Articles

Absolute return bond strategies aim to deliver steadier outcomes by prioritising capital preservation and actively managing volatility. This approach offers investors a potentially more resilient way to navigate uncertain markets, writes Shaun Casey, senior portfolio manager at Insight Investment.

Fixed Income isn’t just defensive—it can be essential to offsetting equity risk. From historically high valuations to a potential recession and rising interest rates, we illustrate the buffer bonds can provide. We believe fixed income plays a vital role in mitigating these six core challenges investors face.

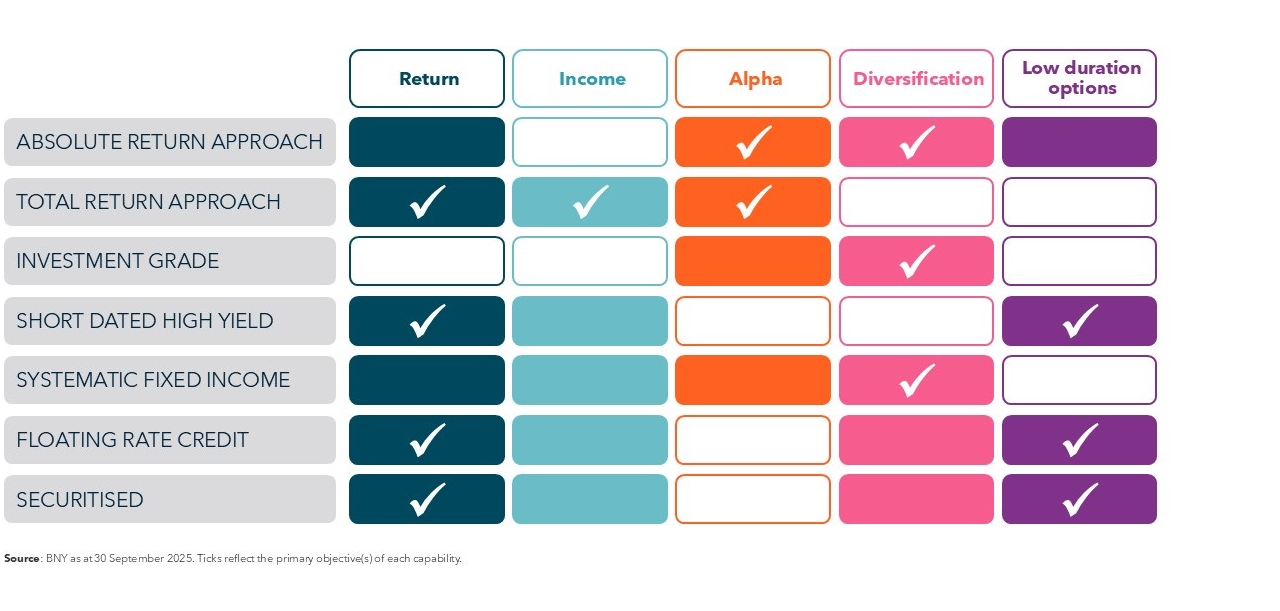

Fixed Income can be the key to building resilient, goal-aligned portfolios amid uncertainty. We believe that a deliberate allocation is key to a balanced, well-diversified portfolio. From capital preservation, to income, and guarded growth, choosing the appropriate approach is essential to reaching desired outcomes.

Expert quarterly insights on markets, strategy, and fund performance - direct from our investment teams.