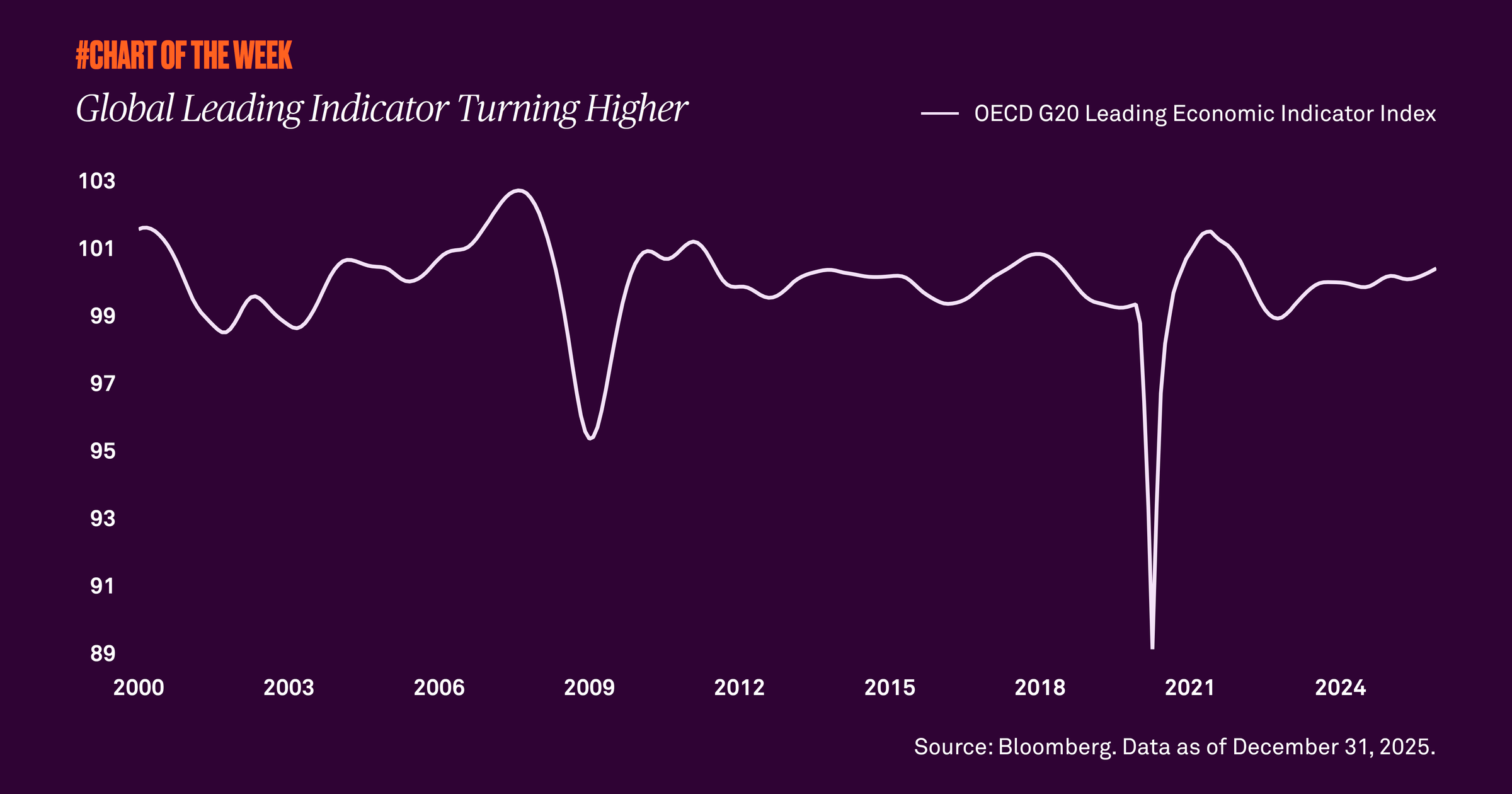

Global leading indicator turning higher

Headline volatility persists and yet the global growth outlook continues to improve. We examined a leading indicator, and why there is good cause to diversify equity holdings if you haven’t already.

Headline volatility has risen recently as geopolitics in different corners of the globe play out on the world stage. While these headlines have been a source of uncertainty, the global economic outlook for 2026 appears to be improving.

The Organisation for Economic Co-operation and Development operates as an international forum for democratic countries to promote economic growth. Its G20 Composite Leading Indicator Index, a proxy for global activity, has reached its highest level in three years. This means that some of the world’s largest economies are expected to experience growth near or above long-term trends. Historically, an improved outlook has led to positive equity returns across both developed and emerging markets.

What does this mean for investors? Despite these headlines, stocks have proven resilient with positive equity returns year to date across the major global equity indices. Given this improved outlook, we have recently recommended increasing exposure to international and emerging markets to capture potential upside. While we still favor U.S. equities, we believe global diversification will remain critical in the year ahead.

873882 Exp : 27 January 2027

YOU MIGHT ALSO LIKE

Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

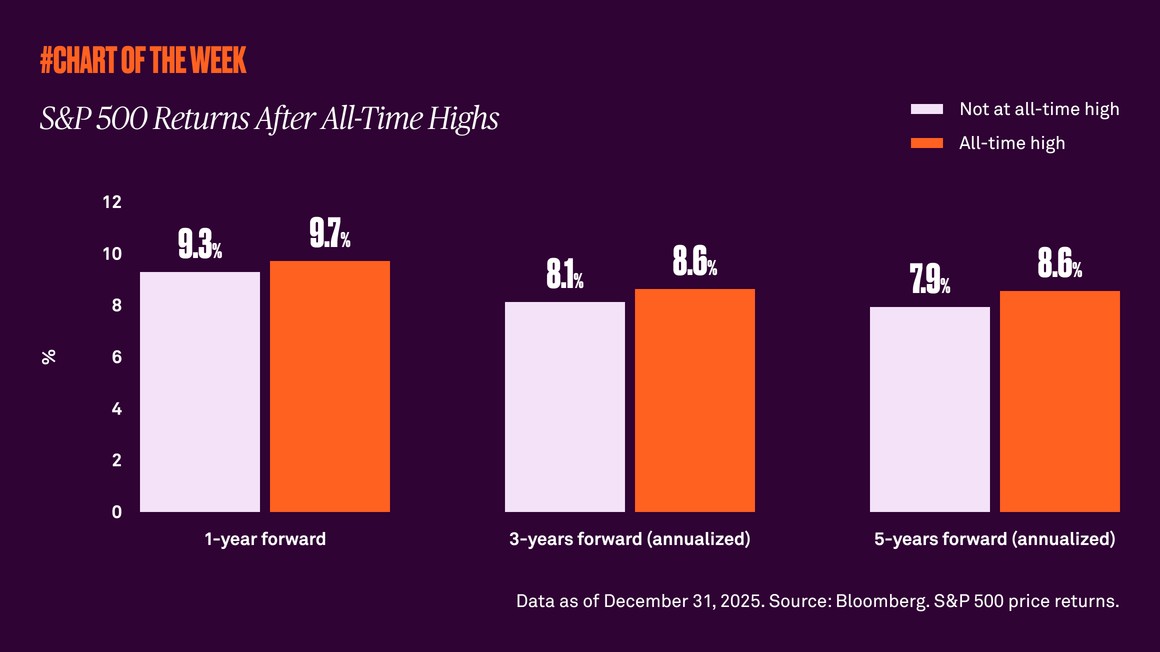

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

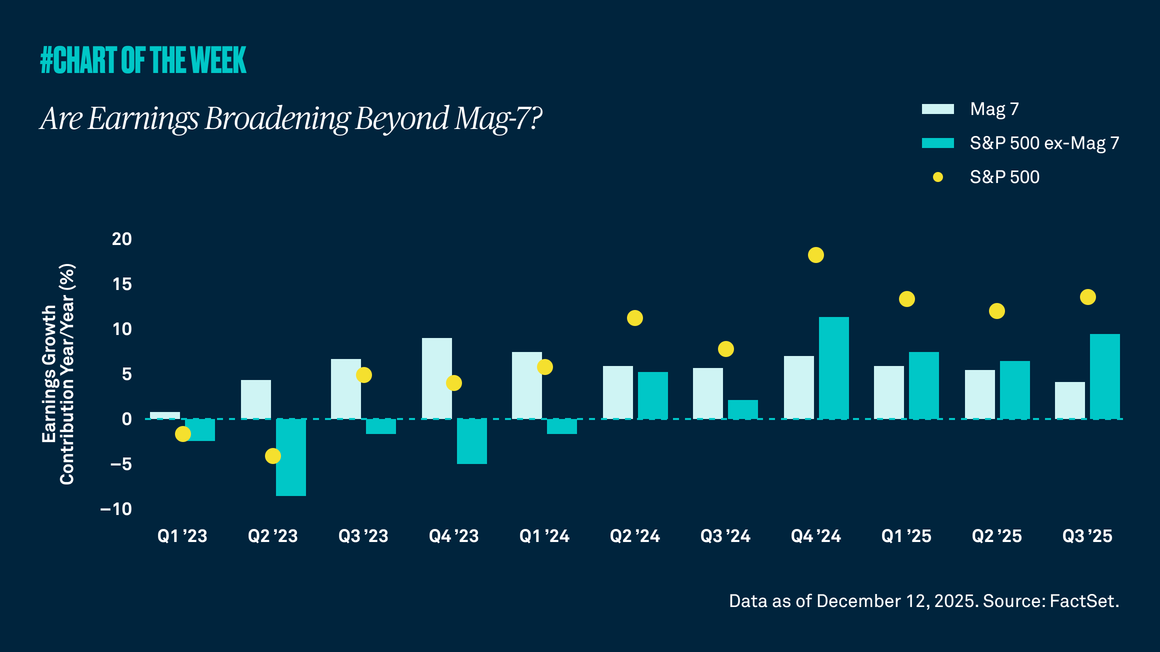

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

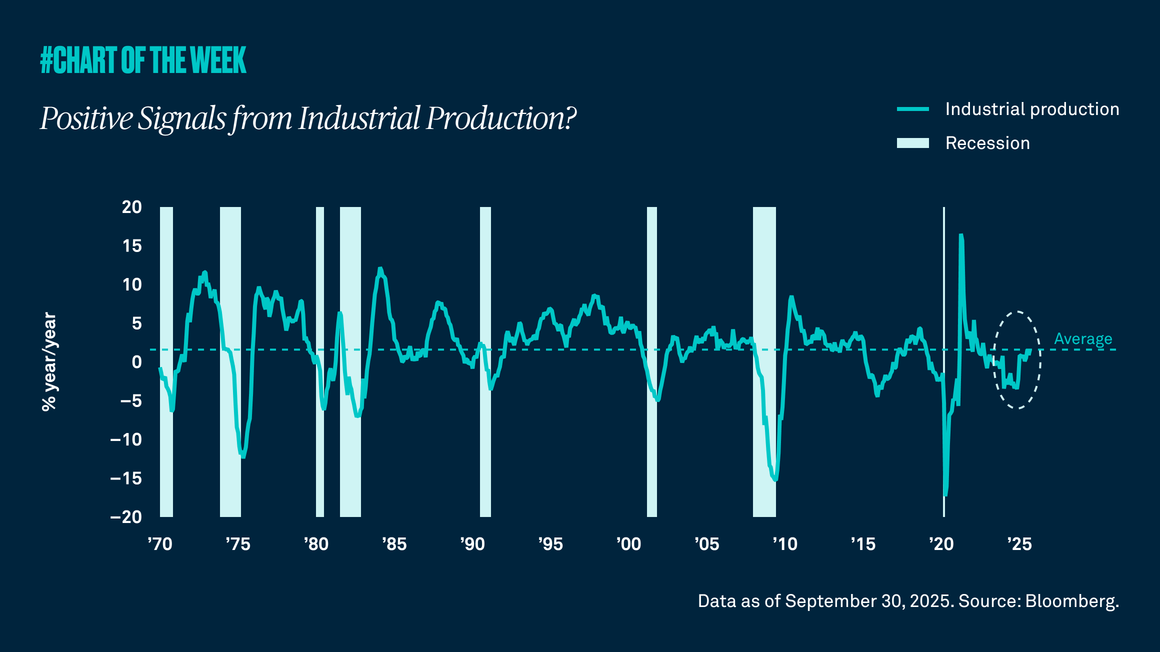

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.