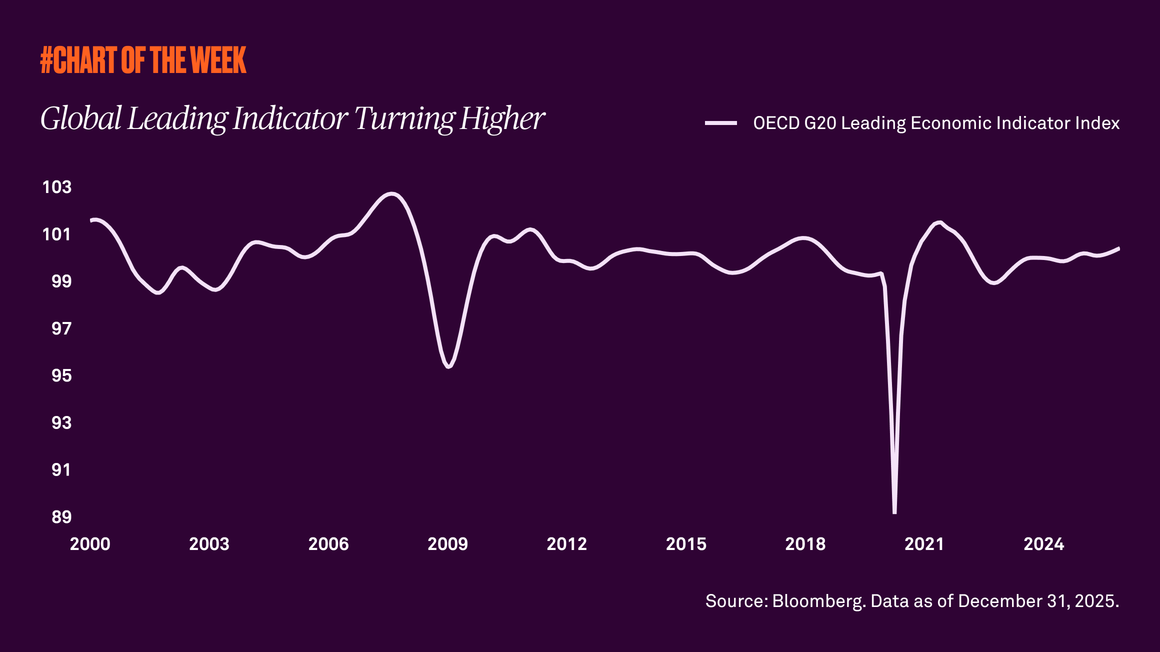

This past year was rife with risks to the global economy: policy changes, tariff uncertainty and more. Yet, the global economy held up as manufacturing and services activity strengthened across the world. We see an opportunity for U.S. investors to diversify geographically.

The global economy remained resilient this past year during a time of pronounced policy and tariff uncertainty, as well as geopolitical tensions. Yet, fiscal support, monetary easing and strong capital expenditures helped economies deliver positive growth.

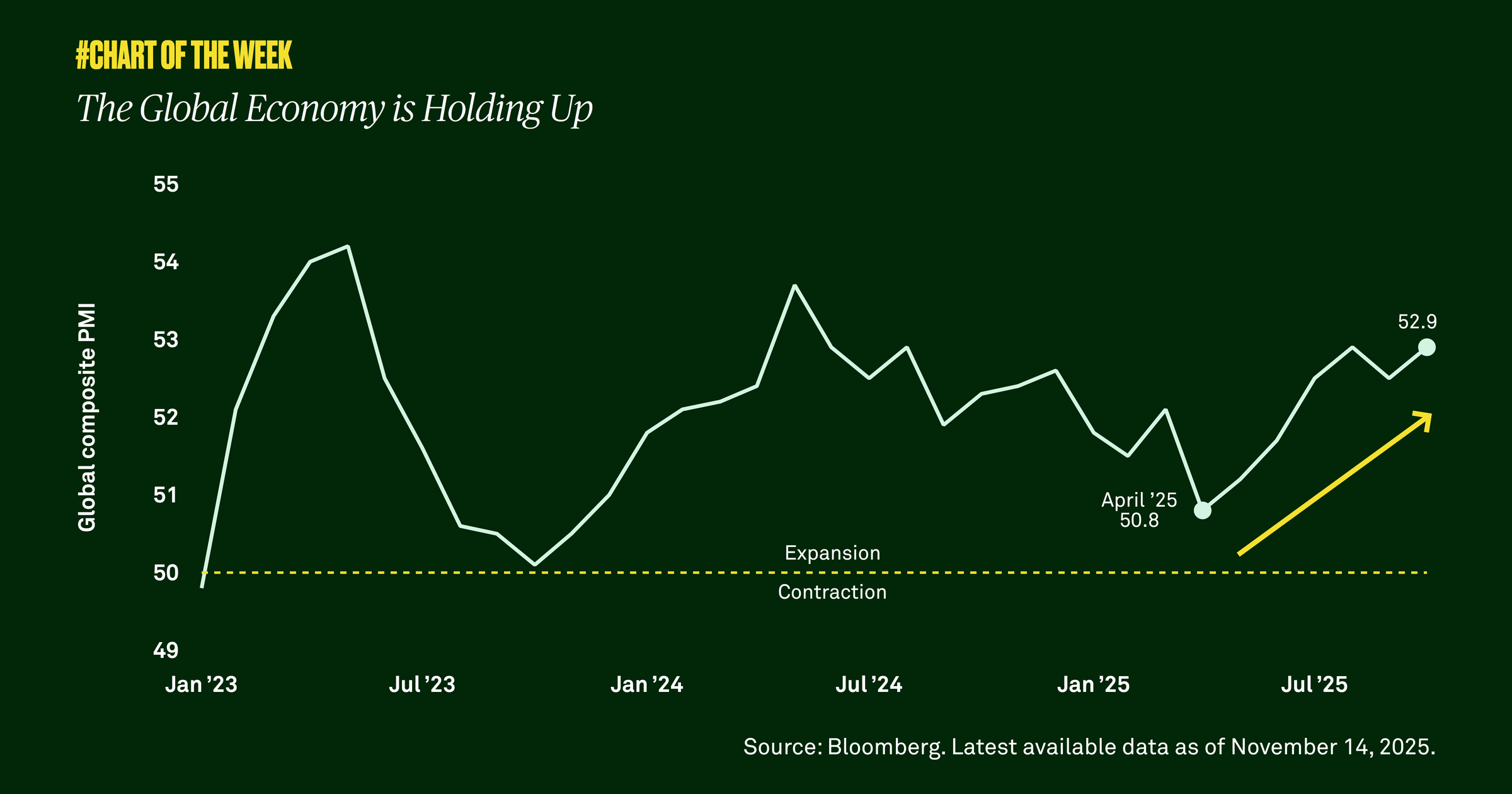

A key measure of economic conditions, the Global Composite Purchasing Managers’ Index (PMI), a weighted average of the global manufacturing and services PMIs, provides a snapshot of overall worldwide economic health. A reading above 50 indicates economic expansion, while a reading below 50 suggests a contraction. This metric is at its highest since August 2024 and underpins our positive outlook for global growth as we head into 2026.

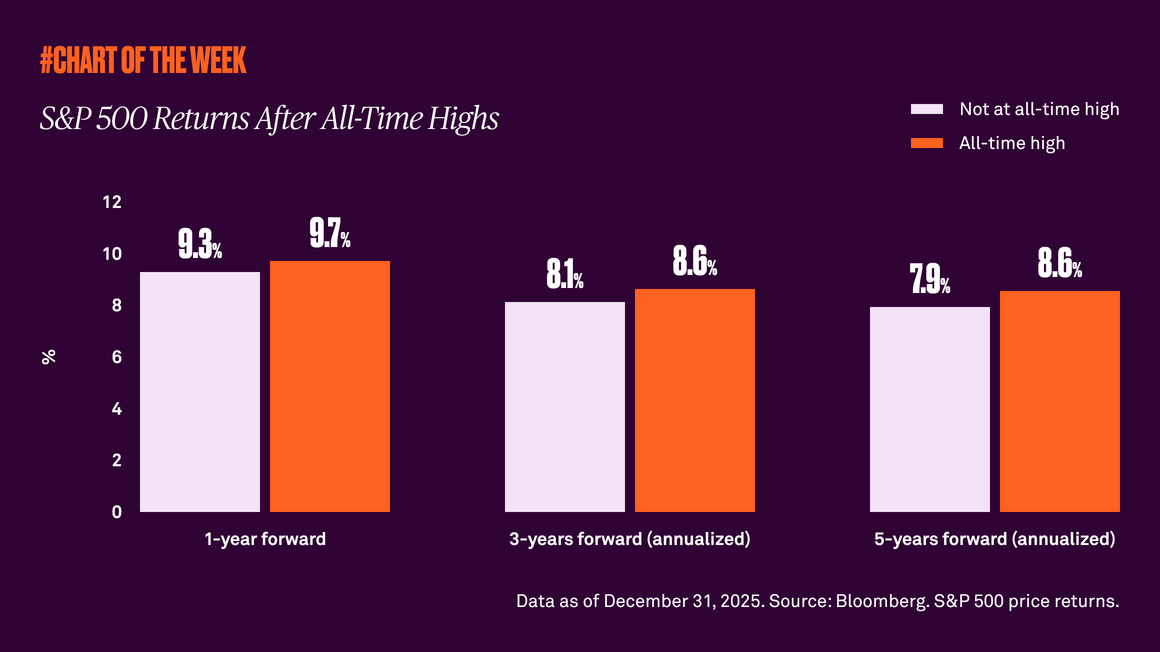

A strong global economy is important to investors because increased economic activity leads to higher corporate profits, boosting stock prices. It is one of the reasons we maintain a constructive view on equities and why diversification across regions remains important.