The S&P 500 is trading at record highs, which some investors didn’t see coming after the tariff-fueled drop in April. What may come as a bigger surprise, however, is the rally is broadening beyond big technology companies. Let’s examine different measures that prove this point.

Ever since early April, when policy uncertainty took the market down around 20%, equity indices have been gaining, hitting all-time highs with notable frequency. The S&P 500 is now up over 13% year to date, which some investors didn’t see coming. What may come as a true surprise, however, is that the rally is broadening beyond big technology companies.

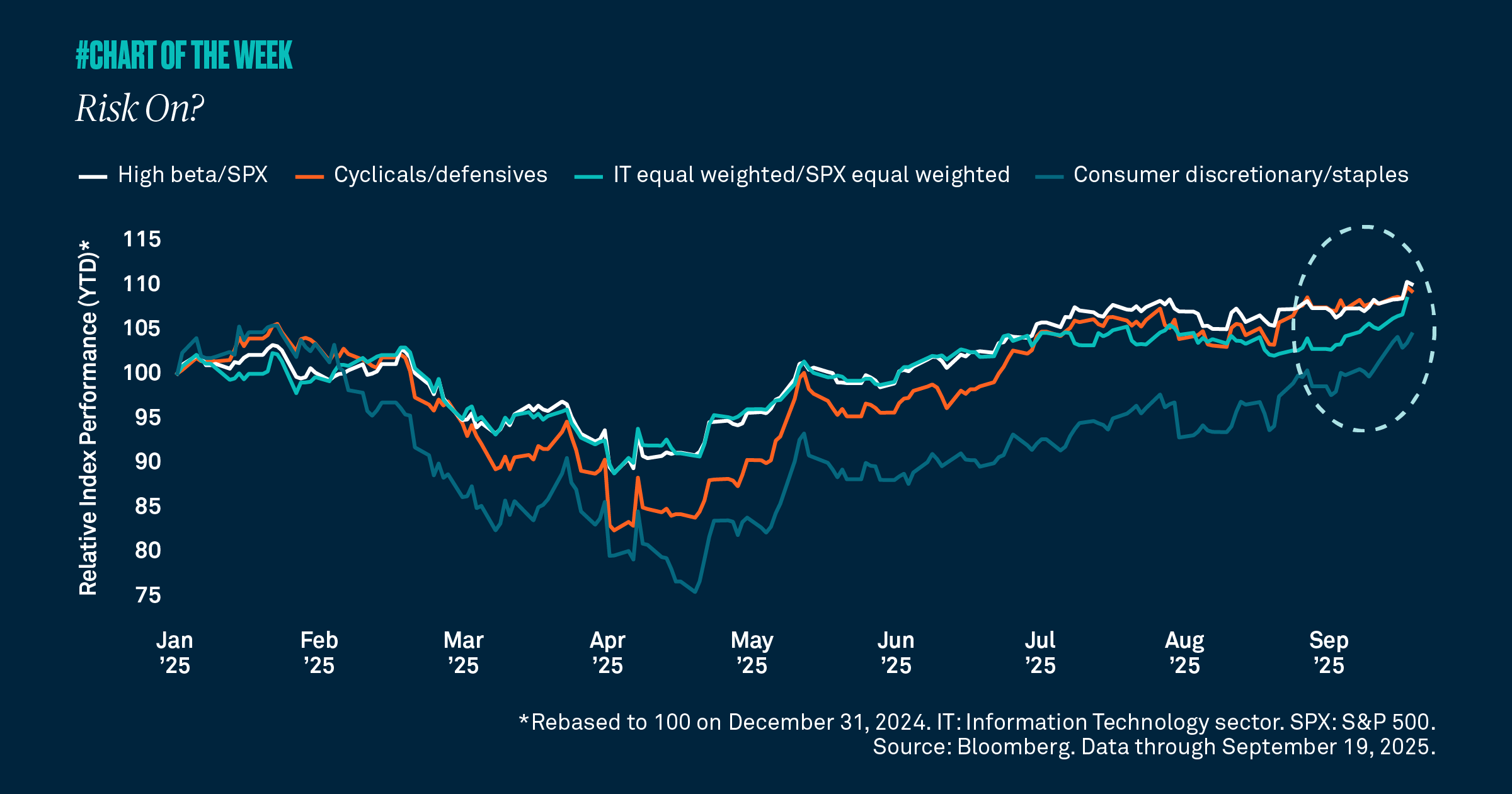

Cyclicals are outperforming defensive sectors, indicating that investors are becoming more positive on the outlook. Additionally, high beta stocks — or those that tend to experience larger price swings — are at a year-to-date high compared to the overall market, as measured by the S&P 500. When high beta stocks outperform, it typically signals the market is becoming more bullish. Consumer discretionary is leading staples, suggesting the consumer can remain resilient despite slowing job growth. Lastly, the equal-weighted technology sector is outperforming the average stock. This means technology stocks other than the Magnificent Seven are performing well too, implying a more diversified constellation of companies is gaining.

Together, these signals demonstrate that the market is more positive on the forward outlook. Slowing job growth remains a risk, and we will watch closely in case it spills over into consumer spending. Nonetheless, we believe equities can continue to move higher as the Federal Reserve eases into an improving earnings environment.