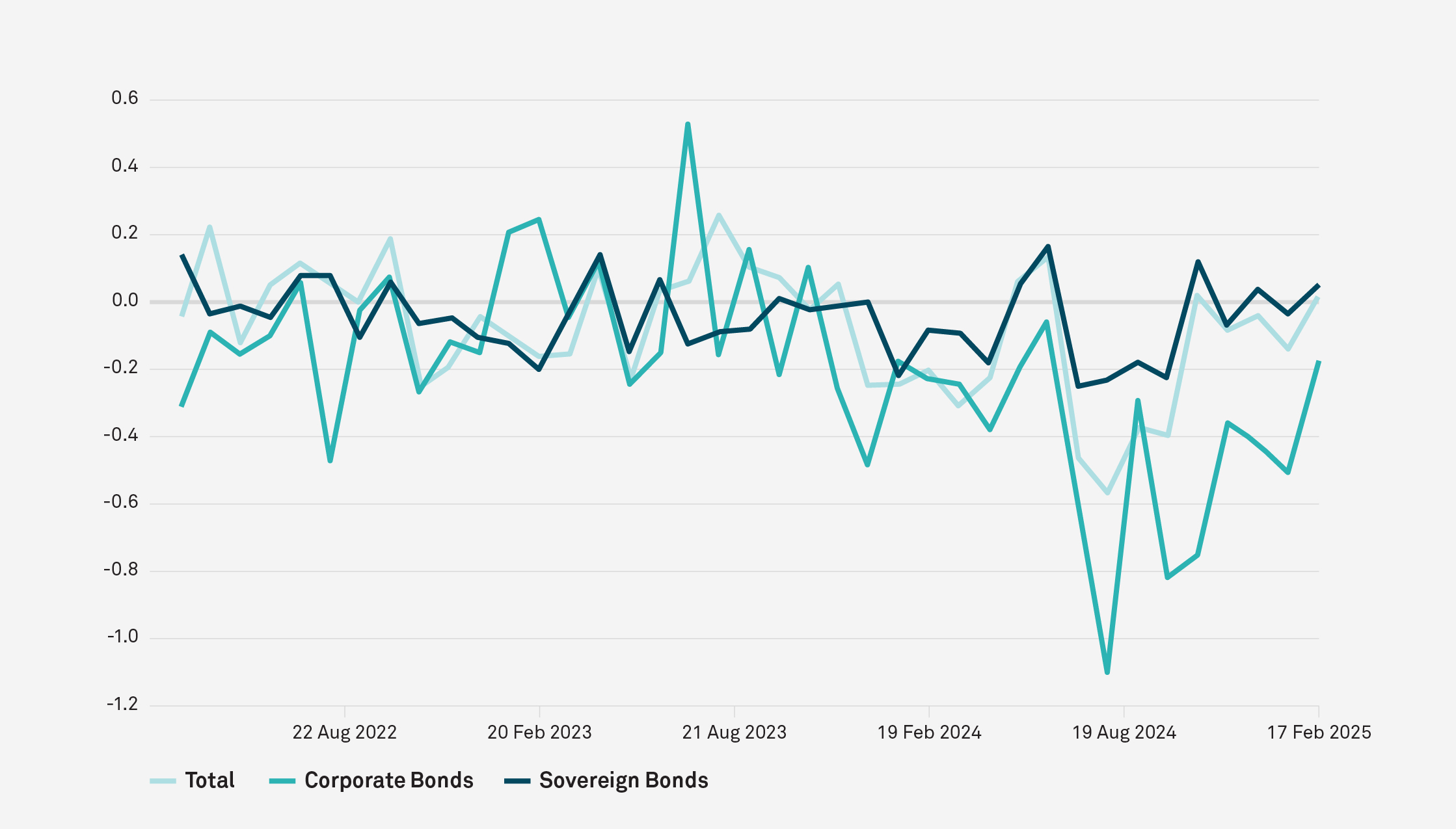

We also expect JGB purchases, by the BOJ, to be tapered through spring 2026, in line with plans laid out last summer and a key next step towards economic normalization. The roll-off of JGBs is seemingly becoming a large driver for investors and bond flows globally, with higher JGB yields bringing increased demand for debt. We view Japan’s bond market adjustment as in line with ongoing reflation and BOJ policy normalization, and it seems market participants agree, as they are not seeking, or fearing, an outright tightening of BOJ policy.

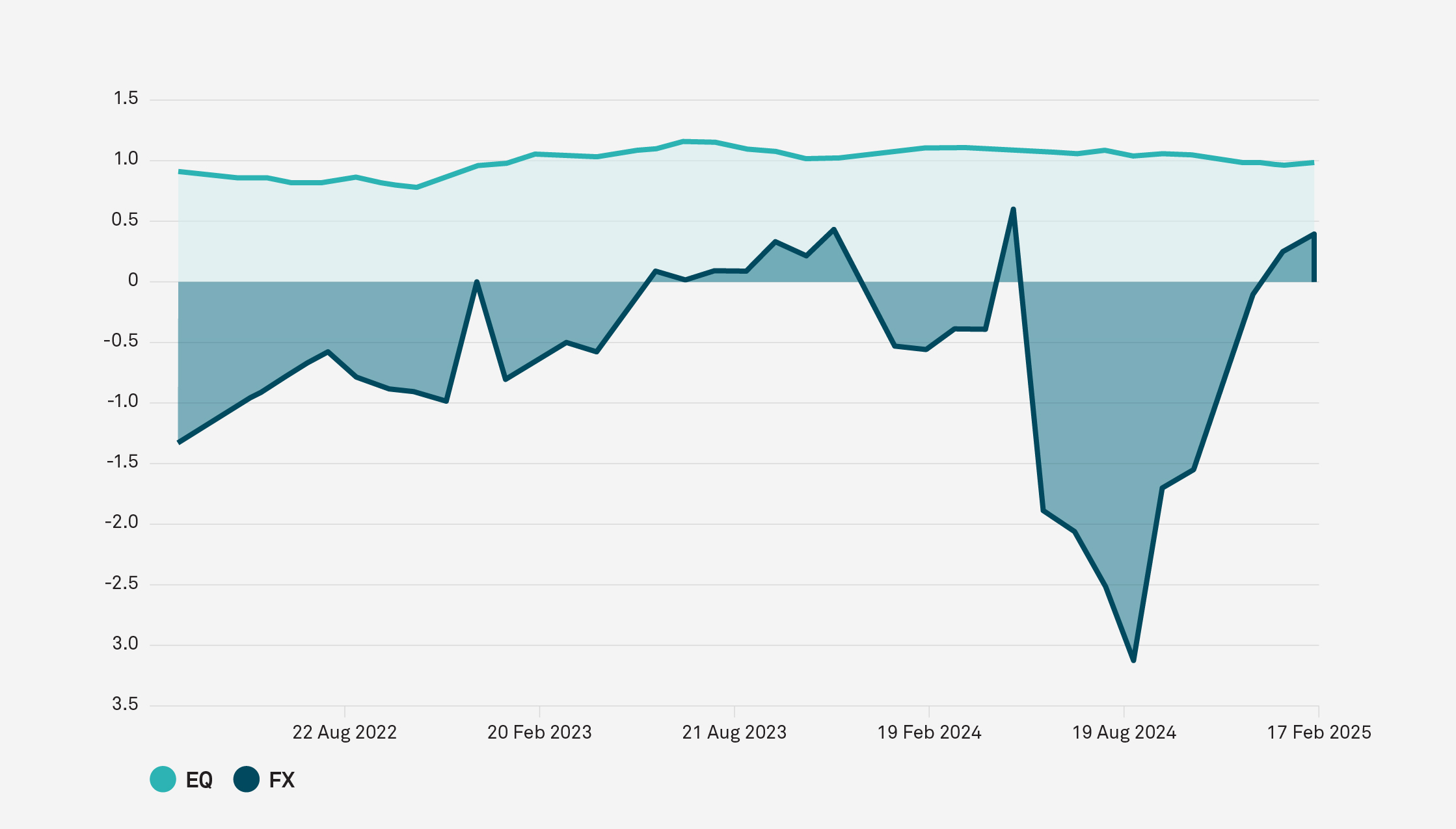

Japanese rates and the link to JPY weakness that has persisted for over three years should turn with BOJ normalization, albeit contingent on Federal Reserve rate easing. In fact, real money investor holdings of JPY have shifted from significantly underheld in 3Q24 to overheld at the end of January 2025 and we see JPY 145 as the target for July with modest home bias from Japanese investors. (Figures 2 & 3) If we are already approaching equilibrium real rates, then Japan may be near pulling off reflation and policy normalization, without a large-scale yen revaluation.

FIGURE 2: EQUITY & FOREIGN EXCHANGE CROSS BORDER SCORED HOLDINGS

Source: BNY, WM/Refinitiv

FIGURE 3: JAPAN CROSS BORDER FIXED INCOME SCORED FLOWS

Source: BNY, WM/Refinitiv

With opportunities such as steel acquisition talks and a widening of its auto manufacturing footprint in the US, Japan is set up as the best of APAC economies to weather potential tariffs, and we see the ongoing rate normalization efforts of the BOJ as supportive for investors adding to JPY and equities rather than derailing growth.

Implications for Investors

Declining global demand for U.S. Treasuries from foreign economies will be a key theme in global asset allocation in the coming years, potentially driving further flows into Japan. Current Japanese equity holdings are well below U.S. positions and valuations of most Japanese companies fall below those of U.S. companies. Additionally, Japanese tech shares look undervalued compared to others in the region. Therefore, the Nikkei 225 average appears set for larger upside risk should investor flows find favor in the overall region.

The drivers for Japan into 2025 appear to be balanced, with equities across the region seen as ready for a bounce back thanks to low rates and attractive valuations. Current tariff risks are likely the biggest block for more investment flows in APAC. On a relative basis, Japan can be seen as a haven as it straddles U.S. risks against the region and is better positioned to reach an agreement with the new administration. The improved outlook for the economy has also helped stabilize downside worries that plagued 2024 as market participants globally view the current government actions as supportive of growth.

Authors: Eric Hundahl, Head of BNY Advisors Investment Institute; Vincent Reinhart, Mellon Chief Economist and Macro Strategist; Bob Savage, Head of Markets Strategy and Insights; and Nick Tocchio, Mellon Global Economist

1Bank of Japan, December 2024 Survey, https://www.boj.or.jp/en/statistics/tk/index.htm

2Anton Bridge and Tetsushi Kajimoto, “Japanese pay hikes must exceed last year's, Rengo union head says,” Reuters.com, Reuters, January 23, 2025, https://www.reuters.com/markets/asia/japanese-pay-increases-this-year-must-exceed-last-years-rengo-union-head-says-2025-01-24/

Disclaimers:

BNY

BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

© 2025 The Bank of New York Mellon. All rights reserved. Member FDIC.

iFlow® / FX MARKET COMMENTARY

The products and services described herein may contain or include certain “forecast” statements that may reflect possible future events based on current expectations. Forecast statements are neither historical facts nor assurances of future performance. Forecast statements typically include, and are not limited to, words such as “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “likely,” “may,” “plan,” “project,” “should,” “will,” or other similar terminology and should NOT be relied upon as accurate indications of future performance or events. Because forecast statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict.

iFlow® is a registered trademark of The Bank of New York Mellon Corporation under the laws of the United States of America and other countries. iFlow captures select data flows from the firm’s base of assets under custody, as well as from its trading activity with non-custody clients, on an anonymized and aggregated basis.