The 2025 edition of our 10-Year Capital Market Assumptions (CMAs) offers our projections for asset class returns, volatilities and correlations over the next decade. This yearly exercise helps in shaping the design of our investors’ long-term portfolios.

Overview

Annually, the BNY Investment Institute develops CMAs for approximately 50 asset classes spanning global markets. The 10-year forward expected return, volatility, and correlation assumptions are intended to guide investors in the development of long-term strategic asset allocations and planning activities.

Key Highlights:

- Our 10-year return projection for a hypothetical balanced portfolio1 has increased from 6.2% to 6.3%.

- With the easing cycle underway, bonds are expected to outperform cash given the combination of attractive current yields and potential price appreciation as short-term rates move lower.

- U.S. fixed income is forecast to deliver mid-single digit returns supported by current yields. We expect municipal bonds to deliver an annual return of 3.6%, which for tax-sensitive investors in the highest federal tax bracket translates into a tax-equivalent yield of over 6%.

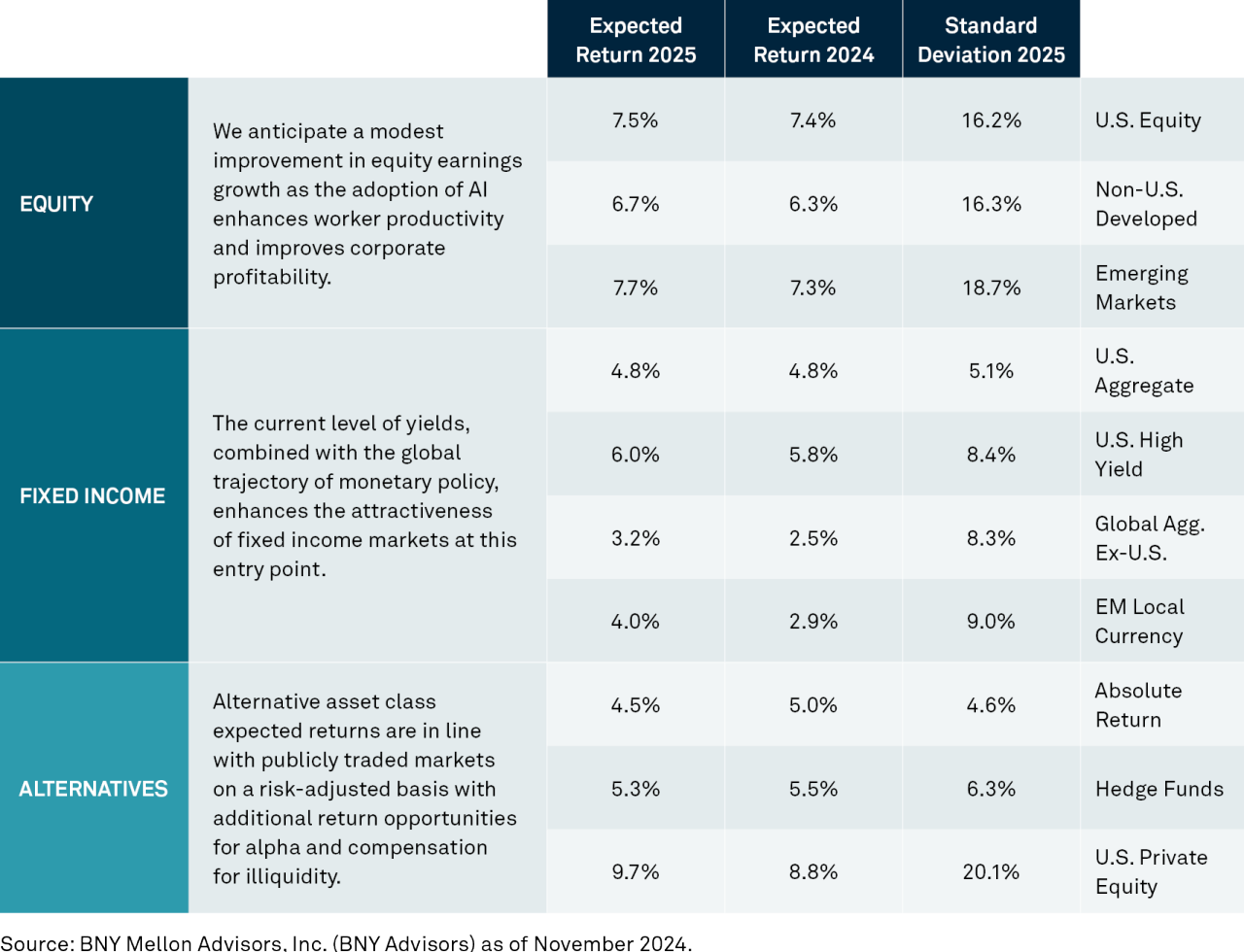

- The artificial intelligence (AI) driven benefits of enhanced worker productivity and improved corporate profitability accrue more to U.S. businesses, driving U.S. returns higher than international and emerging equity markets. As a result, we expect the 10-year returns on U.S. equities to modestly improve to 7.5% from 7.4%.

- Alternatives expected returns are in line with publicly traded markets on a risk-adjusted basis with additional return opportunities for alpha and compensation for illiquidity. Private equity returns are forecast to increase modestly compared to last year given our assumption that venture capital within the U.S. is well positioned to benefit from AI.

Snapshot of 2025 vs. 2024 10-Year Capital Market Return Assumptions

The Use of Capital Market Assumptions

For years, BNY has developed CMAs to assist our clients in designing their long-term asset allocation. In this report, we have found that our 10-year expected returns (published in 2015) were relatively accurate, with a spot-on estimate for the expected return of a balanced portfolio of stocks, bonds and alternatives.

CMAs influence our strategic asset allocation models, which are tailored to our clients’ objectives, risk tolerance and tax sensitivity. From this starting point, we recommend tactical asset allocation shifts based on shorter-term market dislocations. CMAs also provide an important input for other aspects of clients’ wealth, such as developing a spending plan, managing for taxes or borrowing.

Download the Executive Summary