Diversification, disciplined risk management and a forward-looking approach to selecting investments is necessary for multi-asset portfolios in 2026, says BNY Investments Newton FutureLegacy portfolio manager, Bhavin Shah.

Key points:

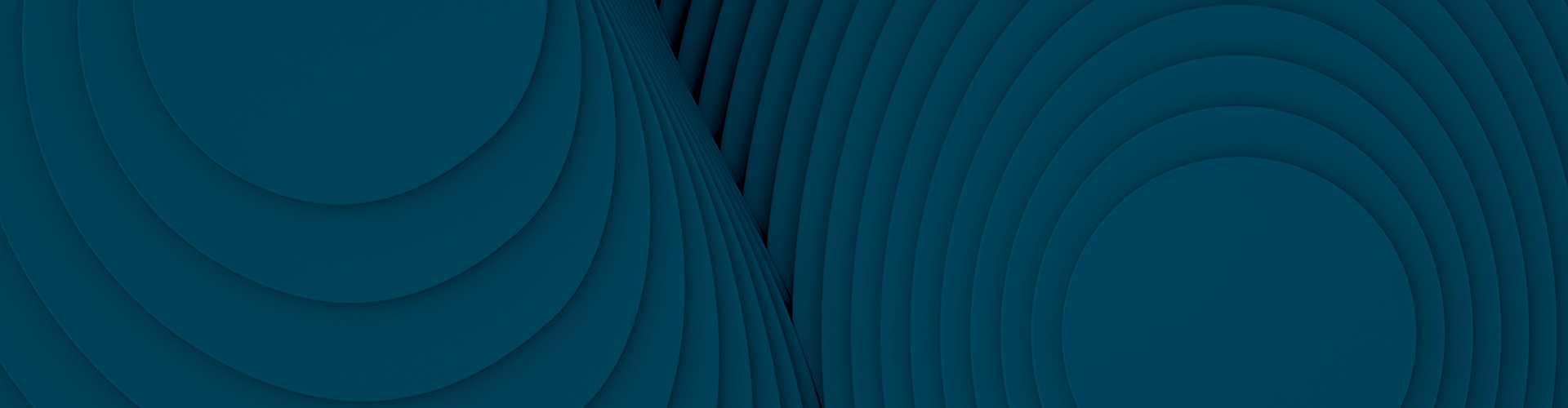

- Global growth is set to moderate in 2026, but trade shifts and inflation pressures keep challenges on the horizon.

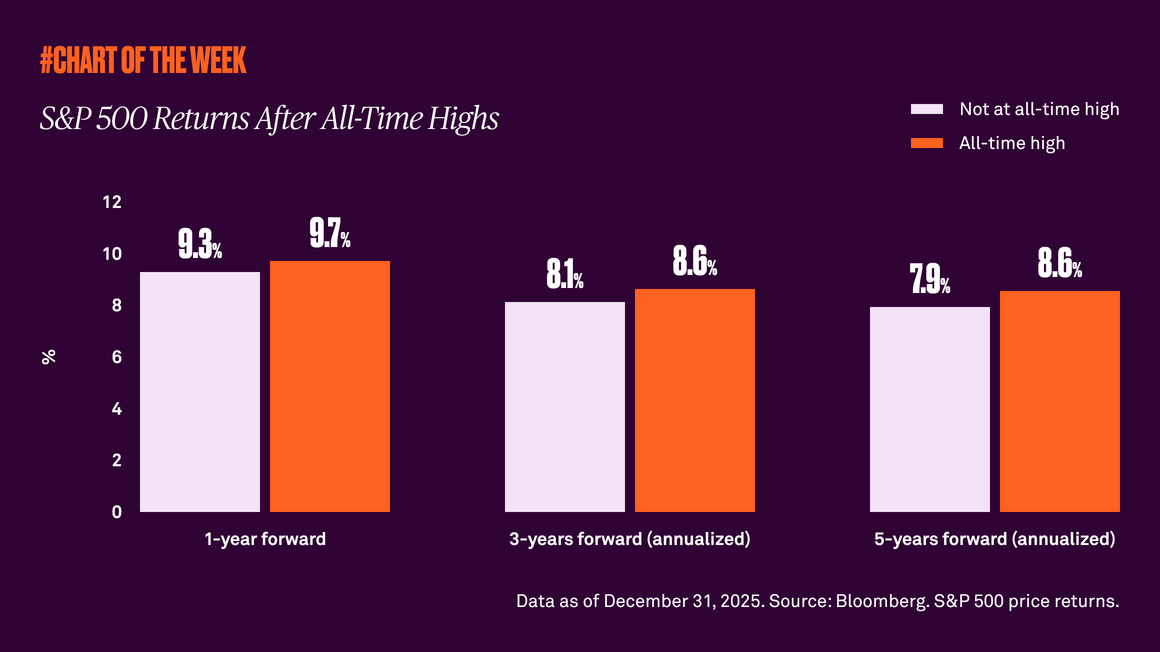

- Stock markets remain highly concentrated, with US dominance heightening correlation and downside risk.

- Selective exposure to emerging markets, especially India and China, could add growth and diversification to portfolios.

- AI spending is expected to surge, with agentic AI and biotech breakthroughs boosting productivity, drug discovery, and new business models.

- Diversification and discipline are important to manage volatility amid geopolitical risks, policy shifts and stretched tech valuations.

3009300 Exp: 30 April 2026