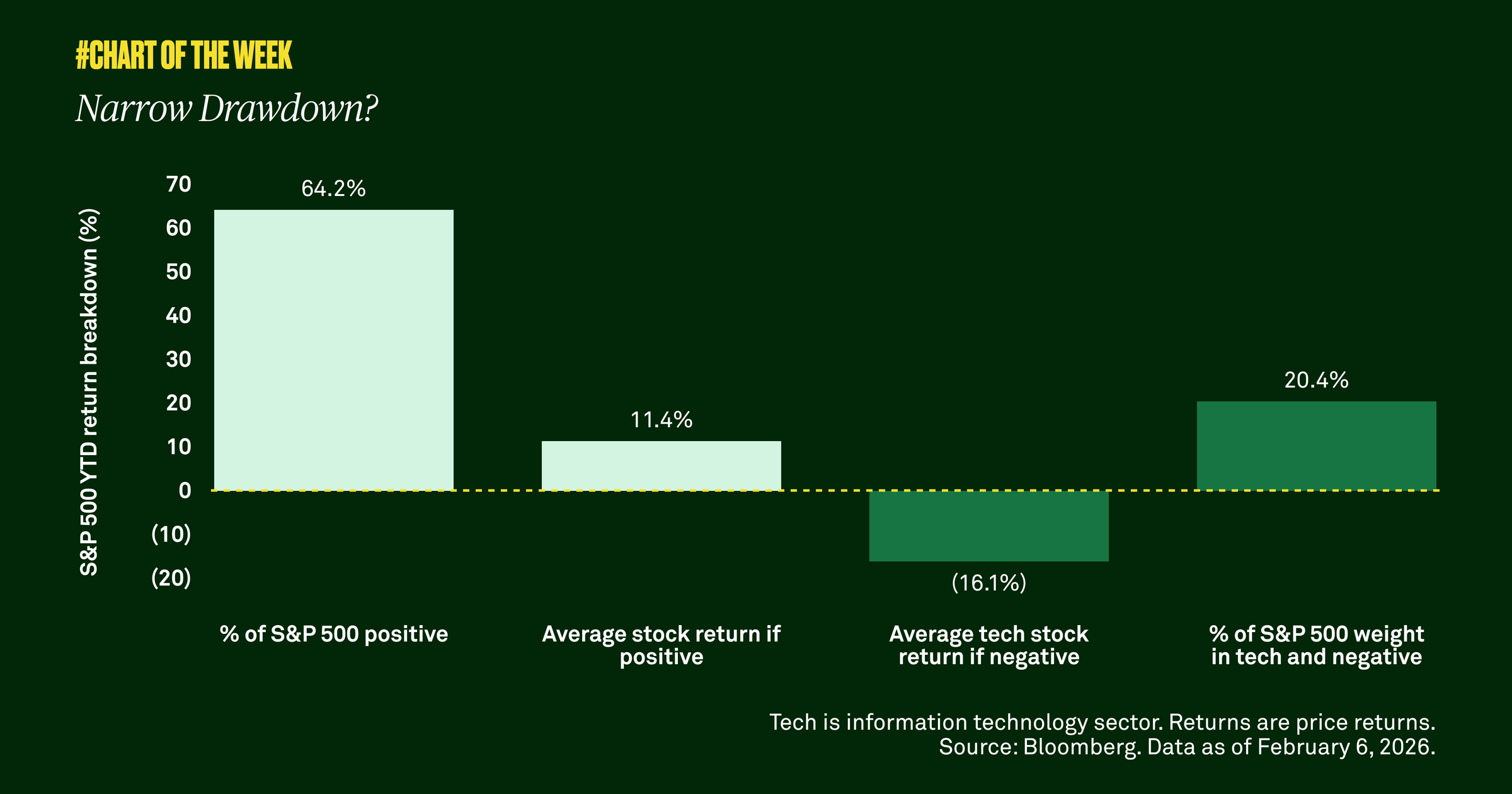

Narrow drawdown?

Equity volatility is rising, but all is not what it seems. The technology sector is weighing on the S&P 500 while value and cyclical stocks lead. A market rotation is underway as many investors begin to favor companies beyond tech.

Equity market volatility has heated up since late January, causing some to fear a more pronounced sell-off may be underway. However, we examined recent performance and found that mega cap technology stocks, which once held market leadership, are driving the decline. As an example, last week software stocks were hit hard because artificial intelligence improvements caused investors to reconsider the sector's competitive positioning and long-term value. Among all the negative performers in tech, the average stock is down 16%—and the entire tech sector accounts for more than 20% of the S&P 500’s weight.

It's not all bad news. Outside of tech, S&P 500 stocks are climbing. Sixty-four percent of those stocks are positive year to date, yielding an average return of 11.4% through February 6. The reason is a market rotation is underway— out of big technology stocks and into cyclical areas such as value stocks. In our view, this trend has legs.

Cyclical stocks tend to be more sensitive to fluctuations in the economy, and right now the U.S. economy is resilient. With market participation and earnings growth broadening beyond big tech, we remind clients of the importance of diversification—across market capitalizations, sectors and even geographies.

883536 Exp : 09 February 2027

YOU MIGHT ALSO LIKE

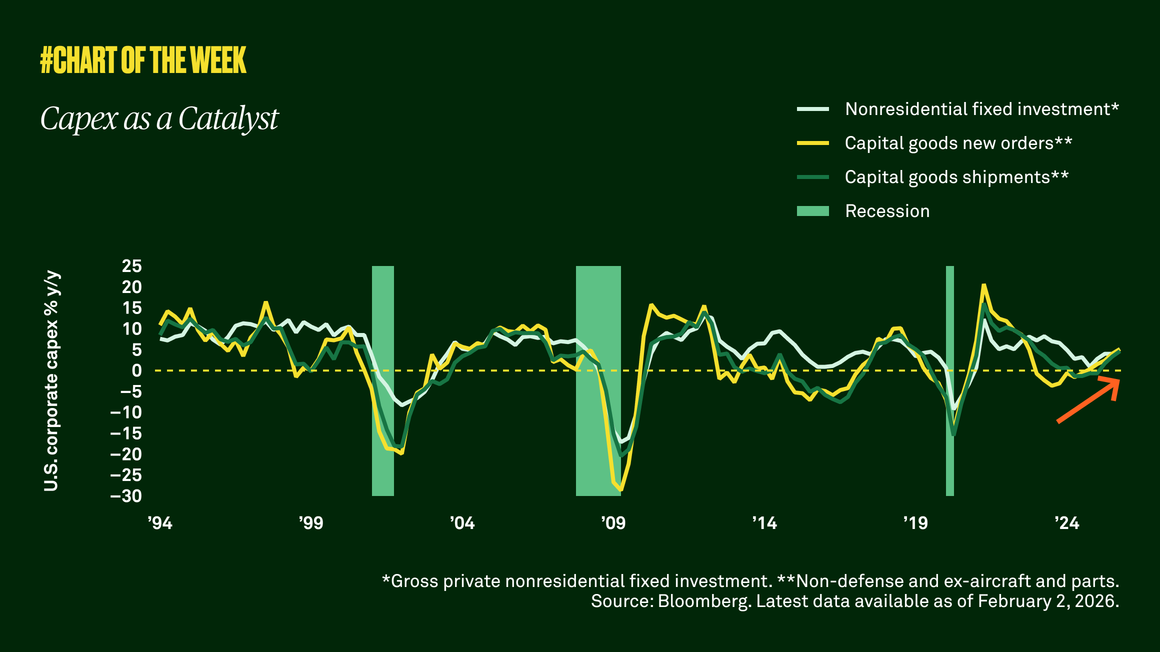

Capex as a catalyst

Capex as a Catalyst

Improved business confidence and recent tax legislation are compelling corporations to reinvest their cash flows in their businesses. We believe this is a positive signal for economic growth.

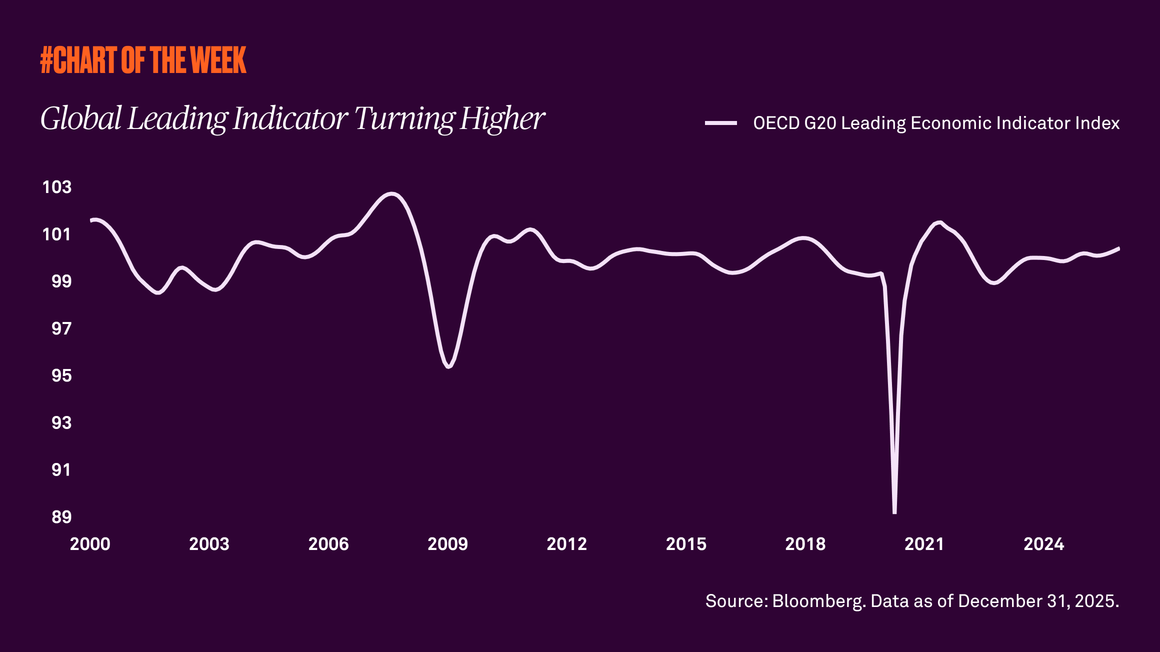

Headline volatility persists and yet the global growth outlook continues to improve. We examined a leading indicator, and why there is good cause to diversify equity holdings if you haven’t already.

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

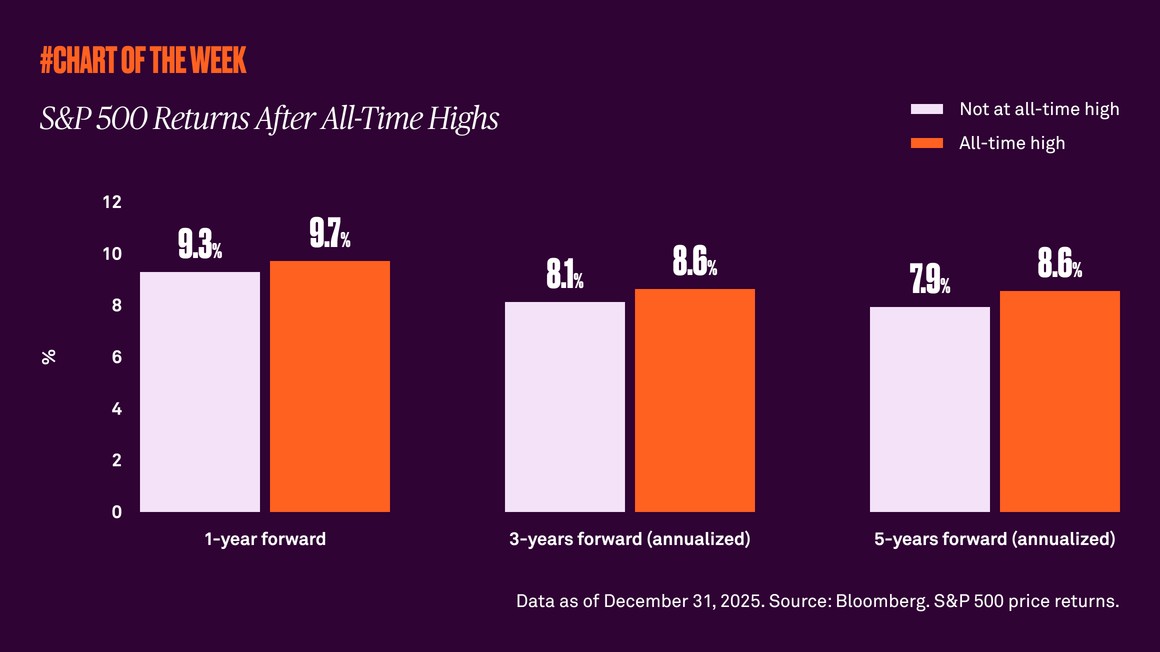

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.