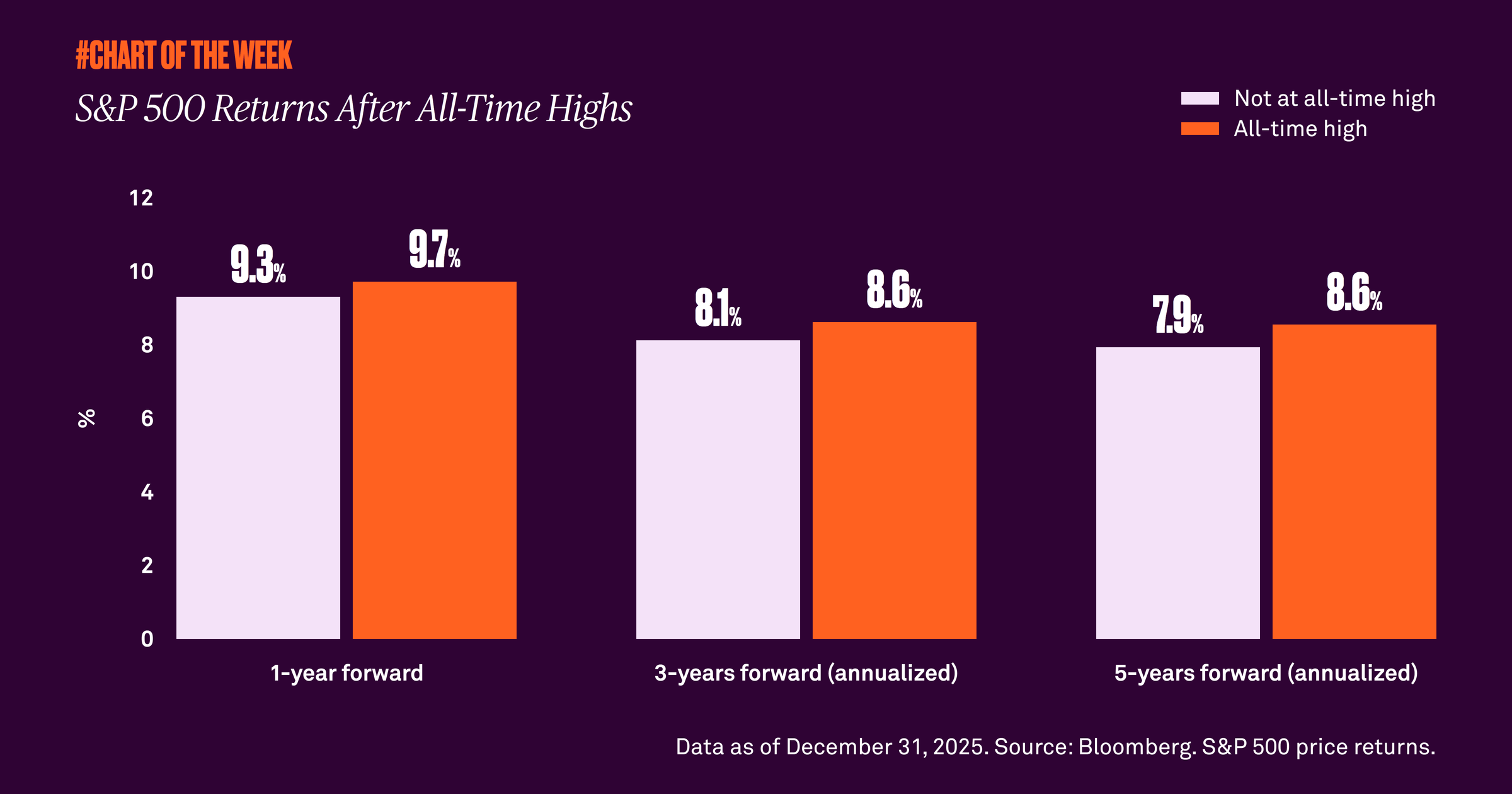

S&P 500 Returns After All-Time Highs

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

Last week, the S&P 500 set a record closing high that neared the still unbroached 7,000 level, after reaching a notable record of 39 all-time highs throughout 2025. Last year’s performance reflects the fifth most all-time highs in a year since 2000 and the 15th most in the entire history of the index.

However, when markets reach new highs, some investors become overly cautious and conclude that the market has hit a ceiling. It’s therefore important to recognize that historically, forward returns after new all-time highs are higher on average than those following other days.

This is a key reason why we advise investors to stay invested at all times, including now. Even when faced with headlines on matters such as geopolitics, the labor market and artificial intelligence capital expenditures, looking past the noise and keeping a long-term perspective is the best way to build wealth.

863965 Exp : 13 January 2027

YOU MIGHT ALSO LIKE

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

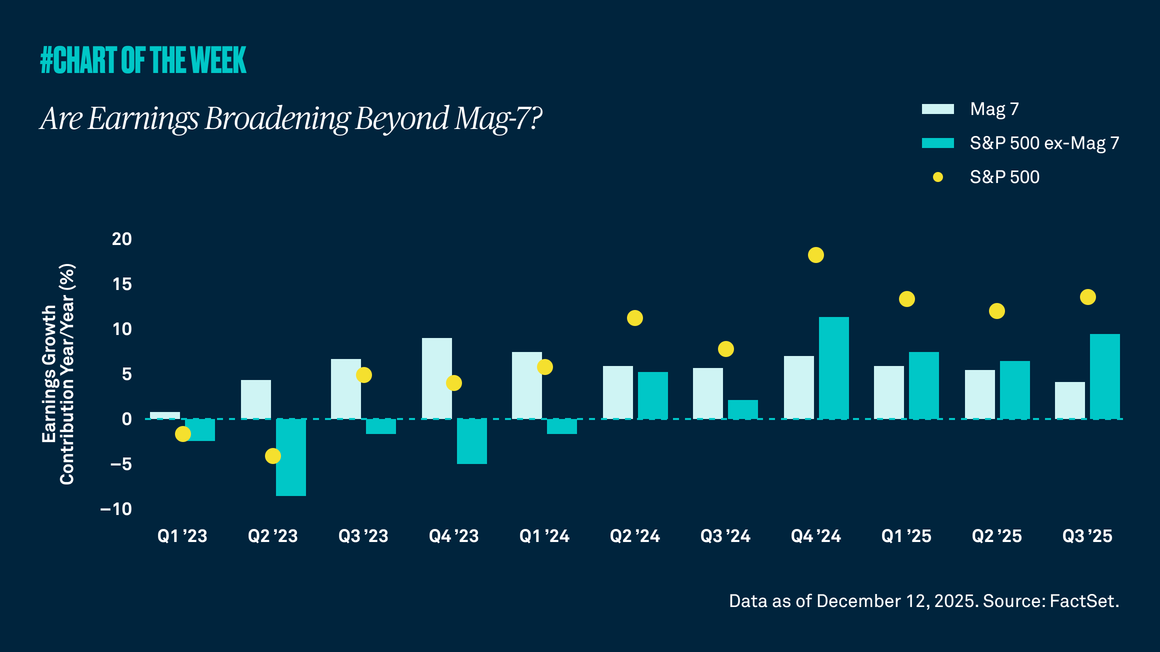

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

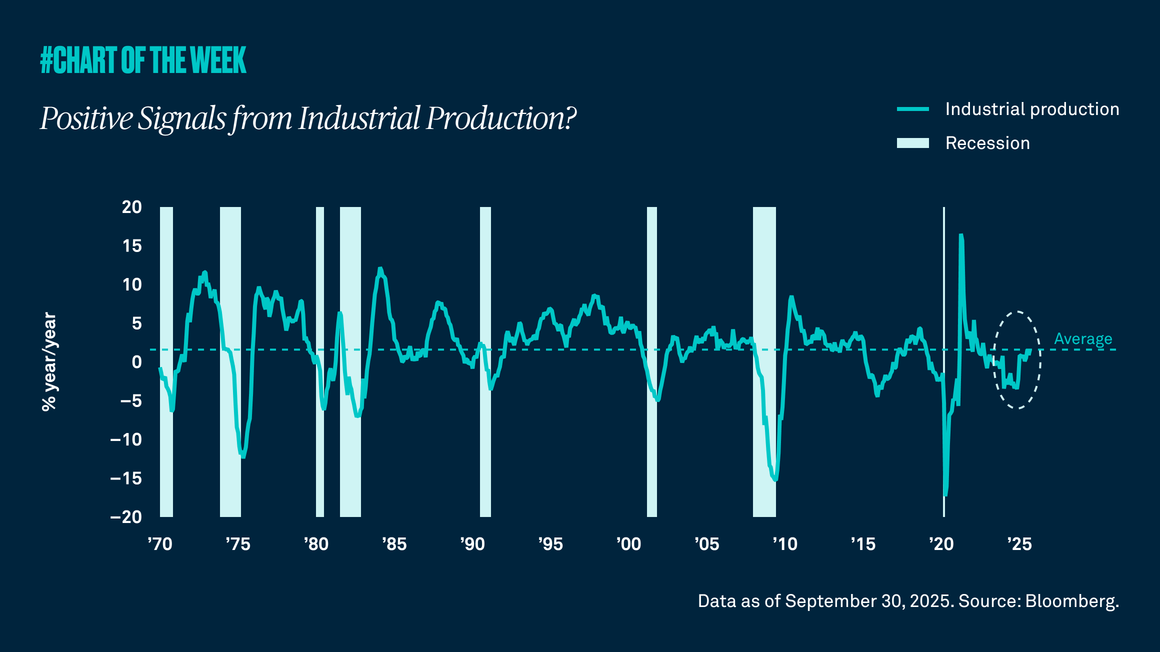

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.

After climbing 17% year to date through late October, the S&P 500 declined 5% through November 20. We believe the market was due for a healthy correction. While further downside is possible, it would not concern us.