Our take

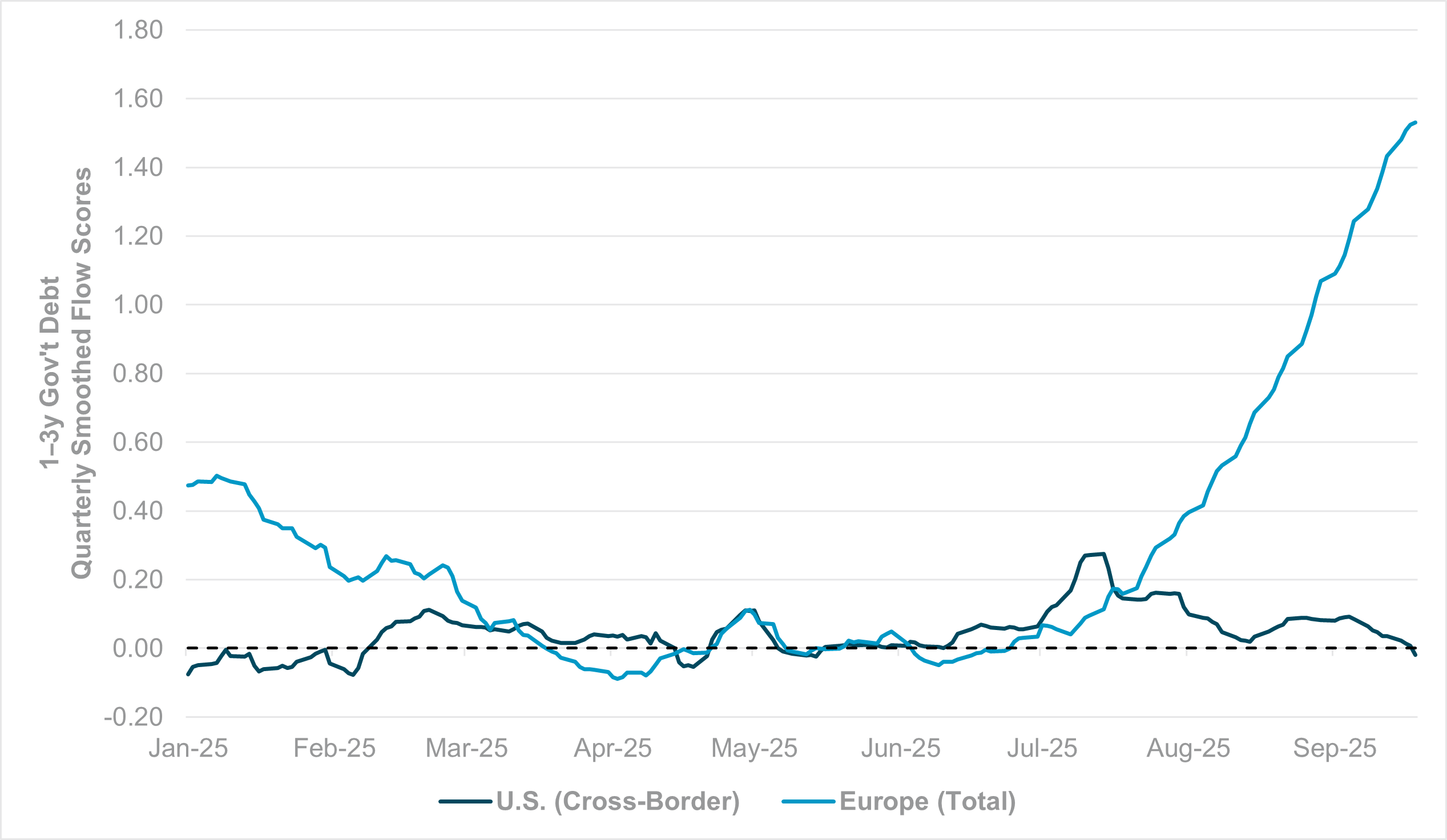

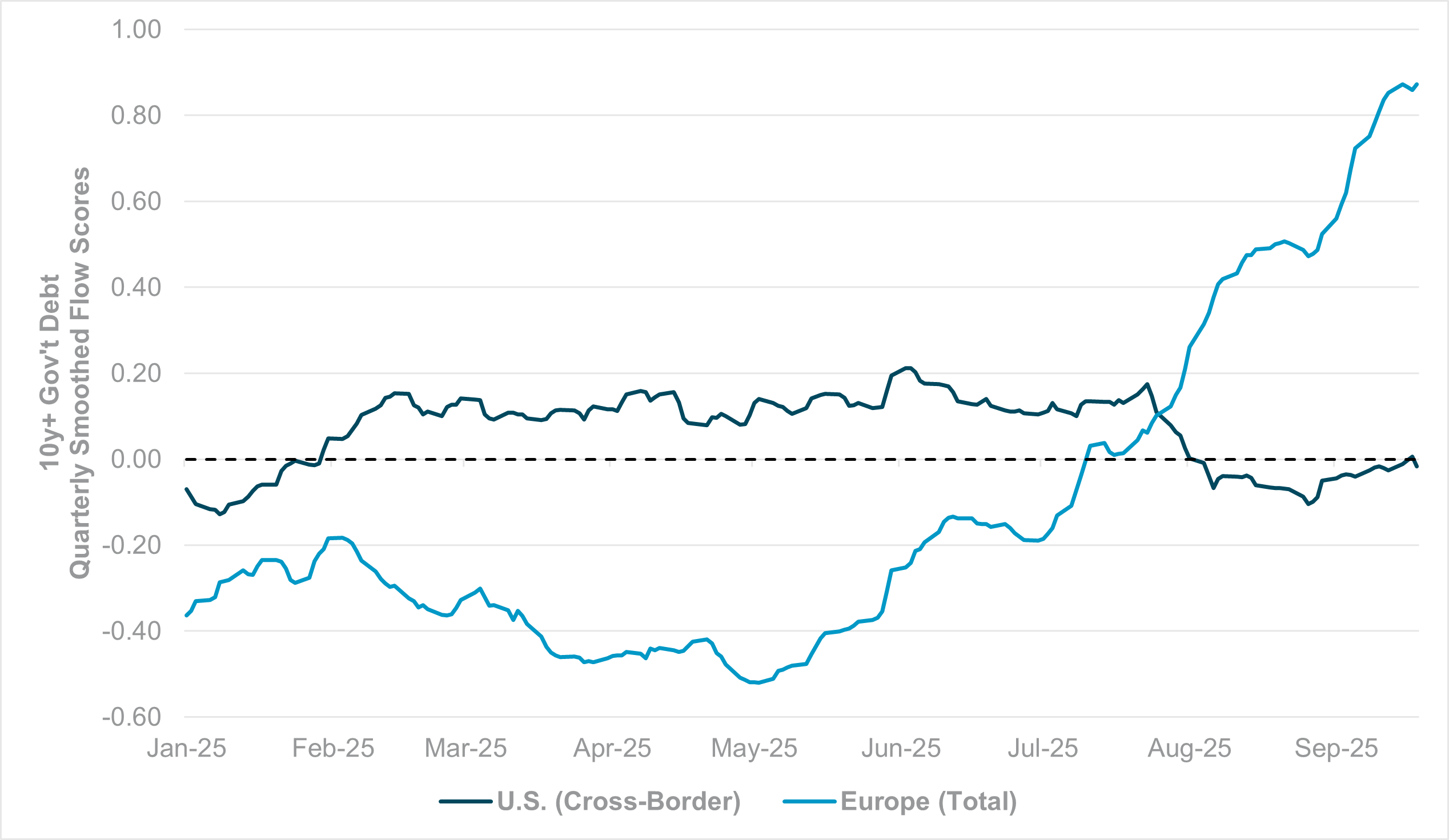

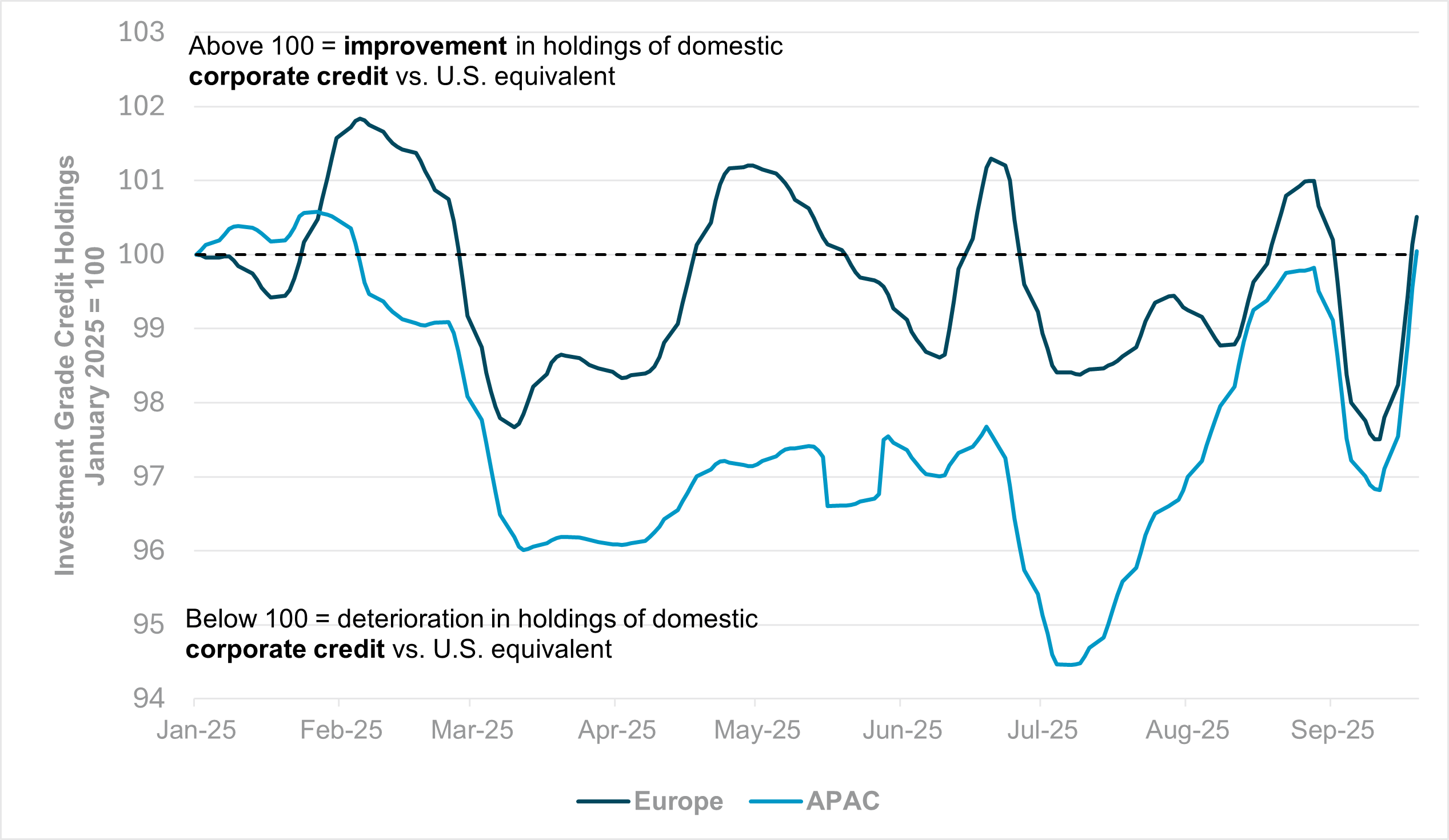

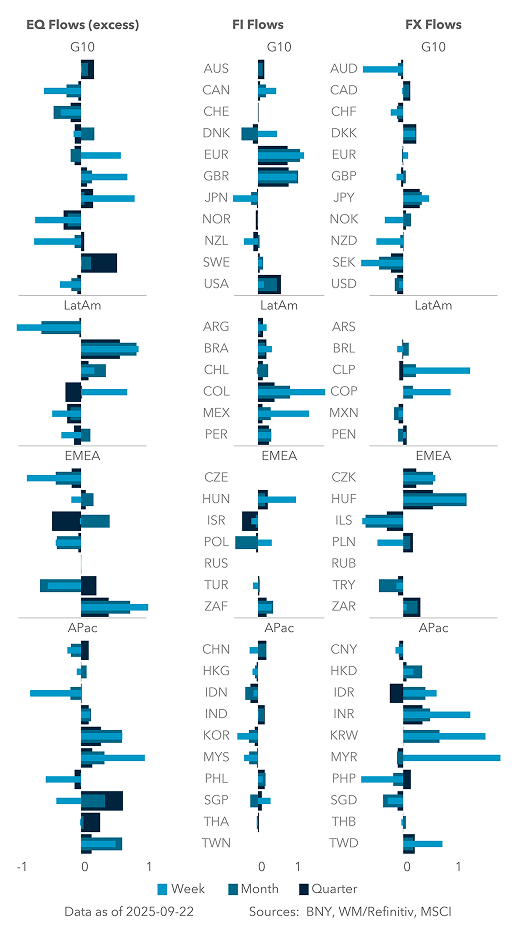

Corporate credit has been one of the weakest performing asset classes globally over the past two years. Simply put, there hasn’t been enough risk/yield compensation in this asset class relative to U.S. equities for several years. There has been no material sign of financial stress, but the consistent selling seen in our data, irrespective of issuer or investor domicile, is a simple indication that there is very low risk-reward in the market. We believe that there has been considerable liquidation throughout the past few quarters where proceeds are redirected into equities or private markets. Even in such an environment, U.S. corporate credit continues to outperform comfortably. Like our assessment of cross-border investment in U.S. equities, we measure the level of holdings for non-U.S. corporate bond markets (which captures investments by local investors) relative to cross-border holdings of U.S. credit (investment grade only). We find that that apart from some gains in mid-Q1, European corporate credit has been struggling to make headway and for the most part, relative holdings in the U.S. have been stronger. For Asia-Pacific, the story is even worse – during the summer selling was far more intense in this space, though we suspect that similar to the U.S. and global theme for the asset class, selling picked up to fund equity positions.

With Fed easing in place and global nominal yields relatively low, financial conditions will continue to support the asset class but the structural issues facing the market, such as liquidity constraints and competition from alternatives will continue to impact overall demand. On the remaining criteria, the U.S. is still seen as the “least bad” market due to depth, diversified instruments and, crucially, yield levels. Should U.S. credit begin to underperform due to economic factors, it will be difficult to see rotation into the rest of the world, as the market will not be large enough nor have the risk profile to absorb such flows.

Forward look

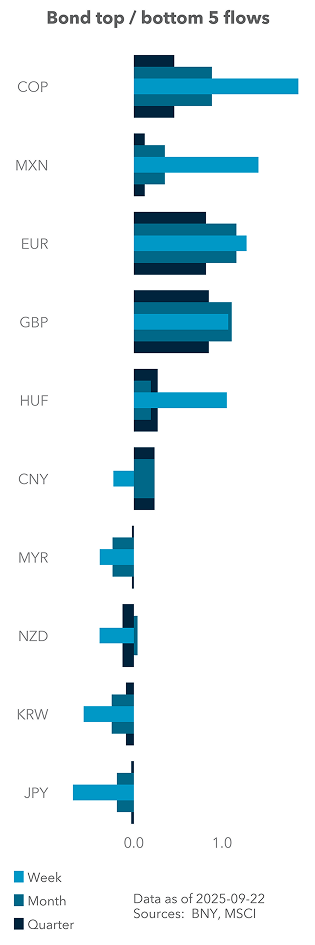

We do not see credit as being material to the overall theme of diversification away from the U.S. The market itself is facing some secular issues but global easing should be sufficient to anchor demand for now. Recently we highlighted that global flows had reached their best levels year-to-date: European junk bond CDS fell to their lowest levels in three years ahead of the ECB decision and even low-yielding Asia-Pacific credit began to see inflows, but the strongest interest globally was still in U.S. markets on an aggregate basis. As the Fed continues to cut rates and with equity valuations likely proving prohibitive, credit has become the fallback for investors seeking yields, especially as inflation remains stubborn and some real protection is necessary, but only on the margins. Either way, this is the market where we expect global investors to show the strongest preference for the U.S. market relative to home jurisdictions.