Appropriate leverage ratio reform paired with prudent risk management and other solutions could promote increased liquidity and lay the foundation for a more resilient Treasury market.

Supporting a Safe & Liquid U.S. Treasury Market

Last year we highlighted the importance of safety and liquidity in the United States Treasury market as it navigates through several key structural forces, including: fiscal and monetary policy, regulatory changes and market structure changes.

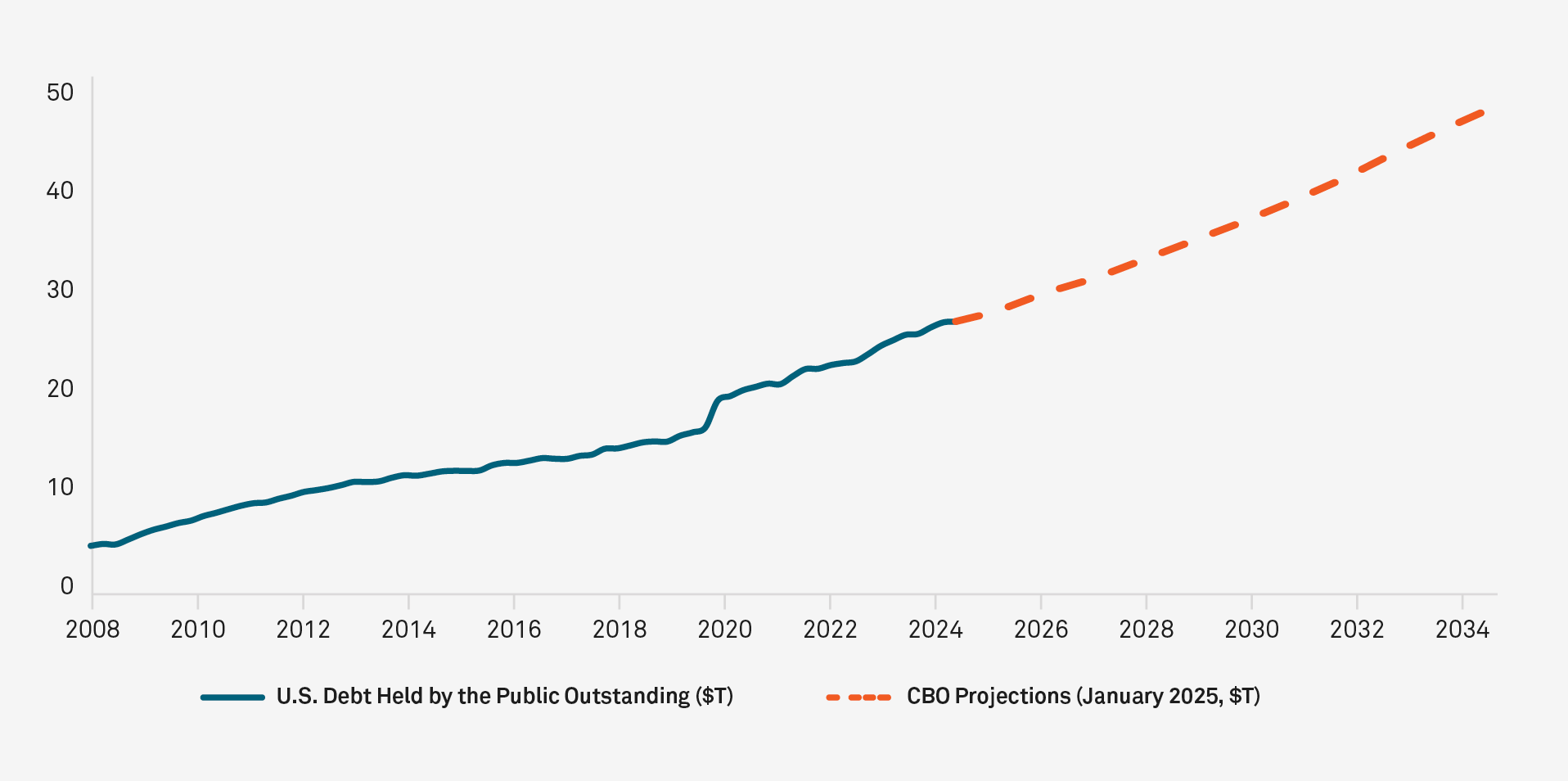

Standing at over $29 trillion today, there is no other government bond market as deep or liquid as the U.S. Treasury market, and it plays a critical role in the global economy. The market continues to grow rapidly, expected to nearly double to over $52 trillion within the next decade (Figure 1).1

One of the most significant changes to come is the SEC’s central clearing mandate, which will fundamentally alter how market participants interface with the Treasury market, potentially requiring $4 trillion in daily transactions to be centrally cleared.2 These changes are intended to improve the safety of the U.S. Treasury market by reducing counterparty and settlement risk in stressed times, though may come with higher demands for liquidity.

A more resilient Treasury market will depend on solutions that promote both its safety and liquidity. One potential solution that has generated attention in recent months is leverage ratio reform, aimed at providing additional capacity for Treasury market intermediation and liquidity, particularly during times of stress.

Figure 1: U.S. Debt Held by the Public Outstanding

Source: Bloomberg, quarterly, non-seasonally adjusted. January 2025 CBO debt projections reflected

What are Leverage Ratios & Why Do They Matter?

In the aftermath of the Global Financial Crisis, regulators undertook a series of steps to better support the health and safety of the U.S. financial system. Today, U.S. banking organizations are subject to a number of regulatory requirements across liquidity, capital and other financial resources. A key component of capital requirements is leverage ratios.

Intended to supplement risk-based capital requirements, leverage ratios require banks to hold a minimum amount of capital agnostic to the composition or “risk” of a firm’s balance sheet in the event risk-based capital levels are insufficient.3 For example, leverage ratios would require a bank to hold the same amount of capital for a highly liquid U.S. Treasury bond as it would an equivalent, less liquid private loan, all else equal.

There are different types of leverage ratio requirements: U.S. banking organizations are subject to the Tier 1 Leverage ratio (T1L). The largest firms must also comply with the Supplementary Leverage Ratio (SLR), which includes certain off-balance sheet exposures. The U.S. Global Systemically Important Banks (GSIBs) are also subject to an Enhanced Supplementary Leverage Ratio (eSLR).

Leverage ratios play a key role in shaping how banking organizations engage in core activities and markets, such as the U.S. Treasury market. Banking organizations provide liquidity through market-making activity, extend financing through repo and reverse repo transactions, and hold significant quantities of U.S. Treasurys. Each of these activities can expand the total size of a bank’s balance sheet and, in turn, affect its leverage ratio(s). With the size of the U.S. Treasury market expected to continue to grow rapidly, regulators are focused on efforts to promote a more resilient U.S. Treasury market and banking organization intermediation, particularly during times of stress.4

Impacts to the U.S. Treasury Market and U.S. Banking Sector

While leverage requirements were initially intended as a “backstop” to risk-based capital requirements, they have become the main or “binding” constraint for a number of firms. This can result in distorted outcomes when consistently binding on banking organization activities for a period of time. Furthermore, leverage can bind more quickly during times of stress, when banking organization balance sheets can see larger than usual demand for Treasury trading and financing activity, or inflows of deposits, including those that coincide with sizable fiscal and monetary policy responses.

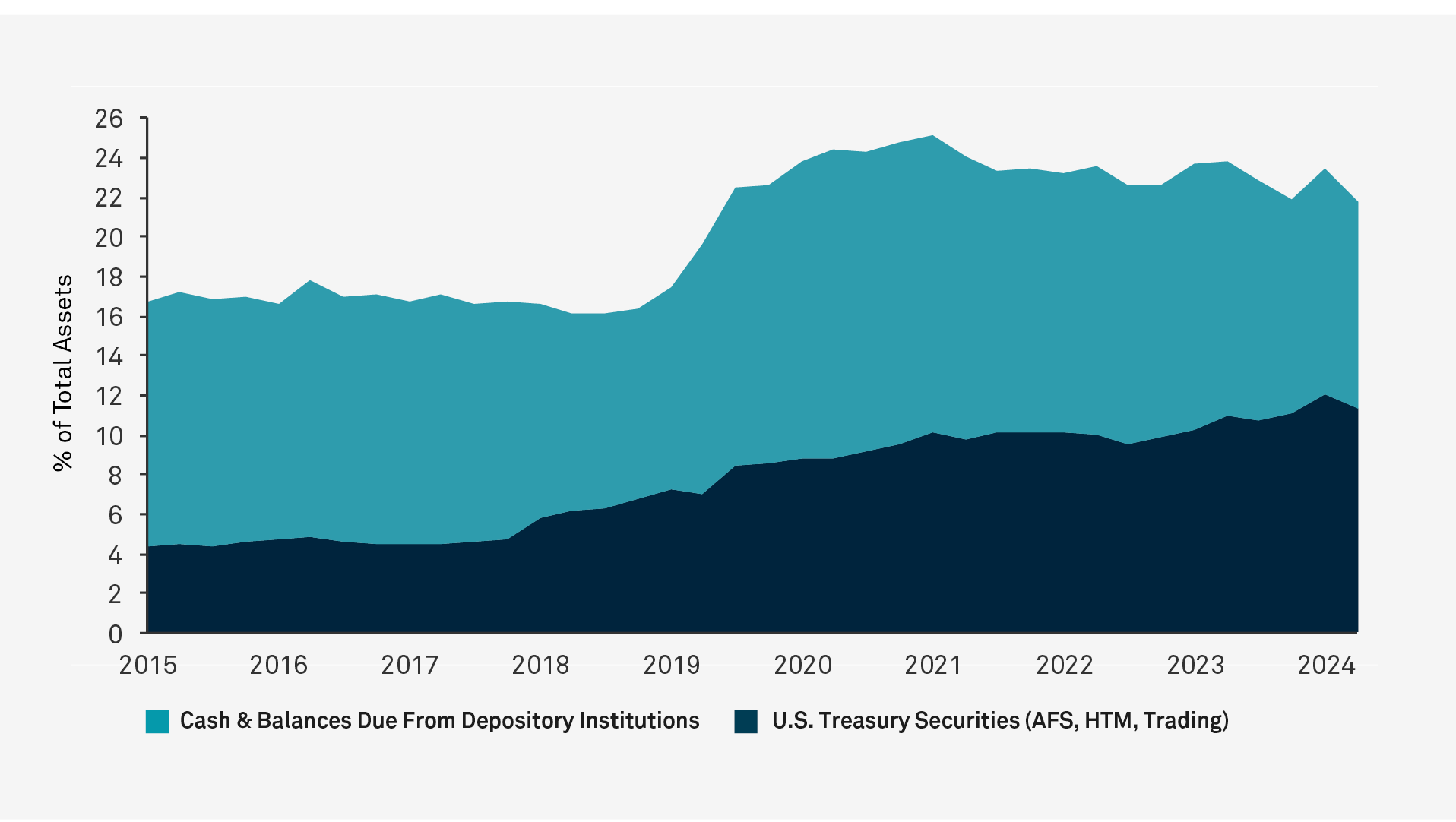

More recently, as a result of regulatory and liquidity risk management changes following the Global Financial Crisis, large banking organizations now hold higher levels of U.S. Treasurys and other lower-risk assets (Figure 2). However, these efforts to promote higher levels of liquidity can come into conflict with similar efforts to limit excess leverage. While these liquidity regulations incentivize holding higher levels of these High-Quality Liquid Assets (HQLA), which include cash and Treasury securities, the higher mix has consequently led to reduced balance sheet capacity from leverage constraints that could be otherwise used for additional low-risk activity, such as U.S. Treasury market intermediation.5

Figure 2: Mix of Cash and U.S. Treasury Securities as a Percent of Total Assets for Select Large U.S. Bank Holding Companies

Source: Regulatory filings, reflects quarterly balance sheet levels vs YE2015 for select large U.S. bank holding companies

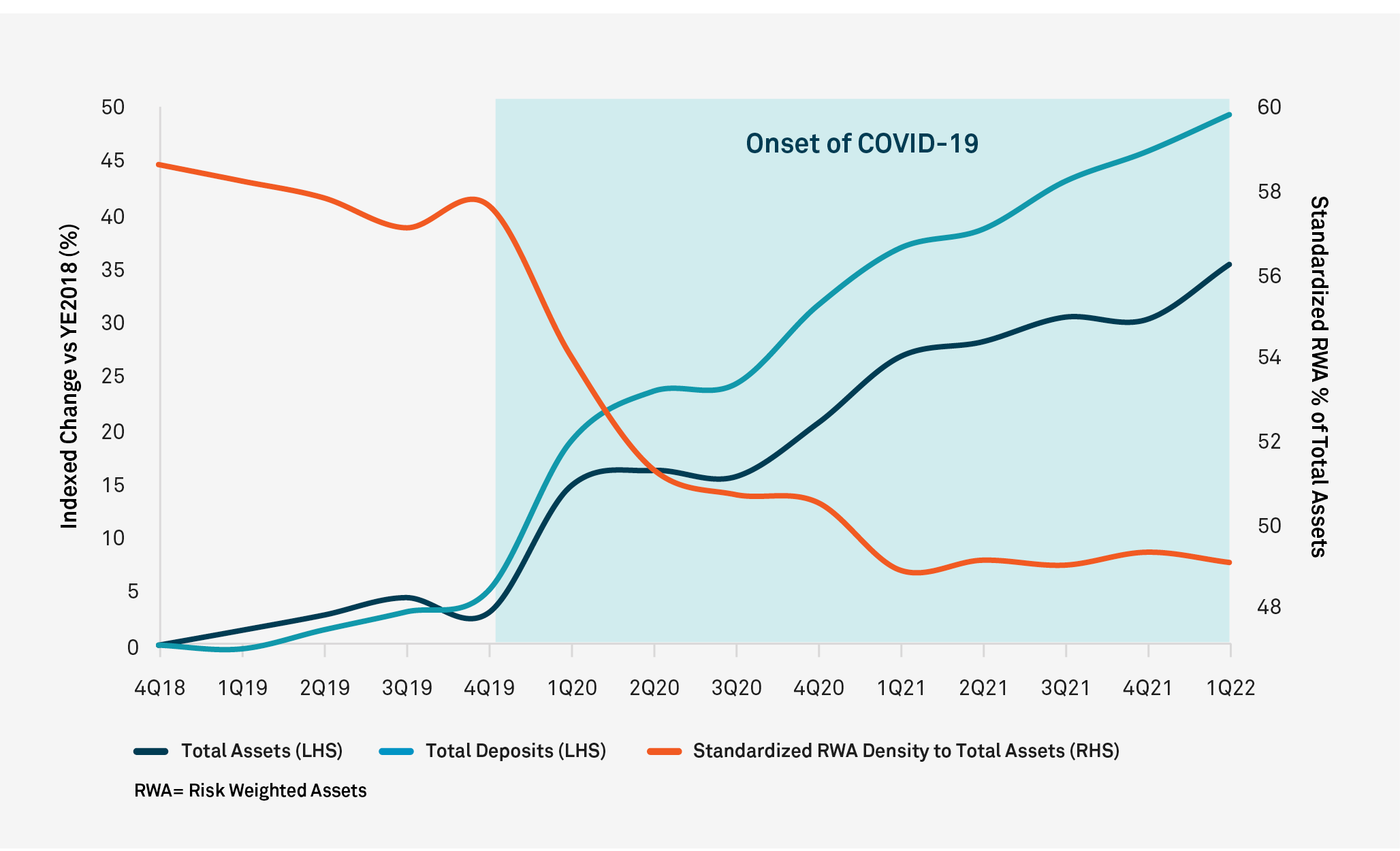

This was observed during the “dash for cash” at the onset of the COVID-19 pandemic. Alongside a significant fiscal and monetary policy response to the crisis, regulators also provided targeted temporary leverage relief to the largest firms to ease strains in the Treasury market, promoting additional intermediation capacity and liquidity, as well as increasing banking organizations’ ability to provide credit as balance sheets rapidly expanded (Figure 3).6

Figure 3: Growth of Total Assets and Deposits following COVID-19 for Select Large U.S. Bank Holding Companies

Source: Regulatory filings, quarterly levels for select large U.S. bank holding companies reflected, indexed to YE2018 where applicable

Banking organizations that are consistently leverage bound may be more inclined to increase the amount of “risk” per dollar of balance sheet, depending on their business model, given leverage ratios require the same amount of capital to be held irrespective of the type or “riskiness” of their assets. As a result, that same firm may be less inclined to engage in low-risk activities, such as U.S. Treasury market intermediation. This is counter to risk-based capital requirements, which naturally requires higher capital levels held against “riskier” activities. Several officials highlighted these perverse outcomes and how this dynamic can be particularly challenging during times of stress, when it’s most important for U.S. Treasury market intermediation.7

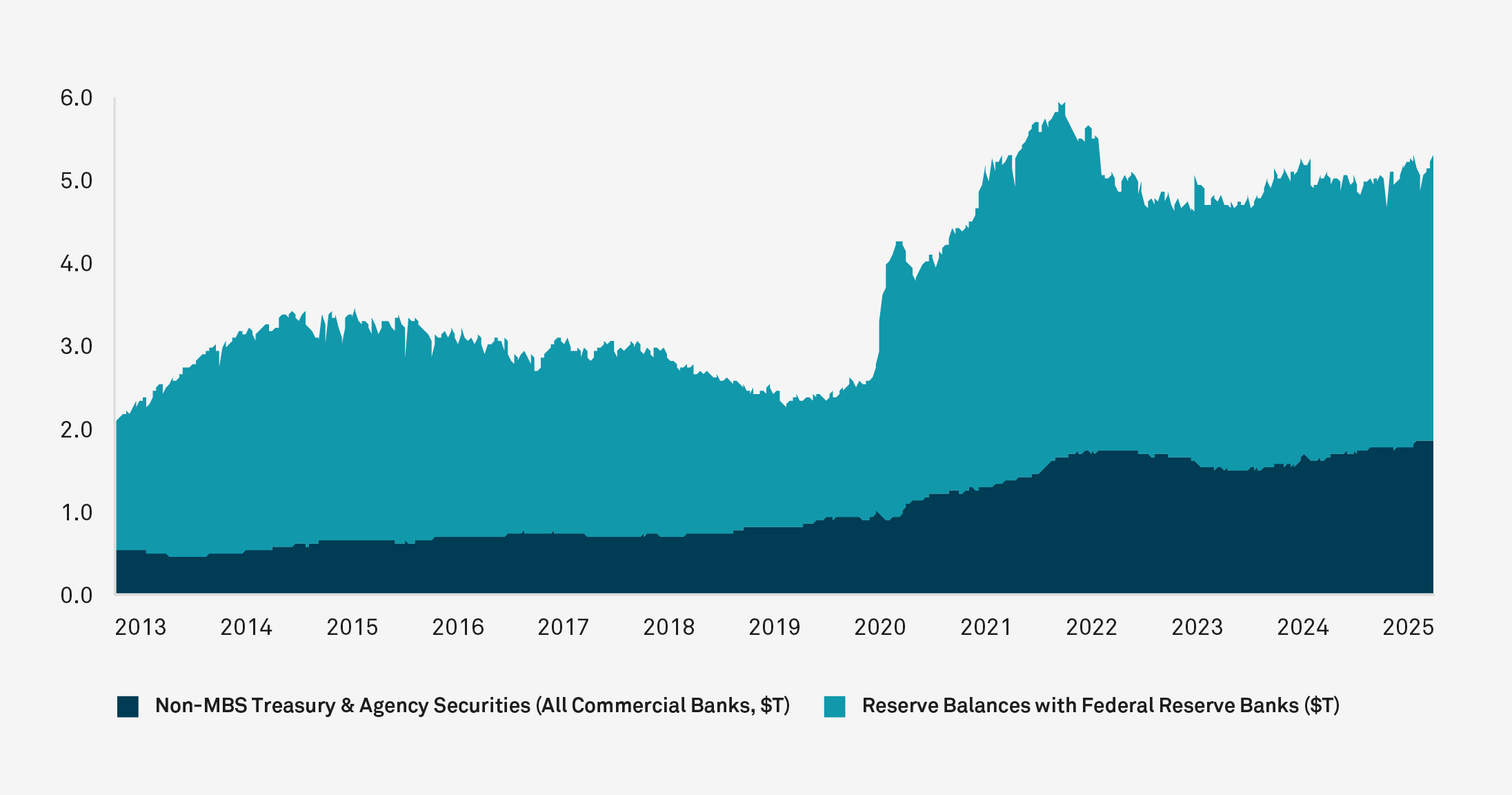

Figure 4: U.S. Treasury Securities at U.S. Commercial Banks & Bank Reserves

Source: Federal Reserve, non-seasonally adjusted

While the targeted temporary relief expired, the level of lower-risk assets continued to grow, leading many to advocate for more permanent solutions to improve liquidity and intermediation, particularly during times of stress (Figure 4). Even more recently we’ve seen early signs of liquidity pressures in the U.S. Treasury and repo market, such as in early April following the elevated market volatility and over month-end periods.

What Could Leverage Ratio Reform Look Like?

Leverage ratio reform could take several forms to adjust the level of capital banking organizations are required to hold against lower-risk assets, such as U.S. Treasurys, with two primary approaches: excluding assets from the denominator or reducing the ratio requirements.

Removing all or a portion of designated assets from the denominator of the leverage ratio calculation would effectively provide firms with targeted balance sheet capacity to hold and intermediate these specific assets. This approach could specifically target the lower-risk assets, such as central bank reserves and/or U.S. Treasurys, while still requiring capital to be held against all other assets on banks’ balance sheets.

Another approach would be to reduce the leverage ratio requirement, effectively reducing the amount of capital (numerator) firms need to hold against their assets (denominator). This approach would still require capital to be held against lower-risk assets, while freeing up balance sheet capacity for leverage-bound firms to use at their discretion, though it may not be as targeted towards lower-risk activity as intended.

Potential adjustments could also be directed at one or more leverage ratios. Implementing uniform changes across all leverage metrics would promote consistent regulatory treatment and align incentives throughout the banking sector, though it may face a higher hurdle for change.8 Modifying T1L would affect all banking organizations, while an adjustment to SLR (or eSLR) would specifically benefit the largest firms, which account for a large share of U.S. Treasury market activity.

In the U.S., regulators recently released an initial proposal specifically focused on the eSLR requirements and are soliciting feedback from the public on the proposal, as well as other approaches, to best promote a more resilient banking sector and U.S. Treasury market.9

A Comprehensive Approach to Risk Management

While adjustments to leverage ratios may improve U.S. Treasury market intermediation, some market observers may point out that such adjustments could result in less capital across the banking sector to absorb unexpected losses. Although Treasury securities have limited credit risk, they are still subject to broader interest rate and liquidity risks like other fixed-income securities. As seen in the latest rate hiking cycle, banking organizations that purchased large quantities of long-dated U.S. Treasurys and other securities in the aftermath of the COVID-19 pandemic when yields were historically low, quickly saw the market values of those securities decline as the Federal Reserve rapidly raised interest rates to address rising inflation.

While leverage requirements are a key component of a firm’s capital adequacy, they are one aspect of a firm’s broader regulatory and internal risk management framework. Sound banks prudently manage interest rate risk, liquidity risk and broader asset and liability management, employing several techniques such as disciplined planning and scenario analysis, ongoing stress testing and comprehensive risk limits, among others.

Adhering to leverage ratio requirements alone will not guarantee a firm’s safety, as effective risk management requires a comprehensive approach. For example, the bank failures of 2023 showed institutions with large unrealized securities losses that failed were also compliant with leverage ratio requirements at the time. Analysis of these failures points to a number of other significant deficiencies at play, including insufficient risk management practices and controls.10 Today, the largest U.S. banks are subject to the highest standards of liquidity and capital management, including ongoing stress testing, which also includes unrealized losses in available-for-sale securities portfolios reflected in capital metrics. Irrespective of how leverage ratio reform may ultimately take shape, it’s important that robust, prudent and appropriate risk management practices continue to guide the industry.

Looking Forward

With the U.S. Treasury market continuing to grow rapidly, both the public and private sectors should continue to explore additional solutions to promote a more resilient U.S. Treasury market. Appropriate leverage ratio reform paired with prudent risk management could provide liquidity and intermediation capacity tailwinds to the Treasury market during times of stress, while also preserving the safety and soundness of the U.S. banking sector. However, any changes should be thoughtful and applied consistently to achieve the desired outcome. Leverage ratio reform is one piece of a more holistic approach needed, which should also include better means of collateral mobilization and additional contingent funding sources, amongst other tools. Putting fiscal funding on a more sustainable path will also become increasingly important. Having played a role in supporting the U.S. Treasury market since its inception, BNY remains committed to promoting a safe and liquid U.S. Treasury market in an ever-evolving landscape.

Nate Wuerffel, Head of Market Structure and Product Leader for BNY's Global Collateral Platform, contributed to this article.

1“Budget and Economic Data,” Congressional Budget Office, January 2025, https://www.cbo.gov/data/budget-economic-data

2“DTCC Survey Identifies Significant Improvements in Industry Understanding and Preparedness Around Expanded U.S. Treasury Clearing,” Depository Trust & Clearing Corporation (DTCC), July 15, 2024, https://www.dtcc.com/news/2024/july/15/dtcc-survey-significant-improvements-in-industry-preparedness-around-expanded-us-treasury-clearing

3“Notice of proposed rulemaking: Leverage ratio,” Federal Reserve Board, June 25, 2025, https://www.federalreserve.gov/aboutthefed/boardmeetings/files/frn-leverage-ratio-20250625.pdf

4“Notice of proposed rulemaking: Leverage ratio,” Federal Reserve Board, June 25, 2025, https://www.federalreserve.gov/aboutthefed/boardmeetings/files/frn-leverage-ratio-20250625.pdf

5Francisco Covas, Felipe Rosa, “Treasury Market Resiliency and Large Banks’ Balance Sheet Constraints,” Bank Policy Institute (BTI), February 6, 2025, https://bpi.com/treasury-market-resiliency-and-large-banks-balance-sheet-constraints/

6“Federal Reserve Board announces temporary changes to its supplementary leverage ratio rule to ease strains in the Treasury market resulting from the coronavirus and increase banking organizations’ ability to provide credit to household and businesses,” Board of Governors of the Federal Reserve System, April 1, 2020, https://www.federalreserve.gov/newsevents/pressreleases/bcreg20200401a.htm

7Randal K. Quarels, “Between the Hither and the Farther Shore: Thoughts on Unfinished Business,” Board of Governors of the Federal Reserve System, December 2, 2021, https://www.federalreserve.gov/newsevents/speech/quarles20211202a.htm; Michelle W. Bowman, “Taking a Fresh Look at Supervision and Regulation,” Board of Governors of the Federal Reserve System, June 5, 2025 https://www.federalreserve.gov/newsevents/speech/files/bowman20250606a.pdf; Guowei Zhang, “Reforming Leverage Ratios is Critically Necessary,” SIFMA, May 27, 2025, https://www.sifma.org/resources/news/blog/reforming-leverage-ratios-is-critically-necessary ;

8“Leverage and risk-based capital requirements,” Title 12 U.S. Code Section 5371, Available at: https://uscode.house.gov/view.xhtml?req=granuleid:USC-prelim-title12-section5371&num=0&edition=prelim, Accessed: 7/15/2025

9“Notice of proposed rulemaking: Leverage ratio,” Federal Reserve Board, June 25, 2025, https://www.federalreserve.gov/aboutthefed/boardmeetings/files/frn-leverage-ratio-20250625.pdf

10“Re: Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank,” Board of Governors of the Federal Reserve System, April 28, 2023, https://www.federalreserve.gov/publications/files/svb-review-20230428.pdf; “FDIC’s Supervision of Signature Bank,” Federal Deposit Insurance Corporation, April 28, 2023, https://www.fdic.gov/news/press-releases/2023/pr23033a.pdf

BNY General Disclaimer

This material and the information and any statements contained herein is for general information and reference purposes only. It is not a recommendation with respect to, or solicitation or offer to buy or sell, any products (including financial products) or services, including but not limited to BNY stock, or to participate in any particular trading strategy, including in any jurisdiction in which such an offer or solicitation or trading strategy, would be illegal, and should not be construed as such. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The contents may not be comprehensive or up to date and there is no undertaking as to the accuracy, timeliness, completeness or fitness for a particular purpose of information given. The Bank of New York Mellon, London Branch will not be responsible for updating any information contained within this material, and opinions and information contained herein are subject to change without notice. Neither The Bank of New York Mellon, London Branch nor any BNY affiliate assumes any direct or consequential liability for any errors in or reliance upon this information, and are not responsible for any third party website or website content (including, without limitation, any advertising appearing therein) which can be accessed through any of the following websites at https://www.bny.com/corporate/global/en/solutions/financing-and-liquidity.html; https://www.bny.com/corporate/emea/en/regulatory-information.html; and https://www.bny.com/corporate/global/en/disclaimers/business-disclaimers.html. The Bank of New York Mellon, London Branch includes links to other websites for information purposes only and makes no representation whatsoever about any such link, website or consent.

© 2025 The Bank of New York Mellon. All rights reserved. Member FDIC.