2026 OUTLOOK

Innovation Drives Opportunities

Our top thought leaders and investment experts share their insights on the role of innovation in driving growth, corporate profitability and investment opportunities.

2026 OUTLOOK

Our top thought leaders and investment experts share their insights on the role of innovation in driving growth, corporate profitability and investment opportunities.

Our report, “Insights for Private Business Owners—Mastering the Sale,” offers first-hand views and advice from 127 privately held business owners, plus actionable insights from BNY Wealth experts.

Family offices are leaning into AI and crypto, seizing on two of the most dynamic investment themes.

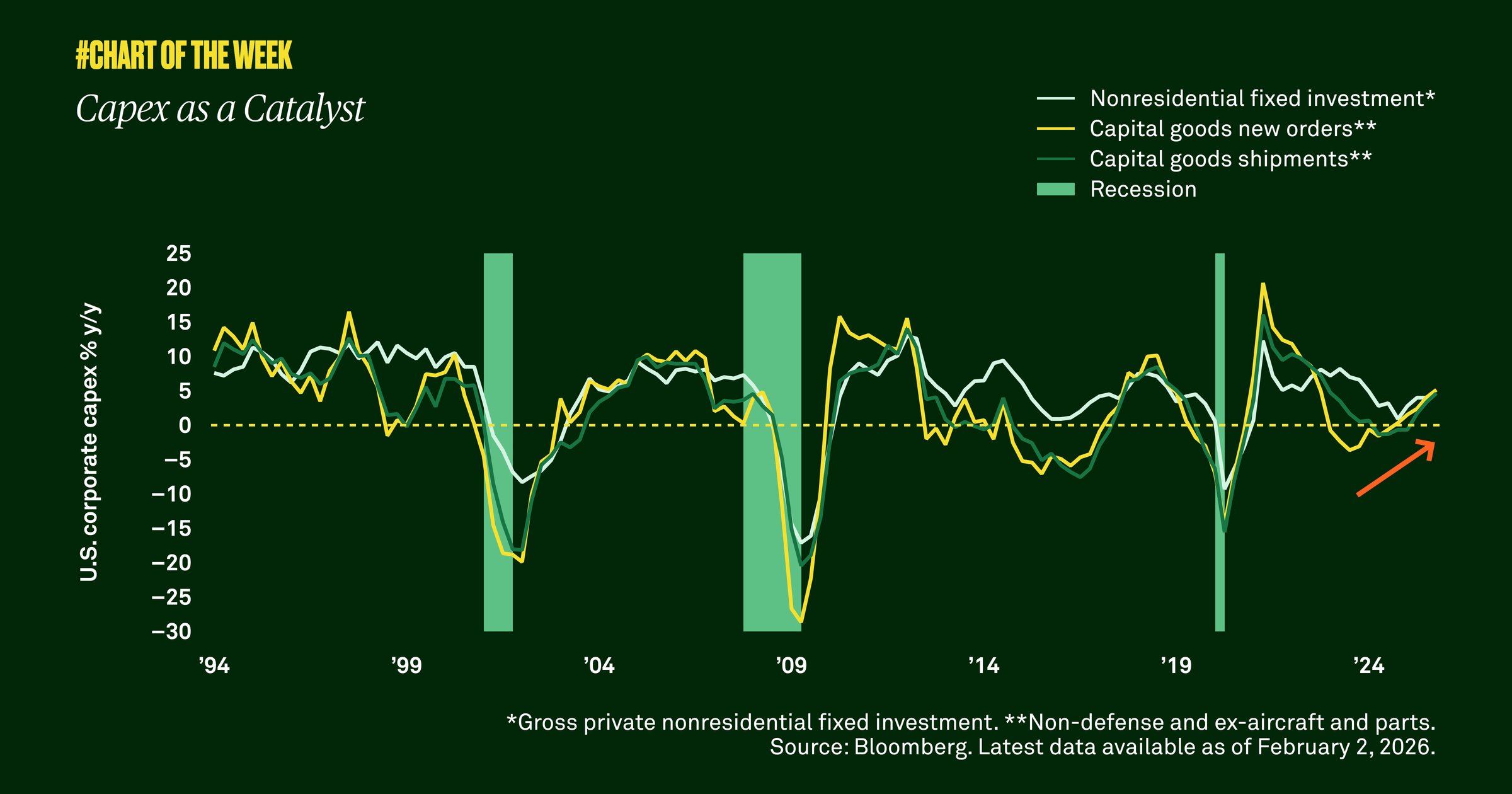

Improved business confidence and recent tax legislation are compelling corporations to reinvest their cash flows in their businesses. We believe this is a positive signal for economic growth.

The 2026 edition of our 10-Year Capital Market Assumptions (CMAs) offers our projections for asset class returns, volatilities and correlations over the coming decade.

For more than two centuries, our commitment to clients has been central to our approach and it continues to this day.

Jose Minaya, global head of BNY Investments and Wealth, shares how we remain focused on anticipating clients’ needs,

understanding their goals and helping them achieve financial success.

Our comprehensive Active Wealth framework helps you sustain and build wealth in the shifting market environment. Learn how to implement a dynamic approach to wealth management that consists of investing, borrowing, spending, managing taxes and costs, and protecting wealth for future generations.

We’ve been helping private business owners and entrepreneurs tackle their most complex business issues and open doors to new opportunities for generations. Perhaps that’s why 92% of Fortune 100 businesses are clients.1

1 Fortune, Time Inc. ©2024