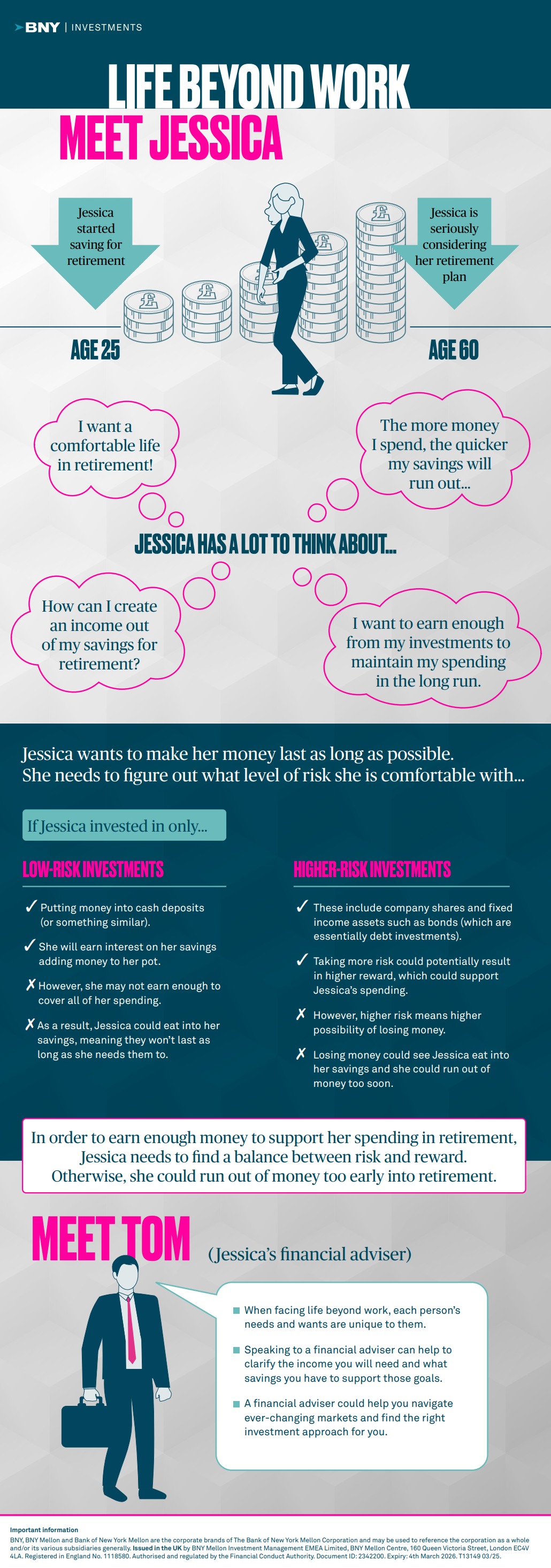

Striking the balance between risk and reward (end-client ready)

When planning for retirement each person’s needs and wants are unique to them. In this infographic, designed to be used with your clients, we meet Jessica, a 60-year-old who is considering her retirement options and seeking to strike the right balance between risk and reward for her future planning.

2342800 Exp : 04 March 2026

YOU MIGHT ALSO LIKE

Have you considered how you would like to spend your retirement, and how much it might cost? It’s a tricky question to answer, but Pensions UK in conjunction with Loughborough University has created the Retirement Living Standards* framework to help you answer exactly that! When considering how much you will need, Pensions UK has categorised the cost of retirement into three possible standards of living – minimum, moderate and comfortable.

The four pots of retirement (end-client ready)

The fours pots of retirement (end-client ready)

Facing retirement can be overwhelming for many clients. Despite the excitement of slowing down to enjoy a life free of work-related responsibilities – it also creates a lot of upheaval in a person’s life and routine. Amongst the many questions that arise – how can I begin to plan my finances in retirement? – is a common query. To help answer this, we have created an infographic, designed to be used with your clients, where we have suggested how a client could divide their retirement finances into four separate pots.

This 5 Ws infographic explains the what, who, why, when and where of active management in retirement.

For many clients, a happy retirement looks like a long stretch of time in which they have the freedom to strive towards their life beyond work goals. To meet those goals, clients will likely want their money to stretch as far as possible. In this infographic, designed to be used with your clients, we assess how inflation could factor into your clients’ plans and impact their purchasing power.