Market concentration rarely lasts

The market concentration around AI has been widely reported on, but here Walter Scott offer some perspective on past market concentrations.

Artificial Intelligence (AI) is undoubtedly a significant and disruptive technology that is impacting the way we work, live and invest. The market concentration around AI companies has been widely reported on, but here Walter Scott1 offers some perspective on past market concentrations.

Key takeaways

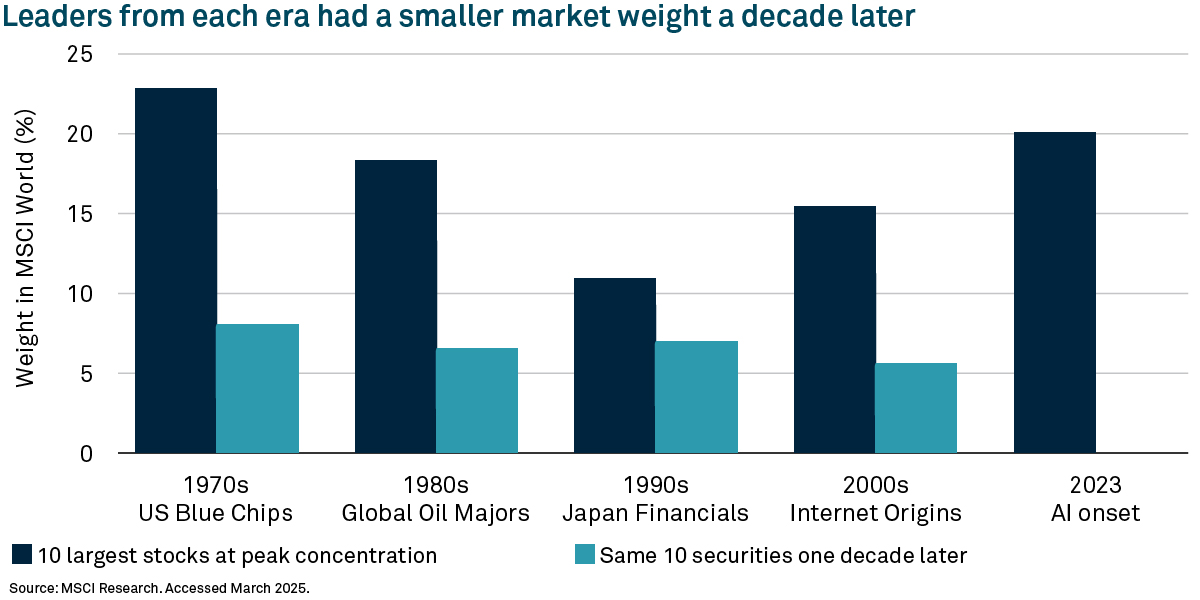

- Since the 1970s, when looking at the 10 largest stocks within the market trend, major market concentrations have not lasted beyond a decade.

- There are long-term leaders such as Microsoft and Alphabet that hold onto their dominance across decades.

- Walter Scott believes that the AI ecosystem and many of its key players will remain significant for decades to come, however it suspects the market concentration of today may not last.

The AI-driven surge of recent times has resulted in market concentration levels not seen for decades. Whilst not commonplace, these episodes do occur.

From the established blue-chip giants of the 1970s to the mobile telecommunications and internet companies of the early 2000s, stock markets have experienced periods where a select few companies have held significant dominance.

Darker shades indicate weight of 10 largest stocks at peak concentration (dates noted above). Lighter shades indicate weight of the same 10 securities one decade later.

One interesting point is what happens next. As the chart above shows, these eras of market concentration rarely last.

What happens to so many of these large stocks in the subsequent decade? Dropping out of the top 10 could be due to any number of factors, from industry consolidation to regulation or a failure to innovate and adapt. Whatever the reason, it suggests that investors should be cautious about extrapolating today’s market trends too far into the future.

LONG-TERM LEADERS

Some companies do feature in the top 10 from one decade to another (and another). Until recently, companies such as Exxon, General Electric, and IBM were prominent members of the group regardless of the market trends.

Today, Microsoft is one of those staying the distance, having been there in the early 2000s and now very much part of the AI story today. This speaks to the software company’s continued ability to innovate and adapt from a leader in software to being at the forefront of AI, having first invested in OpenAI in 2019. More recently, it has incorporated Copilot, an AI-powered digital assistant, into Word, PowerPoint, Outlook and Excel. Looking to 2030 and beyond, we believe Microsoft will continue to rank highly.

Another is Alphabet, a business which has built up a dominant position in online advertising and search, through Google. Like Microsoft, it has also been in the AI game for years, having bought the UK-based AI research laboratory DeepMind back in 2014. Alphabet has a strong competitive position over the long term, thanks to its ownership of multiple platforms with billion-plus users, strong data-gathering capabilities, proprietary hardware and mobile operating systems (Android).

BEYOND SENTIMENT

It is still very early days for AI and progress is rarely linear. While, Walter Scott believes many of today’s market leaders will continue to play a critical role in the AI ecosystem for decades to come, history at least suggests that recent concentration levels are unlikely to persist.

1Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

2383709 Exp : 31 January 2026

YOU MIGHT ALSO LIKE

Artificial intelligence (AI) has rapidly advanced from novelty to an integral part of workflows and daily life. Adoption is already surpassing many of the expectations from a few years ago. As usage accelerates, we look beyond productivity gains to see which firms can turn technological advantage into lasting market power.

As Europe boosts defence spending in response to rising geopolitical tensions, the technological transformation of warfare is changing how that money is spent, writes Walter Scott investment manager Connor Graham. Now it’s more cybersecurity and sensors and fewer bombs and bullets.