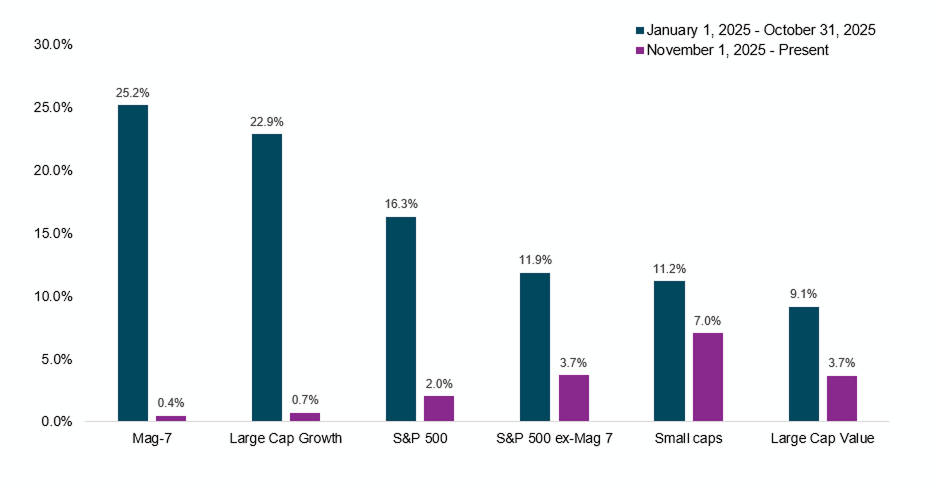

Mega cap technology stocks have dominated the market for years due to higher earnings and margins, as well as enthusiasm about artificial intelligence. However, since November 1, the tide has been turning, with market leadership shifting to cyclical sectors, such as value and small cap stocks, that lagged during much of 2025.

Market Leadership is Shifting

Returns are price returns. Source: Bloomberg. Data as of January 28, 2026.

There are three reasons why we believe this market rotation has legs. The U.S. economy is resilient, interest rates are poised to move lower and corporate earnings are broadening.

A Resilient Economy

The U.S. economy is estimated to have grown at 2% in 2025, demonstrating resilience in the face of tariff uncertainty and a slowing job market. We expect that to persist in 2026, with the economy increasingly likely to improve and grow more than 2%. Although we are in a “no-hire, no-fire” job market, we have not seen signs of significant deterioration. This has proven to be a critical factor in consumers’ ability to spend at healthy levels. However, lower-income households are showing signs of stress.

Nevertheless, we believe the tax provisions in the One Big Beautiful Bill Act (OBBBA) will help buoy aggregate spending. Lastly, the capital expenditure tax benefits of the OBBBA should further stimulate corporate investment and domestic production, positive signs for productivity and growth.

Rate Cuts Still on the Table

Another potential tailwind is lower interest rates, which will be guided by trends in the labor market and inflation. After reducing short-term interest rates by 75 basis points in 2025, the Federal Reserve has paused its easing cycle for now due to sticky inflation. We expect the Fed to cut one to two times in 2026. However, expectations for cuts could change if the labor market worsens more than expected.

Earnings Growth Is Key

Our 2026 outlook for S&P 500 earnings growth is 10% to15%, which is in line with last year’s pace. However, unlike in prior years, we expect two-thirds of that growth to come from stocks outside of the Magnificent Seven as growth broadens due to less policy uncertainty, lower borrowing costs and business-friendly provisions from last year’s legislation.

Bottom Line

The improved economic outlook leads us to believe that broadening earnings growth will continue to support the current market rotation. While periods of volatility are likely, we continue to favor U.S. large cap stocks. Nonetheless, diversification across market caps and geographies will be key to fully reaping the upside of this cyclical expansion.

For more on our outlook on the year ahead click here.