The Strength of Infrastructure

2025 was a strong year for infrastructure and we expect momentum to continue in 2026. In an environment marked by heightened geopolitical risk, elevated inflation, and narrow equity leadership, we see global infrastructure as an effective hedge against these challenges. Infrastructure can also provide a differentiated way to participate in growth opportunities. We believe the asset class is well-positioned to benefit from durable long-term tailwinds like continued government spending and AI-driven demand for data centers and power.

Building In Diversification

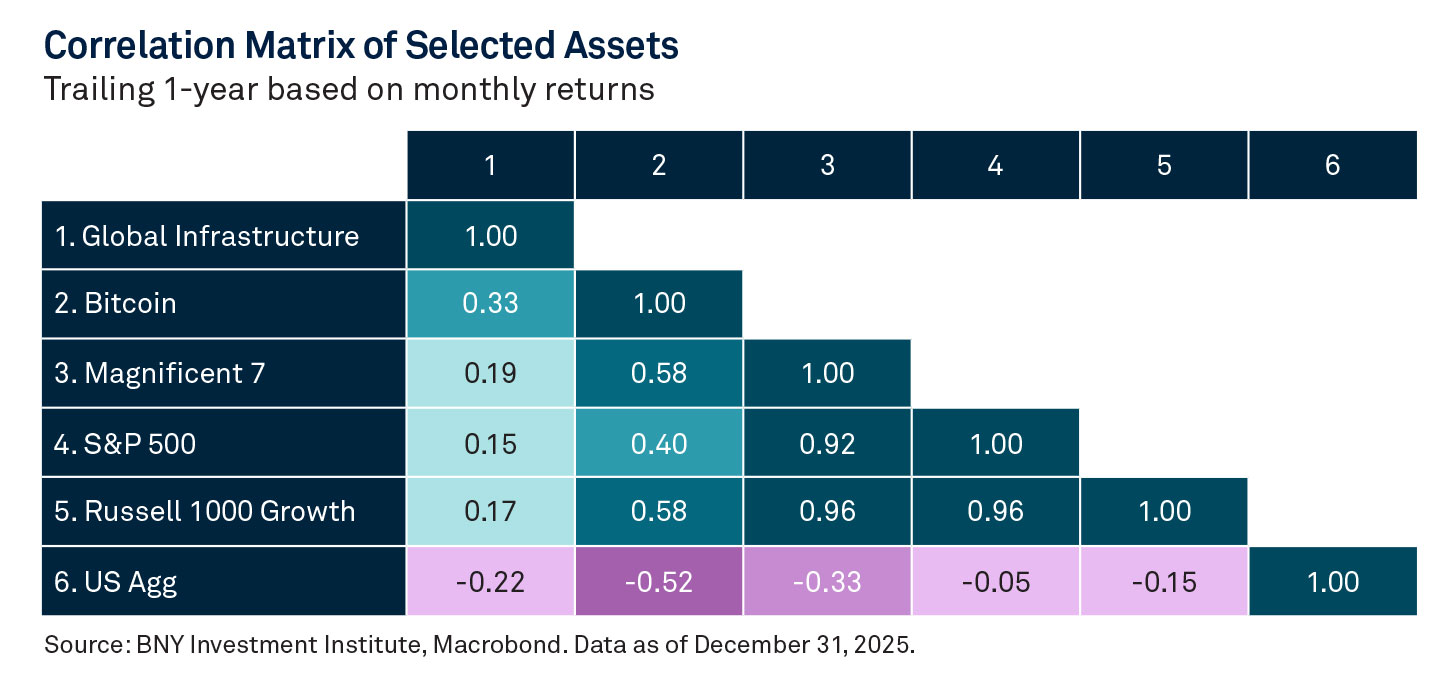

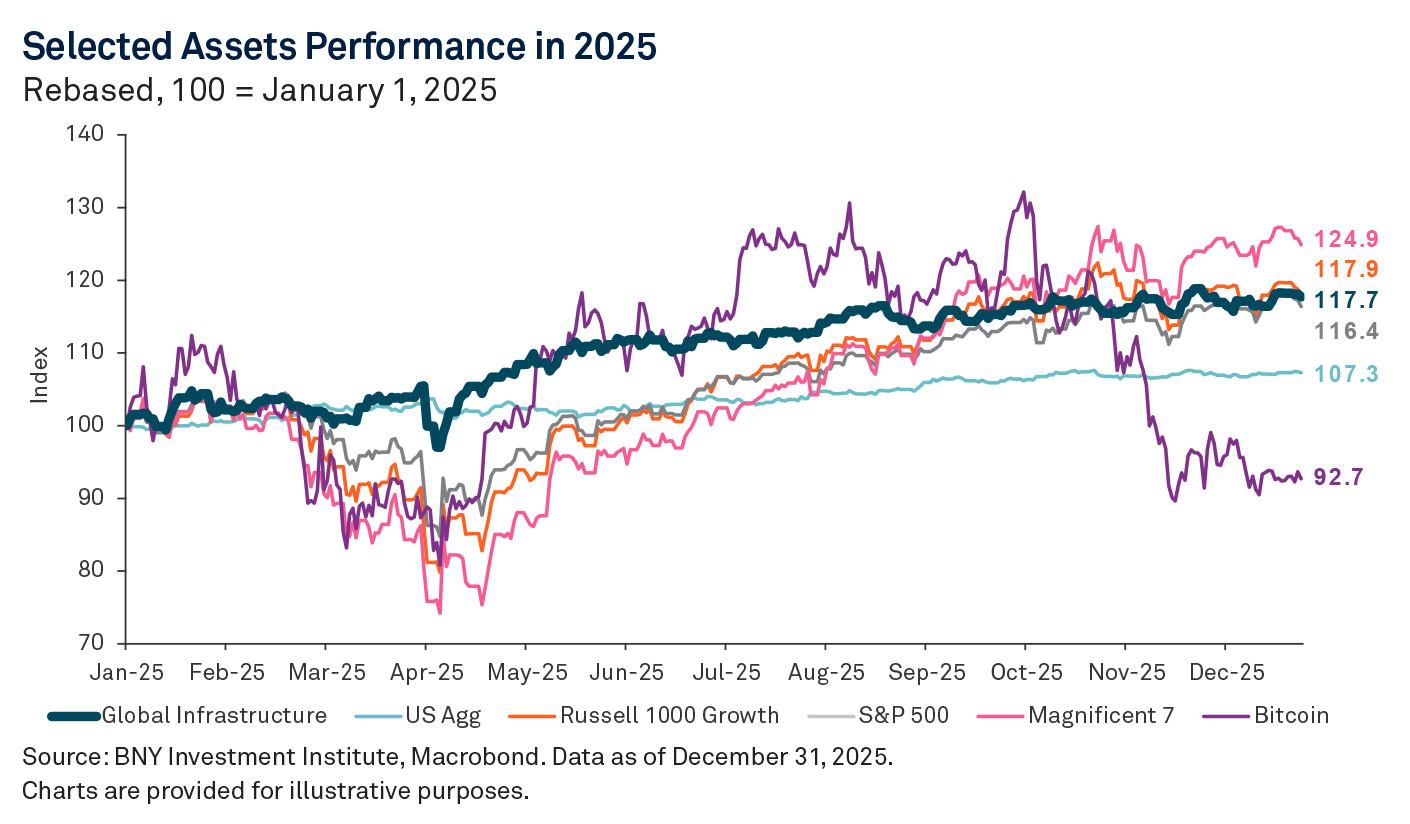

Global infrastructure’s historical low correlation to the Magnificent 7 and major equity indices, as well as its negative correlation to traditional bonds, supports diversification and expands investment opportunities. Exposure to global infrastructure may help broaden equity and geographic exposure, limit reliance on a narrow group of companies, and aid in mitigating risk.

A Smoother Ride

In addition to lower correlation, we believe global infrastructure’s steady income streams and inflation-linked revenues could boost performance. Last year, global infrastructure delivered steady gains, finishing solidly higher and with much lower volatility than the S&P 500 and Bitcoin. A more stable return profile can help reduce overall volatility and improve risk-adjusted outcomes.

This is an extract from Checkpoints, a comprehensive monthly chartbook that provides insights into major themes affecting financial markets. For additional analysis, read the full report.

GLOSSARY

Artificial intelligence (AI) refers to computer systems that can perform tasks typically requiring human intelligence, such as visual perception, speech recognition, decision-making, and language translation.

Bitcoin is a decentralized digital currency that uses blockchain technology to enable peer-to-peer transactions without the need for a central authority like a bank or government.

Global Infrastructure: The S&P Global Infrastructure Index is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability.

Magnificent 7 refers to the following seven stocks: Nvidia, Meta, Tesla, Amazon, Alphabet, Apple, and Microsoft.

Russell 1000 Growth: The Russell 1000 Growth Index measures the performance of the large cap growth segment of the US equity universe.

S&P 500: The S&P 500 is an index designed to track the performance of the largest 500 US companies.

US Aggregate: Bloomberg US Agg Total Return Value Unhedged USD Index is a widely accepted, unmanaged total return index of corporate, government and government-agency debt instruments, mortgage-backed securities and asset-backed securities with an average maturity of 1–10 years.

An investor cannot invest directly in any index.

IMPORTANT INFORMATION

IN THE UNITED STATES: FOR GENERAL PUBLIC USE.

IN ALL OTHER JURISDICTIONS: FOR INSTITUTIONAL, PROFESSIONAL, QUALIFIED INVESTORS AND QUALIFIED CLIENTS.

The information contained herein reflects general views and is provided for informational purposes only. This material is not intended as investment advice nor is it a recommendation to adopt any investment strategy.

Opinions and views expressed are subject to change without notice.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. ISSUING ENTITIES

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: • United States: by BNY Mellon Securities Corporation (BNYSC), 240 Greenwich Street, New York, NY 10286. BNYSC, a registered brokerdealer and FINRA member, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Investments firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue Eugène Ruppert L-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • South East Asia and South Asia: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manage and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario. All issuing entities are subsidiaries of The Bank of New York Mellon Corporation.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

© 2026 THE BANK OF NEW YORK MELLON CORPORATION

MARK-874040-2026-01-27

GU-788 Exp : 15 April 2026

YOU MIGHT ALSO LIKE

With the S&P 500® hitting new highs, investors question if fundamentals or hype is fueling the rally. Despite uncertainty, the S&P 500 has delivered strong performance year to date. Its price-to-earnings (PE) ratio now sits at 22x above the nearly 17x long-term average. To some, that screams “overvalued,” but context matters.

BNY Investments Newton’s investment strategists Brian Blongastainer and Carolina Ortega explain why they expect to see a major acceleration in global infrastructure spending over the next decade, driven by new investment opportunities fuelled by the growth in artificial intelligence (AI).

As Europe boosts defence spending in response to rising geopolitical tensions, the technological transformation of warfare is changing how that money is spent, writes Walter Scott investment manager Connor Graham. Now it’s more cybersecurity and sensors and fewer bombs and bullets.