Our take

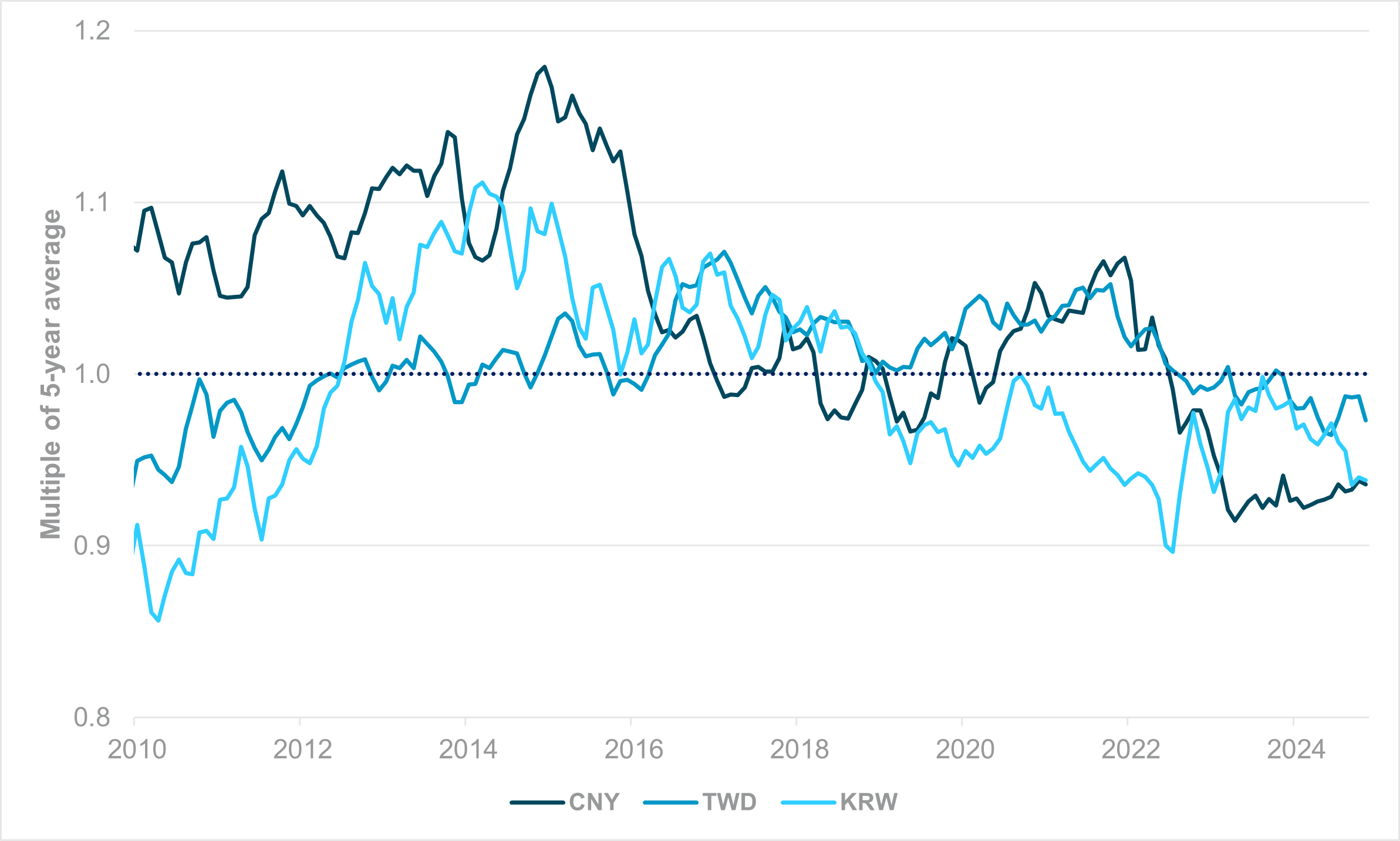

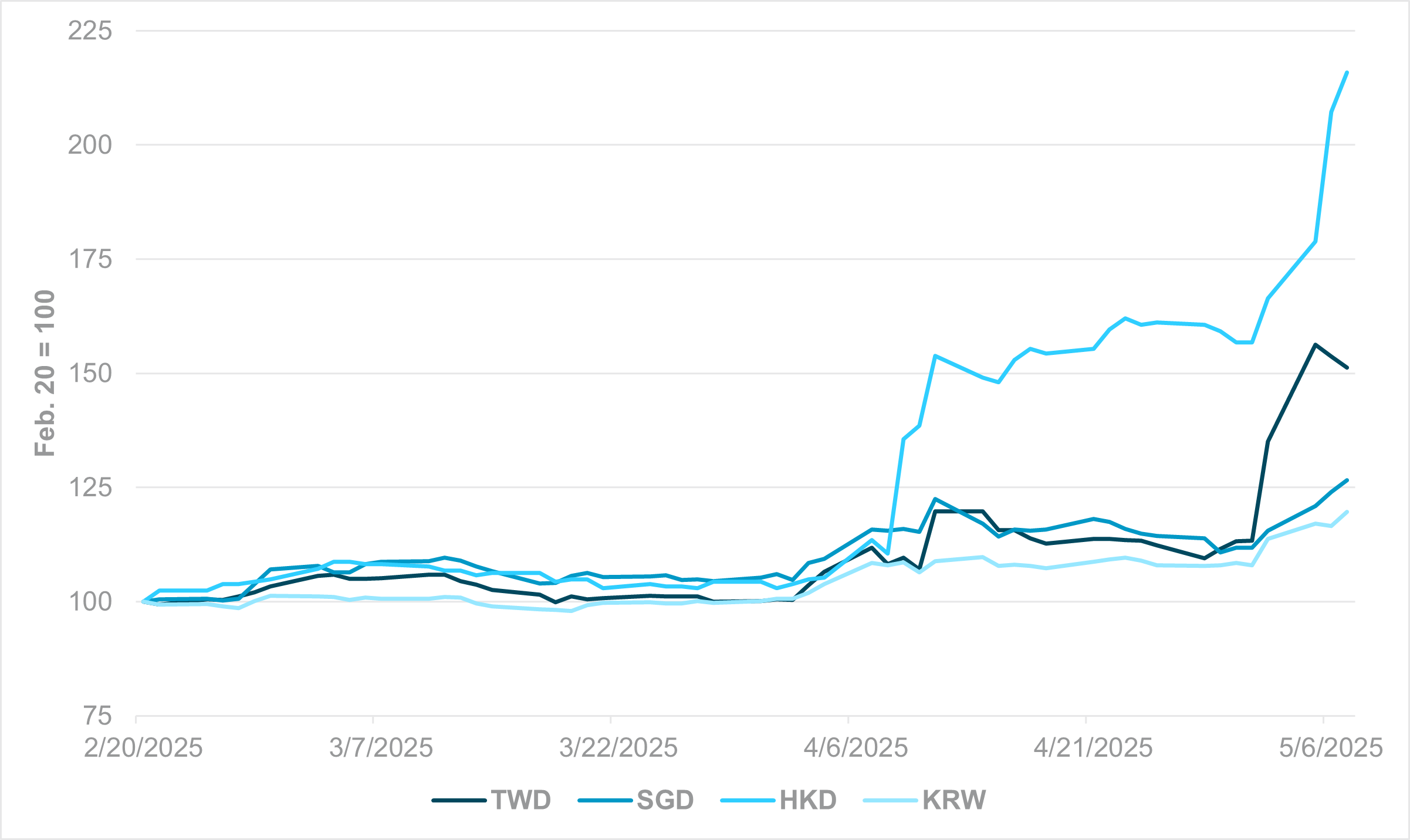

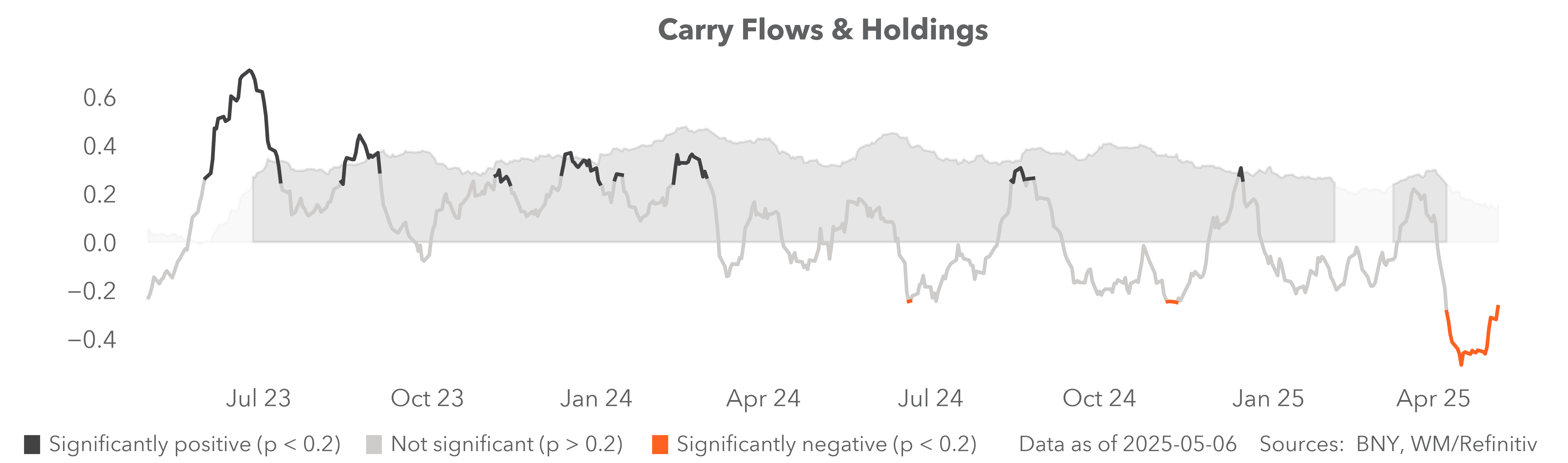

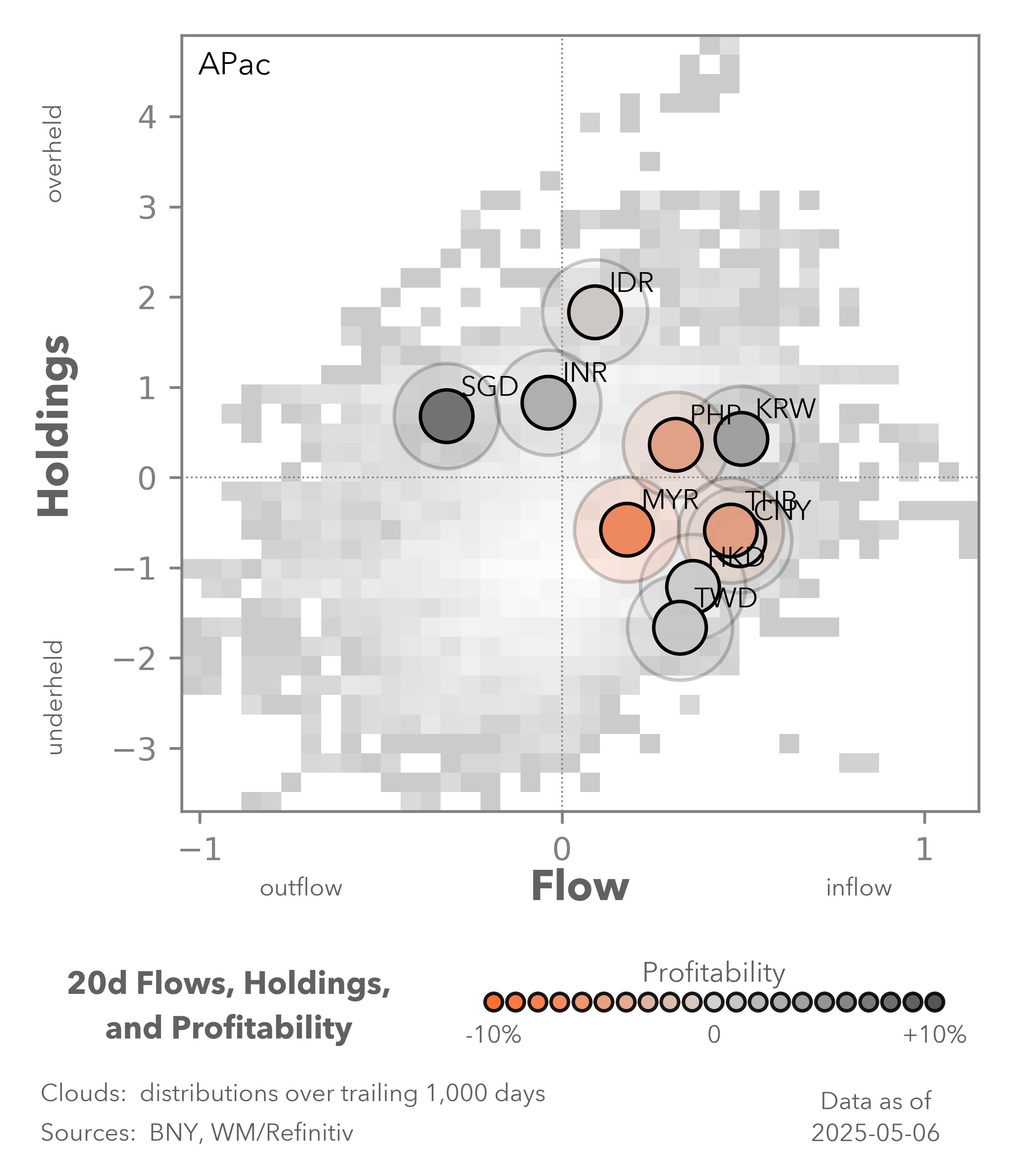

In sharp contrast to European central banks, their counterparts in the Asia-Pacific region are now acting more forcefully to prevent financial conditions from tightening further through the currency channel. This week’s monetary easing salvo by the People’s Bank of China will only step up the pressure on regional peers to act, especially in the face of tariff uncertainty, which could further reduce national income due to loss of export earnings. Short-term flows into the currency and equity markets aside, we believe that these central banks are fully aware that valuations are clearly not in their favor: in the run-up to “liberation day,” real effective exchange rates (REER) in North Asia were all well below their five-year averages (Exhibit #2). This is the criteria we use in iFlow for valuations-based mean reversion and the risk to FX performance was clearly to the upside.

Forward look

We do not expect central banks in the region to tolerate strong appreciation in their currencies against the dollar. However, they must recognize that trying to inhibit REER adjustments will only exacerbate domestic imbalances. The obvious solution is allowing REERs to rise solely through the inflation channel, especially by lifting wages and domestic demand. We believe policymakers in the region recognize this is the only way forward in the longer term as the U.S. seeks to re-shore goods production, but since “liberation day”, fiscal plans are non-existent in the region. Even China’s fresh initiatives this week to support household consumption is largely based on expanding existing liquidity facilities, and fiscal authorities did not even participate in the press conference which made the relevant announcements. Now that official trade talks between China and the U.S. are taking place, there could be a temptation for these countries to kick the “economic restructuring can” down the road. In our view, this is not the optimal outcome for exporters and will only delay the necessary adjustments in REERs.