Investment portfolios with concentrated positions can pose significant risks to long-term investment goals. Here’s how you can diversify a concentrated portfolio.

Executive Summary

This article is excerpted from our full paper.

While an investor may have created their wealth through a concentrated position in one or a few stocks, this can also lead to hidden risks within a portfolio. There are many ways investors accumulate an outsized amount of a single stock. Whether stock was received through an initial public offering, part of compensation through work, or an inheritance, too much wealth in one or a handful of stocks can prove costly if the stocks lose value over time.

Risks of Concentrated Stock Positions

1. Contrary to what investors assume, most individual stocks will underperform the broader market.

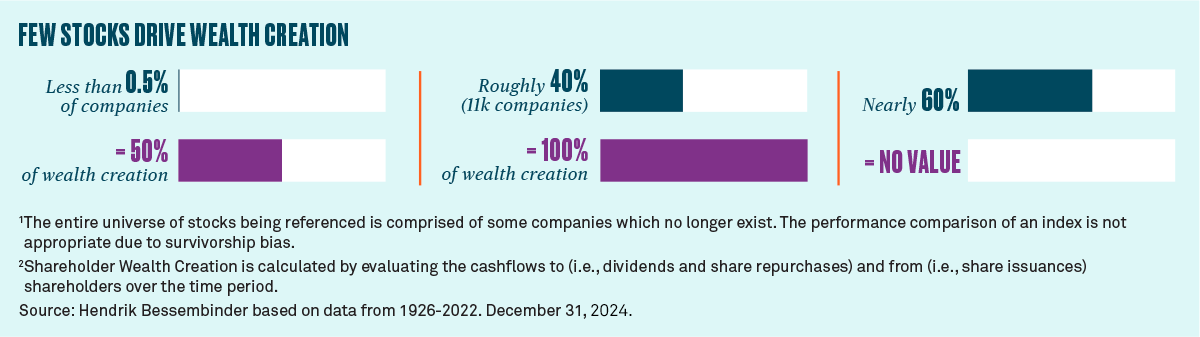

In fact, less than 0.5% of all U.S. stocks since 19261 have delivered 50% of gross wealth creation. This represents just 110 companies out of a total universe of 28,000 companies. Shareholder Wealth Creation2 measures the dollar amount by which investors in aggregate were rewarded for participating in company stock appreciation. And, approximately 40%, or over 11,500 companies, create the remaining 50%. That means that nearly 60% of companies available to investors do not generate nearly any value and in many cases lose wealth over time.

2. Individual stocks can vary in how much their value fluctuates up and down.

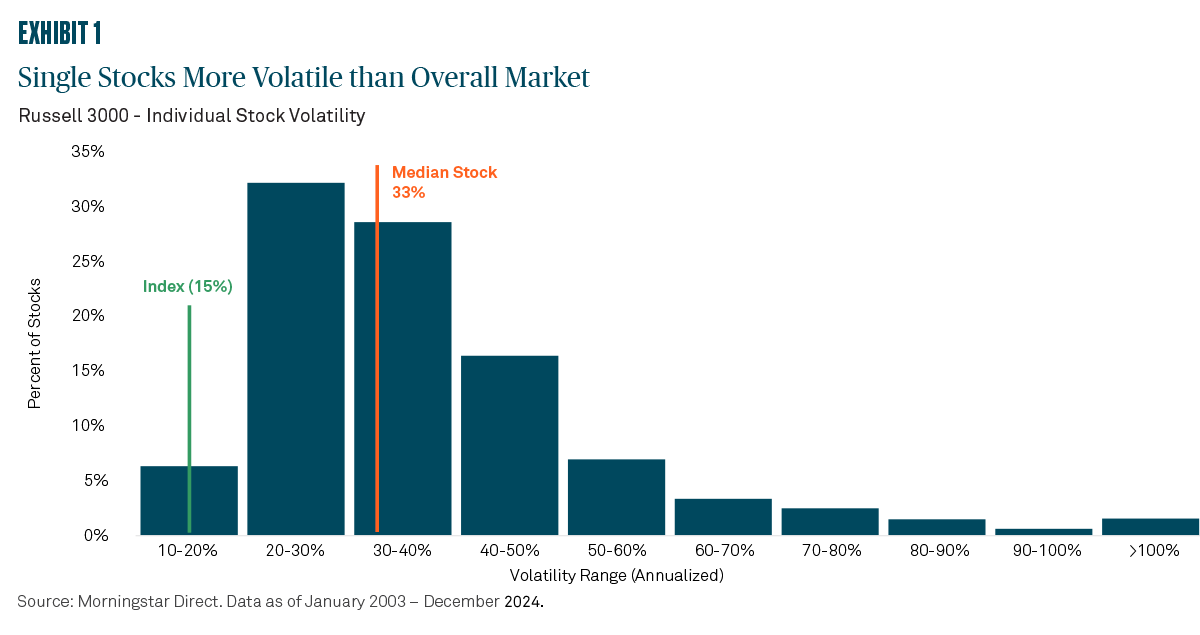

While some stocks are more volatile than others, on average, the median stock is more than twice as volatile as the index itself. For example, the Russell 3000 has historically fluctuated 15% from the mean in any given year, while the average single stock’s volatility is 33%. This suggests investors in a single stock should be prepared to weather a much bumpier ride.

3. Higher volatility negatively impacts long-term cumulative returns.

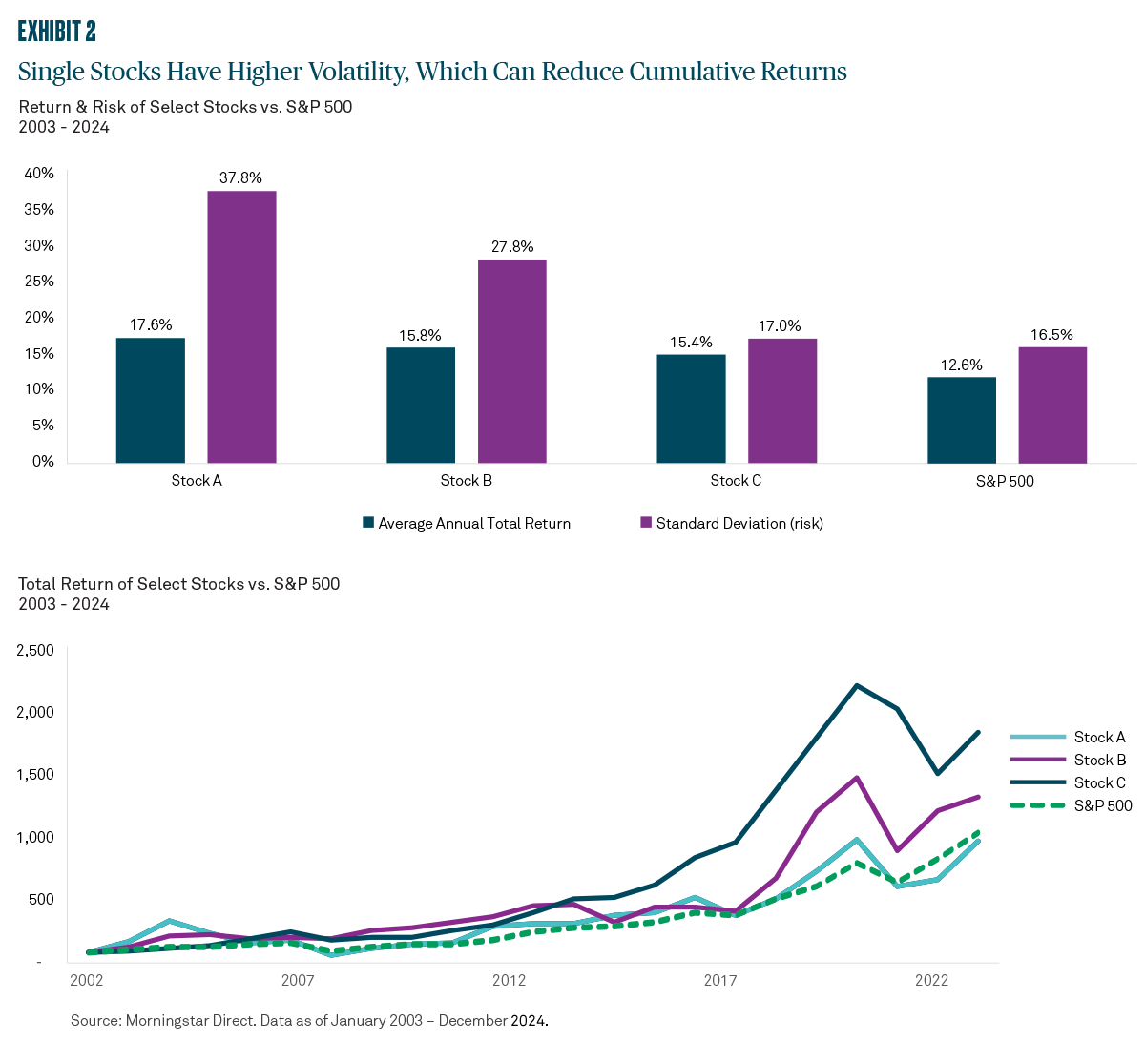

If we look at a few examples of bellwether stocks that delivered strong annual returns from 2003 through 2024, we can see large dispersions in their cumulative returns driven by this volatility. For example, Stock A and Stock B had similar average annual returns, as illustrated in the top chart of Exhibit 2, but since Stock A had much higher volatility, it resulted in a much lower cumulative return (bottom chart). An investment of $1 million in Stock A at the beginning of 2003 would have increased to over $9 million by the end of 2024, versus almost $13 million for Stock B. Further, while Stock C had a lower annual average return than Stock A over this same period, its total cumulative return of almost $18 million was nearly double Stock A’s due to its much lower volatility. The key message here is that a concentrated portfolio is likely to have high volatility, and high volatility reduces long-term cumulative returns.

The Risk/Reward Trade-off of a Concentrated Position

It’s crucial for investors to be aware of the risk/reward trade-off of holding a concentrated stock position. Although a single stock can provide strong annual returns, its higher volatility will reduce the long-term cumulative benefit of those returns. Further, a significant loss from a concentrated position can weigh on long-term investment goals. And as market forces change, so does leadership across companies and sectors. These changes make it more likely that a concentrated portfolio will miss out on new stock market leaders.

How to Diversify a Concentrated Portfolio

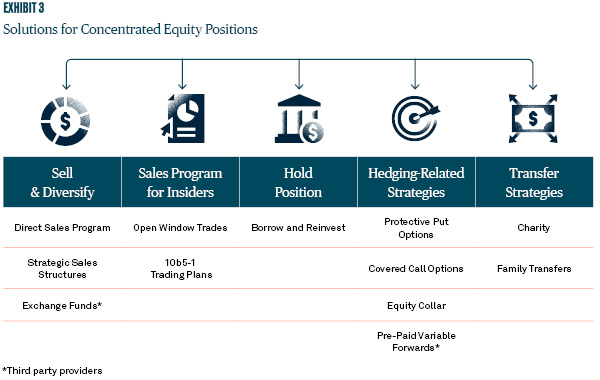

While many investors are reluctant to diversify away from stocks that have helped to build their wealth and may be concerned about the tax bill associated with diversification, selling the concentrated position is not the only option. BNY Wealth offers a full range of strategies that can help reduce risks associated with concentrated positions, including selling shares in a tax-efficient manner, hedging and gifting shares.

At BNY Wealth, we have a team of specialists that can analyze the specifics of each client’s situation and recommend a plan to de-risk the portfolio, manage taxes and help preserve wealth now and into the future.