The debt vs. growth dilemma: a multi-asset perspective

BNY Investments Newton multi-asset managers Simon Nichols and Janice Kim tour the US, Europe, UK and China, pinpointing how each market’s nuances are shaping their multi-asset strategy positioning.

Key points:

- Governments are juggling debt burdens and growth goals, requiring disciplined thematic research to assess short-term shocks against long-term trends.

- US tariffs could raise revenue and One Big Beautiful Bill Act could generate tax savings by year end, prompting bond overweight and a moderation in tech exposure.

- Europe is moving from austerity to stimulus, but political volatility and high debt could hinder growth.

- UK is facing limited fiscal headroom and rising long gilt yields with difficulty in cutting spending.

- China is contending with “involution”, demographics, property stress, and trade tensions, yet benefits from surplus savings, fiscal support and AI innovation.

Governments around the world are facing a shared challenge: how to balance mounting debt burdens with aspirations for growth. From the US’s tariff regime to Europe’s embrace of stimulus, the UK’s tightening gilt market and China’s structural recalibrations, this year has tested governments and investors alike.

To assess the materiality of these shifts on the investment landscape, we believe it is vital to have perspective. We find having a disciplined and thematic research process is crucial for perspective when weighing short-term events against long-term trends. This allows us to identify the disruptive influences and global themes that may impact economies and companies – and act accordingly.

Here we break down the some of the shifting dynamics in key economies and explain how these are influencing the multi-asset team’s investment thinking.

US: a ‘carrot and stick’ approach

On one hand, the post-Liberation Day tariffs have dramatically raised average import duties, from roughly 2.5% at the start of the year to nearly 19% by August1. Bond investors are factoring in tariff revenues as a potential salve for federal debt2 and by some estimates, tariffs could raise a half a trillion dollars in incremental revenues, which would help to offset the near $2 trillion deficit3.

On the other hand, the One Big Beautiful Bill Act (OBBBA) has granted corporations accelerated capital-expenditure write-offs and more generous interest-expense deductions, creating an estimated $300bn in tax savings by year-end4.

Large US companies have, so far, maintained margins, reconfigured supply chains and internal efficiency drives. Yet warnings from retailers such as Walmart suggest input-cost pressures are mounting, and consumers may soon feel the pinch.

We have been incrementally adding to government and investment-grade bonds since the 2022–23 correction, attracted by higher real yields while remaining vigilant on inflation and fiscal sustainability risks.

In equities, we have moderated our exposure to the mega-cap technology stocks. Magnificent Seven names account for about 10% of both the growth and balanced strategies’ assets.

Europe: spending plans collide with political volatility

After decades of strict budgetary rules, European Union (EU) policymakers are striving for investment-led growth. In March, Germany announced a €500bn package targeting infrastructure and defence. Yet France’s recent government collapse5 has shown that ambitious spending plans can collide with political volatility.

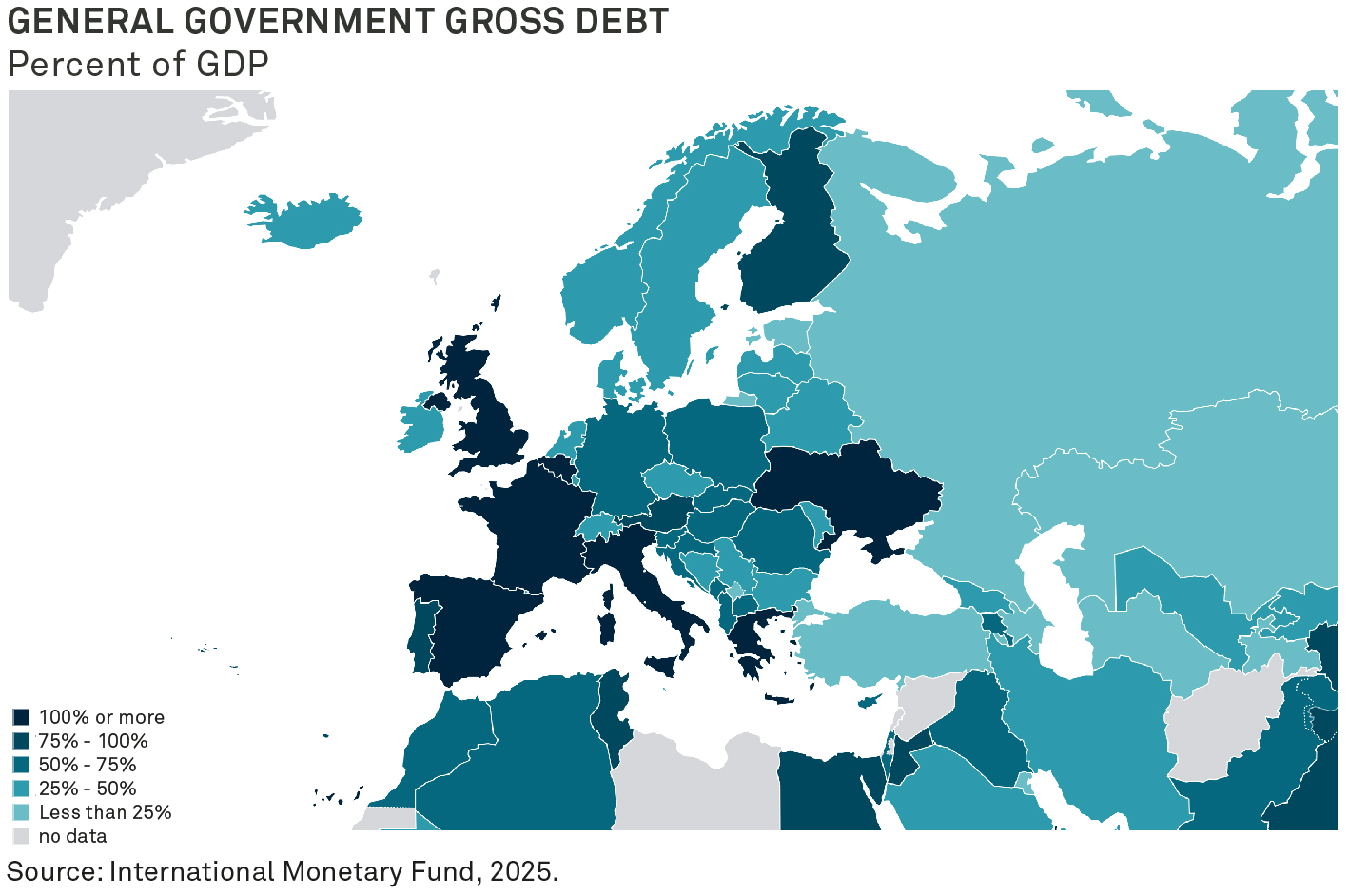

While there is optimism that the EU could move away from decades of fiscal constraint and achieve higher GDP growth, many countries face high debt-to-GDP levels. This raises questions about the region's ability to finance its ambitious new growth strategies.

Europe’s push for greater strategic autonomy in trade and defence may well position winners among industrial names. Our equity allocations in the region include Siemens and Schneider Electric, which we believe stand to gain from Europe’s structural emphasis on energy efficiency and resilience.

UK: limited fiscal headroom and rising yields

The lead-up to November’s Budget is characterised by limited fiscal headroom and rising yields on long-dated debt – the latter driven by quantitative tightening and evolving pension-fund demand.

Policy U-turns on spending cuts6 highlight how difficult it is to cut government spending in the absence of a crisis, even when faced with an ageing population and elevated health and social-care costs.

In equities, we maintain a preference for high-quality companies that we believe can weather a higher-for-longer interest-rate environment and deliver steady cashflows amid fiscal uncertainty.

China: headwinds and tailwinds

China’s policymakers face a distinct set of headwinds. So-called “involution” – excess capacity, compressed margins and deflationary pressures – has weighed on corporate returns and consumer confidence. We've seen this deflation being exported outside of China. For example, Chinese car brands like BYD are becoming an increasingly common sight on UK roads.

Having an ageing population and a workforce set to shrink by nearly a quarter over the next 25 years also compounds the challenge. Meanwhile, property-sector stresses and lingering trade tensions with the US add further uncertainty.

Yet there are positives. Corporate and household savings remain elevated, and the government has signalled willingness to deploy additional fiscal support to meet its 5% growth target. Innovation around artificial intelligence has accelerated, with Chinese firms making strides even amid semiconductor export controls.

Chinese equities have rallied roughly 25% year-to-date on a forward P/E of 13 times and still trade at an apparent discount to developed-market peers. As such, our growth-oriented portfolios have modestly increased exposure to select Chinese names, focusing on domestically oriented leaders in technology and consumption.

Aligning interests

Against a backdrop of central-bank scrutiny, tariff tensions, demographic headwinds and ambitious stimulus, the BNY Investments Newton multi-asset team’s combination of increased bond allocations, selective equity tilts and disciplined valuation thresholds, reflects both the opportunities and risks presented by global policy shifts.

By using our multi-dimensional research platform, we aim to align asset allocation with each region’s fiscal trajectory in the pursuit of resilient, long-term outcomes in an environment defined by fiscal crosswinds.

The value of investments can fall. Investors may not get back the amount invested.

1BBC.co.uk. How much cash is the US raising from tariffs? 31 July 2025.

2FT.com. Bond investors count on Trump tariff revenues to rein in US debt. 4 September 2025.

3Barrons.com. The U.S. Deficit is Nearly $2 Trillion Now. 11 September 2025.

4Source: Newton estimates, 2025.

5FT.com. French government collapses as PM François Bayrou loses confidence vote. 8 September 2025.

6BBC.co.uk. The benefits U-turn raises questions about the credibility of Labour’s long-term plan. 28 June 2025.

RELATED FUNDS

Easy access to our funds and related content

BNY Mellon Multi-Asset Income Fund (UK domiciled)

BNY Mellon Multi-Asset Balanced Fund (UK domiciled)

BNY Mellon Multi-Asset Moderate Fund (UK domiciled)

BNY Mellon Multi-Asset Diversified Return Fund (UK domiciled)

2774952 Exp : 01 May 2026

YOU MIGHT ALSO LIKE

BNY Investments Newton Portfolio Manager and Quantitative Analyst Paul Byrne walks through why active volatility management is essential for positioning in the new risk reality.

Paul Flood, Head of Mixed Assets Investment at BNY Investments Newton, examines six prospective investment catalysts for 2026 and underscores the significance of diversification across asset classes, regions, and sectors.

Newton Portfolio Manager and Quantitative Analyst Paul Byrne explains his path to investment management and the importance of multi-dimensional research against a backdrop of increasing concentration risks.

BNY Investments Newton’s Global Real Return portfolio manager, Lars Middleton, discusses the value of risk overlay strategies in an era of tightening market correlations and unprecedented idiosyncratic risks.