The Active Volatility Imperative: Building Resilience in Multi-Asset Portfolios

BNY Investments Newton Portfolio Manager and Quantitative Analyst Paul Byrne walks through why active volatility management is essential for positioning in the new risk reality.

BNY Investments Newton Portfolio Manager and Quantitative Analyst Paul Byrne walks through why active volatility management is essential for positioning in the new risk reality.

Key Takeaways:

- Active volatility management helps control downside risk without sacrificing upside potential.

- In today’s uncertain markets, volatility-managed portfolios provide a path to smoother long-term returns.

- An active, multi-dimensional approach to risk management offers potential benefits including greater diversification, compared with passive peers.

Downside Protection, Upside Retention

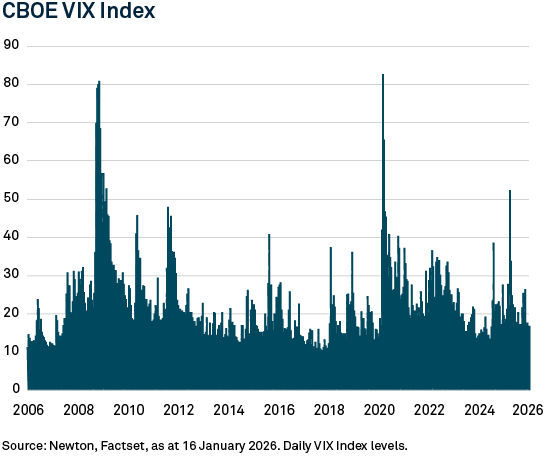

The post-2020 market regime has been defined by extreme volatility swings. While the CBOE Volatility Index (VIX) has calmed very recently, 2025 was one of the most volatile years on record with sharp spikes including a VIX peak above 60 amid the April tariff shocks.

This new risk reality is in sharp contrast to the previous decade which saw the VIX consistently in the low teens. We believe market conditions necessitate a dynamic risk approach, for which volatility-managed portfolios have clear benefits, particularly with respect to actively managed, multi-asset strategies, which can scale exposures and dynamically de-risk when asset classes are moving in tandem.

Volatility-managed funds have long been touted as a means of producing higher Sharpe ratios (returns per unit of risk). We argue that the frequency and magnitude of spikes further justifies the need for a path to smoother returns, and volatility-managed funds have demonstrated clear benefits, by producing higher Sharpe ratios and larger alphas while minimising tail-risk.1

Here’s How

When markets are calm, volatility-managed strategies increase exposure, sometimes using leverage, so the portfolio is positioned to capture more upside. With increased volatility, the strategy reduces exposure – shifting allocations to safer assets classes to buffer potential losses during market crashes or drawdowns.

In today’s markets, successful implementation in multi-asset, volatility-managed investing depends upon two things:

- A robust framework to identify risks. We rely on a multi-dimensional, consistent process—combining thematic insights, bottom-up fundamentals, quantitative analysis, and investigative research — to actively manage risk within a targeted risk rating category while pursuing enhanced risk-adjusted returns.

- Direct investment capability and the flexibility to adapt. Directly holding securities allows active managers to gain intimate knowledge of true underlying risks and allows for quick, tactical adjustments to reduce exposure during sharp market corrections. Active managers can also dynamically rebalance to exploit shifting asset class correlations without sacrificing the long-term return potential of individual asset classes.

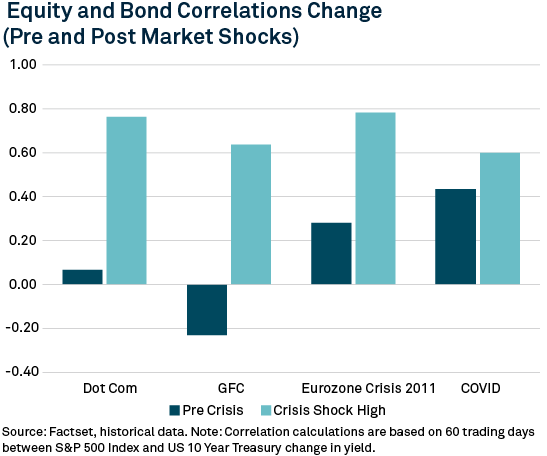

Active volatility managers can adapt to market changes in a structured risk-targeted way. By contrast, a fixed weight approach to asset allocation assumes static volatilities and market correlations, which can result in outsized market losses for classic 60/40 portfolio composites, as was the case in 2022 when both equities and fixed income declined simultaneously.

Smoother returns, reduced drawdowns

Volatility-managed funds can deliver smoother, improved long-term returns and reduce drawdowns in environments with frequent volatility spikes. Portfolios which experience larger drawdowns can see slower long-term growth despite market recoveries because drawdowns force a recovery at a much lower base. For those with a longer-term investment horizon, limiting losses is vitally important as it can lead to greater compounding of returns over market cycles.

An active, volatility-managed approach aims to help smooth returns and actively manage risk in times of heightened volatility, which we believe markedly reduces portfolio drawdowns. Proactive risk oversight can produce shallower losses and provide investors with greater comfort that risks are being dynamically addressed. This builds confidence that long-term returns are being pursued in a holistic manner, within a framework based on analysis and accountability.

The current market landscape is being shaped by ever-increasing risks, caused by a range of drivers. In our view, a multidimensional research approach better positions active managers to identify and manage future risks proactively, allowing for smoother, more consistent return profiles.

Dynamic risk adjustment: the active advantage

An active, multidimensional approach to risk management offers potential benefits compared with passive peers. Active volatility management more precisely targets and controls portfolio risk by dynamically scaling overall exposure rather than relying on fixed asset-class weights, which passively accept whatever risk the market delivers.

This approach allocates capital to seek greater risk efficiently, responding quickly to reduce risk during times of market chaos while opportunistically increasing risk in high-conviction areas for greater potential long-term returns.

Market volatility is just one factor facing investment managers today. As asset classes increasingly move in tandem and we see concentration of tech stocks rise to unprecedented levels, the need for diversification is paramount. Passive approaches are particularly vulnerable to sudden shifts in asset-class correlations, which can cause amplified portfolio losses precisely during periods of market stress—when capital preservation matters most.

To illustrate, below are the correlations of bonds and stocks from the last 20 years of notable market shocks. Where -1 represents perfect opposites and +1 is perfectly in sync. Bonds and stocks offer strong diversification benefits during pre-crisis “normal” market conditions. However, these benefits begin to disappear in times of crisis shocks-when investors need it most.

In an era of elevated volatility, greater concentration risks, and more extreme drawdowns during periods of market stress, active volatility multi-asset managers can provide clear benefits for investors facing increasingly correlated and concentrated market risks. Strategies with a robust framework and capability to adapt quickly can provide real-world diversification and resilience, to mitigate risk without sacrificing upside potential.

The value of investments can fall. Investors may not get back the amount invested.

1 Alan Moriera and Tyler Muir. 2017. “Volatility Managed Portfolios.” The Journal of Finance. Access at: onlinelibrary.wiley.com on 16 December 2025.

RELATED CAPABILITIES

RELATED FUNDS

Easy access to our funds and related content

BNY Mellon FutureLegacy 5 Fund (UK domiciled)

BNY Mellon FutureLegacy 7 Fund (UK domiciled)

3006753 Exp : 31 July 2026

YOU MIGHT ALSO LIKE

Paul Flood, Head of Mixed Assets Investment at BNY Investments Newton, examines six prospective investment catalysts for 2026 and underscores the significance of diversification across asset classes, regions, and sectors.

BNY Investments Newton multi-asset managers Simon Nichols and Janice Kim tour the US, Europe, UK and China, pinpointing how each market’s nuances are shaping their multi-asset strategy positioning.

Newton Portfolio Manager and Quantitative Analyst Paul Byrne explains his path to investment management and the importance of multi-dimensional research against a backdrop of increasing concentration risks.

BNY Investments Newton’s Global Real Return portfolio manager, Lars Middleton, discusses the value of risk overlay strategies in an era of tightening market correlations and unprecedented idiosyncratic risks.