Asset allocating for volatile times

Amid a volatile investment environment, Newton head of mixed assets investment Paul Flood shares the team’s view on bonds, equities and alternatives.

Amid a volatile investment environment, Newton head of mixed assets investment Paul Flood shares the team’s view on bonds, equities and alternatives.

Key points:

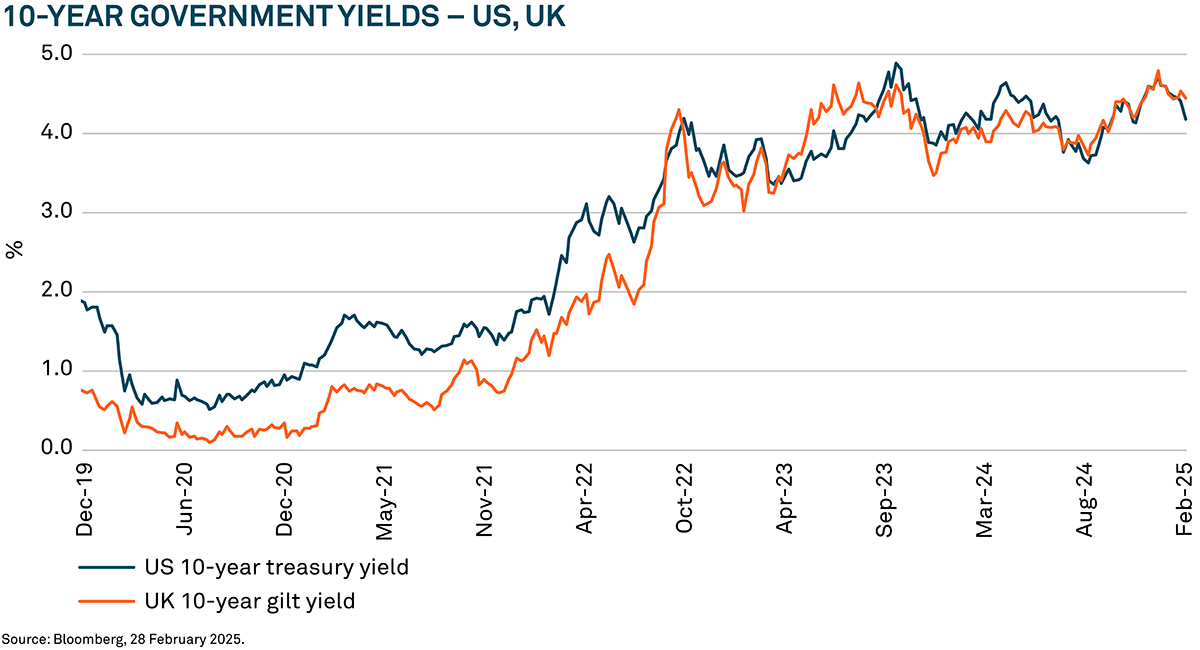

- Bonds: The mixed assets team has been adding to bonds, preferring gilts over Treasuries, and has been selling short-dated government bonds in favour of longer-dated bonds.

- Equities: The team believes it's a good time to be exposed to regions outside the US, due to concerns about market concentration and valuations, and has been reducing its US growth allocation in favour of Europe.

- Alternatives: Despite weaker recent performance, the team is optimistic about alternatives due to attractive yields, diversification benefits, and the potential for stable and growing income.

Bonds

Newton’s Paul Flood says the team has started adding to bonds recently, with several early data points pointing to an economic slowdown. The mixed asset portfolios are currently more balanced relative to the low weight to bonds they have held for the last five years.

“We have a preference for gilts over Treasuries and to that end, recently sold short-dated inflation protected Treasuries as they had appreciated materially and moved into longer-dated nominal UK gilts,” adds Flood.

When it comes to interest rate sensitivity, the team has recently been selling short-dated government bonds in favour of longer-dated bonds. Flood sees this activity continuing throughout the year as they take time to build into positions.

“We believe that government bonds are attractive as they currently offer two things,” he adds. “First, they offer attractive yields above long-term inflation expectations. Second, they offer real diversification. You're now being compensated for taking on longevity risk, and with signs of economic growth deteriorating, bonds are becoming increasingly more attractive on a relative basis.”

Equities

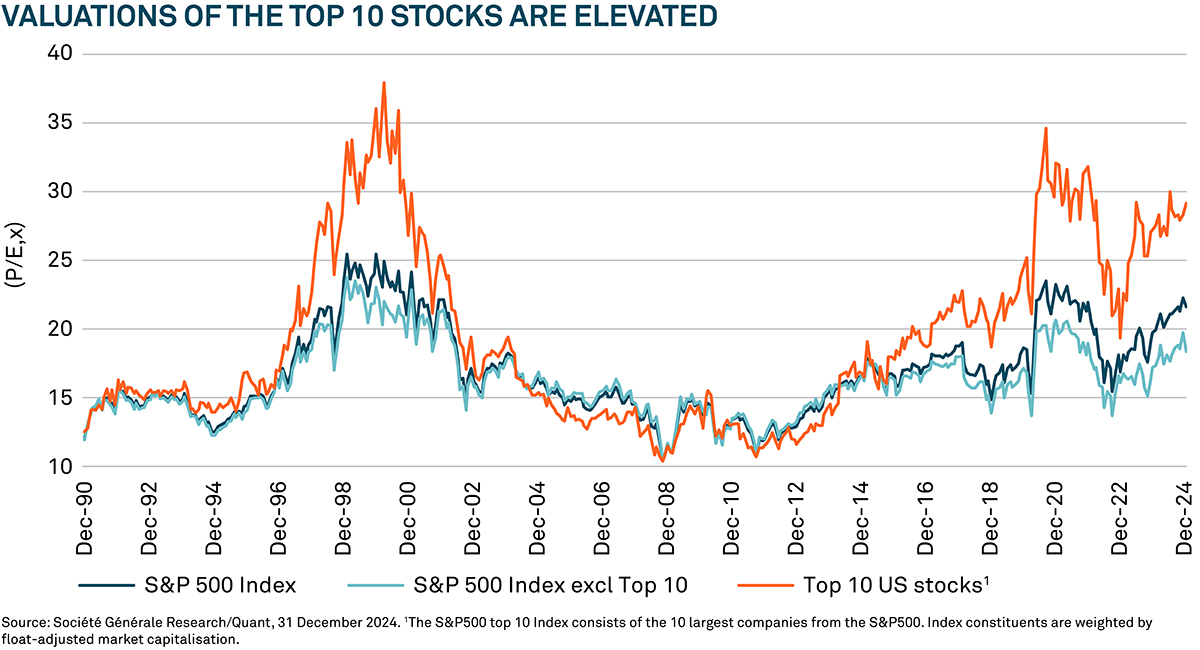

When it comes to equities, Flood believes it is a good time to be more exposed to regions outside the US.

Like many, the mixed assets team is concerned by market concentration, especially when considering the US accounts for about 66% of the global equity market1. The Magnificent Seven2 make up about US$17 trillion worth of market cap and as a combined group are significantly larger than the individual market cap of certain countries around the world, including China, India and Japan, that have bigger populations than the US3.

“We've been considering this within the portfolio construction process to try and protect clients and diversify away from some of those risks within the US equity market, but also some of the valuations that we see in the US versus other markets.”

In terms of valuations, Flood adds the S&P 500 index is trading on average at just over 20 times earnings but if you look at the top 10 securities in the S&P 500, which includes the Magnificent Seven, this group is trading at about 30 times multiples4.

Furthermore, Flood notes how the top 10 stocks represent about 35% of the S&P 500 index which is a larger weight than during the tech bubble in the early 2000s, when the top 10 represented about 25%. It's a similar story today with the MSCI World index where the top 10 stocks represent about 25%5.

“To put that in context, those stocks represent about 10% of our Multi-Asset Balanced and Multi-Asset Growth portfolios,” adds Flood. “We believe this approach improves diversification and makes sure our clients aren't overly concentrated.”

Flood and the team have noticed signs of divergence between the US and European economies. The US economy excelled until recently thanks in part to economic stimulus through tax cuts and subsidies but is highly indebted. In the eurozone, by contrast, Flood says tighter policy, stricter rules around bank regulation, for example, have resulted in debt to GDP falling.

Additionally, Flood says with Germany looking to spend more on defence and changing its budget rules to allow more fiscal leeway. Taken together, he says perhaps that could lead to a prolonged rebalance between the US and global equity markets.

“So, we believe it's a good time to be overseas with our allocations outside of the United States,” he adds.

Over the past six to 12 months Flood says the team has been reducing its US growth allocation in favour of European options. But it believes technology companies should continue to perform.

Alternatives

After a strong 2022 for alternatives due to both equities and bonds selling off, the sector has been weaker of late, admits Flood. He believes this is due to three reasons:

1. The higher interest rate environment has driven investors’ capital towards bonds rather than alternatives.

2. Regulatory concern over cost disclosure of investment trusts has pushed up the ongoing costs figures and led capital toward fund structures instead.

3. The liability driven investment (LDI) crisis in September 2022 led to pension funds offloading risk assets, including alternatives, and buying more bonds to match their liabilities.

But Flood believes there are key attractions to alternative assets. These include:

- The regulated nature of revenue streams providing the potential to gain insight over forward-looking returns

- Inflation-linked cash flows in a period of higher inflation. These assets can protect you in real terms like we saw in 2022.

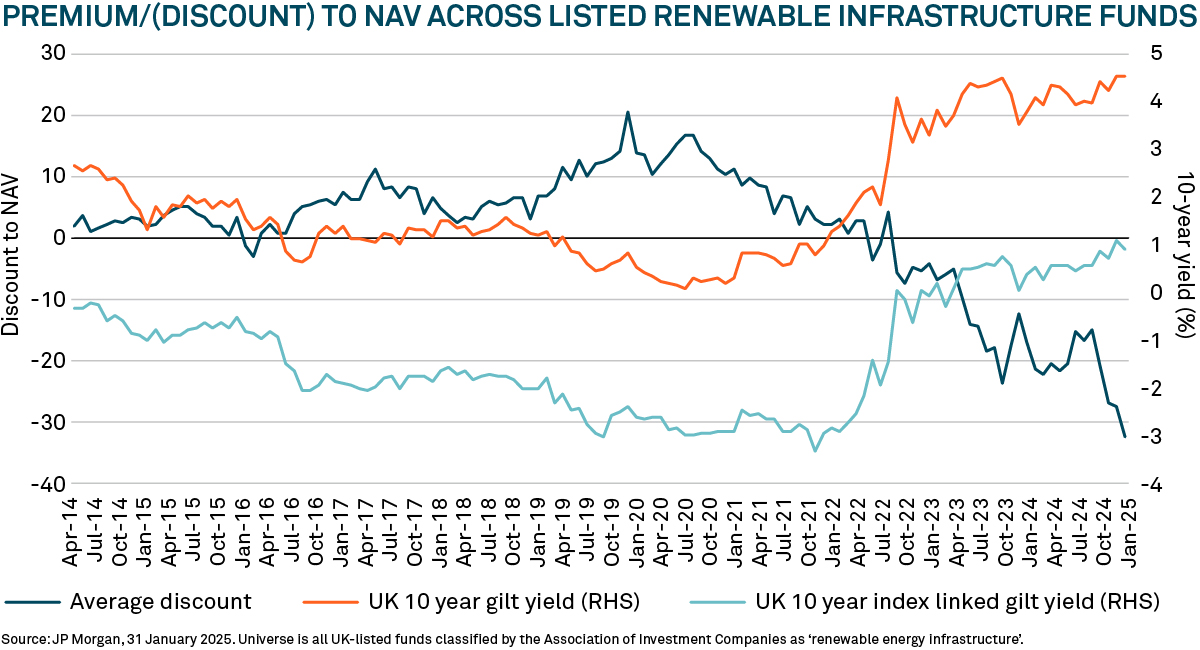

Importantly, he notes these assets have attractive yields and therefore better forward-looking return potential. Flood explains that as bond yields rose through 2022 and into 2023/24 they offered an attractive option for investors which meant alternatives were overlooked. As such, higher discount rates were used to calculate net asset values (NAVs) which has increased the discounts on certain renewable infrastructure funds, offering investors an opportunity to lock in attractive real yields.

“Renewable infrastructure funds that once traded at 10-20% premiums now trade at more than 30% discounts,” says Flood. “As shares prices declined, investment trusts offer large dividends, well covered, and high dividend yields.”

Flood also argues alternatives play an important diversification role in portfolios. He points to 2018 and 2022 which saw stable and robust returns from alternative assets when equity and bond markets were negative. “They are great diversifiers, particularly when inflation comes through higher than anticipated,” he adds.

Seeing the big picture

As long-term investors, having clear sight on the big picture using a thematic investing approach helps the Newton mixed assets investment team to navigate short-term noise in the markets.

Newton head of mixed assets investment Paul Flood says: “We use themes to help us identify global opportunities and we have a range of multi-asset or fixed income credit and equity analysts to do the fundamental rigorous research that's required to understand the companies in which we invest.”

Here, he explains three elements to the mixed asset team’s process:

1. Thematic research

“We use a thematic framework to identify the key changes happening in society and driving global economies. We think about the themes, from a macro and micro perspective and how they are shaping global economies and what that means for the different asset classes we can invest in.”

2. Portfolio construction

“We use those themes as part of our portfolio construction process to select the securities we think meet the risk and reward characteristics of the strategies we're managing – what asset allocation mix do we want for each strategy?”

3. Risk and position sizing

“We tend to frame portfolio construction around the tree buckets: ‘safe havens’; ‘core’; and ‘opportunities’. Safe havens will have the largest weights within portfolios, while core ideas will be our core positions. Opportunities tend to be higher growth and/or higher risk areas. These are typically smaller weights within the portfolios.”

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

1 Source: MSCI AC World Index, as at 31 December 2024.

2 ‘Magnificent Seven’ includes Apple, Amazon, Google, Meta Platforms, Microsoft, Nvidia, Tesla.

3 Source: Bloomberg, as at 31 December 2024.

4 Source: Société Générale Research/Quant, 31 December 2024. The S&P 500 top 10 Index consists of the 10 largest companies from the S&P 500. Index constituents are weighted by float-adjusted market capitalisation.

5 Ibid.

RELATED FUNDS

Easy access to our funds and related content

BNY Mellon Multi-Asset Moderate Fund (UK domiciled)

BNY Mellon Multi-Asset Diversified Return Fund (UK domiciled)

BNY Mellon Multi-Asset Income Fund (UK domiciled)

BNY Mellon Multi-Asset Balanced Fund (UK domiciled)

2431362 Exp : 24 October 2025

YOU MIGHT ALSO LIKE

Uncertainty around tariffs, inflation and interest rates has been looming for months. Meanwhile, the Federal Reserve (the Fed) left rates unchanged at its July meeting, to the surprise of market observers. So, the question remains — what’s the Fed’s next move? The BNY Investment Institute considers the factors influencing the central bank's path ahead.

We asked experts across three of our investment firms about the key themes that could be shaping the economy in the second half of 2025 and how they believe their asset classes may fare.

The latest U.S. non-farm payroll data underwhelming, the second quarter gross domestic product (GDP) print marginally exceeding expectations, and the Federal Reserve’s (Fed) decision to leave interest rates on hold are all consistent with the BNY Investment Institute’s view of the U.S. economy continuing to slow but not stalling.

Absolute return bond strategies are designed to deliver a positive return in all environments. In an era characterised by high volatility, Insight Investment portfolio managers Harvey Bradley and Shaun Casey explain why they think absolute return strategies can be used by those seeking a mixture of stable growth and capital preservation.