Key Takeaways

- Cryptocurrency has evolved into a multi-trillion-dollar market.

- Innovation is reshaping financial services and other industries.

- The GENIUS Act clarifies stablecoin regulation and reinforces the U.S. dollar’s role.

- Institutional adoption is strengthening.

Introduction

Cryptocurrency has evolved from a small-scale experiment into a multi-trillion-dollar global market. Bitcoin’s debut in 2009 sparked a movement that has grown into an ecosystem of digital assets, decentralized finance and blockchain-powered innovation. Understanding where crypto came from, where it stands today and where it may be headed is essential. This article dives into the market’s history, adoption, innovations and regulations — exploring both its promise and its effect on the broader financial system.

The Past, Present and Future of the Crypto Market

Crypto’s origins date back to early digital cash experiments like David Chaum’s “eCash” and Wei Dai’s “b-money,” but the true breakthrough came in 2009 with the launch of Bitcoin, created by the pseudonymous Satoshi Nakamoto. In 2015, the Ethereum Foundation launched the Ethereum blockchain, which introduced “smart contracts” — self-executing programs that allow for automated, programmable transactions on the blockchain. Smart contracts enabled decentralized applications and expanded the market’s scope beyond payments. Together, Bitcoin and Ethereum gave rise to a peer-to-peer payment system that could operate without a central authority.

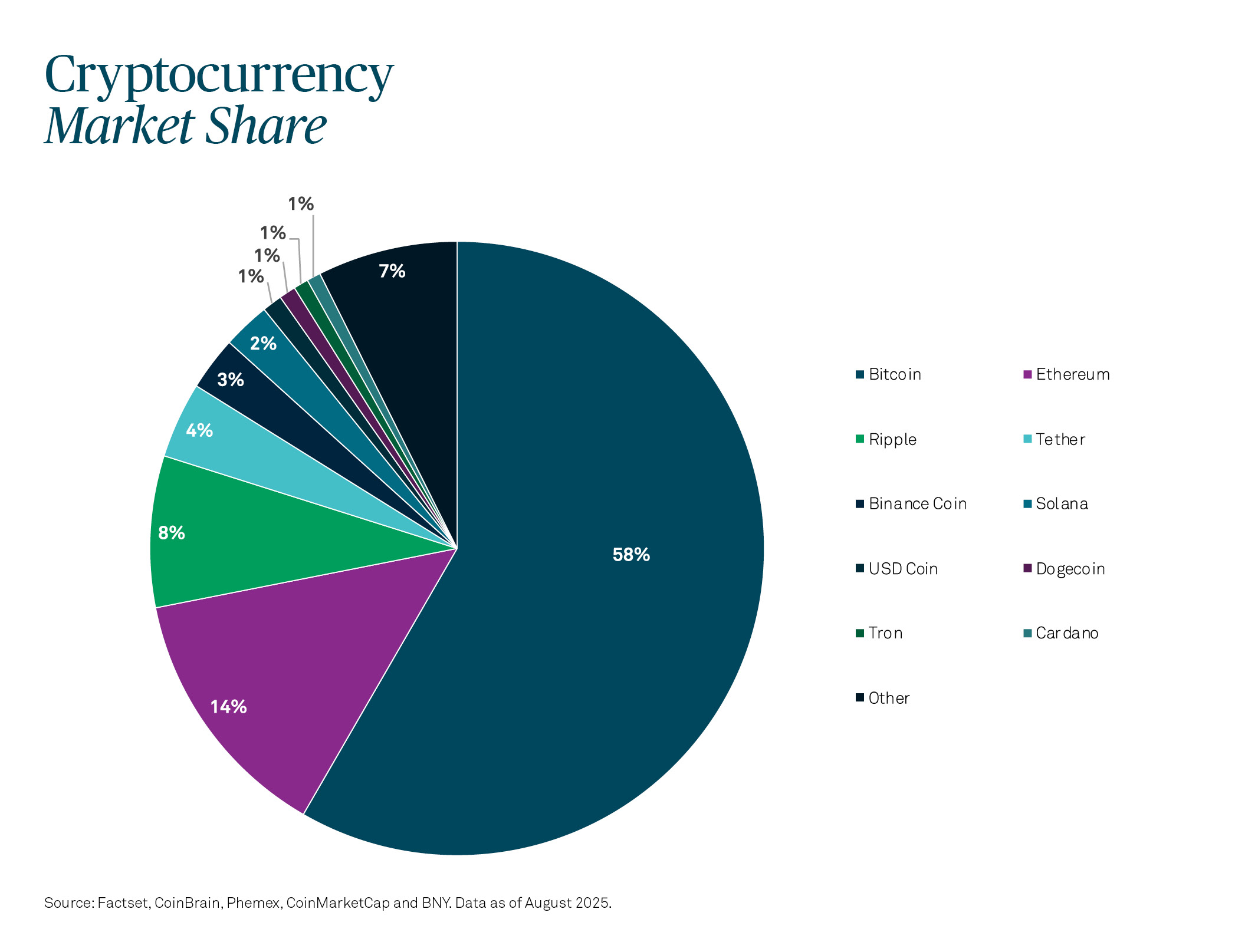

While crypto has evolved into a multi-trillion-dollar asset class, it continues to exhibit significant volatility. The year began with a total market capitalization of approximately $3.8 trillion, which declined to $2.8 trillion in the first quarter due to equity market volatility before rebounding to more than $4 trillion in the same quarter. Record inflows into Bitcoin and Ethereum exchange-traded funds (ETFs) drove a recovery. As shown below, Bitcoin and Ethereum represent nearly three-quarters of the crypto market’s total capitalization. Institutional participation has expanded markedly, with leading firms reporting annual trading volumes in the hundreds of billions of dollars and several pursuing public listings, underscoring the sector’s growing acceptance within the broader investment community.

Looking ahead, it appears that three forces will define the future of crypto: increasing institutional participation, clearer regulation and continued technological innovation. Growth is expected to be driven less by speculative cycles and more by institutional adoption — through investment products, corporate use cases and integration into financial infrastructure. From a niche experiment to a global movement, crypto is evolving into both an asset class and a technological framework that could define the next phase of digital markets.

The Adoption Phase – Momentum in the Early Innings

Crypto is poised to enter mainstream relevance. More than 560 million people worldwide, about 6.8% of the global population, own some form of cryptocurrency. In the U.S., Pew Research indicates 17% of adults have invested in the crypto market, with the largest share of holders falling with those ages 25 to 35. Notably, adoption often follows price trends: when Bitcoin surges, new users tend to follow.

This growth is also reflected in transaction value. As of 2024, combined spot and futures trading volumes reached roughly $150 trillion, essentially doubling 2023’s volume of $76 trillion.

While retail investors still comprise the largest number of participants, institutional activity is rapidly rising. The SEC’s approval of Bitcoin ETFs, the increase in corporate Treasury holdings and the gradual inclusion of crypto in retirement plans are signs of a market evolving beyond its retail roots. Adoption is not limited to trading: El Salvador became the first country to recognize Bitcoin as legal tender, and the U.S. now has more than 30,000 crypto ATMs, expanding access to digital currency.

Key Innovations and Cross-Industry Potential

Crypto has given rise to a range of innovations with applications far beyond digital assets. The most transformative of these is blockchain technology itself. Blockchain technology facilitates the creation of decentralized, distributed and immutable digital ledgers that can record crypto transactions (among other functions and categories of data), allowing for greater security and transparency in the information they store. Blockchain technology underlies all cryptocurrencies, but because of its broad applications, it is now being explored for use cases in supply chain tracking, medical record management and real estate transactions.

Decentralized finance (DeFi) platforms have emerged to let users lend, borrow and earn yields on crypto without intermediaries. Asset tokenization, another major leap, enables participants to own real-world assets, e.g., property, bonds and art, as blockchain-based tokens that can be traded seamlessly. These innovations are beginning to influence the broader financial system, pushing industries toward faster, more transparent and efficient operations.

Stablecoins, the GENIUS Act and the Role of the Dollar

One of the most practical and widely used products in the crypto market is the stablecoin, a digital token designed to maintain a fixed value relative to a reference asset, often a fiat currency such as the U.S. dollar. Because stablecoins maintain a stable value (as compared to other digital assets such as Bitcoin or Ether that tend to experience significant price volatility), they are typically used as a medium of exchange, or as a settlement asset, on the blockchain, allowing instant settlement, cheaper cross-border payments and reduced volatility for traders.

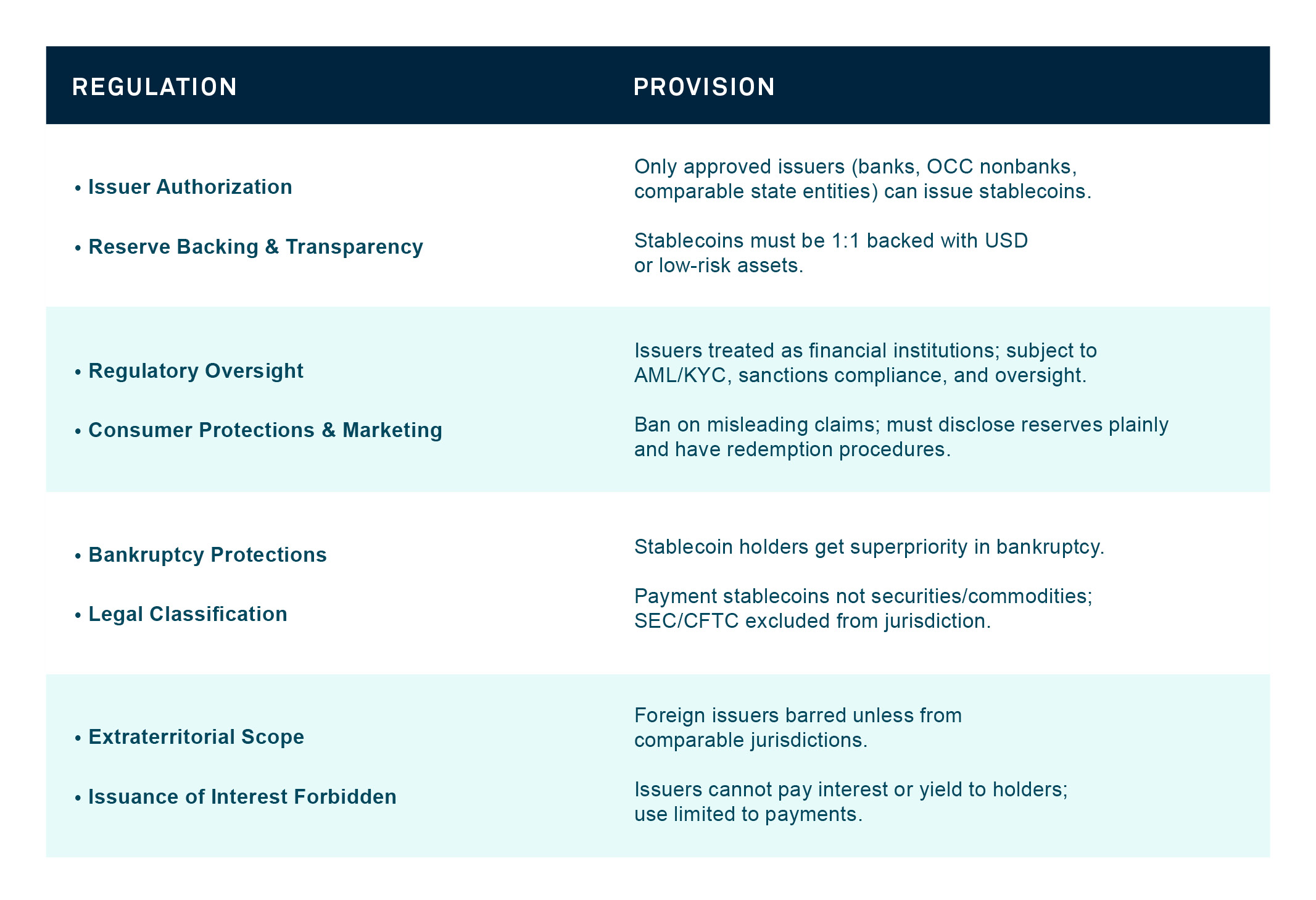

The role of stablecoins has grown so prominent that in July 2025, the U.S. government enacted the GENIUS Act, the country’s first federal framework for payment stablecoins. Among other things, the GENIUS Act introduces licensing requirements for issuers, mandates one-to-one reserve backing with a set list of permissible reserve assets — generally cash or cash equivalents (e.g., short-term U.S. Treasuries and money market funds) — and requires clear disclosure standards. While as a practical matter the law creates a federal regulatory framework for stablecoins, it also serves other important functions: it legitimizes stablecoins as part of the financial system and strengthens the dollar’s presence in digital transactions. If stablecoins continue to increase in popularity and are backed predominantly by the U.S. dollar, there is an underlying bid for the dollar, resulting in incremental currency strength.

Source: Congress.gov as of August 2025.

Regulation: The U.S. and the World

The U.S. is moving toward a more defined and supportive regulatory stance on cryptocurrency. The GENIUS Act represents a major step forward, but it is part of a larger shift that includes executive orders and a more coordinated approach among federal agencies. The focus is on creating a framework that is technology-neutral while still addressing investor protection, financial stability and illicit finance concerns.

Globally, the U.S. is not alone in developing comprehensive rules. The European Union’s Markets in Crypto-Assets (MiCA) regulation established a unified licensing framework for crypto companies across its member states, while parts of Asia, such as Hong Kong, are implementing similar structures to attract global capital. Although approaches differ, there is a growing trend toward global coordination, with the U.S. increasingly influencing how other nations design their crypto regulations. The ultimate direction seems clear: regulations are evolving to drive adoption, innovation and investor protection.

Crypto’s Impact on the Financial System

Crypto does not simply create a parallel financial system. It is increasingly interwoven with the traditional one, and that integration will have winners and losers. Fintech companies, crypto exchanges and blockchain infrastructure providers stand to benefit from the technology’s efficiency and transparency. Consumers may see lower costs for remittances, faster settlement for payments and greater access to investment opportunities.

However, traditional banks, payment processors and remittance services could face disruption. The role of intermediaries in transactions is being challenged, and the infrastructure underpinning today’s markets may need to adapt to a tokenized, always-on economy.

Perhaps most transformative is the gradual inclusion of crypto in retirement accounts, which could unlock significant new demand. A recent executive order could allow for crypto in 401(k) plans, though additional rulemaking will be necessary and such decisions are up to plan sponsors.

Conclusion

Crypto is a maturing global market that blends innovation with increasing regulatory clarity. Blockchain, smart contracts, stablecoins and tokenization are beginning to influence industries far beyond finance, and adoption continues to grow among both retail and institutional players. With laws like the GENIUS Act and global regulatory frameworks taking shape, the foundation for broader integration is being laid. The years ahead will determine how quickly crypto moves from the edge of the financial system to its core — and who will lead, adapt or be left behind.