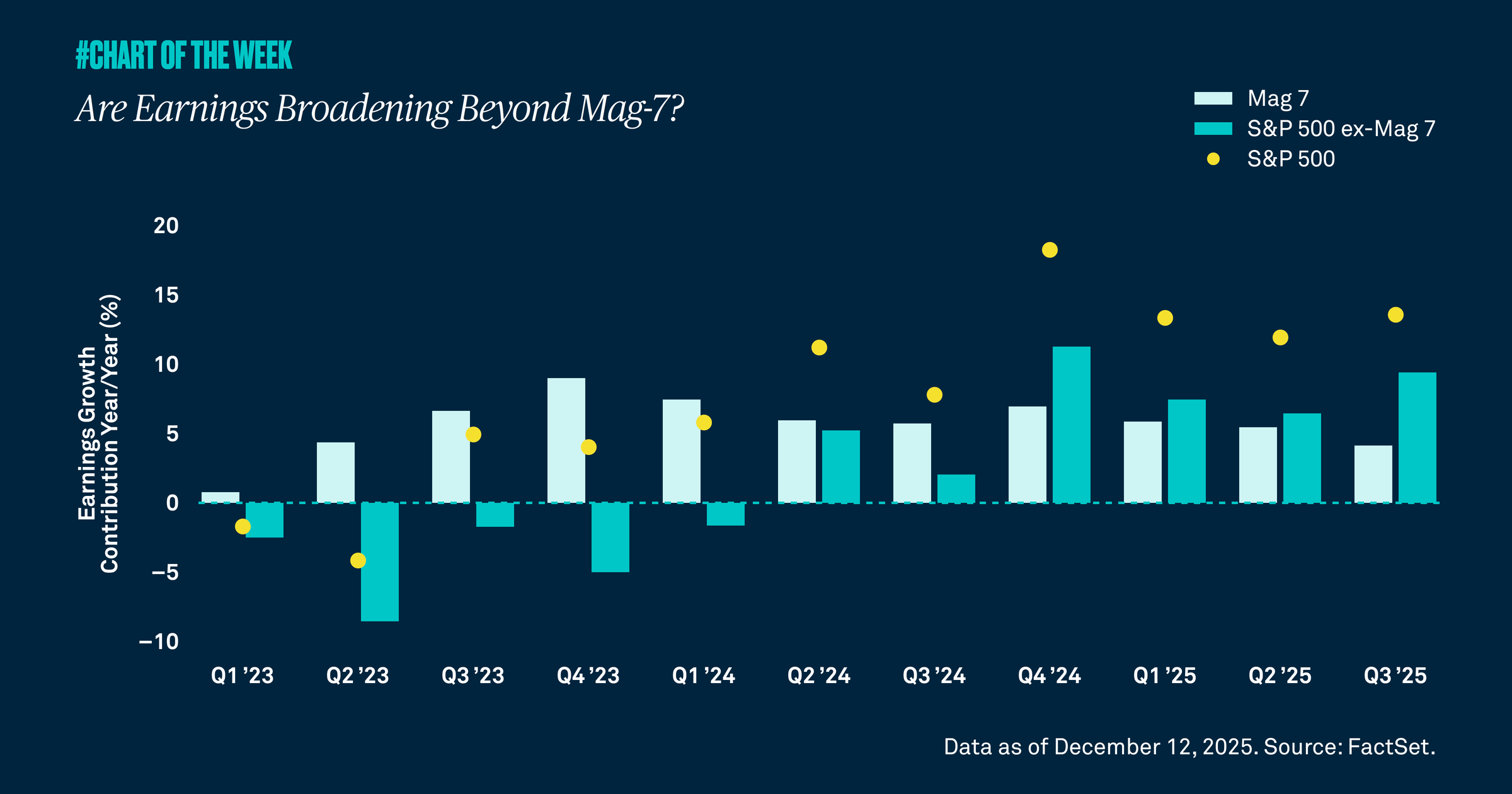

Tech stocks have outperformed the rest of the S&P 500 for several years, and while we expect earnings growth among these companies to continue in 2026, we see another encouraging trend emerging. Earnings across the rest of the market are on an upward path too — and are set to contribute more to earnings growth for the S&P 500 Index in 2026 than the Magnificent 7.

In the third quarter, the Magnificent 7 stocks contributed 4.1% to the S&P 500’s year-over-year earnings growth compared to more than double that, or 9.4%, from the rest of the index. Beyond the third quarter, the Magnificent 7 stocks are expected to trail the earnings growth contribution from the rest of the market for all of 2025. Earnings are broadening beyond tech, and they are on track to continue this path in 2026 — a positive sign in our view.

What’s behind this shift? Productivity and profitability among all sectors have been improving on the heels of AI technology advancements, lower borrowing costs and business-friendly regulatory and policy provisions set by this year’s tax and spending bill. These factors should support upward earnings momentum in 2026 across the S&P 500.

In fact, consensus expectations are for the index’s earnings to grow 14% next year with 5.4% of that growth coming from the Magnificent 7 and 8.9% from the rest of the market. This is in line with our 10-15% earnings target for 2026 as well as our view that the broadening trend will strengthen further in the upcoming months.