Thinking beyond yield in bond markets

Insight Investment believes that an active approach to fixed income allows investors to exploit structural inefficiencies inherent to bond indexes. Here, it detail the potential opportunities.

Insight Investment1 believes that an active approach to fixed income allows investors to exploit structural inefficiencies inherent to bond indexes. Here, it details its views on the potential opportunities

Key takeaways

- The benefits of active for fixed income investors: Insight believes that an active approach could capitalize on structural inefficiencies in bond indexes, which can present opportunities to generate excess returns.

- Fixed income benchmarks are structurally less efficient than equity indices: Unlike equity indices, which weight companies by market capitalisation, fixed income benchmarks weight issuers by the amount of debt outstanding, which, Insight argues, may not be the most suitable way to allocate investments.

- Participating in new issues and exploiting mispricing opportunities can add value: Participating in new bond issues could add value, as according to the article, they are often priced at a yield premium relative to comparable debt, and that passive strategies may exacerbate mispricing opportunities.

- Global opportunity set can be optimised: Investing globally could allow active managers to optimise portfolios towards bonds of an issuer in currencies that offer the greatest value, and away from those that offer the least value.

- Exploiting non-index positions can provide additional value: Even a broad universe like the Global Agg doesn't include every asset class. Using an unconstrained approach could provide the freedom to allocate into non-benchmark issues within a given risk budget.

Fixed income benchmarks are structurally less efficient than equity indices

Whereas markets assign the highest equity index weights to the companies with the largest market capitalisation (and generally the highest profits), fixed income benchmarks are weighted towards issuers with the most debt (or bonds) outstanding. While those issuers are not always the most leveraged, it is hardly a natural way to allocate to the most suitable investments.

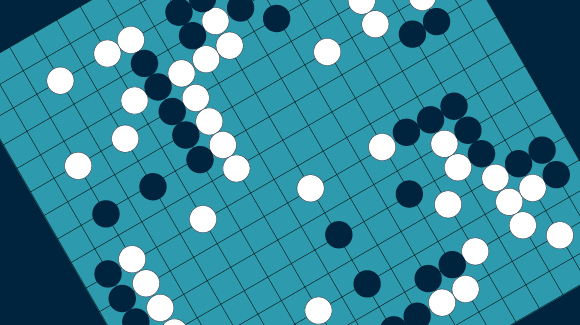

For a broad index such as the Global Agg, the scale of government bond markets makes them a sizeable index component. For example, in the US, government-related debt represents just under 50% of the Bloomberg US Aggregate Index. 2As this weighting is purely based on the relative size of debt in issuance, it may represent an overly conservative weight for an investor with a positive growth outlook. This investor may feel that the potential allocation outlined in Figure 1 may be more suitable, and its bias towards corporate debt should result in a higher level of income.

Simply participating in new issues can add value

Fixed income indices undergo more frequent compositional changes than equity indices. Where equity markets saw $580bn of IPOs in 2024, credit markets saw $1.8trn of new issuance across investment grade and high yield.3

In the same way that equity IPOs tend be priced conservatively, new bond issues are usually priced at a yield premium relative to comparable debt. These issues often tighten to move in line with the broader market after the issue is complete, rewarding those investors that participate in the deal.

The rise of passive may exacerbate mispricing opportunities

As passive strategies have grown in popularity, their synchronised monthly rebalancing flows have a meaningful and predictable impact on market pricing. For example, when an issuer is downgraded from investment grade to high yield (known as a “fallen angel”), passive investment grade accounts are forced to sell the bond regardless of the outlook or price. Similarly, when new debt is issued, passive strategies can typically only purchase the deals in the secondary market at the end of the month, missing any initial gains.

These structural inefficiencies present significant opportunities for active managers to exploit.

Taking advantage of a global opportunity set

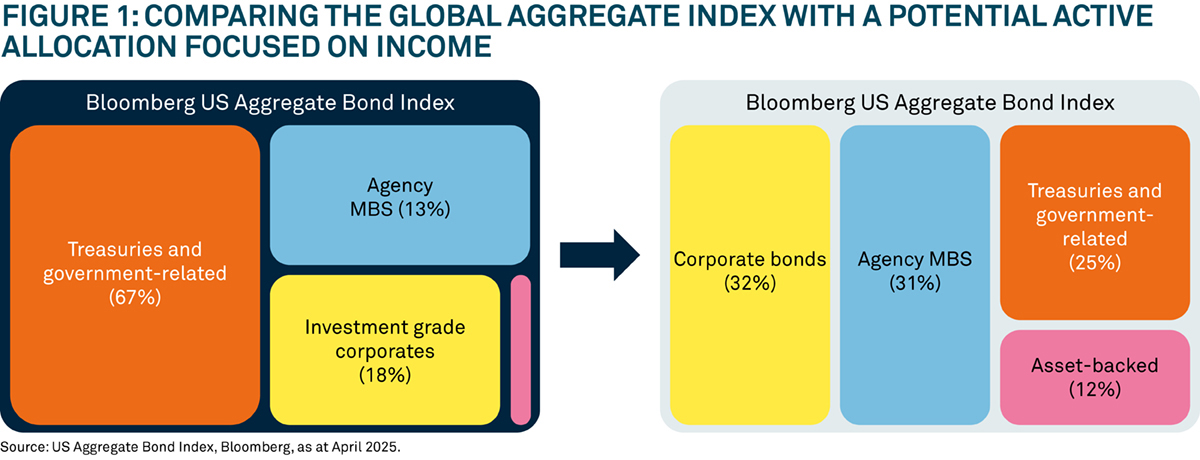

Within a universe as broad as the Global Agg, these types of inefficiencies can be global in nature. For example, many multinational corporations can issue bonds across a range of currencies to fund local operations in various regions. Investing globally, it is possible to optimise a portfolio towards the bonds of an issuer in currencies that offer the greatest value, and away from those that offer the least value. Alternatively, an investor may simply prefer the outlook in one market over another and want to bias credit holdings towards it. This can create value even while maintaining a neutral exposure to the underlying issuer and without increasing credit risk.

We illustrate this in Figure 2, which shows the spreads of US dollar, euro and sterling-denominated bonds issued by a large European energy company.

Beyond the benchmark: exploiting non-index positions

Even a universe as broad as the Global Agg doesn’t include every asset class within the spectrum of fixed income investment. Two obvious exclusions are high yield and emerging market debt. In securitised assets, it also excludes sectors such as collateralised loans and “esoteric” assets like data centre-backed deals or whole-business securitisations. Using a relatively unconstrained approach provides the freedom to allocate into non-benchmark issues within a given risk budget.

The value of investments can fall. Investors may not get back the amount invested.

1 Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

2 Global Aggregate Bond Index, Bloomberg, Data as at 30 April 2025.

3 Insight and Bloomberg, Data for 2024 for US markets.

2471159 Exp : 30 November 2025

YOU MIGHT ALSO LIKE

While passive equity funds have become a staple in many portfolios, passive fixed income strategies have yet to gain the same traction among UK financial advisers and wealth managers. Our latest BNY Insight Fixed Income report reveals why active management remains the preferred choice for 64% of fixed income allocations.

A responsible approach to European corporate bonds could offer investors an attractive combination of appealing returns and alignment with responsible investment expectations. Fabien Collado, portfolio manager of the Responsible Horizons Euro Corporate Bond strategy, explains why.

Fixed income was challenged in 2022 due to inflation and rising rates, causing historic losses. But Insight Investment head of global credit, Adam Whiteley believes current high bond yields offer strong compound return potential, especially for active managers.

As part of a new report “Global Credit: Uncovering opportunity and capturing value”, Insight Investment outlines why the time is now to harness value opportunities in credit markets.