The luxury home market, defined as the top 10% of home values, is less influenced by mortgage rates and more dependent on net worth and lifestyle factors. This segment operates differently from the conventional home market; thus, buyers should be cautious about using mass market real estate reports for decision-making.

An experienced luxury property specialist, who can provide market-specific research and information to inform buyer expectations, should be consulted well in advance of purchases.

If you are contemplating the purchase of a luxury home, BNY can help.

State of the Market

Luxury home prices in many markets have remained steady or improved consistently over the past few years, with that trend continuing through the first half of 2025, reflected by a slight uptick in both prices and sales volume. As luxury home inventory is finally increasing in some areas, the market is starting to return to a state of normalcy, or at least a new normal.

It appears homeowners are realizing that the favorable mortgage rates of 2019-2022 will not be available for the foreseeable future, and expectations have been pared back to better align with historic rates, considering the 50-year average is around 8%.

Regional Variance

Regional variations across the luxury home market are quite significant. Therefore, it is best to research your area of interest to leverage higher inventory market advantages and off-season purchases.

Inventory has risen quite substantially, and prices appear to be softening in certain markets within Sun Belt states such as Florida, Texas and Arizona. On the other hand, in some luxury markets in the Northeast, prices are holding up where there is continued strong demand and lower inventory levels.

We are currently seeing that contrasting characteristics may exist in neighbouring markets; for example, a buyer's market could be positioned close to a seller's market in a nearby area. Therefore, it is essential to differentiate between the two, as buyer’s markets offer greater negotiating power and potential price discounts.

Because of the nuance of opportunities within any given market, it is critical to engage a lender who can navigate complex collateral and financial situations with precision and expertise.

Land Your Dream Home Without Disrupting Your Goals

If your wealth is less liquid and the preservation of cash reserves is a priority, mortgages can help you avoid having to liquidate valuable stock positions to raise cash, allowing you to participate in future gains by remaining invested.

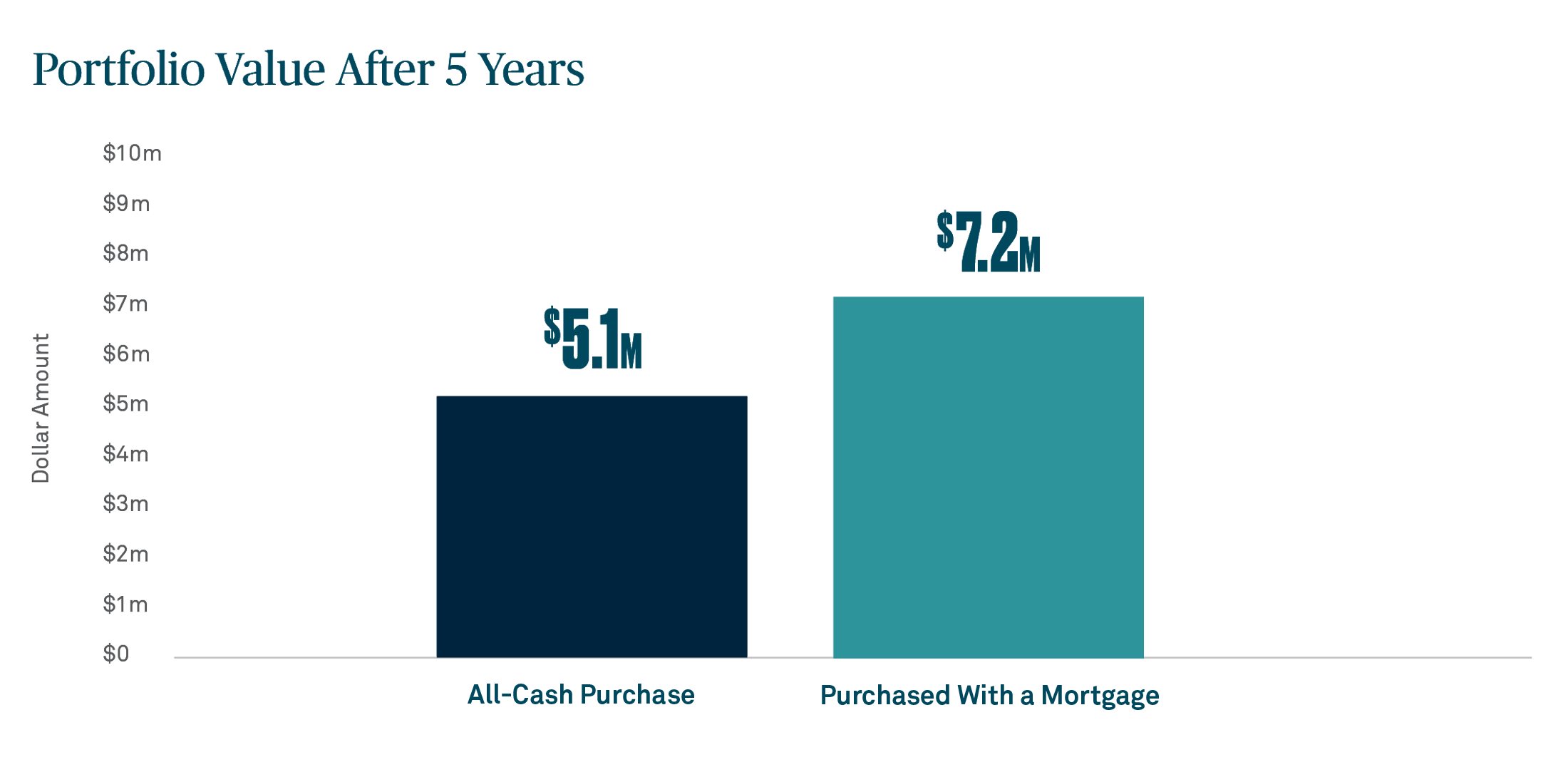

Consider this illustrative example where a buyer is contemplating the purchase of a $2 million property. They can either execute an all-cash purchase or obtain a 30-year fixed rate mortgage with a 30% down payment and an interest rate of 6.50%.

In the first scenario, the buyer liquidates $2 million from their $6 million investment portfolio to pay for the home; however, in doing so, they incur a 20% capital gains tax, resulting in an additional cost of $500,000. After a five-year period with an annual investment return of 8%, their investment portfolio is valued at $5.1 million.

In the second scenario, where the buyer takes out the mortgage, they only liquidate $600,000 for the down payment, as well as an additional $150,000 to pay capital gains tax, and the remaining $5.25 million stays invested and grows to $7.7 million at the end of the five-year period. With the aggregate monthly mortgage payments totalling nearly $531,000, the investment portfolio is still worth almost $7.2 million at the end of the five-year period.

Therefore, acquiring the property with a mortgage allows the buyer to keep more of their portfolio invested, resulting in a meaningfully higher balance than an all-cash purchase at the end of the five-year period.1

BNY's Assistance

With over 240 years of experience, BNY helps individuals and families manage their wealth. With customized mortgage financing solutions, which are tailored to the client's lifestyle and financial goals, BNY can help navigate the purchase process by:

- Setting up credit lines for quick cash closings

- Incorporating renovation and construction financing into purchase plans

- Offsetting mortgage carrying costs through comprehensive wealth and investment strategies

BNY has a dedicated team of mortgage bankers that specialize in recommending financing strategies to purchase or refinance luxury properties. This includes various mortgage programs and flexible payment options, such as fixed and adjustable rates, 100% financing, construction financing, interest only-financing and its pre-approval program.

BNY mortgage bankers are available to assist clients with understanding the luxury home mortgage market.

Intended for informational use only, not to be considered as marketing or advertisement.