With the S&P 500® hitting new highs, investors question if fundamentals or hype is fueling the rally. Despite uncertainty, the S&P 500 has delivered strong performance year to date. Its price-to-earnings (PE) ratio now sits at 22x above the nearly 17x long-term average1. To some, that screams “overvalued,” but context matters.

While historically elevated, we see today’s valuations as part of a higher-multiple environment supported by stronger profitability and a larger index weight to tech. Economic and earnings growth remain resilient, with global earnings revisions trending higher and profitability broadening beyond big tech. Rising productivity and ongoing AI adoption should further reinforce record-level margins and long-term earnings growth. In our view, higher valuations reflect stronger fundamentals.

Strength in Numbers

Profitability across U.S. companies is strong with the S&P 500’s operating margin2 hovering near a record high of 19%. Nowhere is that strength more visible than in tech, with sector margins nearly twice those of the broader index. In fact, technology’s weight in the S&P 500 has nearly doubled since 2010 to 36%. Tech also carries a higher PE ratio when compared to the overall index, naturally lifting the index’s multiple. We believe this reflects a structural shift toward more efficient, high-margin business models driven by innovation, scale and automation. Investors are rewarding companies not just for growth but for durable profitability.

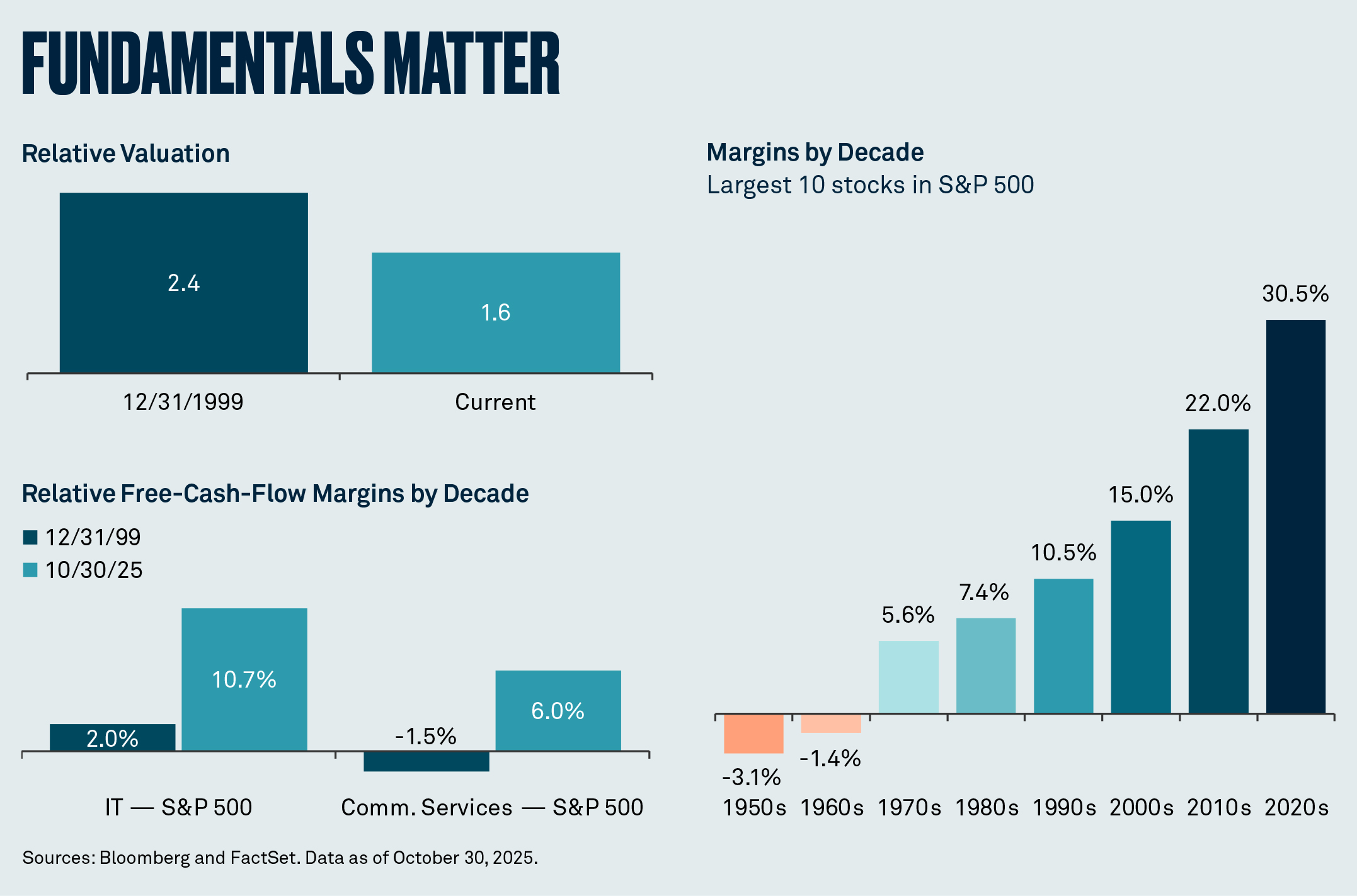

We believe tech valuations are reasonable on a relative and fundamental basis. During the dot-com era, tech traded at a premium of 2.4x the S&P 500’s PE ratio; today the premium is about 1.6x — a much narrower gap. Profitability also tells a similar story. Information technology’s free-cash-flow margins are about 11% above the S&P 500, versus only 2% in 1999, while communication services margins are now 6% higher versus -1.5%.

A Multi-Dimensional Story

While tech is a big part of the equation, we are now seeing earnings growth broadening across sectors and regions. Overall S&P 500 earnings are forecast to rise more than 10% by the end of 2025 and more than 13% in 2026. Operating margin estimates for the average S&P 500 stock have increased to 13.7%, the highest in a year. Given current levels, multiples are unlikely to expand much further and gains will be coming from earnings growth, which we expect to continue after a better-than-expected 2025.

Globally, the share of firms with upward earnings revisions has reached year-to-date highs across the S&P 500, MSCI EAFE, and MSCI EM indices. From a global perspective, rising defense and infrastructure spending in Europe, reform in Japan, and the impact of Fed easing across emerging markets present opportunities as global growth broadens.

With the tailwind of Fed easing, small caps are also starting to re-emerge, trading at their lowest relative valuations since 2001. With earnings expected to outpace large cap earnings in 2026, market foundations are becoming more balanced, with more inclusive growth.

Moving forward, investors should pay attention to monetary and fiscal policy as their interaction could impact debt sustainability and financial conditions for most developed economies. A slower-than-anticipated cyclical rebound may weigh on near-term earnings, and any moderation in U.S. earnings growth, economic expansion, or productivity could undermine the case for structurally higher valuations. Overall, while risks remain, there is opportunity in staying invested and diversified.

Alicia Levine

Head of Investment Strategy & Equities

BNY Wealth

John Porter

Chief Investment Officer

BNY Investments Newton

About the BNY Investment Institute

Drawing upon the breadth and expertise of BNY Investments, the Investment Institute generates thoughtful insights on macroeconomic trends, investable markets and portfolio construction.

Definitions:

MSCI EAFE Index is an equity index which captures large and mid cap representation across Developed Markets countries around the world, excluding the US and Canada.

MSCI EM (Emerging Markets) Index captures large and mid cap representation across Emerging Markets countries.

Operating margin is a key profitability metric that measures the percentage of revenue remaining after covering operating expenses, indicating how efficiently a company generates profit from its core business operations.

Price-to-earnings (P/E) ratio compares a company’s share price with its earnings per share (EPS).

S&P 500® Index is a widely accepted, unmanaged index of U.S. stock market performance. An investor cannot invest directly in any index.

1Average since 1996.

2Operating margin based on 12-month forward earnings before interest and taxes (EBIT) margin estimate per FactSet.

Important information

The information contained herein reflects general views and is provided for informational purposes only. This material is not intended as investment advice nor is it a recommendation to adopt any investment strategy.

Opinions and views expressed are subject to change without notice.

Past performance is no guarantee of future results.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: • United States: by BNY Mellon Securities Corporation (BNYSC), 240 Greenwich Street, New York, NY 10286. BNYSC, a registered broker-dealer and FINRA member, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Investments firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue EugèneRuppertL-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • South East Asia and South Asia: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario. All issuing entities are subsidiaries of The Bank of New York Mellon Corporation.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

© 2025 THE BANK OF NEW YORK MELLON CORPORATION

MARK-847487-2025-12-02

GU-768 - 31 December 2026