Making the most of your portfolio through global credit

In an ever-shifting financial landscape, the ability to remain agile and informed is essential for lasting investment success. Drawing on decades of experience and a globally integrated approach, we have honed a disciplined credit strategy that thrives not just in stable times, but also amid market turbulence. This article explores how our commitment to process, regional expertise, and proactive risk management empowers to uncover value where others might see only volatility—turning uncertainty into opportunity in the global credit markets.

What’s the appeal of a global credit strategy?

We believe investing in global credit can offer a number of attractive benefits to investors. It provides the chance to generate attractive yields from high-quality, global companies. Then there’s an additional potential to deliver capital returns should yields decline, while adopting an active approach, as we do, may help to achieve enhanced resilience and improved diversification.

In our view, to achieve these consistently and reliably depends on a robust and transparent investment process. We believe our global credit strategy exhibits these characteristics.

High-quality investments selected through a rigorous approach

Our approach has an investment grade focus in which we seek to achieve outperformance that is primarily driven by credit decisions. We concentrate efforts on how best to achieve overall exposure to credit markets and to specific issuers where we see value. By using the balanced investment platform that we’ve developed, which has investment presence on both sides of the Atlantic, the generation of ideas can avoid undue geographical bias. We aim to identify and incorporate attractive relative or absolute value opportunities across the entire credit space. We seek to do this without compromising the overall quality of the portfolio.

Credit strategy decisions sit at the core of our process

We focus on adding value through credit decisions and believe our investors can have confidence in what they may expect to see drive our performance. We don’t seek to add meaningful value through allocations to currency or duration risk. We implement our credit views across four layers.

- Beta management: the directional risk we take on credit spreads, looking at the market’s position in the broad credit cycle, valuations relative to historical experience, and tactical considerations such as investor flows.

- Macro credit relative value: our asset allocation decisions, identifying preferences across regions/markets, including such considerations about high yield relative to investment grade, or developed markets versus emerging markets.

- Sector strategy: taking positions across industry sectors based on fundamentals and relative value views.

- Security selection: picking the winners we see in regions/sectors and avoiding the losers. Here we seek to call on the depth and breadth of experience across our team of credit analysts. Their detailed understanding of the fundamental financial standing of so many individual companies can help uncover and identify opportunities at issuer and security level.

Consistency of process and people

The team looking after the Fund consists of market and company veterans, consistently employing the long-standing investment process that we believe has been a key component of the strategy’s track record since it launched.

Regionally balanced organisational structure

The regionally balanced organisational structure we have in place has credit, economic research and portfolio management teams in both the US and Europe. This is an approach we believe enables us to stay close to worldwide news flow and market developments better for a global mandate than a single-location model allows. It also provides for increased interaction with our other specialist credit teams.

Success in global credit

Since the inception of the global credit strategy, we believe we have built a track record that can demonstrate the success of our approach. A key factor has been our focus on identifying credit deterioration early and avoiding issuers where there has subsequently been a sharp deterioration in credit quality.

Volatility is nothing to be scared of

It might seem counter-intuitive, but we welcome increased volatility in credit markets. The reason for that is we believe volatility creates opportunities for security selection and relative value trades.

Typically, uncertainty that creates turbulence in markets makes pricing more volatile. Increased volatility means there is less consensus among market participants about what the fair price of a credit (or indeed any asset) should be. That dispersion of opinion can allow for larger and more prolonged gaps between price and value and create more instances of perceived mispricing. It increases the chances of attractively valued opportunities arising. Having a broadly and dedicated team of credit research analysts with extensive experience built through periods of both credit market turbulence and calm, may be a powerful tool in the quest for generating outperformance.

Markets ahead

We believe there is good reason to expect volatility to remain elevated. Combined with the US administration’s shifting emphasis on trade and tariffs, the significant geopolitical tensions and existence of competing fiscal and monetary priorities in many areas can create an environment of elevated market uncertainty. That in turn can present attractive value opportunities available for capture, meaning conditions remain ripe for the global credit strategy to continue delivering for our clients, through a diversified mix of high-conviction active positions.

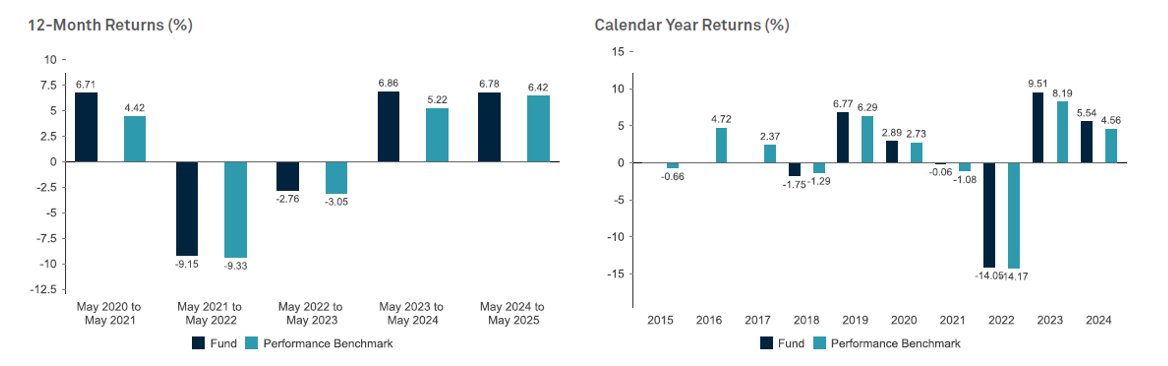

Past performance is not a guide to future performance

BNY Mellon Global Credit Fund

Source: Lipper as at 31 May 2025. Fund performance Euro W (Acc), calculated as total return, based on net asset value, including charges, but excluding initial charge, income reinvested gross of tax, expressed in share class currency. Returns may increase or decrease as a result of currency fluctuations.

Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

RELATED FUNDS

Easy access to our funds and related content

2540000 Exp : 31 December 2025

YOU MIGHT ALSO LIKE

A responsible approach to European corporate bonds could offer investors an attractive combination of appealing returns and alignment with responsible investment expectations. Fabien Collado, portfolio manager of the Responsible Horizons Euro Corporate Bond strategy, explains why.

Fixed income was challenged in 2022 due to inflation and rising rates, causing historic losses. But Insight Investment head of global credit, Adam Whiteley believes current high bond yields offer strong compound return potential, especially for active managers.

As part of a new report “Global Credit: Uncovering opportunity and capturing value”, Insight Investment outlines why the time is now to harness value opportunities in credit markets.

Insight Investment senior portfolio manager, Damien Hill outlines why he believes a strategic bond strategy could be the right fixed income tool when it comes to tackling the job of retirement investing.